My readers know that I love royalty and streaming companies. I really do believe it is one of the best business models ever created.

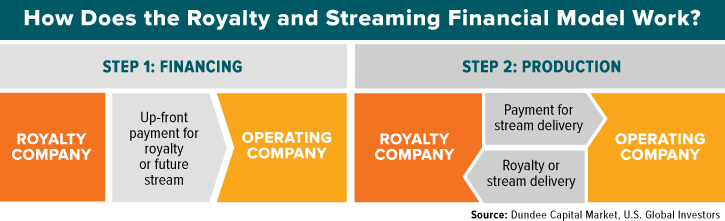

Streaming companies give cash to mining companies in exchange for a share of the mine’s future metal sales.

Equity Guru writer Lukas Kane summarizes it nicely:

It’s like lending someone $10,000 to build a bakery – with the baker agreeing to give you 1% of the revenues. If the bakery never opens, you lose. If the bakery produces bread for 30 years, you win. If the price of bread triples, you win. If the bakery increases production, you win.

A royalty company is similar but they take 1% of the physical bread pulled from the oven – not money directly from the till.

In mining, A royalty and streamer maximizes exploration upside, security of tenure, and focuses on new investments, while minimizing cost exposures, margin encroachment, and involvement in mining.

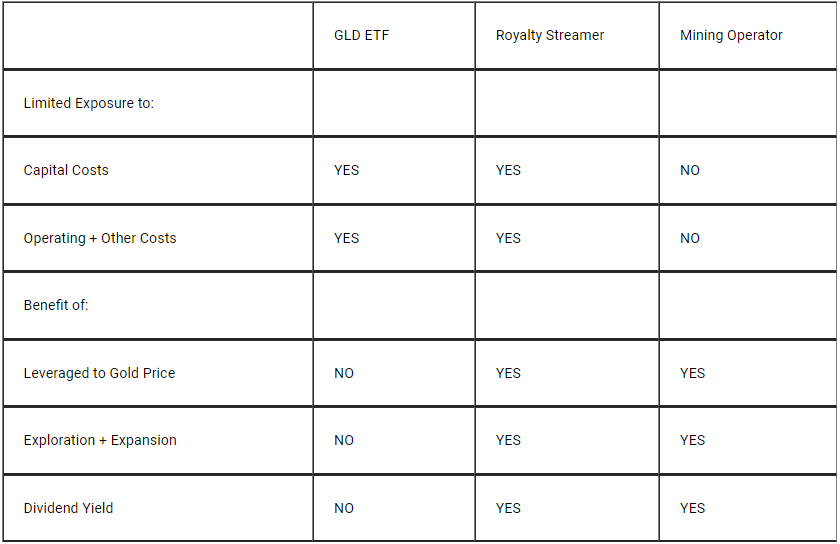

In the past, I have summarized the benefits of investing in a royalty and streamer versus an ETF and a large miner. When it comes to gold, here’s the breakdown:

A royalty and streamer wins on all fronts. Even when the commodity price, in this case gold, is heading down, a royalty and streamer still wins out. Yes, since they are leveraged to the price, the stock can fall, but here is the kicker. A mining operator will continue to mine even if margins begin to drop (higher oil prices anyone?), and quite frankly, they start losing money. Hence why their balance sheets generally show a lot of debt.

A Royalty and Streamer will still be making money, will likely be paying out dividends, and can still hammer out catalysts for the stock price. If the management is great, they will use bear markets in the said commodity to create and acquire new royalty deals which will pay off handsomely in the future.

In summary, these companies are the safest way to play commodities in a bull or bear market, and I highly suggest you consider them for your portfolio.

I highlighted oil above because energy is something not talked about too often in investing nowadays. Many downplay oil due to the green move. The thing is, we will not go to green overnight. And I do believe, the world will be shocked to see the transition not going smoothly. Oil will still be needed, and due to western regulations on going green, it will skew the supply and demand mechanics for oil.

Many energy analysts are saying that we will see HIGHER oil prices due to this demand and supply issue. While western governments are trying to wean off oil and implementing rules and regulations which are not conducive for starting up new oil wells, all of this will come to bite us in the behind when the energy shock occurs.

I do want to say that emerging markets in Asia and nations with large populations such as India and China, will continue to have large demand for oil, and this should be noted when speculating on demand and supply mechanics.

Recently, green investors were shocked to hear that oil companies had their most profitable year in history in 2022. Four oil companies (Chevron, ConocoPhillips, Exxon and Shell) all reported record profits in 2022. Together, the four companies saw $1 trillion in sales last year. To put this number in perspective, this is a sum greater than the total economic output of Colombia, South Africa or Switzerland.

