Get excited uranium bulls! Uranium price is testing a resistance zone and could be due to a breakout. Uranium miners and junior stocks will follow.

We here at Equity Guru are bullish uranium. Just recently we featured Standard Uranium on our site (STND.V). We also have uranium bull and expert Fabi Lara on the team! Check out this interview to find out why Fabi is bullish uranium:

The fundamentals just keep getting better and better and a worsening energy crisis in Europe and higher fossil fuel prices may be the catalyst for European nations to seek alternative energy sources. Clean/green energy still cannot handle base load power… Europe may need to reverse decisions on shutting down existing nuclear power plants.

Nuclear energy is a no brainer. Even Bill Gates and Elon Musk have said the world will need to use nuclear energy to solve the energy crisis and to deal with climate change. Nuclear energy does not release harmful CO2. In a way, it is really the cleanest energy we have that can handle base load power.

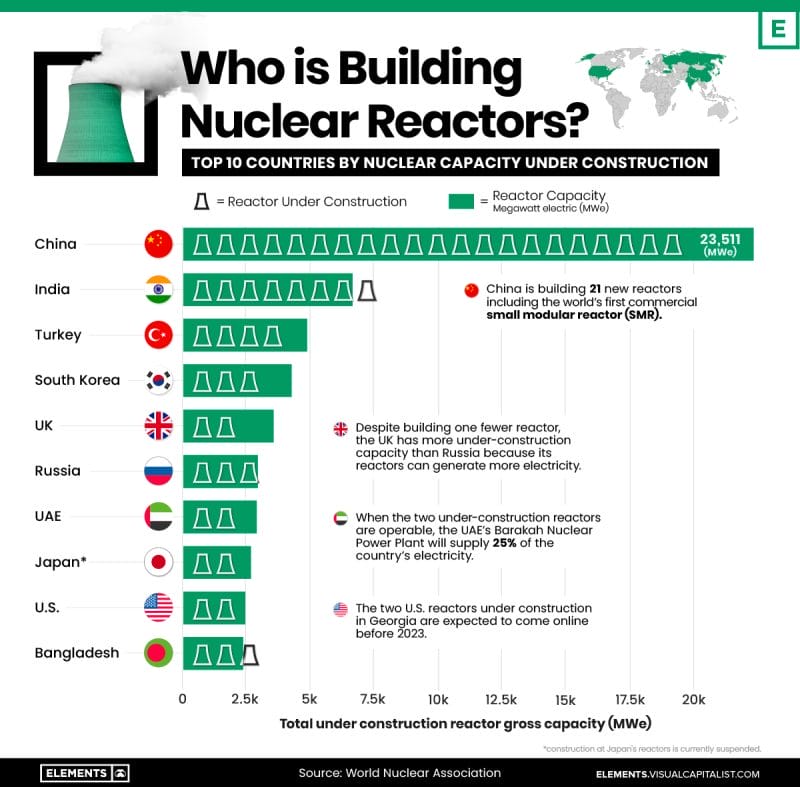

Nations like China and India, who will need a reliant supply of energy for their billion plus populations, are looking at nuclear energy to meet their requirements. They are investing heavily into nuclear energy.

Other nations will follow, but it may unfortunately take an energy crisis to wake leaders up. I am especially referring to European leaders.

Recent articles suggest nuclear power is seriously being considered. Oilprice.com put out an article stating the US is doubling down on nuclear power generation as a means to reduce emissions and is supporting demonstration projects of advanced smaller nuclear reactors which will be more efficient and cost less to build.

The big issue? The uranium type of fuel required for these reactors are sold commercially by only one company in the world. And that company is a subsidiary of Russia’s ROSATOM.

America is recognizing it will need to eliminate reliance on a Russian state corporation for its next generation nuclear reactors. In a recent Senate hearing, the Uranium Producers of America noted that:

“almost none of the fuel needed to power America’s nuclear fleet today comes from domestic producers, while U.S. nuclear utilities purchase nearly half of the uranium they consume from state-owned entities (SEO) in Russia, Kazakhstan, and Uzbekistan.”

“We estimate that there is more than $1 billion in annual U.S. dollar purchases of nuclear fuel flowing to ROSATOM,” said Scott Melbye, president of the association and Executive Vice President at Uranium Energy Corp.

ROSATOM is not under Western sanctions after the Russian invasion of Ukraine because of the Russian state firm’s importance in the supply chain of the global nuclear power industry.

