Uranium remains to be popular among both the retail and institutional crowd. The retail crowd has been in this trade for years. The institutional crowd are beginning to pay attention given the potential of an energy crisis in Europe. Oh and people like Bill Gates and Elon Musk are also getting the institutional crowd to look at nuclear. When these billionaires say things such as ‘nuclear is the CO2 free clean energy we need’ and ‘nuclear energy will be crucial in responding to the climate crisis’, institutions with a long term view start paying more attention.

You might not be hearing this much in the media, but nations are looking to nuclear energy. Nations like China and India, who will need a reliant supply of energy for their billion plus populations, are looking at nuclear energy to meet their requirements. They are investing heavily into nuclear energy.

Other nations will follow but it may take an energy crisis in Europe to get western nations to reverse the decommissioning of nuclear power plants and invest heavily in them. It is the clean energy source which can handle baseload power unlike solar and wind. Nuclear energy can be used to deal with our current energy needs, solar and wind still need more time.

Recent articles suggest nuclear power is seriously being considered. Oilprice.com put out an article stating the US is doubling down on nuclear power generation as a means to reduce emissions and is supporting demonstration projects of advanced smaller nuclear reactors which will be more efficient and cost less to build.

The big issue? The uranium type of fuel required for these reactors are sold commercially by only one company in the world. And that company is a subsidiary of Russia’s ROSATOM.

America is recognizing it will need to eliminate reliance on a Russian state corporation for its next generation nuclear reactors. In a recent Senate hearing, the Uranium Producers of America noted that:

“almost none of the fuel needed to power America’s nuclear fleet today comes from domestic producers, while U.S. nuclear utilities purchase nearly half of the uranium they consume from state-owned entities (SEO) in Russia, Kazakhstan, and Uzbekistan.”

“We estimate that there is more than $1 billion in annual U.S. dollar purchases of nuclear fuel flowing to ROSATOM,” said Scott Melbye, president of the association and Executive Vice President at Uranium Energy Corp.

ROSATOM is not under Western sanctions after the Russian invasion of Ukraine because of the Russian state firm’s importance in the supply chain of the global nuclear power industry.

America will need to invest in and establish domestic assured supply of uranium for its new nuclear reactors. An opportunity for uranium investors.

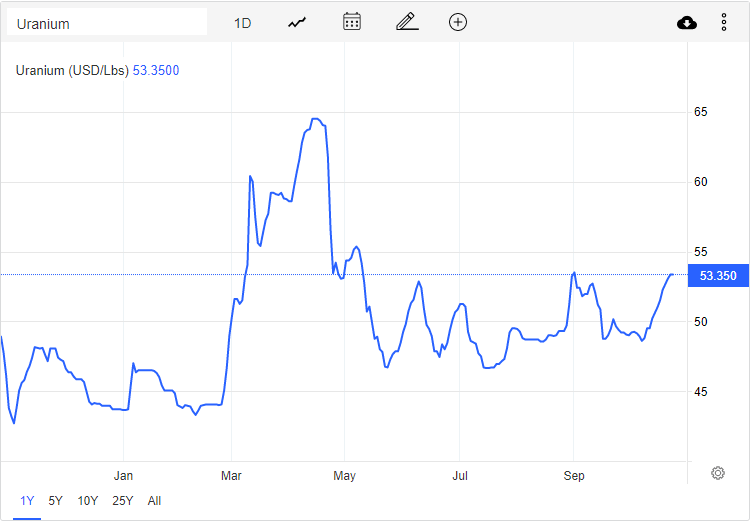

Uranium is on the verge of a breakout as it tests resistance at the $53.50 zone. The breakout is the trigger, and of course uranium could just pullback and continue to range between $46.60-$53.50. Perhaps a Russian ban could be the catalyst to get uranium to breakout. We are on breakout watch.

If uranium breaks out, we have a real possibility to retest the 2022 highs at around $65. Uranium miners and juniors will follow along.

In this sector roundup, I will cover uranium stocks that are located in the Athabasca region, an area that hosts the world’s highest grade uranium deposits. Here is what happened in uranium stocks this week.

Standard Uranium (STND.V)

Standard Uranium is an exploration company and evaluates, acquires and develops uranium properties in Canada. The company holds five projects located in the Athabasca Basin. Its flagship project is the Davidson River Project. The Davidson River Project is located in the heart of the Patterson Lake Uranium District (Southwest Athabasca region). Surrounded by major players in uranium exploration and development including Cameco, Orano, NexGen, Fission Uranium, Fission 3.0, Denison, Purepoint, UEX, ALX and Skyharbour. Other projects include the Sun Dog and East Basin Projects.

