EasTower Wireless (ESTW.V), a US provider of wireless communications infrastructure and related services, announced today that it had successfully closed it non-brokered private placement originally announced August 8, 2022.

The company issued 10.32 million units at $0.05 CAD per unit for the PP and brought home gross proceeds of $516,043.60.

Each unit was comprised of one common share in the equity of EasTower and one transferrable share purchase warrant.

Each warrant entitles the holder to purchase one common share in EasTower at an exercise price of $0.10 per share until 24 months after the date of closure. Warrants are subject to an acceleration provision.

The offering also included the effective conversion of $28,499 USD of debt the company held with an arm’s-length lender in exchange for 731,300 units at five cents per unit.

In recent news, the company announced in the middle of June that it had signed a master service agreement with one of the largest tower operators in the world.

The global 5G service market is estimated to reach $1.67 trillion by 2030 at a compound annual growth rate of 52%.

The United States is expected to be the primary driver of this trend.

Equity.Guru’s own Chris Parry, sat down back at the end of April and gave his thoughts on EasTower Wireless and what the company held in terms of potential for investors:

EasTower reported $1.10 million USD in cash and cash equivalents as of March 31, 2022, with $425,061 in revenues and gross profit of $218,670 for the quarter ending March 31, 2022, for a net loss of $2.23 million or -$0.061 per share.

Founded in 2015, EasTower customer base includes industry heavyweights such as AT&T, SBA, Lockheed Martin, and Nokia Siemens Networks.

The company’s revenue model consists of an upfront cost of $75,000 to have a crew fully trained, certified, licensed & operating. This results in approximately $17,000 per crew (four personnel) per week (43 weeks per year) equaling top line revenue of over $730,000 annually for each crew.

EasTower committed to having a target of six operating crews by August and 10 crews by October 2022. It went on state in its presentation that it brings in a healthy average gross margin of 37% to 52%.

The company has projected a run-rate breakeven by the end of Q4 2022.

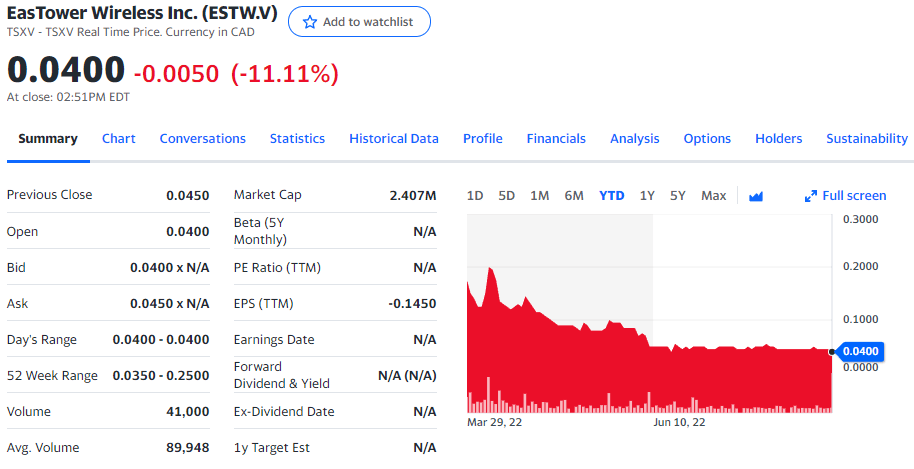

Currently EasTower Wireless trades at $0.04 CAD per share for a market cap of $2.41 million.

–Gaalen Engen