We have a major week ahead with the Federal Reserve and potential confirmation of a US recession. Is now the time to look at gold?

It gets a bit more complicated. Sure, money can run into gold when there is fear and uncertainty, but there are some typical money flow signs that I watch for.

A weaker US dollar helps as gold and the dollar are negatively correlated. The major chart for investors to watch is the US 10 year yield. It is hinting at a positive sign for gold bulls.

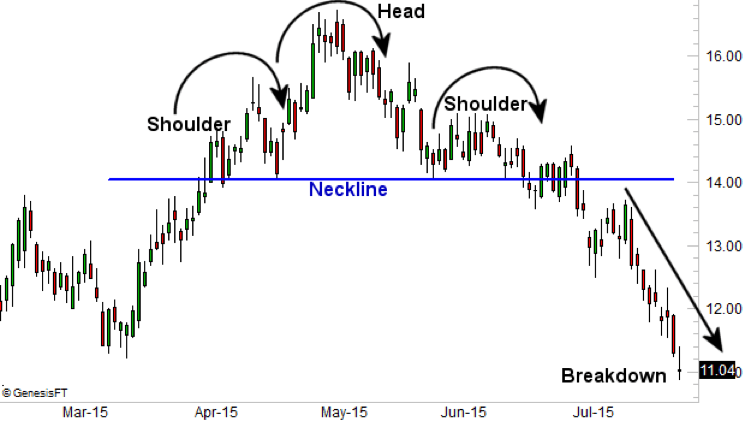

I spy with my technical analysis eyes a reversal pattern known as the head and shoulders pattern. Here is how that pattern looks:

Compare this with the structure of the 10 year yield above. We could have a reversal here folks.

The implication is the market is calling the top of interest rates, forecasting a recession. Since central banks tend to cut interest rates in a recession, it is best to buy bonds yielding whatever they are now because they will be worth more than the bonds issued at a later date when central banks cut rates.

The other thinking is a run into bonds could be for safety but I think this only applies if we see bonds AND the US dollar moving up together.

So what does this all mean for gold? Besides the fact that central bank cutting rates when inflation continues to come in higher might trigger a confidence crisis, which would be great for gold, there is another mainstream financial reason. Gold tends to do poorly in an environment when interest rates are rising. When rates are low gold tends to shine. This is because gold does not yield anything unlike bonds. When bond yields are low, gold looks more attractive.

If the market is pricing in the topping of bond yields, and our head and shoulders pattern triggers, gold is due for a reversal.

I’m not going to lie, the gold chart from a technical analysis perspective doesn’t have me optimistic just yet. $1680 is a MAJOR support (price floor) level for everyone’s favorite shiny yellow metal. We tested this support this week. So far so good. Gold must remain above $1680 to have any chance of a reversal. Look at how many times this support zone has held in the past. Gold has bounced at $1680 multiple times going back to 2020!

If a reversal is to be initiated, this is a good place for it to begin.

Going down to the daily timeframe and we see that buyers are already stepping in at $1680. The evidence of this is the big engulfing green candle we printed on July 21st 2022. Uber bulls may consider going long and placing a stop loss below that candle. For those who want to play things a bit safer, I would wait for signs that selling pressure is exhausting. If the price of gold begins to range here, that would be a good indication that selling pressure is exhausting. How so? It indicates that there are not enough sellers to cause a breakdown below $1680. The buyers are, sorry to use an old Wall Street Bets terminology, holding the line.

Trading paper contracts is just one way to play gold. Best suited for trading. If you want to go long gold because you believe central banks and the fiat currency will have issues, governments will have issues, the world will experience a lot of uncertainty due to geopolitics, well you should adopt a longer term perspective. Approach gold as an investment rather than a trade.

I do both. I trade many assets, but I also have a long term portfolio with commodities being a big portion of it.

One can buy gold ETFs, gold juniors, and/or gold miners. However, my preferred way of going long gold is investing in a gold royalty and streaming company.

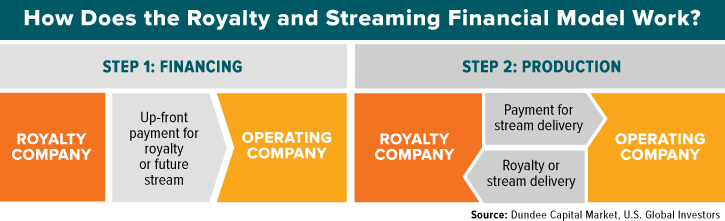

What is a gold and royalty streamer?