Skyrocketing gas prices played the major role. Gas prices which saw a rise due to the war in Ukraine and the post-pandemic recovery.

When you consider the supply and demand mechanics I have mentioned above, oil prices are bound to make a move higher… and as I said, it will cause quite the energy (and inflationary!) shock.

So why doesn’t oil and gas get much love? I would say when it comes to institutions and value investors, large oil companies paying handsome dividends definitely do get their attention. When it comes to mid and smaller caps, the balance sheets tend to be a factor to drive away investors. And I do not blame them. Many of them are in a lot of debt after oil prices rocketed to record highs in 2008.

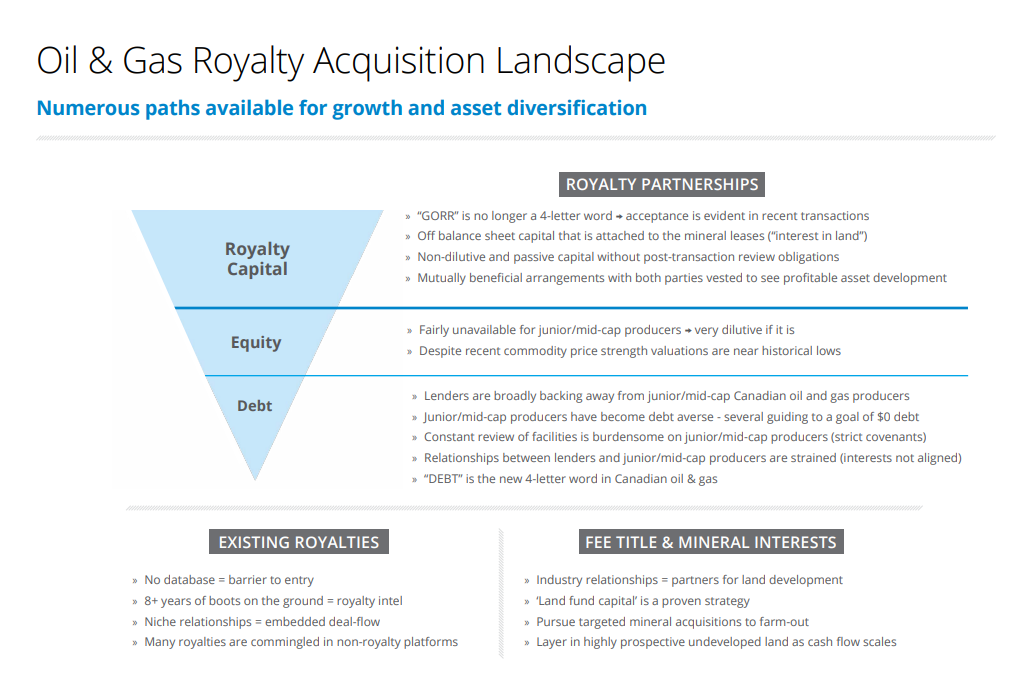

This is where royalty and streamers become a prudent investment. Enter Source Rock Royalties (SRR.V).

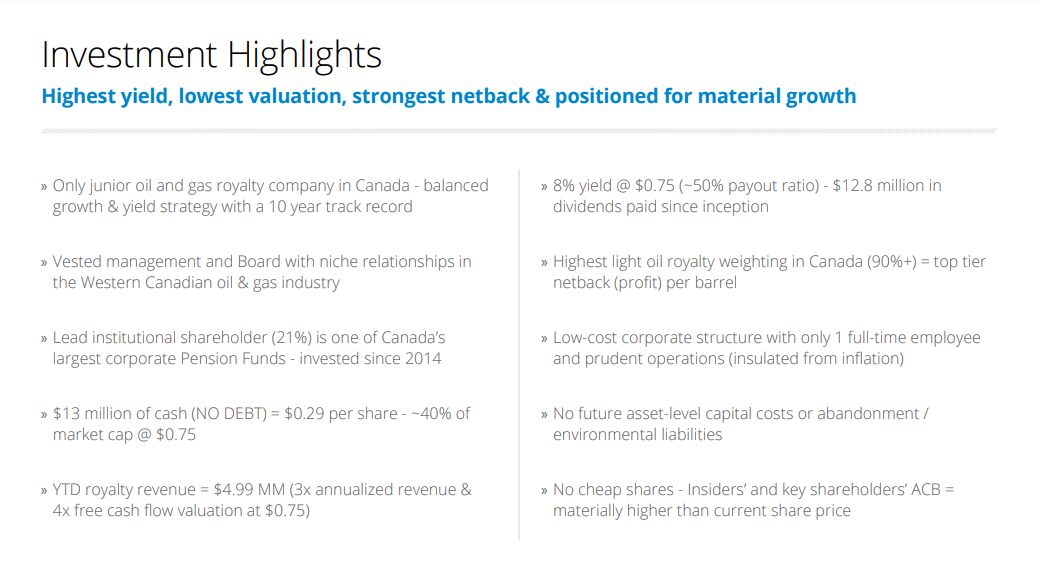

Canada’s only publicly listed pure-play junior oil and gas royalty company.

