Say, “helium,” and people immediately think party balloons and squeaky voices, but this inert gas is far more purposeful than making your friends giggle with your minion impressions. Among many other things, helium is an integral component when it comes to MRIs, eye surgery, rocket engines, arc welding, nuclear reactors, and superconductivity.

Say, “helium,” and people immediately think party balloons and squeaky voices, but this inert gas is far more purposeful than making your friends giggle with your minion impressions. Among many other things, helium is an integral component when it comes to MRIs, eye surgery, rocket engines, arc welding, nuclear reactors, and superconductivity.

For many of the applications helium is used for, there is no substitute. Which makes the fact that it is non-renewable problematic. Even though helium is one of the most plentiful elements in the universe, it is only found in a few locations on earth and producing deposits are rapidly being depleted.

Helium is a byproduct of decaying uranium and fossil fuels with most of the world’s reserves in the US, Middle East, Russia, and North Africa. The Bureau of Land Management’s (BLM) Federal Helium Reserve in the US was responsible for over 40% of the world’s helium supply until it shuttered in 2021.

Helium pricing is relatively opaque as the gas is bought and sold through confidential long-term private contracts. According to the August 2018 crude helium auction by the BLM, it was priced at an average $280/mcf USD with a high of $337/mcf. As such, helium is considered a high-value low-volume resource approximately 100 times more valuable than natural gas.

So, with geopolitical tensions with Russia and supply chain disruptions in Qatar pointing toward an extended supply shortage of helium, domestic helium explorers and producers have more opportunity and potential than ever before. Here are three you may want to put on your radar:

First Helium (HELI.V)

First Helium (HELI.V) is a Vancouver, British Columbia-based junior primarily focused on the exploration and development of helium assets in Alberta, Canada.

The company’s portfolio properties cover more than 32,000 hectares in Northern Alberta’s Worsley Trend and 111,693.24 hectares near Lethbridge in Southern Alberta. The trend is situated on the northern flank of the Peace River Arch and is host to a multiple of economic helium concentrations.

Wells in the area have traditionally produced significant amounts of helium along with the targeted hydrocarbons but historically, the helium has never been recovered during production and allowed to float off into the atmosphere.

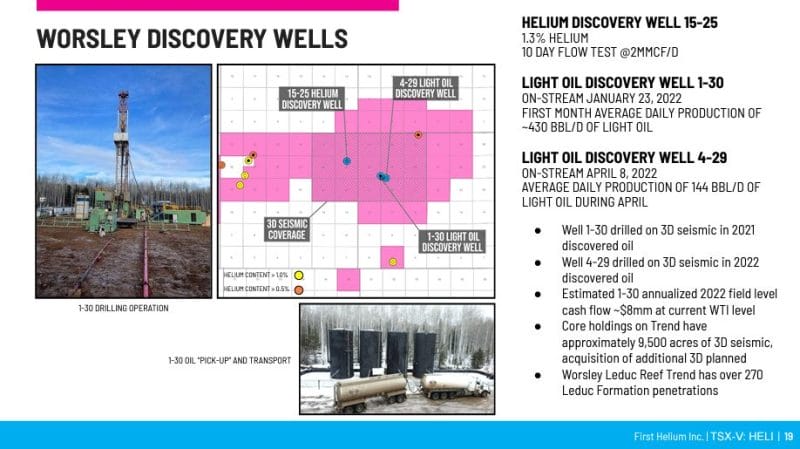

First Helium’s Worsley Helium Project hosts three discovery wells: 15-25, 1-30 and 4-29. 15-25 has shown a concentration of 1.3% helium and during a 10-day flow test, produced 2MMCF/D. 1-30 has been on stream since the end of January and during its first month produced an average of ~430 BBL/D of light oil. 4-29 has been on stream since the beginning of April and in its first month, produced an average of 144 BBL/D.

Contingent resources base case scenario for the 15-25 discovery well as noted by Sproule and Associates on March 31, 2021, is $15.2 million at $340/mcf (NPV 10%). First Helium expects each new well’s production profile to be like 15-25 with a 50% risk applied to the volumes of resource.

In May 2021, the company inked a deal to explore for helium over 356,123 contiguous hectares in Southern Alberta near known helium production. A number of formations within the Helium Fairway package have returned helium volumes of more than 0.5%.

