Investing in junior mining is speculative. You need to do your homework on management and their past experience and successes. You need to do your due diligence on the jurisdiction the miner is operating in (stay away from those AK-47 countries!). And then the hardest part, you need to speculate on whether the good stuff (gold, silver whatever) is in the ground on said junior’s claims. Close-ology and geology sharing characteristics similar to nearby past-producing or indicated resource assets is a good sign, but sometimes the geology doesn’t pan out.

It really is a treasure hunt. A story about exploration and discovery. Some say this is a rather risky way of investing. However, those who love the junior mining space keep on coming back.

Perhaps it has to do with the fact that many of these companies are traded for a cheap price… and one major find or press release can easily provide you a 10x plus return on your money. The key is looking for juniors that align as many positives in order to increase your probabilities for success. This is easier said than done, and doesn’t only apply to junior mining but investing in general.

My readers know that I also like to apply technical analysis to my entries. My most preferred entry is based on market structure. A fancy way of saying that markets move in three ways: downtrend, range/consolidation, and an uptrend. Ideally, we look for a stock that has completed its downtrend and is in range/consolidation process.

Saying all this, there is one junior miner that has caught my eyes. This junior company is Northern Lights Resources (NLR.CN).

The company has been quiet for sometime in 2022. But that all changed after Northern Lights raised some funds. The company is now putting out press releases regularly, and is currently drilling at one of their assets.

Northern Lights is a junior explorer with two assets.

The first is the 100% owned Secret Pass Gold Project in Arizona. The project is located in the Oatman-Katherine gold district, a historic district which has seen numerous producing mines.

The Oatman district is seeing a renewed exploration interest with the recent rise in gold prices.

The Secret Pass Gold Project is located in Mohave County in Arizona. Northern Lights acquired 100% interest of the project on July 15th 2019. Secret Pass consisted of 84 unpatented lode mining claims comprising 655.6 hectares (1,620 acres) of claims under the administration of the US Bureau of Land Management and 212.4 hectares (524.9 acres) of State of Arizona mining claims for a total of 868 hectares (2,145 acres).

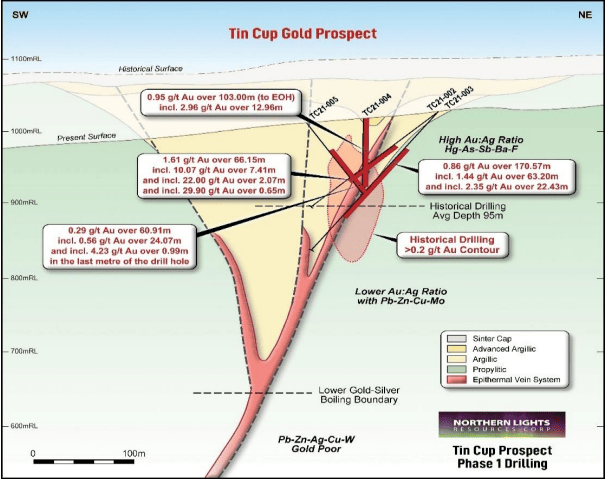

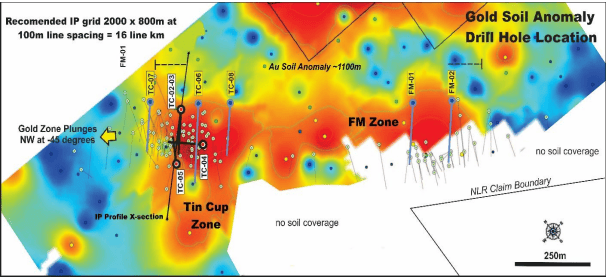

After a strategic review, Northern Lights has decided to reduce its land position at the project to focus on areas of gold mineralization between the Tin Cup and the FM zone (seen below). Assay results from initial drilling at Tin Cup in 2021 indicated a strong presence of gold mineralization with results up to 29.9 g.t gold.

The Secret Pass Project area now totals approximately 271 hectares comprising one State Mineral License (212 Ha) and 8 Bureau of Land Management mineral claims (65 Ha).

Going forward, Northern Lights is planning to expand its exploration program at Secret Pass to include the drilling of three additional holes at Tin Cup and 2 drill holes at the FM zone for a total of approximately 1,100 meters.

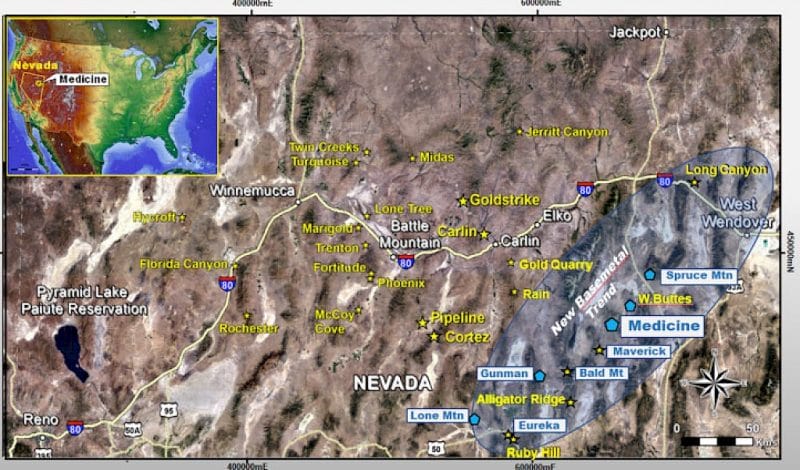

Northern Lights second project is Medicine Springs Silver-Zinc-Lead Project in joint venture with Reyna Silver (RSLV.V), located in Elko Country, Nevada.

