Following NioCorp’s press release on March 16th 2023, NioCorp closed the deal to acquire SPAC GX Acquisition Corp II on March 17th 2023, and began trading on the US Nasdaq exchange today (March 21st 2023).

“This transaction with GXII delivered to us several important benefits, including a ready pathway to an up-listing to the Nasdaq Stock Market, which is expected to allow additional institutional firms to invest in and trade in our stock for the first time. Further, it has given NioCorp and the Elk Creek Project a much higher profile among institutional investors looking for promising projects in the critical materials space,” said Mark A. Smith, CEO and Executive Chairman of NioCorp

Dean Kehler, Co-Chairman and CEO of GXII, said: “Many new investors, including institutional and other large investment funds, are now expected to look more closely at NioCorp, particularly since the Company’s stock is expected to begin trading on Nasdaq. In my experience, even in volatile markets, hard assets that are expected to be strategic, long-lived, and valuable — such as the Elk Creek Project – are able to attract the capital necessary to unlock their value, both for investors and for the economic and national security of the United States.”

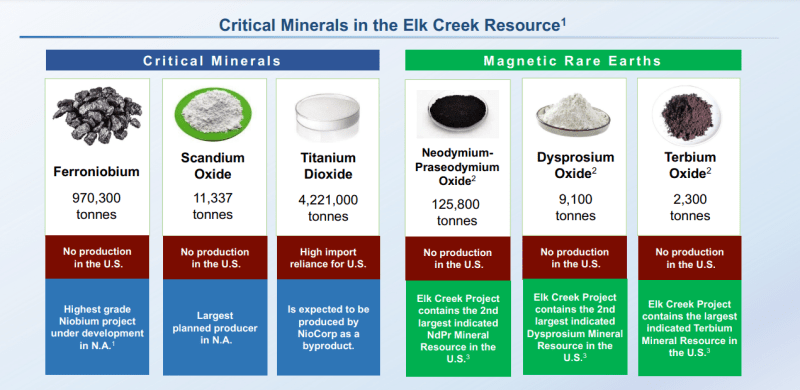

The benefits have been laid out above. With NioCorp trading on the Nasdaq, the stock will be open to many investors given the popularity and easy accessibility of US stocks around the world. This also includes big institutional money given China’s dominance of this rare earth/critical minerals market and recent geopolitical tensions between the US and China. The US government’s priority is resource security and has a plan to kick start and invest in domestic vital projects to ensure rare earth and energy security.

NioCorp’s Elk Creek Project will definitely catch some eyes being the second largest indicated-or-better rare earth resource in the US.

Here is how the charts look given the recent share consolidation (reverse stock split) on the basis of one post-consolidation common share for every ten pre-consolidated common shares.

Quite some volatility given the SPAC acquisition and the Nasdaq listing. If you line this chart up with older pre reverse split charts, you will notice the technicals are all the same. Just different price levels to adjust to the share consolidation.

NioCorp on the Canadian exchange saw a drop and found buyers at major support at the $8.00 zone. Note the long wick on the current daily candle indicating heavy buying.

We used to talk about the $1.00 zone being major psychological support. Now we can move that to $10 after the 1:10 reverse stock split. At time of writing, NioCorp is above $10.00 and it would be a positive sign for the stock to close above this by the end of the trading day.

And above is the US Nasdaq listing. Same technicals, same levels of importance but just in US dollar terms. We are seeing the same price action with a bid at major support and the stock battling at support here at $7.50.