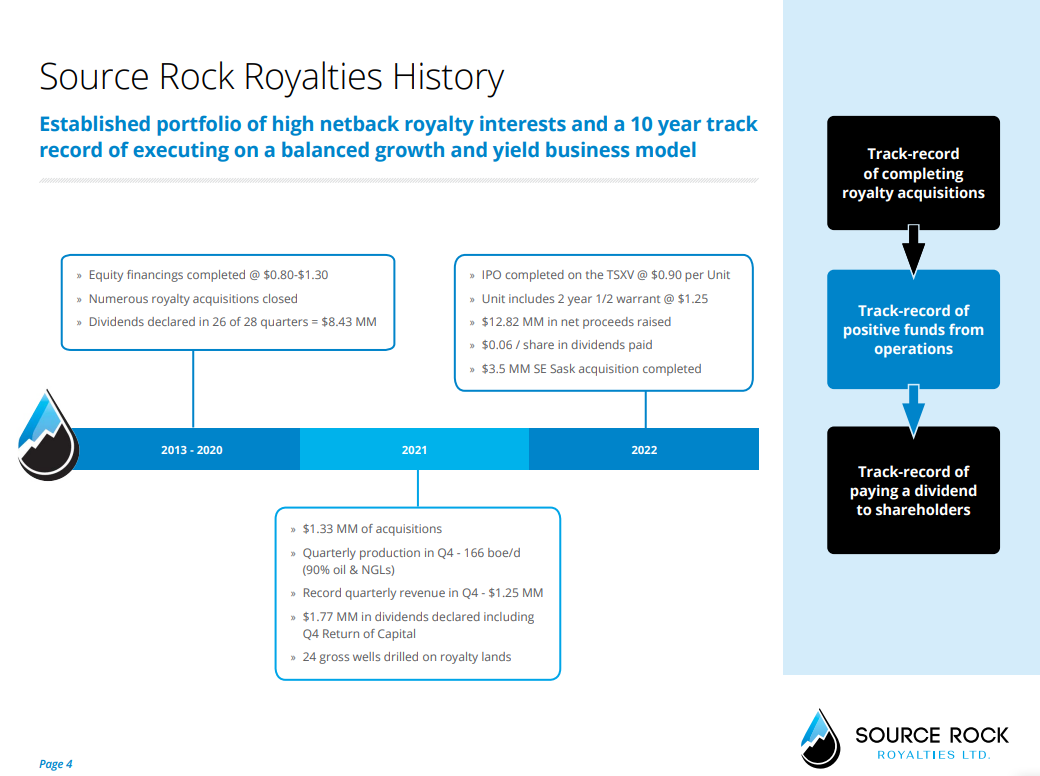

Source Rock is a pure play on oil and natural gas royalties in Western Canada. The company has 10 years of positive cash flow, $30 million of royalty acquisitions, $12.8 million in dividends paid, the highest royalty company yield, the lowest royalty company valuation and an industry leading netback. It has 1 full-time employee and the company holds no debt.

When it comes to its business, Source Rock buys an interest in land, targeting key areas with strong operators and proven long-life reserves. When you include top-line revenue with little or no deductions exposure, minimal management costs, no exposure to abandonment, environmental and reclamation costs, and development and optimization at no cost, Source Rock’s strategy maximizes exposure to the upside. Great news for shareholders.

