Earnings season continues. Netflix beat expectations and saw a breakout rip. Will Tesla be next?

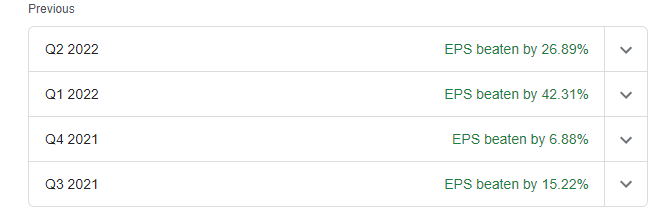

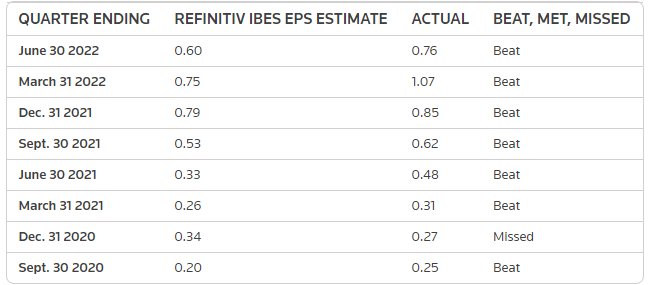

Recent earnings has seen Tesla beat earnings expectations:

In fact, the last 4 earnings reports have been positive surprises beating Wall Street estimates.

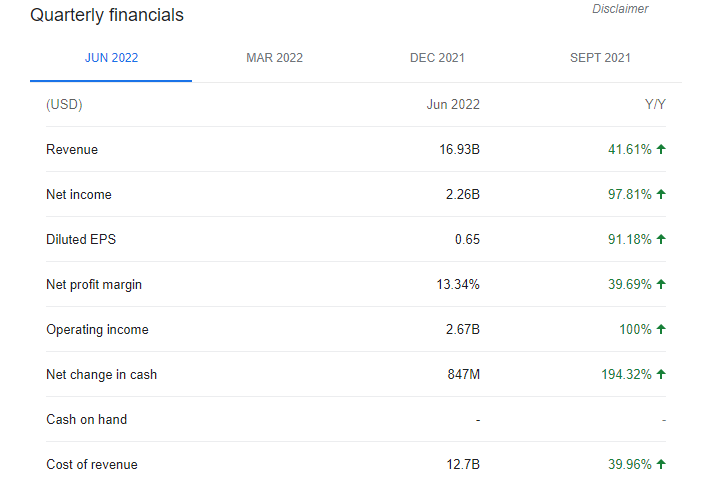

Here are the numbers from the last earnings report released in June:

Can Tesla continue this momentum? Wall Street is expecting Tesla to report:

- Q3 Revenue: $22.13 billion

- Q3 Adjusted EPS: $1.015

This revenue figure would account for more than a $5 billion jump from Q2. And Q2 earnings is when Tesla mentioned it experienced COVID related operation issues at their Shanghai plant. Year over year, this $22 billion expected revenue would be a nearly 61% jump from Q3 2021.

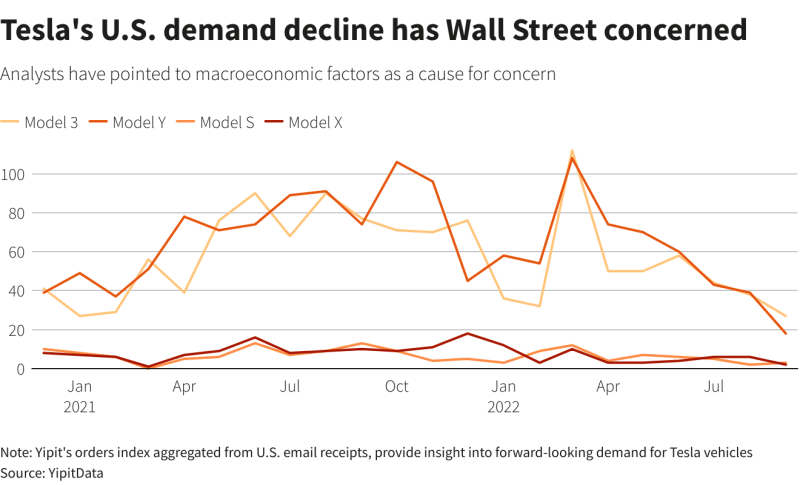

However, what investors will be focused on in this earnings report will be demand.

With the economy slowing down, and with Chinese demand also slowing down due to their economic problems, will Tesla still be able to sell more vehicles than previous quarters? In the last report, Tesla said it made 22,000 more EVs than it delivered and blamed the rise in inventory on transportation related problems. But Musk has been adamant in saying their is no demand problem.

“While we believe demand for Tesla products exceeds supply, it would be unreasonable to assume that there is (a) a limit to how much Tesla can continue to increase prices without demand suffering and (b) that the company was not exposed to decelerating macroeconomic growth,” Morgan Stanley’s Adam Jonas said in a note to investors two weeks ago.

“A top concern right now is demand in China as wait times seem to be shrinking,” RBC Capital Markets said in a note. “Question is if this is a blip or signs of a bigger change among consumers.”

Other things to note will be Tesla’s plans to ramp up production in Giga Berlin and Austin, as well as whether Giga Shanghai is fully back in 100% operations. Product wise, Elon Musk is expected to share details regarding the rollout of Tesla’s semi. The future roadmap of Tesla’s Cybertruck will also be a hot topic.

Many analysts and traders believe that Elon Musk is running out of excuses and will need to execute reasonable growth and unit targets. But one cannot help but wonder if Musk’s other ventures have taken up more of his time. I am of course referring to the Twitter drama.

Currently, out of 43 analysts, 27 rate Tesla stock as a ‘buy’ or higher, 10 have a ‘hold’ rating and 6 have ‘sell’ or lower.

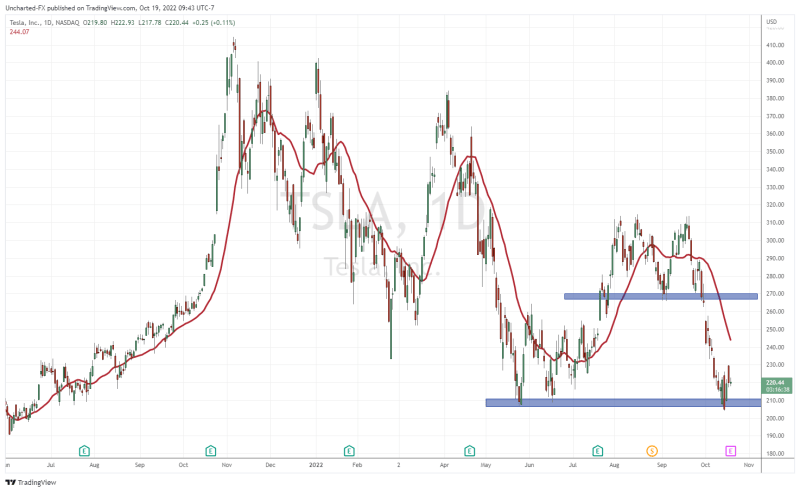

Tesla stock is at a major support level just before earnings. From a technical standpoint, things don’t get better. We have been basing here for multiple days and this is hinting at a rip higher. We do need the breakout though.

Earnings could provide the break required… but it could also do the opposite and cause a breakdown lower. I would wait for a green close above $221.50 for the bullish trigger. This means to wait for earnings and then likely play the pullback retest rather than the FOMO.

Nest resistance comes in at the $270 zone. If Tesla breaks below $205 support, then we could be heading down to the $180 zone and then $150.