Cryptostar (CSTR.V), a Canadian-based company operating in the U.S. and Canada focused on self-mining cryptocurrency and supplying GPU and ASIC mining and hosting solutions, announced today that it had terminated its letter of intent (LOI) with an energy company based in Kansas effective October 6, 2022.

The termination of the LOI announced on February 10, 2022, was the result of due diligence investigations, but no specifics were given, instead the company provided an update on operations.

According to Cryptostar, its aggregate self-mining hash rate as of October 6, 2022, was 92,24 petahashes from ASIC miners running at its data centres.

This hash rate reportedly contributes $227,247 USD every month in self-mining revenue based on an USD bitcoin price of $19,985.68. Bitcoin price as of October 7, 2022, is $19,438.70.

With the $570 million Binance blockchain hack announced today, cryptocurrency including bitcoin may see further lows.

Now that Ethereum has merged to proof of stake from the original proof of work protocol, Cryptostar has announced it is actively exploring opportunities for its GPU computing power.

Hosting operations in Utah, U.S. currently is expected to contribute $2.1 million in annual revenues to the company.

Cryptostar is amid litigation with its Alberta partner, Avila Energy, for non-compliance with terms of the power supply agreement as the partner’s natural gas power generator remains shut down.

The company reported it had 550.64 ethereum, 80.05 bitcoin and $2.1 million in cash as of October 7, 2022.

Payments and deposits for buildings and infrastructure equipment of $3.9 million were made by Cryptostar.

Effective October 1, 2022, Cryptostar extended its lease for another five years at one of its data centre facilities in Utah and made security deposit payments of $340,000 in relation to the extension of the lease.

Cryptostar reported $1.76 million in revenues for the quarter ending June 30, 2022, with a net comprehensive loss $4.81 million for the same period.

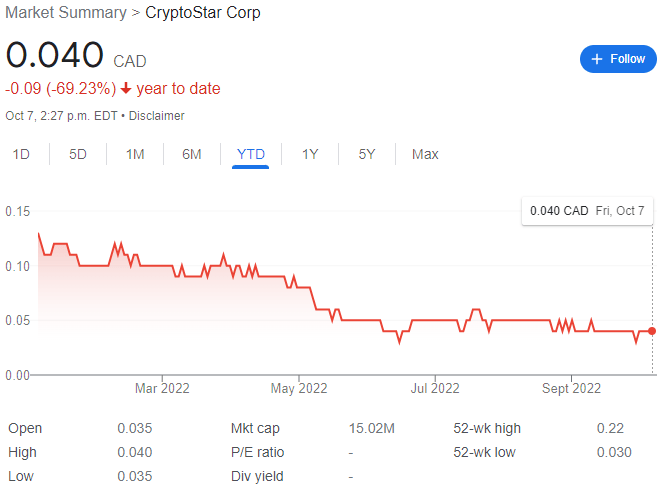

The downward trend of bitcoin and cryptocurrency in general has negatively impacted the hash price index and as of September 2022, it fell 7.7 cents for each tetrahash. While energy prices anticipated to grow over the next six months and crypto facing continued downward pressure, this index may drop even further.

Mining operations are being significantly affected with companies like Marathon Digital Holdings and Riot Blockchains dropping approximately 65% and 70% respectively for the year.

Cryptostar currently trades at $0.04 per share, a 69.23% drop YTD, for a market cap of $15.02 million.

–Gaalen Engen