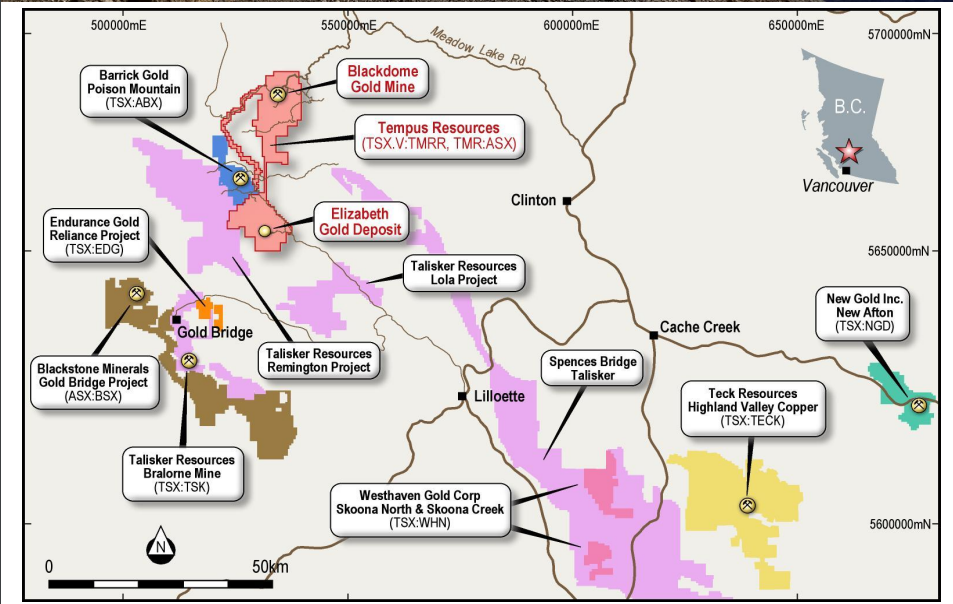

Australian-based Tempus Resources (TMRR.V, TMR.AX) is evaluating and exploring projects in British Columbia and Ecuador. In recent months, Tempus has had a focus on the flagship Elizabeth Gold Project in British Columbia.

In February 2023, bonanza results were announced including:

No. 9 Vein intersections include:

- EZ-22-28 – The most northernly hole on the No. 9 vein confirming the continuity of the high-grade mineralisation along strike

- 5.2g/t gold over 6.60m from 214.10m, including:

- 35.0g/t gold over 1.63m from 216.75m;

- 5.2g/t gold over 6.60m from 214.10m, including:

- EZ-22-23 – Multiple high-grade gold zones in sheeted quartz

- 5.6g/t gold over 13.70m from 141.1m, including

- 5.4g/t gold over 0.70m from 144.00m, and

- 24.0g/t gold over 2.78m from 152.02m

- 5.6g/t gold over 13.70m from 141.1m, including

President and CEO, Jason Bahnsen, commented, “There’s a number of other players around us. There’s Talisker Resources or Westhaven. They’re at a very similar sort of stage in the drilling or have just come out with a maiden resource. So, I think Tempus an attractive opportunity, especially when you look at the valuations of some of the other peer group companies, I’ve mentioned that are in the same area.”

Today, Tempus Resources announced it has received firm commitments to complete a non-brokered private placement raising gross proceeds of approximately AUD$2.5 million through the issuance of 62,500,000 fully paid ordinary shares in the Company at a price of AUD$0.04 per Placement Share, together with one free attaching listed option for every two Placement Shares subscribed for and issued.

President and Chief Executive Officer, Jason Bahnsen, said: “This placement will be used for further exploration and development studies of our high-grade Elizabeth Gold Project in British Columbia and for general working capital requirements.”

$2.5 million approximately (5%) is expected to be paid to “Non-Arm’s Length Parties”, up to $125,000 (5%) toward Investor Relations Activities, and the balance to be used to further drilling programs, exploration, resource confirmation and geological sampling & testing and for general working capital purposes.

The Placement Shares will be issued on or about May 19, 2023, under the Company’s shareholder resolution that was approved by shareholders 15 March 2023 whereby the Company may issue up to $5 million of shares via share placements. Placement shares will only be offered to purchaser residents in Australia and will not be offered to purchasers resident in Canada.

The Placement Options are exercisable by the holder thereof to acquire one (1) fully paid ordinary share of the Company at price of AUD$0.075 on or before 5 September 2025 and are issued on the same terms as the same terms as the existing class of listed options currently on issue.

In accordance with the policies of the TSX Venture Exchange, the Company is relying on a minimum price exception in order to issue securities at less than $0.05 per listed security. As such, the aggregate number of common shares issued by the Company in this offering and in any 12 month period does not and shall not exceed 100% of the number of common shares which were issued and outstanding prior to this issuance.

For more information on Tempus Resources, be sure to check out our deep dive article.

The stock is down -2.22% at time of writing on today’s news, and sits at a market cap just under CAD $11 million.

Tempus Resources is in the consolidation or range phase of market structure. This phase is the ‘in between’ phase and generally represents the exhaustion of one trend and thus, the beginning of a new trend. In the case of Tempus Resources, since the range has printed after a long downtrend, this range indicates the selling pressure exhaustion and the potential for a new uptrend to begin.

A range has two levels: support and resistance. Resistance is the price ceiling. It is an area where we expect sellers to be, or where range traders take their profits. For a stock to start a new uptrend, this range must be broken which means price must close above resistance. The new uptrend trigger on Tempus Resources would be a break and candle close above the $0.075 resistance level. You can see the last two times the stock tested resistance, the sellers stepped in. Perhaps the third time will be the charm.

When we talk about recent price action, Tempus Resources is testing support, or price floor. This is an area where we expect buyers to be, or where range trader short sellers take their profits. Looking at the recent price action, we can tell there is a strong presence of buyers around the $0.04 support zone. On April 5th 2023, we printed one of the strongest single price action candles there is known as the engulfing candle. A very strong sign that buyers are here in strength.

This zone is also a previous all time record low for the stock, which tends to be another strong confluence for support and potential bottoming and reversal. With strong bullish candlestick patterns, investors should next watch for the volume profiles to increase which would give a stronger bounce higher from this important technical zone.