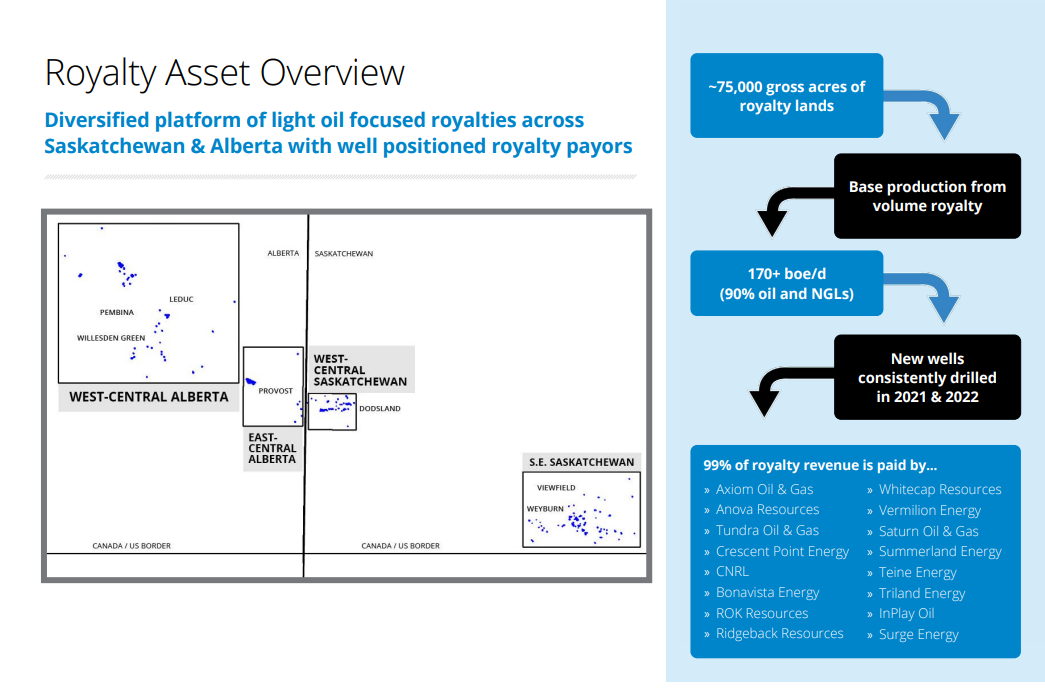

Here are Source Rock’s royalty assets:

Take a note of some of those companies paying royalty revenue. Some names you have likely heard of if you invest in Canadian energy.

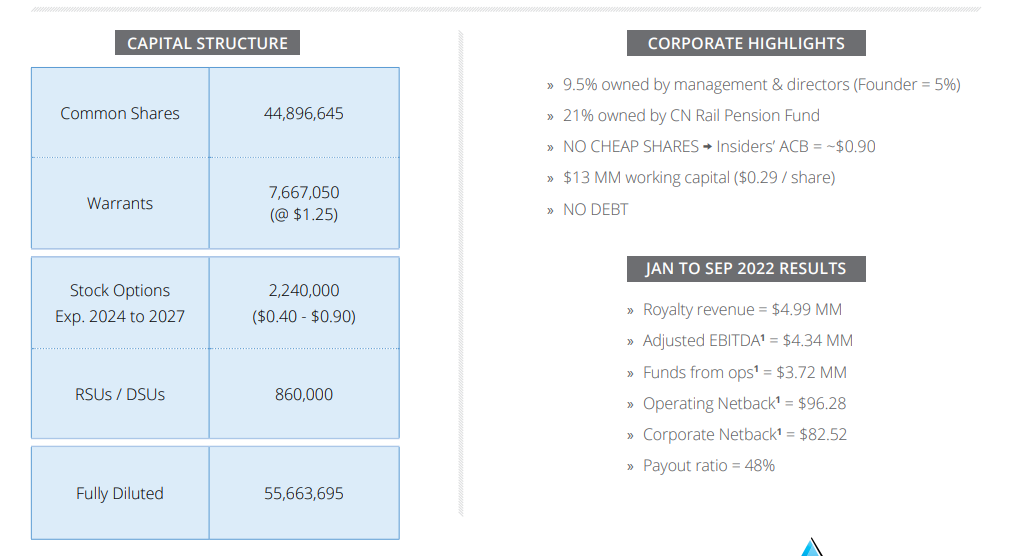

Here is a look at the share structure with the company currently sitting on a market cap of ~$33 million:

21% of shares are owned by the CN Rail Pension Fund. Take note of the price that insiders own the shares at ($0.90). You can get in at a better price than them:

When it comes to my criteria for trading and investing, Source Rock Royalties looks very promising. Readers know I look for reversal set ups. All markets move in three ways: an uptrend, a range and a downtrend. Source Rock has had a downtrend, and is currently in the range stage of market structure. What comes after a range breakout is a new uptrend. The range is broken when Source Rock shares close above $0.76.

But for long term investors, you may want to take a peek at the price of oil and natural gas:

Notice anything? Both charts show the same range set up as Source Rock Royalties. A reversal is only triggered once the breakout is confirmed, but given the macro fundamentals I laid out earlier, perhaps this is the base before we get rising oil prices and an energy shock due to supply and demand imbalances due to supply chains and western government rules and regulations on fossil fuels.

From a long term perspective, Source Rock Royalties is one of the best ways to play the higher oil price trade. And again, it is from a royalty and streamer perspective meaning that positive catalysts can move the share price even when the price of oil and gas falls. It is well positioned to achieve high accelerated growth.

Keep this company high up on your energy watchlist!