First Helium intends to drill and production test two new Worsley exploration wells over the next 12 months and by the end of that period, the junior explorer expects to have constructed and commissioned an onsite facility, and commenced helium production at the Worsley project.

The company also plans to finalize drill locations and prepare to drill in the Lethbridge Area during H2 2022.

On July 6, 2022, First Helium traded at $0.49 CAD per share, up 75% over the previous 12 months, for a market cap of 36.68 million.

Imperial Helium (IHC.V)

Imperial Helium (IHC.V) is a Calgary, Alberta-based junior focused on the acquisition, exploration and development of helium assets located in Alberta, Canada.

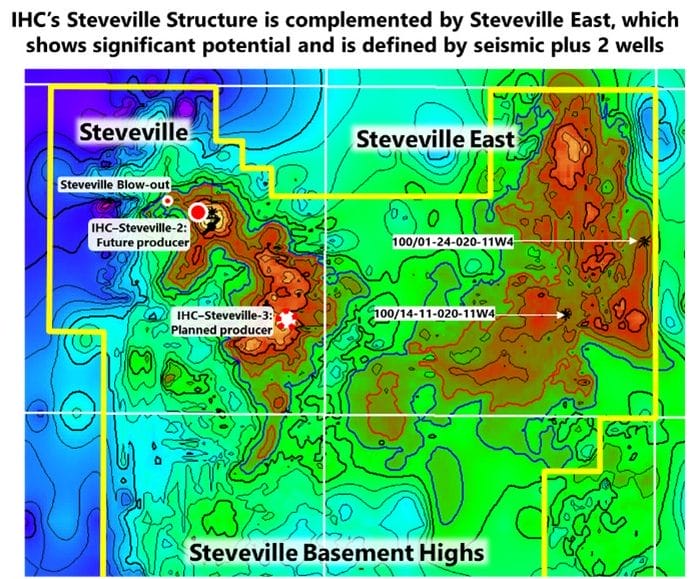

The company’s flagship Steveville Asset is in Alberta approximately 200 kilometres east of Calgary and 40 kilometres northeast of Brooks.

The property covers 24,635 hectares and is thought to host one billion cubic feet of helium. At the end of 2021, Imperial commenced drilling its second future producing helium well on the Steveville asset, IHC-Steveville-3.

In February this year, the company announced it had confirmed the presence of helium in an additional zone in Steveville. The first production test returned an immediate gas flow to surface with a helium concentration of 0.51%, some 19% higher than encountered from the Blowout Zone (BOZ) in IHC-Steveville-2.

Later in March, Imperial announced that it was planning to construct a production facility at Steveville that was capably of processing a combined 10-15 MMcf/d of raw gas from the two producing wells. According to results from testing, the helium explorer has deliverability capacity of 10-15 MMcf/d of raw gas for more than three years before experiencing a 15% decline over an estimated 10-15 years.

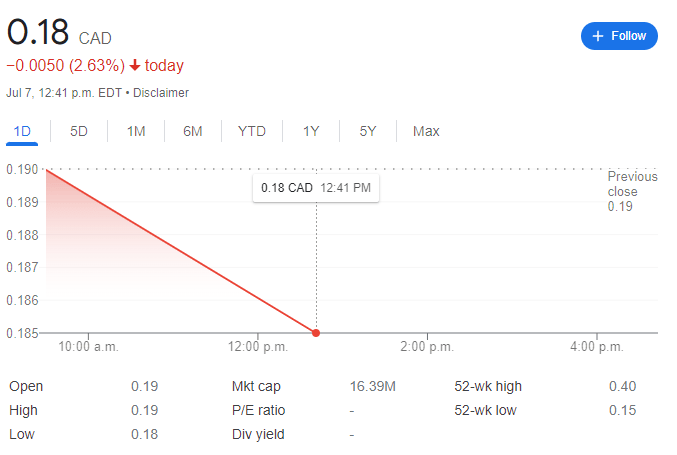

In May, the company entered into an agreement to be acquired by Royal Helium in an all-share deal which would see Imperial shareholders receive 0.614 of a Royal Helium share for every Imperial common share held, a 10.01% premium to Imperial’s closing price on April 29, 2022. Details are to be released about the deal at a July 12, 2022, shareholder meeting where the matter will be voted on.

