Newrange Gold (NRG.V), a Canadian gold junior focused on district-scale exploration for precious metals in the prolific Red Lake District of northwestern Ontario, announced today that it and Great Panther Mining had mutually terminated the share purchase agreement to acquire the Coricancha gold-silver-copper-lead-zinc mine in Central Peru.

Coricancha is a high-grade, narrow-vein underground mine in the Central Polymetallic Belt of Peru, approximately 90 kilometres east of Lima, Peru. The project consists of a 600-tonne-per-day processing plant, dry-stack tailings storage facility and all necessary surface and underground infrastructure.

The mine was in production intermittently from 1906 – 2013 and has been on care and maintenance since then but is still in excellent shape and is fully permitted.

Newrange announced signing a definitive agreement to acquire Coricancha at the end of October. The deal called for Newrange to purchase all the shares of Great Panther Peru Holdings and Great Panther Silver Peru, both wholly-owned subsidiaries of Great Panther Mining and the owners of the Coricancha Mine.

The transaction was to be carried out with a single cash payment of $750,000 USD to Great Panther, acquiring the Mine on an “as-is” basis.

Robert Archer, president and CEO of Newrange, commented on the termination, “We are deeply disappointed to have arrived at this outcome. We have been working on this acquisition since March and believe strongly in the potential of the Coricancha mine. However, the current market for mining stocks, one of the worst in decades, has created a serious impediment to financing, especially for new acquisitions. While we attempted to gain an extension to the closing date, the intransigence of Great Panther’s creditors has, regrettably, made that impossible.”

Due to the termination, Newrange will not be proceeding with the proposed financing, share consolidation and name change at this time, and it is expected that trading in the company’s shares will resume within days.

Great Panther Mining first announced it intended to make a proposal under the Bankruptcy and Insolvency Act (Canada) in the first week of September. The company expected it would likely default on several material debtor agreements due to liquidity constraints due to operational challenges, decreasing revenues, rising production costs, and mounting net losses.

Shortly after this announcement, Great Panther had both its Mina Tucano and Coricancha assets on the auction block.

On November 22, 2022, the junior explorer announced that the BCSC had issued a cease trade order pursuant to National Policy 11-207 – Failure to File Cease Trade Orders and Revocations in Multiple Jurisdictions. The order was handed out as a result of the company’s failure to file its interim financial results for the quarter ended September 30, 2022, and the related management’s discussion and analysis and CEO and CFO certificates by the prescribed deadline of November 14, 2022.

Beyond the mutual announcement made by Newrange and Great Panther, Great Panther has released no further details concerning the Coricancha purchase termination.

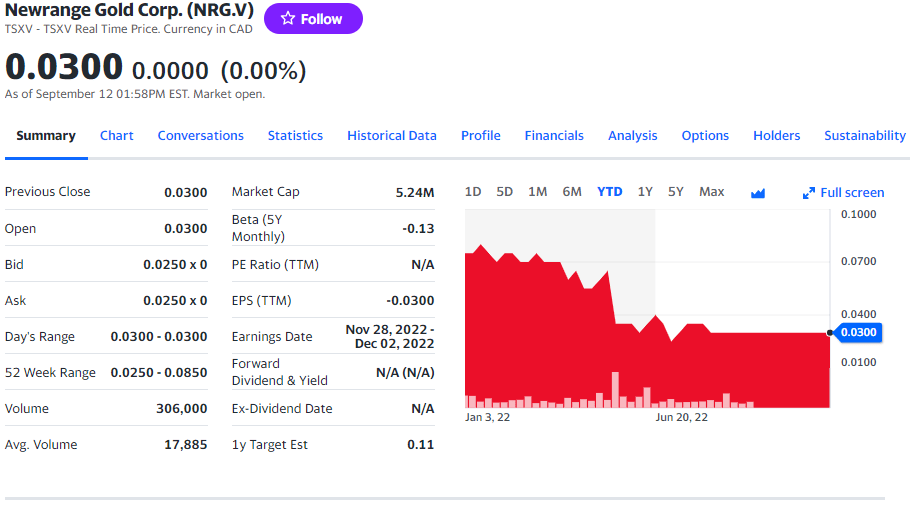

Newrange currently trades at $0.03 CDN per share for a market cap of $5.24 million.