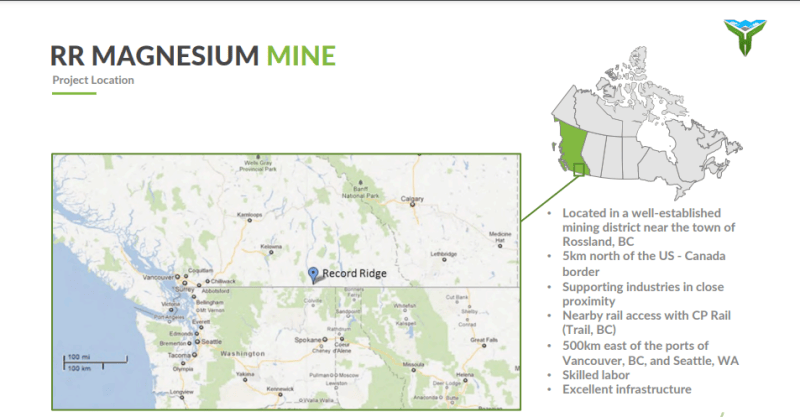

West High Yield resources (WHY.V) is a company with the objective to bring into production one of the world’s largest, greenest deposits of high-grade magnesium. The Record Ridge magnesium deposit is located 10 kilometers southwest of Rossland, British Columbia has approximately 10.6 million tonnes of contained magnesium based on an independently produced preliminary economic assessment technical report.

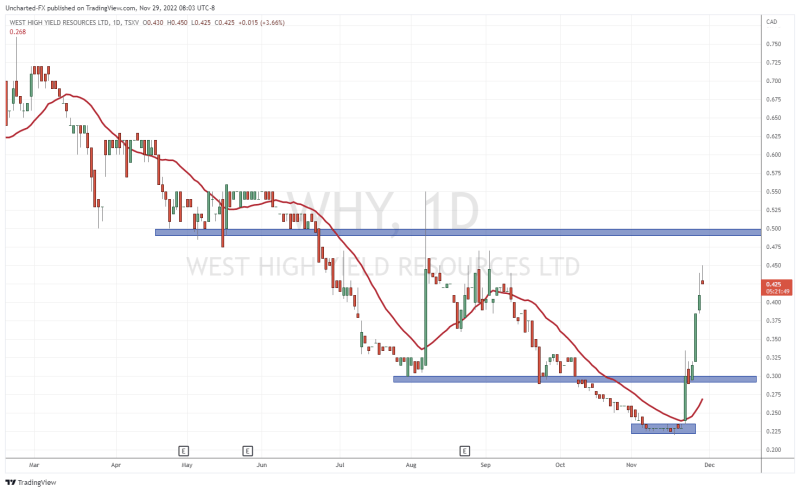

The stock is up over 90% ever since it broke above a range on November 22nd 2022. A range which was detailed with a plan of action for our readers. For more information, check out my technical report here. The stock has already cleaned through our first resistance level, and is now testing the second resistance zone.

And the run up in the stock was in anticipation for today’s news that the company has announced the completion of a positive pre-feasibility study for its high-purity magnesium oxide (MgO) industrial production plant.

All figures are in US Dollars.

Kingston Process Metallurgy Inc., a company based out of Kingston, Ontario, together with consultation with KON Chemical Solutions and Tenova (both Austrian companies) were mandated to establish the technical viability of a MgO production facility, to prepare plan and capital estimates of the Project, and to provide detailed design and economic evaluation of a semi-commercial demonstration plant, in addition to a high-level design and economic evaluation of a commercial plant at a location to be determined in southern British Columbia, Canada.

The financial model was prepared by Bumigeme Inc. based out of Montreal, Quebec.

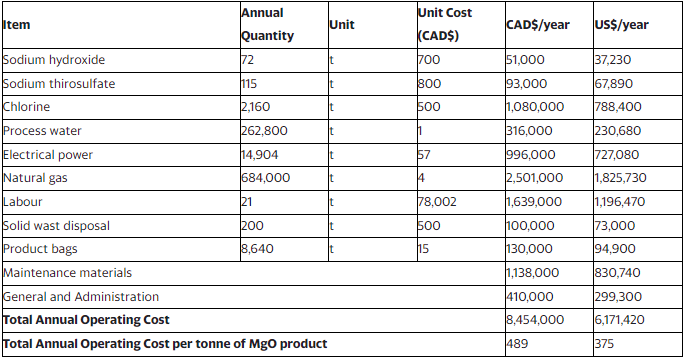

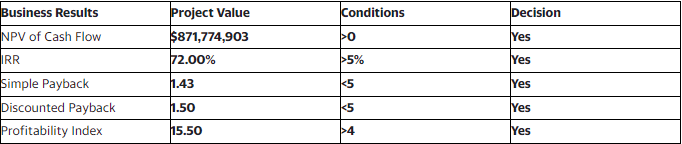

The study looked at a MgO plant of 250,000 Mt/year ore capacity based on installing 5 processing modules of 50,000 Mt/year ore capacity. The study produced these results:

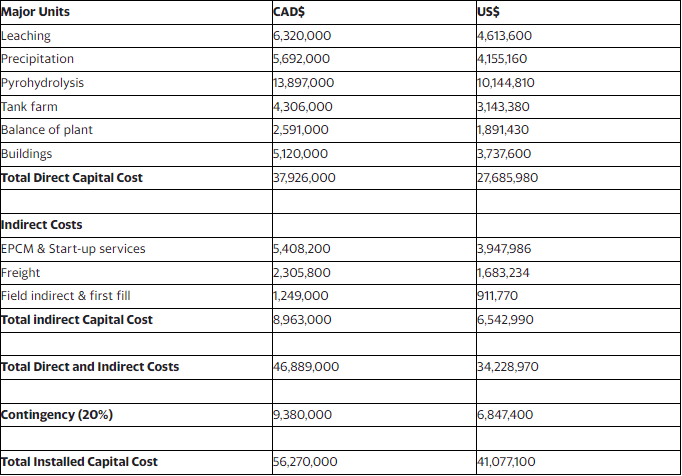

The study concluded that the capital costs of the MgO plant to be about $205 million, with operating costs of $375/Mt of MgO product which includes mining costs, processing costs, and mine and plant general and administrative expenses.

The economic analysis was performed using a discount rate of 5%. On a pre-tax basis, the Net Present Value (NPV) of the project is $872 million, the Internal Rate of Return (IRR) is 72% and the payback period is 3.5 years. Here is a summary of the economics:

In comparison, the base NPV of 2013 of $1.25 billion which was based on a million tpa of throughput, you need to multiply the $872 X 4 for an equivalent comparative NPV value that is $3,488 billion or a $2,238 billion upside difference to the 2013 NPV. The business case value continues to climb and with the projected demand cagr’s and short supply, market pricing is expected to increase.

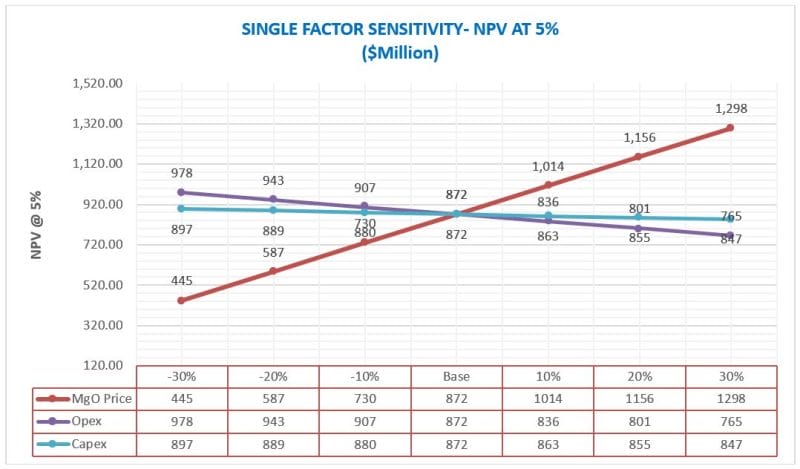

A sensitivity analysis was conducted on the base case after-tax NPV and IRR of the Project, using the following variables: MgO price, total CAPEX and total operating cost. Here is the result:

Frank Marasco, President and CEO of the Company, reports: “The MgO production Project described by the Study represents extremely positive news for West High Yield and its shareholders. The Study’s completion is a significant milestone on the pathway to production. The results as outlined in this news release make a compelling case for the economic viability of the Project. The Company’s high-purity MgO plant would create a carbon-free alternative to the currently dominating operations in China that are based on the calcination of carbonate ores (mainly magnesite), thus providing U.S. and European end users a green, secure and independent Canadian source of high purity MgO products. The PFS demonstrates the economic benefit of developing magnesium compounds operation in southern B.C. – a mining-friendly jurisdiction with deep mining talent and exceptional infrastructure.”

What comes next? West High Yield Resources will move the semi-commercial demonstration project forward, and will be a crucial step to bridge the work for the commencement of the feasibility-level studies for the successful development of the plant.

Recently, Equity Guru Founder Chris Parry sat down with Frank Marasco Jr., president, CEO and director, and Barry Baim, director and corporate secretary of West High Yield Resources. They spoke about the importance of magnesium, the company’s challenges and upcoming catalysts, and the investment growth potential.

The stock has been on a tear, popping 90% since the technical analysis article I wrote.

The stock was up 3.6% on the news before going flat for the day at time of writing.

From a technical and trading perspective, we have closed above a major $0.30 resistance zone. This now becomes support going forward, and West High Yield Resources will remain in an uptrend as long as we stay above $0.30. A retest down to $0.30 could be possible, but bulls may jump in earlier on the pullback given the momentum and the fundamental news out today.

The stock is approaching the second resistance zone. I have marked $0.50 because it is a major psychological number, but $0.475 is also a strong resistance zone. We are seeing some sell off near this zone, and investors must realize that because of this large move within days, there will be some profit taking especially as we head towards the Christmas holidays.