Replenish Nutrients (previously known as EarthRenew) is a company that we here at Equity Guru are big fans of. Fertilizers have long been making headlines ever since the war in Ukraine began. With supply chains being affected, there will be more need of cementing domestic fertilizer production.

Especially in Canada, as Ontario, Quebec, and Atlantic Canada rely heavily on fertilizer imports. Approximately 660,000 – 680,000 tonnes of nitrogen fertilizer is imported from Russia to Eastern Canada annually, which represents between 85-90 per cent of the total nitrogen fertilizer used in the region. This is becoming a problem with the 35% tariff that the Canadian government implemented on all Russian imports including fertilizers.

This is the opportunity for Replenish Nutrients. Their Canadian sources of nutrients reduces the exposure to geopolitical supply chain issues.

EarthRenew acquired Replenish Nutrients back in May of 2021. This was the beginning of a new phase for EarthRenew as the company shifted dominantly to regenerative fertilizers. Replenish Nutrients delivers leading regenerative fertilizer solutions to support a farm system that puts healthy soils and grower profitability back on the table. By combining Canadian-sourced nutrients with their proprietary delivery system, they have developed a sustainable alternative to synthetic fertilizers that enhances overall soil function and biology while providing valuable plant-available nutrients farmers rely upon for healthy crops.

In other words, regenerative fertilizers which not only increases crop yield and decreases seed mortality, but also rehabilitates years of nutrient depletion from conventional farming. Regenerative fertilizer literally brings life back to soils by replenishing nutrients such as sulphur, potassium and phosphate. And it is great for the environment!

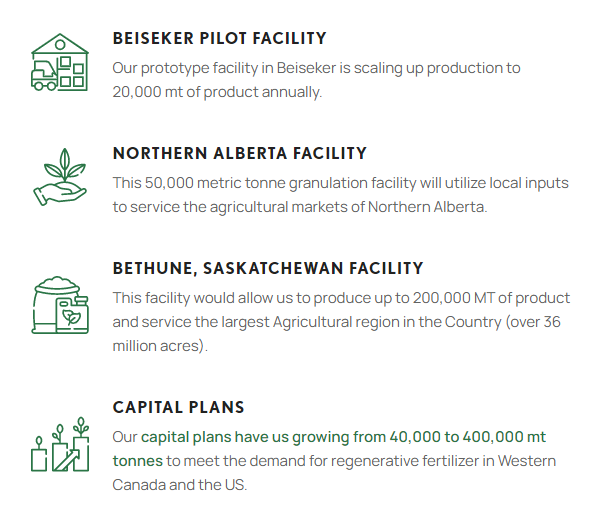

The company is making sales and expanding their production capacity, at the right time. The company is looking to benefit from the supply and demand imbalances in the current fertilizer market. Replenish Nutrients is scaling up production at its Beiseker prototype facility in Alberta, and are securing a number of blending sites to increase production of their regenerative fertilizer. With what is going on in the world, the demand for fertilizers will increase.

Fans of my technical analysis are very familiar with this company. Back when we called it EarthRenew, I claimed that this company was the most undervalued fertilizer play. The stock had the best looking chart in the agriculture space and met all my technical criteria.

The result of my call lead to a 100% gain for our readers who joined in on the ride:

Since then, the company announced a $10.45 million equity offering 41,804,500 units at a price of $0.25 per share. There are also warrants for $0.32 exercisable for a period of 48 months following the date of issuance. The offering occurred at a discount from where the stock was trading and led to a gap down.

Here is the current chart of Replenish Nutrients:

We are back to levels when I said that this company was ready for a big move in February 2022. Things have changed. The company has more cash in the bank, and supply and demand imbalances for fertilizers remain. I was a fan a few months ago, and I am a fan now at this price level.

In my opinion, the technicals are indicating a repeat of the move we rode along with readers earlier this year. But there are a few missing elements.

In order for a reversal pattern to trigger, the first criteria we need is a candle close above $0.17. You can see we attempted to break above this level a few times in recent weeks. We almost did on August 8th, but sellers jumped in and the price failed to close above $0.17 by the end of the day. This price level is current resistance.

Once we break above $0.17, the next major zone I will be watching is $0.20. This is currently a flip zone. It is an area that has been both support and resistance in the past which means that $0.20 is a very important technical level. We should expect some action there. For bulls, we want to see a strong close above $0.20. This would really get the ball going and we can then look for higher targets.

What if we drop lower instead? That’s fine because perhaps we could print a double bottom pattern. The key bottom side support zone comes in at $0.145. Just by looking at the chart, you can see that buyers always stepped in at this price zone in the recent year. If we closed below, it would be bearish. We do not want this to happen.

In summary, the technicals are looking very promising. A new uptrend is poised to begin but we first need that close above $0.17. That will be the trigger.

In terms of fundamentals, the company has the cash to trigger catalysts and it now is all about management doing what they promised to do. The current price level is near a major support zone and is showing signs of basing. It is cheaper now than it was back in February when we also saw signs of basing before beginning a new uptrend. It looks like Replenish Nutrients is poised for another.