Northern Lights (NLR.C) is a micro-cap (market cap: $650,000) resource developer, advancing two projects

- The 100% owned, Secret Pass Gold Project located in Arizona

- The Medicine Springs silver-zinc-lead Project located in Elko County Nevada

With a sub-$1 million market cap, you could be forgiven for thinking that NLR management are dilettantes, the EPA has blacklisted the company and the land packages lack geological interest.

But none of those things are true.

Northern Lights spends little money on marketing, and has been flying under the radar.

The CEO and Director of NLR is Jason Bahnsen – “a Canadian mining engineer with over 30 years of experience in natural resources finance and operations”.

Mr. Bahnsen has hybrid expertise, able to read a drill log, design a mine or structure an acquisition. He holds a B.Sc. in Mining Engineering from the Queen’s University in Kingston and an MBA from University of New England, Australia. He’s worked at Rio Tinto and operated in the belly of investment banks like Deutsche Bank. Full Bio here.

To put the current $650,000 valuation of NLR in local real-estate context, the entire company is valued at 20% the asking price of this $3 million 80-year-old west side Vancouver charmer that boasts, “the added bonus of back lane access to the property!”

The small Vancouver home sits on a 50 x 122 ft lot.

NLR owns subsurface mineral rights, in safe mining jurisdictions, on land packages about 16,000 X bigger.

On October 11, 2022, Northern Lights announced an update to its 100% owned Secret Pass Gold Project located in Arizona and the Medicine Springs Silver Project, which it is exploring in a JV with Reyna Silver (RSLV.V) in Nevada.

“Following a strategic review, Northern Lights has reduced its land position at its Secret Pass Gold Project to focus on the areas of known gold mineralization between Tin Cup and the FM Zone,” reports NLR.

“The Secret Pass Project area now totals approximately 271 hectares comprising one State Mineral License (212 Ha) and 8 Bureau of Land Management mineral claims (65 Ha).

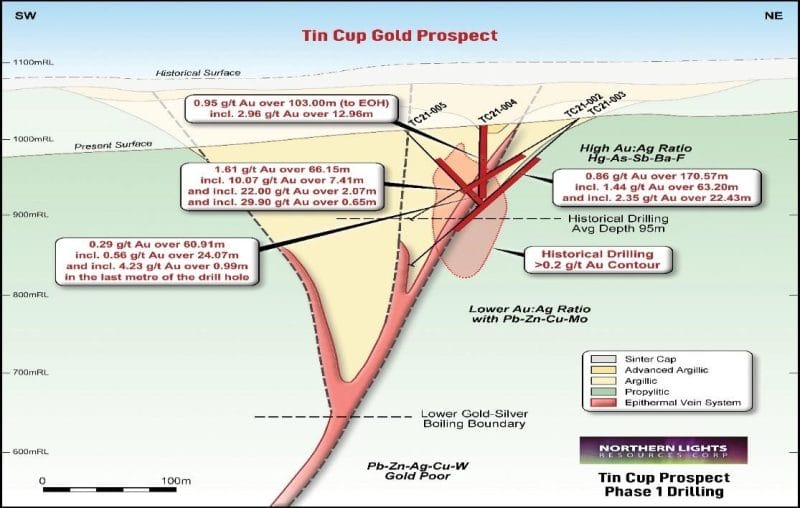

In 2021, Northern Lights completed a 610-metre drill program at the Tin Cup Prospect that included 4 diamond drill holes.

The assay results from the initial Tin Cup drill program showed the presence of significant gold mineralization with assays up to 29.9 g/t gold.

Following on from the success of the initial four holes completed, Northern Lights is planning to expand the exploration program at Secret Pass to include the drilling of three (3) additional holes at Tin Cup and two (2) drill holes at the FM Zone for a total of approximately 1,100 metres plus a deep penetrating Induced Polarization (IP) Survey over the area between the Tin Cup and FM zones. The FM Zone is located approximately 1 km east of the Tin Cup prospect.”

Six weeks ago, NLR’s JV partner Reyna Silver reported it has received drilling permits and has begun mobilizing for its fully budgeted initial 4,000m Phase 1 drilling program on the 4,831 hectares Medicine Springs Project in Elko Co., Nevada.

Reyna can Earn-In an 80% interest in the project from Northern Lights Resources.

“Medicine Springs lies in a belt of highly productive Porphyry Copper systems, so it is possible that the intrusive driver of mineralization at Medicine Springs may also be an economically important target,” states Reyna.

“Drilling targets for the Phase 1 drilling campaign at Medicine Springs are defined by reinterpretation of controls on historically mined high-grade mineralization combined with new detailed structural, geochemical, and geophysical field studies of the area.

Holes are designed to define key parameters of the Carbonate Replacement Deposit (CRD) mineralization including: thickness of the favorable host rock package; continuity of the well-defined mineralized structures to depth; and key features of mineralization that support Reyna’s proprietary exploration model for the project”.

“Medicine Springs has revealed strong indicators of being a high-grade, district-scale CRD play and we are really excited about being the first group to evaluate it on that basis”, said Jorge Ramiro Monroy, the CEO of Reyna Silver.

“Now that we have our permits in hand we are mobilizing quickly to drill our first targets, which are designed to define the project’s overall framework and see how much mineralization we can find.”

“What we see at Medicine Springs includes 10 of the 13 major features we expect to see at the very top of a large CRD system… and we see these before drilling our first hole!” said Dr. Peter Megaw, Chief Exploration Advisor to Reyna Silver. “The project has the right address, we’ve already identified high-grade silver mineralization, and we can see evidence of a long-lived, multi-phase system at work. In short, all the ingredients that tell us to “Drill here” are present and we look forward to what the rig delivers.”

Investors often ask: “Why should I invest in a tiny resource company, when I can buy shares in an international miner with an established production profile?

The answer is upside.

Nothing is going to push the $17 billion Teck Resources (TECK.NYSE) 10X into a $170 billion company.

What would it take to turn NLR into a $6 million company?

An aggressive drill program.

That is happening now.

Full Disclosure: Northern Lights is an Equity Guru marketing client.