Skyharbour Resources (SYH.V), a Canadian-based mineral explorer with key uranium assets in the legendary Athabasca Basin, announced today that it had entered into an option agreement with Tisdale Clean Energy (TCEC.V), another Canadian uranium explorer operating in northern Saskatchewan.

The agreement, dated October 19, 2022, provides Tisdale with an earn-in option to acquire an initial 51% interest and up to 75% interest in the South Falcon East (SFE) property which makes up a portion of Skyharbour’s South Falcon Point project.

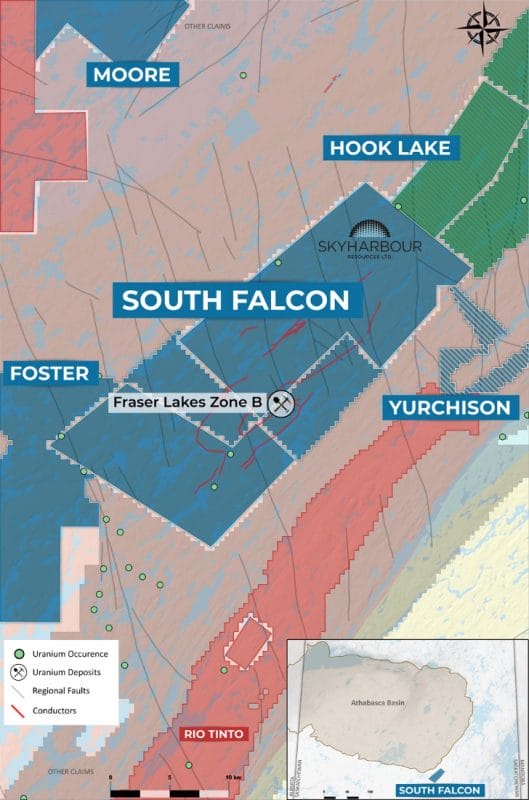

South Falcon Point is located in the Athabasca Basin and consists of 21 claims totaling 44,470 hectares and is 55 kilometres east of the Key Lake Mine. Of that, SFE totals approximately 12,464 hectares and lies 18 kilometres outside of the Athabasca Basin.

Historical exploration at the SFE property identified an area of U-Th-REE mineralization at the Fraser Lakes Zone B over an area approximately 1.5 kilometres by 0.5 kilometres.

The near-surface Fraser Lakes Zone B deposit has a current NI 43-101 inferred resource totaling 7.0 million pounds of U3O8 at 0.03% and 5.3 million pounds of ThO2 at 0.023% within 10.35 million tonnes using a cut-off grade of 0.01% U3O8.

According to the option agreement, Skyharbour will keep a minority interest in SFE assuming the earn-in completes.

Also outlined and if Tisdale completes the 75% earn-in requirements, Tisdale will issue Skyharbour 1.11 million Tisdale shares upfront, fund exploration expenditures totaling $10.5 million CAD and pay Skyharbour $11.1 million in cash, of which $6.5 million can be settled for shares in the capital of Tisdale over the five-year earn-in period.

Jordan Trimble, president, and CEO of Skyharbour commented on the deal, “We are very excited to have this new Option Agreement signed as we continue to execute on our business model by adding value to our project base in the Athabasca Basin through strategic partnerships and prospect generation, as well as focused mineral exploration at our core projects of Moore and Russell Lake. We are looking forward to working with Tisdale Clean Energy and its management team as they advance the South Falcon East Project over the coming years with a substantial amount of exploration planned and significant cash and share payments to Skyharbour. Assuming the option earn-in is completed, Skyharbour will retain a minority interest in the project as well as an NSR while maintaining a 100% interest in the surrounding claims. News will be forthcoming on exploration plans at the Property and will complement our aggressive drill campaign forthcoming at Russell Lake as well as those at various other partner-funded projects in our portfolio.”

All common shares issued to Skyharbour by Tisdale are subject to a customary four-month holding period. Also, in the event that additional shares given to Skyharbour would result in Skyharbour owning 10% or more of Tisdale, a cash payment will be made in lieu to prevent Skyharbour from becoming a reporting insider of Tisdale.

If Tisdale’s exploration spending falls short of contractually set terms, Tisdale may pay the difference to Skyharbour in cash before the expiry of that period. If Tisdale spends more than the specified sum, the difference will be carried forward to the next period.

When Tisdale fully earns-in at SFE, Skyharbour and Tisdale intend to form a joint venture for the continuing development of the property.

A small portion of SFE carries an existing 2% net smelter royalty owing to a former owner. As a result of the option agreement, Tisdale will grant a further 2% royalty to Skyharbour on the remaining bulk of the project area including the Fraser Lakes Zone B deposit.

One-half of the Tisdale’s royalty grant to Skyharbour, 1%, can be purchased at any time by Tisdale for a one-time cash payment of $1.0 million.

In recent news, Skyharbour announced that it had intersected additional uranium mineralization at its Moore Lake Project and planned for a winter drill program at both Moore as well as its Russell Lake Project.

Currently Skyharbour trades at $0.39 per share for a market cap of $56.45 million.