NioCorp Developments Ltd. (NB.T), a leading U.S.-based mineral development company, is on a mission to unlock the full potential of critical minerals from the proposed Elk Creek Critical Minerals Mine in Nebraska. As North America’s only niobium, scandium, and titanium project, NioCorp is poised to become a major contributor to the global supply of these essential minerals. With a strong focus on sustainability, NioCorp’s minerals play a pivotal role in reducing greenhouse gas emissions through their use in electric and hybrid vehicles, renewable energy systems, lightweight transportation, and high-efficiency motors and appliances.

The critical minerals supply chain challenge

The global critical minerals supply chain is becoming increasingly important as these minerals are essential for numerous modern technologies and industries, including aerospace, defense, healthcare, telecommunications, and clean technologies such as solar panels, nuclear energy, and electric vehicles (EV) batteries and motors. Critical minerals encompass not just rare earth elements but also niobium, scandium, cobalt, copper, precious metals, nickel, uranium, lithium, magnesium, and many others. However, the supply chain is currently facing significant challenges due to geopolitical uncertainties and a lack of diversified sources.

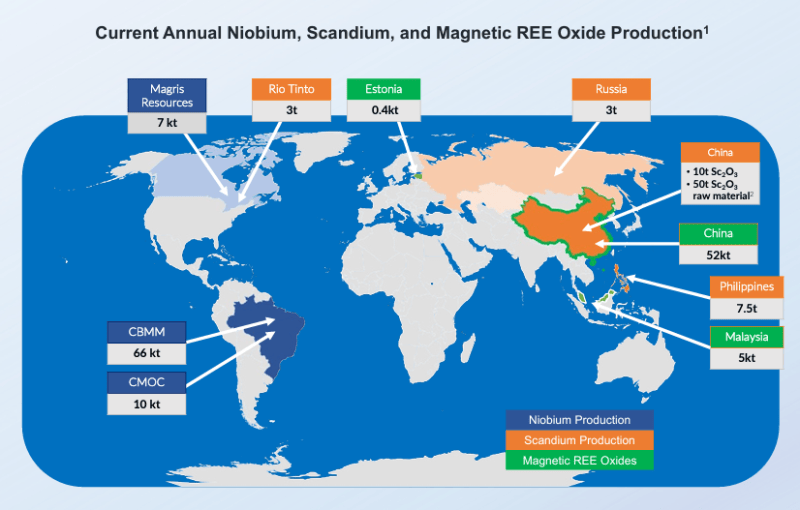

China has long been the dominant supplier of these critical minerals, controlling a majority of their production and distribution. This has resulted in an over-reliance on China for procurement by the rest of the world. G7 Panel on Economic Resilience reports that China accounts for 80% of the US’s rare earth element imports and 98% of the EU’s. This reliance is further exacerbated by the ongoing global chip and semiconductor shortage, as well as the increasing demand for clean technology, which the World Bank forecasts could require up to a 500% increase in the production of multiple mineral and metal inputs.

To address these challenges and bolster economic security, national defense, and low-carbon energy transitions, policies and partnerships are being developed across like-minded countries to secure new access to critical minerals. Canada, for example, has entered critical minerals dialogues with the United States and the European Union to assess how deepened partnerships can increase supply chain resiliency. Governments are looking to Canada as a preferred source for increased volumes of critical minerals and a reliable destination to diversify existing supply reliance.

The two main pillars of newly sought critical minerals supply are: 1) proximity to supply sources from trusted partners to increase reliability and reduce the scope for supply chain disruption and associated risks, and 2) preference for supply sources with higher environment, social, and governance (ESG) ratings to align with the sustainability goals driving demand. Low greenhouse gas (GHG) production intensity is a key metric, as low-carbon transitions account for the majority of projected critical mineral demand increases over the long term. By developing and strengthening these partnerships, countries can help secure their access to critical minerals, mitigate risks, and promote responsible and sustainable mining practices.