A regular mining company sticks drills into the ground, uses shovels, they try to find and extract the actual Gold and Silver. It is a very expensive business factoring in the labor costs, the machinery and the costs of doing business. Their balance sheets tend to show a lot of debt, and if the price of Gold and Silver drops, they cannot just stop mining.

A royalty and streamer on the other hand, issues loans to mining companies, thereby helping to finance the development of said mining companies deposit(s). In exchange for the funds/loans, the streamers receive a set amount of Gold and Silver physical metal in the future when the mining company successfully begins to extract from the ground.

It’s like lending someone $10,000 to build a bakery – with the baker agreeing to give you 1% of the revenues. If the bakery never opens, you lose. If the bakery produces bread for 30 years, you win. If the price of bread triples, you win. If the bakery increases production, you win.

A royalty company is similar but they take 1% of the physical bread pulled from the oven – not money directly from the till.

The key point here is that streamers generally have a fixed cost (in terms of how much they loan, and labor costs), while their revenue is variable ( the price of the metals they receive varies over time). Royalty and Streamers are leveraged to the price of metals, and their charts often reflect the expectations of precious metals into the future. So if you do not want to buy them, at least use them for sentiment and confluence for determining precious metal prices.

Another benefit for investing in a royalty and streamer is the risk. Mining, especially in certain jurisdictions, can be risky. Certain governments may decide to change the laws and take over mines situated in their country. A royalty and streamer does not need to worry about governments increasing taxes on mining once the mine is developed and begins extraction.

There is an ever increasing list of Royalty and Streamers, but the big five would be Franco-Nevada, Wheaton Precious Metals, Royal Gold, Osisko, and Sandstorm Gold. I am positive that we will be seeing the big boys gobble up more of these up and coming royalty and streamer companies in the months to come.

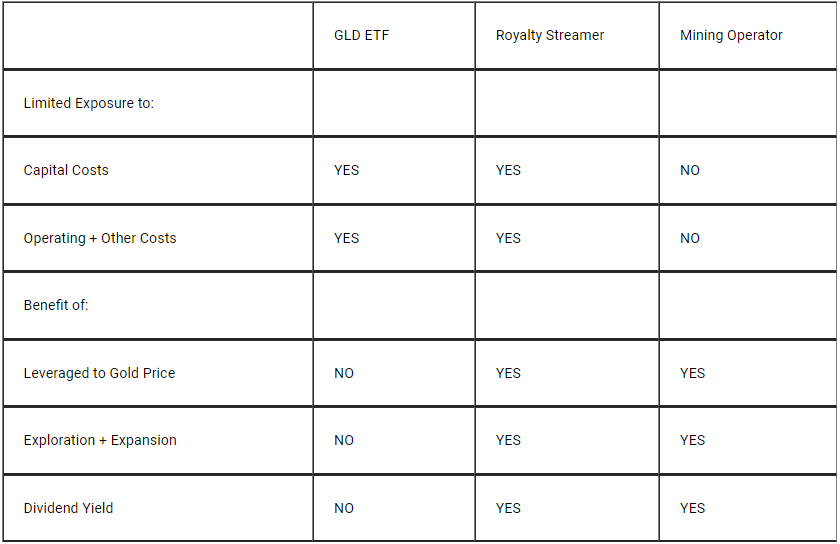

Let’s summarize why royalty and streamers are the best way to invest in precious metals.

A Royalty and Streamer maximizes exploration upside, security of tenure, and focuses on new investments, while minimizing cost exposures, margin encroachment, and involvement in mining.

Let’s break this down in comparison to the GLD ETF and a large mining operator:

The royalty and streamer wins on all fronts.

But what if the price of gold and silver drops? Won’t the royalty and streamer drop as well being leveraged to the price of metals? Yes, but here’s the kicker. If gold and silver prices drop, a major miner will continue to mine even as margins drop. They will start losing money and go into debt. This has happened before, and why many miners have balance sheets that show a lot of debt.

A royalty and streamer on the other hand will still be making money. It comes down to management. When gold and silver prices drop and are in a down market, good management will use this opportunity to create new royalty deals which will pay off handsomely in the future. This news in itself can be a catalyst for the stock even when gold and silver prices are dropping.

In summary, these companies are the safest way to play the precious metals in a bull or bear market, and I highly suggest you consider them for your portfolio.