Tesla today announced that it is voluntarily recalling more than 40,000 (40,168 to be exact) US cars over possible loss of power steering. These cars include 2017-2021 Model S and Model X vehicles. The loss of power experience was noted by the National Highway Traffic Safety Administration on a November 1st filing which was made public today.

An October firmware release caused some vehicles to lose power steering when driving over bumpy roads and potholes. an estimated 1% of recalled vehicles have the defect.

“Reduced or lost power steering assist does not affect steering control, but could require greater steering effort from the driver, particularly at low speeds,” the administration said.

Tesla said that as of November 1st, 97% of the recalled vehicles have installed a new update that addresses the issue and no further action is necessary from the owners of the vehicles. Tesla is not aware of any injuries or death related to the issue.

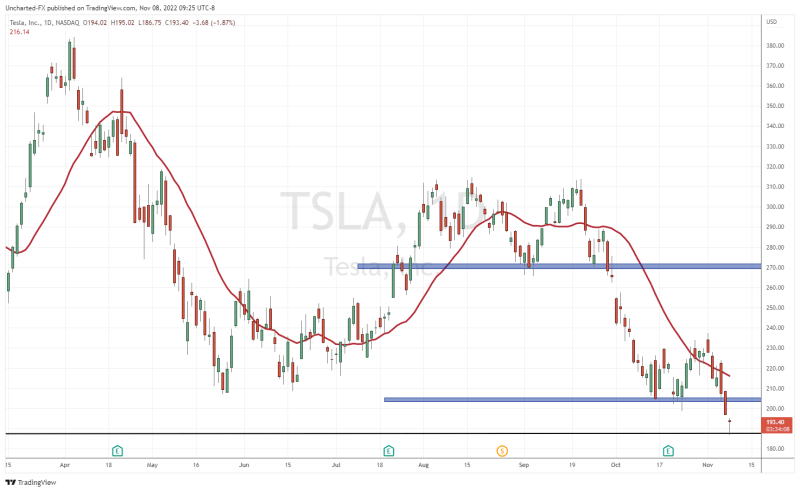

Tesla stock was showing positive signs of a reversal for reversal traders. After breaking down below $270, the stock began to range just above the $200 zone. $205 is our real support level, however this important psychological number saw a battle between the bulls and the bears. It looked like the bulls would win out. A range developed which usually indicates the exhaustion of selling pressure. However, one important thing for trading is to have set criteria. The real criteria for a breakout is a candle close above the range.

This almost occurred on November 1st 2022 with the candle initially looking like a breakout. But by the end of the day we had reversed. Definitely trapped some bulls. Since that fake out, Tesla stock fell back to the $200 zone and just recently closed below support. A breakdown has triggered instead!

With a close below $200, what comes next for Tesla stock?

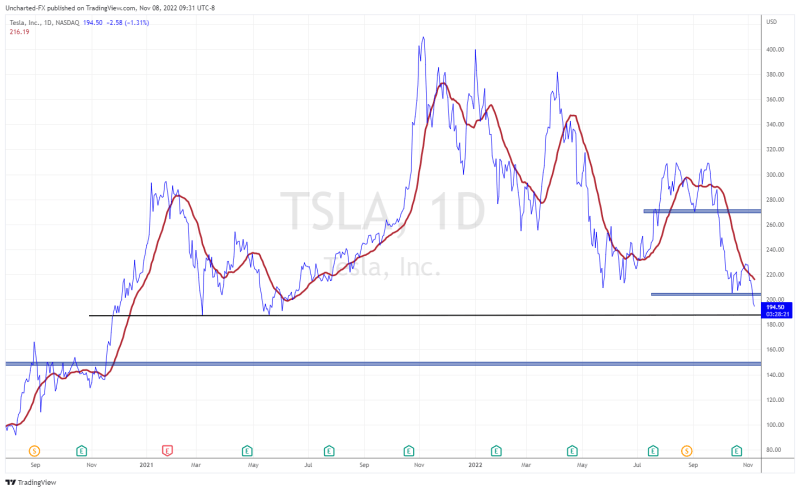

Let’s zoom out a bit.

And use our secret weapon: the underrated line chart.

This chart type is useful in finding next support (or resistance!) levels. All we do is play connect the dots… or lines.

We do have a support level coming up at the $187.50 zone. If you go back to the candlestick chart above, you will see that we actually saw buyers step in near this support zone and have bid the stock up quite nicely. Support is playing out as it should be.

But is it a buy signal? For me, I would like to see more price action indicating a range here. This would be a telling sign that selling pressure is exhausting. Alternatively, I would like to see Tesla stock climb back over $205, which was previous support. $200 is great, and would be a good start.

If Tesla fails and continues to move lower say due to a broader tech and stock market sell off due to a hawkish Fed, then $150 is the next major support as seen on the line chart.