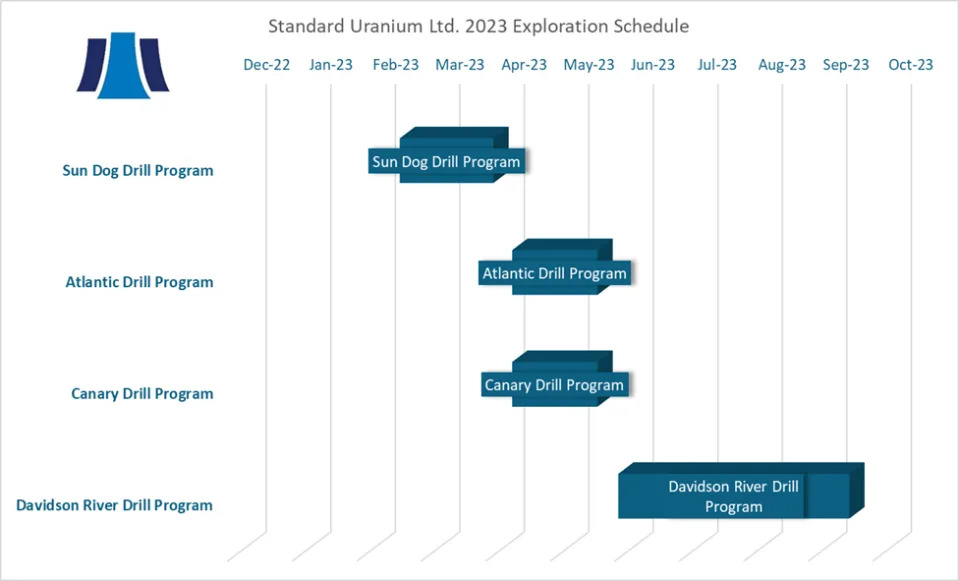

The company just raised some cash, and this week announced exploration plans for 2023.

In summary, Standard Uranium will be following up on prospective drilling results from 2022 on its flagship Davidson River Project (“Davidson River”) in the southwestern corner of the Basin and its 100% owned Sun Dog Project (“Sun Dog”) near Uranium City, Saskatchewan. In addition, the Company has planned inaugural drill programs over two of its three 100% owned projects in the eastern side of the Basin, which are drill ready following successful geophysical surveys that were completed throughout 2022.

Standard Uranium has been in a downtrend and is now in the range, or consolidation phase. This is positive for technical traders as a consolidation is a phase which tends to come before a new uptrend.

Support comes in at $0.07 (which is the previous record all time lows) and resistance comes in at $0.145. Support is an area where buyers enter and we can expect to see a wall of buyers at $0.07. For those wanting to enter on a technical breakout, we would need $0.145 to break. This triggers the end of the range and the beginning of a new uptrend.

Baselode Energy (FIND.V)

Baselode Energy is an uranium explorer looking for the next world class deposit in the Athabasca region. The company is focused on discovering ear-surface, basement-hosted, high-grade Uranium orebodies outside of the Athabasca Basin. The company controls approximately 227,000 hectares for exploration.

Baselode is another company which outlined 2023 exploration plans for investors this week. Here is the summary:

ACKIO Definition and Expansion (April to October)

- 20,000 m of diamond drilling with an estimated 87 drill holes expanding near-surface, high-grade uranium zones.

ACKIO Exploration (May to July)

- 5,000 m of diamond drilling with an estimated 16 drill holes exploring structural interpretations for more uranium mineralization within a 1 km radius of ACKIO (Figure 1).

- 2,500 m of diamond drilling with an estimated 12 drill holes covering four target areas defined with coincident airborne geophysical anomalies and areas of interest identified during ground reconnaissance exploration in 2021 (Figure 3).

Hook Exploration (July to September)

- 5,000 m of diamond drilling with an estimated 16 drill holes exploring four target areas defined with coincident airborne geophysical anomalies (Figure 2).

Shadow (June to August)

- 2,000 km airborne geophysical survey.

“2023 is going to be a busy year for Baselode. We have over 30,000 metres of drilling planned over 10 months of the year. Expanding ACKIO’s high-grade mineralized zones is our top priority, where we’ll focus on delineating additional near-surface mineralization. Our understanding of the structural system hosting ACKIO suggests the area within a 1 km radius is prospective for other zones of mineralization. Therefore, exploration for new near-surface mineralization also remains a high priority. Accordingly, we are planning additional 2,500 m and 5,000 m reconnaissance drill programs for both Catharsis and Hook projects, respectively, with targets generated using the same technical evaluation that supported the ACKIO discovery. Similarly, these targets will be testing for the same style of near-surface, high-grade uranium mineralization as our ACKIO discovery, an evolving Athabasca 2.0 exploration model proof of concept,” said James Sykes, CEO and President of Baselode.