America will need to invest in and establish domestic assured supply of uranium for its new nuclear reactors. An opportunity for uranium investors. As always, I believe holding some juniors in addition to front runner producers such as Uranium Energy Corp (UEC) and Energy Fuels (UUUU) would be a prudent strategy for the upcoming uranium bull market.

Analysts at Citigroup are bullish uranium. They see a number of factors making the nuclear energy outlook optimistic for the coming years and decades. Nuclear energy will be one of the preferred sources for clean energy and energy independence and security.

Citi also sees a potential western ban on Russian uranium. This just means that domestic supply in the US will have to be heavily invested in.

Citi’s uranium price bull case assumes the US, the UK, the EU and countries in Asia will introduce bans on Russian uranium supplies starting in 2023, based on publicly available information on ongoing discussions in the US Congress and the European Parliament.

In addition, any Russian-related projects would likely be halted in Eastern Europe, including reactor construction in Hungary, Slovakia and Turkey, Citi suggests.

Under this scenario, uranium production in Kazakhstan with Russian state-owned shares would also likely be banned from Western markets. Such an embargo would create a shortage of enriched products and add even further tightness in the conversion market in the short term, and provide a bid to the U3O8 price.

Uranium: all about Russia.

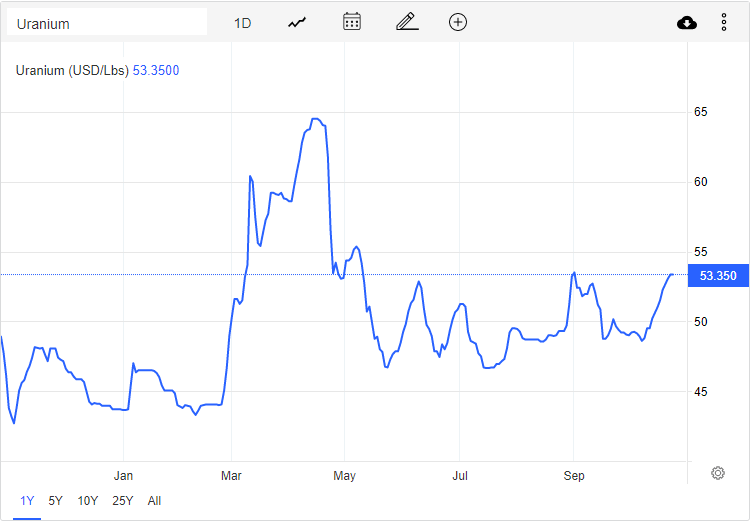

In recent uranium articles, I have been highlighting this range between $46.60 and $53.50. Uranium has been ranging between these two levels since May of 2022 after starting the year with a bang. Uranium price still remains up 10% for the year… but this could change very quickly.

We are on the verge of a breakout, and a catalyst could be the western sanctions on Russian uranium. Of course, we could just continue to range, so as of now, we are on breakout watch. If uranium confirms a break, we can easily go back to testing 2022 highs around $65.

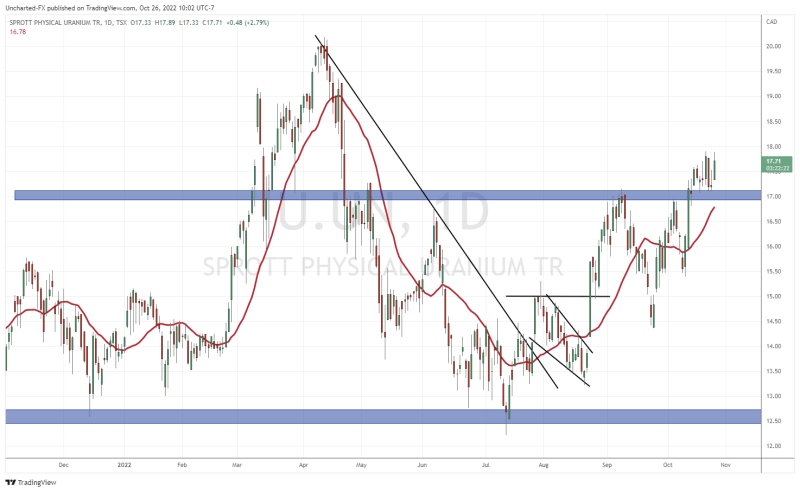

Readers know that I also like following the Sprott Physical Uranium Trust (U.UN) as a way to gauge where uranium prices are going. The charts look similar, and if we can hold above $17, the chance of a breakout and run in uranium increases.