The solution

NioCorp’s solution lies in the Elk Creek Project, which aims to diversify global supply and provide significant production volumes of niobium, scandium, and titanium from a low-risk jurisdiction. This will create a reliable and meaningful Scandium supply, potentially providing non-Chinese rare earths for the expansion of renewables and electrified vehicles. By utilizing an underground mineral source and environmentally responsible processing, NioCorp offers a sustainable production solution.

Niobium, one of the key minerals to be produced by NioCorp, is a versatile metal with numerous applications due to its unique properties. It is often used in pipeline construction, as it strengthens stainless steel and other nonferrous metal alloys. As a low capture cross-section material for thermal neutrons, it finds utility in the nuclear industry. In addition, niobium is employed in arc welding rods for certain stabilized grades of stainless steel, and as an alternative to tantalum in capacitors. The metal is physiologically inert, making it suitable for jewelry and medical devices, such as porous layers that aid osseointegration. Furthermore, niobium serves a crucial role in the optical industry, where it is added to glass to achieve a higher refractive index for thinner corrective glasses. When cooled to cryogenic temperatures, it becomes a superconductor, with potential applications in particle accelerators and superconducting magnets.

Scandium, another mineral from NioCorp’s Elk Creek Project, is valued for its low density and high melting point. Although it reacts with many acids, it is primarily used in aluminum-scandium alloys for the aerospace industry and sports equipment, such as bicycle frames, fishing rods, golf iron shafts, and baseball bats. Scandium iodide is utilized in mercury vapor lamps to replicate sunlight in film and television studios, while the radioactive isotope 45Sc is employed as a tracing agent in oil refineries. Scandium sulfate, in very dilute form, can improve the germination of seeds like corn, peas, and wheat.

Scandium, another mineral from NioCorp’s Elk Creek Project, is valued for its low density and high melting point. Although it reacts with many acids, it is primarily used in aluminum-scandium alloys for the aerospace industry and sports equipment, such as bicycle frames, fishing rods, golf iron shafts, and baseball bats. Scandium iodide is utilized in mercury vapor lamps to replicate sunlight in film and television studios, while the radioactive isotope 45Sc is employed as a tracing agent in oil refineries. Scandium sulfate, in very dilute form, can improve the germination of seeds like corn, peas, and wheat.

Titanium, the third mineral to be produced by NioCorp, has a wide range of applications. It is a popular choice for surgical implants, eyeglass frames, and aircraft manufacturing. This abundant element is also used to make titanium dioxide, a white pigment found in paint, sunscreen, cosmetics, paper, toothpaste, and other products. Titanium’s non-toxicity and non-reactivity make it suitable for medical implants and jewelry. Its high corrosion resistance also makes it a potential candidate for long-term nuclear waste storage. In some cases, 24k gold is actually an alloy of gold and titanium, resulting in a more durable material without affecting the gold’s karat. As a transition metal, titanium has unique properties that distinguish it from other metals, such as its nonmagnetic nature and poor conductivity of heat and electricity.

Titanium, the third mineral to be produced by NioCorp, has a wide range of applications. It is a popular choice for surgical implants, eyeglass frames, and aircraft manufacturing. This abundant element is also used to make titanium dioxide, a white pigment found in paint, sunscreen, cosmetics, paper, toothpaste, and other products. Titanium’s non-toxicity and non-reactivity make it suitable for medical implants and jewelry. Its high corrosion resistance also makes it a potential candidate for long-term nuclear waste storage. In some cases, 24k gold is actually an alloy of gold and titanium, resulting in a more durable material without affecting the gold’s karat. As a transition metal, titanium has unique properties that distinguish it from other metals, such as its nonmagnetic nature and poor conductivity of heat and electricity.

