AMPD Ventures (AMPD.CN), a Canadian company providing cutting-edge performance computing solutions for video game development, esports, film and entertainment, AI, and big data is reaching a major inflection point from a fundamental basis and a technical one.

As Chris Parry has said, the company has amazing technology which is being used today but retail investors haven’t clued into the company’s inherent value. In the above video, Chris speaks about how AMPD is on the edge of a new era where its tech, potential and continuing news flow could power a proper valuation, changing the world of virtual environments and entertainment while giving investors a unique opportunity for growth.

He also discusses the Metastage deal and what it means for investors.

The company had major news in the last few months of 2022.

At the beginning of October 2022, AMPD announced that Tippett Studio, a leading full service animation and visual effects production company led by two-time Oscar and Emmy winner Phil Tippett, has picked AMPD Virtual Studio to help power their growth and expansion in the North American market.

A co-developer of the revolutionary go motion animation technique, Tippett has been a fixture in Hollywood animation and visual effects since the 1970’s when he famously created the stop-motion miniature chess scene in the original Star Wars film.

From there, he has earned a string of nominations and awards, working on over 30 films including multiple Jurassic Park offerings as well as the latest Star Wars Trilogy.

Tippett Studio’s expansion into Canada began in May 2022, with the company’s first satellite office, Tippett Canada, in Toronto. Recent projects handled by the studio include work on “The Book of Boba Fett,” Season 2 of “The Mandelorian,” Marvel Studios’ “The Falcon and the Winter Soldier, all on Disney +, and Season 2 of “Locke and Key” on Netflix.

Tippett Canada will be servicing the likes of Marvel Studios, Lucasfilm, Disney, Showtime, New Line Cinema, AMC, Amazon, and Legendary Studios including “The Toxic Avenger.”

AMPD announced its wholly owned subsidiary, Departure Lounge, was open for business. This facility contains the world’s largest volumetric capture stage packed with next gen technologies.

AMPD Technologies also signed an agreement with Magnolia Quality Development Corporation (MQDC). MQDC is a property development company in Thailand which is looking to AMPD’s expertise for their next generation metaverse content production initiative, which is intended to be the largest in Asia.

To kick off the year, APMD announced the intention to complete the acquisition of a world leading animation and virtual cinematography studio. A well-established, profitable industry leader who has consistently delivered several million dollars in annual revenue.

Anthony Brown, CEO of AMPD comments, “We are excited about this potential transaction and adding additional world leading talent to the AMPD family as we continue to execute our business plan. Acquiring an established, profitable company that has numerous synergies with AMPD also creates a new opportunity for increased revenue and earnings growth.”

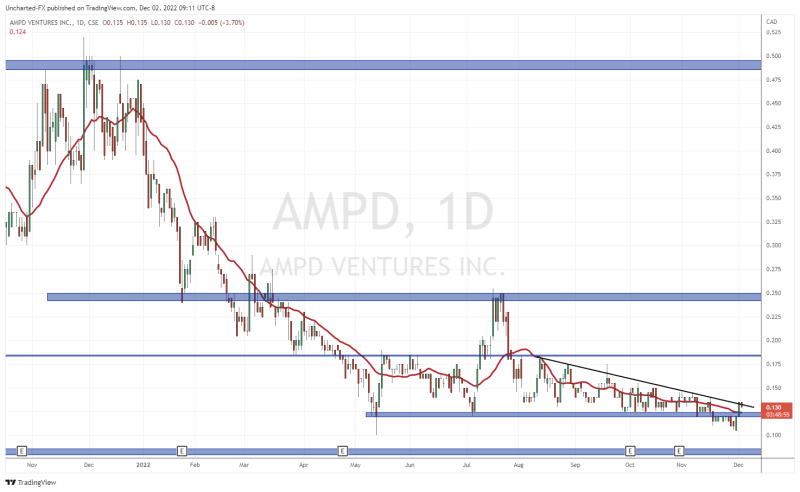

When it comes to the technicals, in December 2022 I highlighted a trendline that AMPD was testing:

A breakout looked likely. But instead:

We failed to breakout (another reason why candle closes are so important!). Instead, the stock ventured lower, once again breaking below support and taking out 2022 lows.

Our trendline is still in play, and is preventing any major upside momentum.

The close back below $0.125 was a bearish sign. One which could still see a move down to $0.075. In order for the stock to regain some momentum and build a bullish case once again, we would want to see a close back above the $0.125 zone. AMPD would reclaim a major support zone and also close strongly above my moving average.

It should be noted that $0.075 is all-time record lows for the stock, and AMPD is hovering just above it.

The big red candle on Feb 16th 2023 did see volume of 1,326,009 shares. But since then, the stock has seen ranges with volume of over 100,000 for multiple consecutive days. Including volume of 221,745 seeing the stock pop over 15% on February 22nd 2023.

For long term investors, the stock provides a nice risk vs reward entry here with the company at a market cap of less than $12 million CAD. From a technical analysis perspective, the stock is oversold and is near all time record lows. Bottom pickers will be looking at this, and they likely enter with their stop loss below record lows. We should see some buyers accumulate here but I would want to either see a range or a major green candle.

The big reversal trigger comes with the breakout above $0.125, but if we can find a close above the downtrend line which is stubbornly acting as resistance, the stock will be able to finally gain some upside momentum.