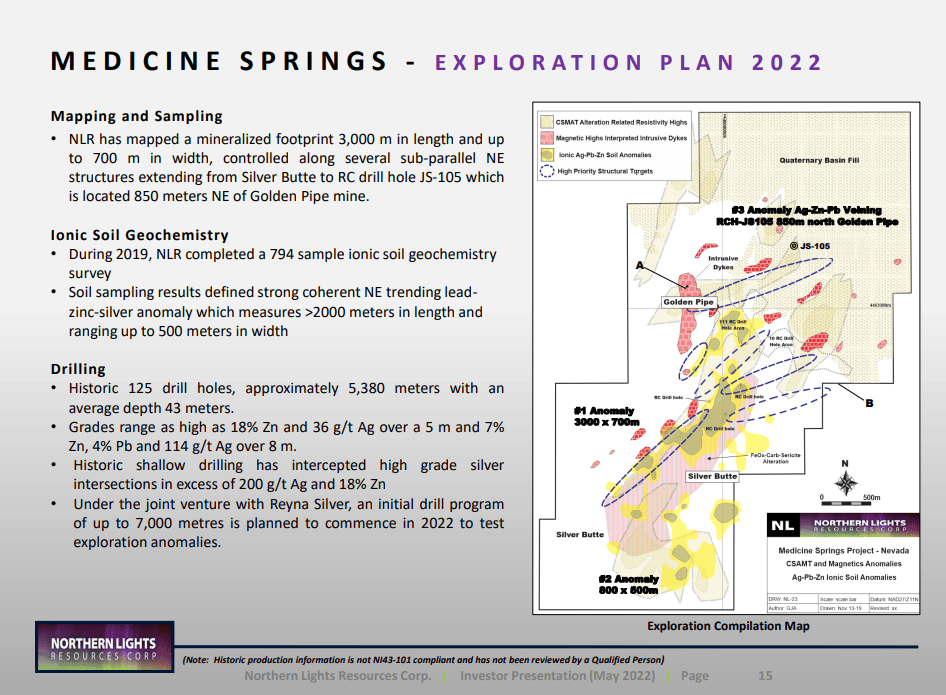

Medicine Springs is a district scale exploration project comprising 599 mineral claims over a total area of approximately 4,830 hectares. Medicine springs has all preliminary exploration work completed. The initial drill program has just begun. The prospects? This project has the potential to host a large-scale high grade silver, zinc lead carbonate replacement deposit.

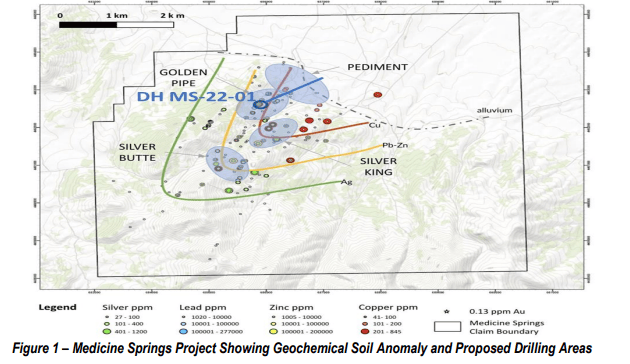

On October 4th 2022, Northern Lights Resources announced that drilling is underway at Medicine Springs. In today’s press release, Northern Lights announced that drilling is continuing on its first drill hole at the project with a target depth of 1,000 meters. The key objective of this drill hole (MS-22-01) is to determine the thickness of the carbonate sequence, the depth of oxidation and confirmation of the geophysical anomalies identified by exploration in 2019. A total of approximately 4,000 meters of drilling is planned to be completed in the next several months.

Historical drilling has shown a zone of mineralization is oxidized to depths up to a depth of 180 meters and is open to expansion in all directions. A total of 125 holes have been drilled (5,440 meters , avg depth 43 meters) with significant intercepts including silver grades of 182 g/t over 7.6 meters and high combined zinc plus lead grades of over 17% over 4.6 meters.

Now let’s get to the juicy part for investors.

This is a company with a market cap of less than $1 million. $641,220 to be exact from Yahoo Finance at time of writing. A low market cap just when the company is due for some catalysts from drilling at Medicine Springs.

The stock has been in a downtrend but began the consolidation phase in Summer of this year. The stock continues to range.

As I said, the company has been quiet but is recently putting out press releases after raising funds. Volume is something which might dissuade some investors, but volume is beginning to pick up to where we are seeing volume come in consistently.

To break the range, the stock needs a close over $0.04. What could cause this? A catalyst could be upcoming drill results from Medicine Springs. This would get some hype back into the stock especially if drill results are positive.

Just look at a stock like Go Metals which was also ranging and then released good drill results. We are talking about a 1000% plus gain!

Is there a chance drill results will find nothing? Absolutely, this is always a risk. However, Northern Light Resources have historical data to work with. When it comes to Secret Pass, initial assays showed wide gold mineralization near the surface. We know gold is at the project, the question is how much.

Medicine Springs is a joint venture with Reyna Silver, a company with a $42 million market cap. These guys have brought up drill results of 14,371 g/t Silver at a project in Mexico. I am not saying they will find something like this here, but what I am trying to say is that Reyna has done their due diligence and they believe a significant deposit can be found at Medicine Springs.

With the current market cap of Northern Light Resources, a good drill result could cause an explosive move in the stock. My first resistance target comes in at $0.20 with a break above $0.04. That is 4x your money!

Keep your eyes on Northern Lights Resources in upcoming weeks as drill results come in, and the drill campaign for Secret Pass is announced.