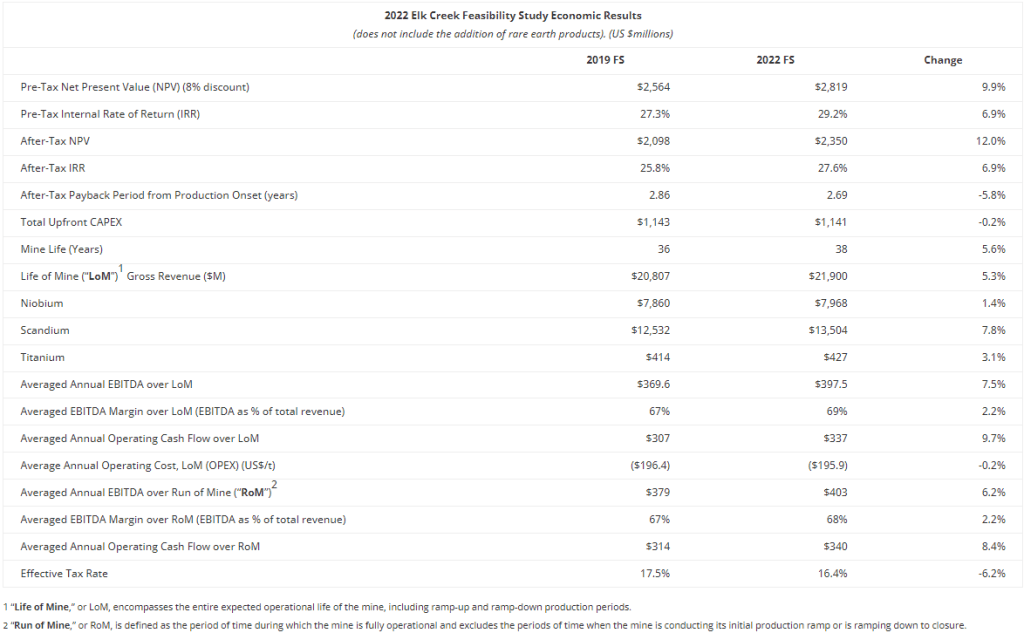

Elk Creek Project

The Elk Creek Project sets NioCorp Developments Ltd. apart as a true leader in the critical minerals industry. Featuring the highest-grade primary Niobium deposit under development in North America, large-scale production of Scandium, and the second-largest indicated-or-better rare earth resource in the U.S., the Elk Creek Project is a force to be reckoned with. Guided by the Equator Principles ESG framework, the project incorporates best practices in recycling, water conservation, and numerous sustainability strategies, showcasing NioCorp’s commitment to environmental responsibility.

NioCorp has secured all key federal, state, and local permits necessary to begin construction, ensuring a seamless start to the project. The company also owns a crucial land parcel in southeast Nebraska, providing the perfect location for the project’s mine infrastructure and supporting operations. This strategic acquisition grants NioCorp ownership of the mineral rights to more than 90% of the Project’s Mineral Resource and Mineral Reserve.

NioCorp’s planned products are designated as “Critical Minerals” by the U.S. Government, further emphasizing the company’s vital role in the industry. These products are crucial to technologies that help reduce harmful air emissions, including CO2. NioCorp has already pre-sold a substantial portion of the Project’s planned production over the first 10 years, with 75% of projected Ferroniobium production under sales contract and 12% of average annual scandium production sold to Traxys North America, a global leader in specialty metals.

Leadership

NioCorp Developments Ltd. is guided by a highly experienced Board of Directors and management team, boasting over 200 years of collective experience in minerals development, including commercial-scale production of separated rare earths. Mark A. Smith serves as Executive Chairman, President, and CEO of the company, with 40+ years of experience in the mining and mineral processing industries. He has led efforts that raised more than $3 billion for previous mining and manufacturing projects, and he holds a B.Sc. degree in engineering and a J.D. (cum laude) from Western State University, College of Law.

Scott Honan, Chief Operating Officer of NioCorp and President of Elk Creek Resources Corp., joined NioCorp in 2014 with 29+ years of experience in the niobium, base metals, gold, and rare earth industries. He holds a B.Sc. Honors in Mineral Processing and an M.Sc. in Environmental Management from Queen’s University and is a registered member of the Society for Mining, Metallurgy & Exploration (SME).