The stock is currently testing a support zone in its range. A range which has been held since July 2022. Support tends to see buyers step in. If the stock were to break below this support, it would be a major technical break and we would be looking at lower prices.

But in the past few weeks, buyers have defended this $0.67 zone. They are not allowing a breakdown. This is a positive sign. If uranium price does breakout, it could trigger a major rally in Baselode. Notice I have drawn a downtrend line. If we see price bounce from support and close above the downtrend line, that would be a major indicator to go long. $0.90 would be the next target on an upside breakout.

ALX Resources (AL.V)

ALX Resources is an exploration company that doesn’t just deal with uranium, but also gold, lithium and energy metals projects. They also have quite the presence in Saskatchewan.

This week, the company increased its private placement financing to $1.3 million, and announced news from the Sabre Uranium Project.

ALX announced the completion of a prospecting program at Sabre which consists of 16 mineral claims encompassing 16,041 hectares (39,637 acres), located along the northern margin of the Athabasca Basin. Two radioactive zones were located on surface in the Athabasca sandstone by ALX’s prospecting team adjacent to an interpreted structural zone of quartz vein brecciation.

Highlights of the 2022 Sabre Prospecting Program

- A significant trend of structural disruption in the Athabasca sandstone known as the Jigsaw Zone was discovered. The structure is exposed at surface as quartz veining and local quartz-breccia in abundant angular boulders (i.e., not far-traveled by glacial movement), sub-crop and outcrop of sandstone and can be traced over a trend approximately 150 metres long by 15 metres wide. The Jigsaw Zone is open along strike to northeast and southwest and disappears under cover in both directions.

- A trend of elevated radioactivity in boulders in possible outcrop or sub-crop was located 15 metres to the south of Jigsaw Zone and is presumed to be a historical uranium-phosphate showing first reported in 1979. Two small pits (“West” and “East”) were hand dug by ALX to better expose the radioactive sources. Scintillometer readings of up to 550 counts per second (“cps”) and 250 cps were obtained from inside the bottom of the West and East pits, respectively (10 to 20 times background radiation levels).

The chart is simple. We are in the basing phase of market structure. A range is well defined which could mean that selling pressure has exhausted. Now the stock needs a catalyst to confirm a breakout trigger above $0.05 to begin the new uptrend.

Denison Mines (DML.TO)

Denison Mines is a big player in the Athabasca basin with a market cap of over $1.4 billion.

The company has a 95% interest in its flagship AND the largest undeveloped uranium project in the eastern Athabasca basin, the Wheeler River Project. Denison’s interests in the Athabasca Basin include a 22.5% ownership interest in the McClean Lake joint venture, which includes several uranium deposits and the McClean Lake uranium mill that is contracted to process the ore from the Cigar Lake mine under a toll milling agreement, plus a 25.17% interest in the Midwest Main and Midwest A deposits, and a 67.01% interest in the Tthe Heldeth Túé (“THT”, formerly J Zone) and Huskie deposits on the Waterbury Lake property.

This week, Denison announced a significant regulatory milestone for Wheeler River. Denison submitted the draft Environmental Impact Statement (EIS) to the Saskatchewan Ministry of Environment (MOE) and the Canadian Nuclear Safety Commission.

The EIS submission outlines the Company’s assessment of the potential effects, including applicable mitigation measures, of the proposed in-situ recovery (“ISR”) uranium mine and processing plant (the “Project”) planned for Wheeler River, and reflects several years of baseline environmental data collection, technical assessments, plus extensive engagement and consultation with Indigenous and non-Indigenous interested parties.

David Cates, Denison’s President & CEO, commented, “Canada is an environmentally conscious nation with rigorous federal and provincial environmental protection regimes. Through the process of assessing potential environmental impacts, it became apparent that our Project has the potential to achieve a superior standard of environmental sustainability. Our assessments indicate that the Project has fewer residual effects remaining after mitigation when compared to conventional open pit or underground uranium mining and milling operations. We are proud of the outcomes outlined in the EIS and the role that Denison is playing in re-shaping the uranium mining industry in Saskatchewan.”

Denison stock looks different from the based/ranging uranium juniors. The stock actually confirmed a breakout with Wednesday’s candle, closing above the $1.70 zone. A retest, which is perfectly normal, is seeing buyers step in and defend the breakout zone at time of writing.

As long as Denison remains above $1.70. a move back to $1.95 is possible with 2022 highs also in sight.