Michael J. Morris serves as the Lead Director of NioCorp, having practiced business and environmental law for over 40 years. He is a graduate of Georgetown University and received his law degree from the University of San Francisco School of Law. Mr. Morris has served on the boards of several mining companies, including Molycorp, a rare earths producer.

David C. Beling, P.E., a Director at NioCorp, is a Registered Professional Mining Engineer with 58 years of project and corporate experience. He has served as a director on the boards of 14 mining companies starting in 1981, including NioCorp since 2011. Mr. Beling has examined, significantly reviewed, or been directly involved with numerous underground mines, open pit mines, and process plants in the global metal, energy, and industrial mineral sectors.

Milestones

Recent milestones achieved by NioCorp include the completion of GXII acquisition, up-listing to the Nasdaq Stock Market, securing access to up to $71.9 million in net proceeds over the next three years through financings with Yorkville, and receiving a Letter of Interest from EXIM for potential debt financing of up to $800 million. On the operational front, NioCorp has demonstrated rare earth recoveries of over 92% at the company’s demonstration-scale processing plant in Quebec, contracted with Zachry Group to update the design and costing of the Elk Creek Project surface facilities, and begun land clearing operations at the Elk Creek Project site.

The potential EXIM loan of up to $800 million comes as a result of the Bank’s preliminary review of NioCorp’s Elk Creek Project in March 2023. EXIM has expanded its funding scope to include projects in the U.S. through its “Make More In America” initiative and is eager to support critical minerals industry projects, particularly as so few critical minerals are produced in the U.S. The EXIM process is estimated to take between 6-9 months to complete.

The U.S. is currently dependent on foreign suppliers for most of NioCorp’s critical minerals, including niobium. With the successful execution of the Elk Creek Project, NioCorp Developments Ltd. anticipates being able to supply some of the world’s largest industries and sustainable technologies with made-in-USA critical minerals produced in a low-impact, sustainable manner.

By addressing the problem of critical minerals supply and driving sustainability, NioCorp Developments Ltd. is not only poised to revolutionize the critical minerals industry but also contribute to a greener, more environmentally responsible future. With a robust project pipeline and a strong commitment to sustainability, NioCorp is set to make a lasting impact on the global critical minerals landscape.

Technical Analysis

NioCorp is traded both on the Canadian TSX exchange, and recently began trading on the US Nasdaq exchange after completing a SPAC acquisition. Both charts and technicals look the same in terms of market structure, the only difference is the price amounts (one in Canadian Dollars, the other in US Dollars). In this article, I will be focusing on the Canadian NB.TO listing.

At time of writing, the stock is up over 0.94% on the day and sits at a market cap just above CAD $258.10 million.

We have a broad range which the stock is contained within. Upside resistance comes in at the $14.50 zone, while downside support comes in at the $8.00 zone. Support is a fancy way of saying price floor, meaning traders expect buyers to step in at support. If a support level is broken, it is a bearish sign and means further downside is coming.

As you can see from the chart above, NioCorp rejected resistance at $14.50 this year and the price then broke below the previous higher low at $12.00 crossing below the 50 day moving average at the same time. This has led to a deeper move down to our support level.

Traders want to see buyers stepping in here, and we know there are buyers here as evident by the long wicked candle printed on March 21st 2023. Price did break below $8.00, but a surge of buyers stepped in and ensured no close below support and bid the price up back over $9.00.

Ideally, bulls would like to see a strong green bodied candle here, or a candle with a long wick just to confirm buyers are still defending support. Look for the stock to range at this support which would indicate an exhaustion of the current downtrend and the potential for a reversal. New trends tend to kick off at support and resistance levels.

If NioCorp bounces here, I would next watch the $10.00 level. This is an important psychological number and hence provides interim resistance.

Videos

NioCorp (NB.T) CEO explains NASDAQ listing and the path to production at Elk Creek

NioCorp’s (NB.T) niobium asset brings world-class investment potential

NioCorp Developments (NB.T) – Five Easy Questions with Maddy