Imperial Helium traded at $0.18 per share on July 7, 2022, for a market cap of $16.39 million.

Royal Helium (RHC.V)

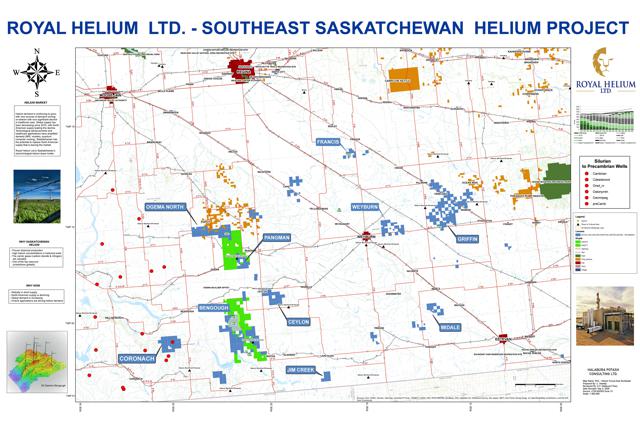

Royal Helium (RHC.V) is a Saskatoon, Saskatchewan-based helium junior engaged in the exploration and development of helium assets in Western Canada.

The company holds 348,908 hectares of prospective helium rights across southern Saskatchewan. It’s helium lease/permit land consists of 10 main blocks.

Drilling in 2021 at the Climax block resulted in the discovery of the Climax Nazare zone where the company expects to drill further production wells. Economic helium concentrations were announced in April 2021 with tests returning levels ranging from 0.33% to 0.64% helium in the Deadwood, Souris River and Duperow formations.

Royal has commenced drilling activity on the Ogema block and also plans to drill test 30 structures of similar size to the existing Wilhelm and Mankota helium pools.

The helium junior announced in the middle of June 2022, that it had received final results on its seismic program at Val Marie. The program helped identify six high priority targets. The initial well at Val Marie has been permitted and is scheduled to spud on July 10, 2022.

The Val Marie project consists of claims totaling 13,000 hectares and lies in the heart of the Bowdoin Dome feature which has hosted both historic and current helium production.

As mentioned earlier, Royal is in the process of acquiring Imperial Helium, which will add considerably to both its exploration potential and production capacity.

At the beginning of July, the company announced results from its Nazare production modeling simulation where base case production levels of a dual-leg HZ well supported an initial six-month average flow rate of 6,155 MCF/D with a forecast of expected ultimate delivery of 60,255 MCF helium.

Royal Helium president and CEO, Andrew Davidson commented, “We are extremely pleased with the outcome of Dr. Zhao’s study, the validation that our Nazare discovery is capable of large-scale deliverability is a huge addition to our “conventional” production profile beginning with our first 2 processing plants at Climax and Steveville. We now look forward to planning the first Nazare well for later this year and, predicated on its outcome, the design work for an additional, larger permanent facility for the Climax Nazare reservoir. The question of whether the Nazare will be a producible reservoir has now been answered and we will move aggressively towards the first production well and further, will make plans toward exploiting the whole reservoir.”

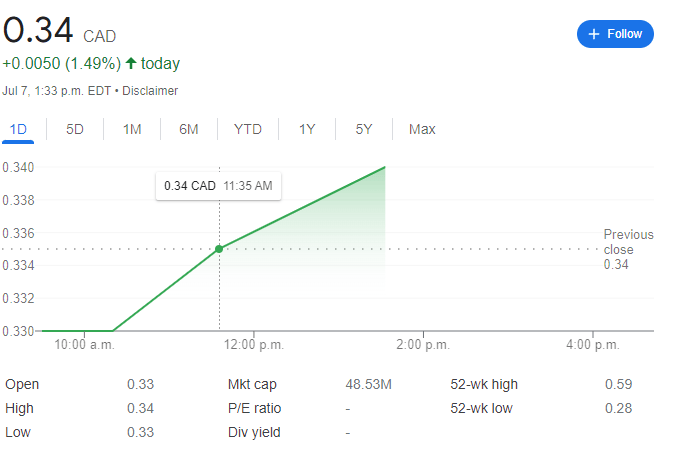

Royal traded at $0.34 per share on July 7, 2022, for a market cap of $48.53 million.

These Canadian explorers show promise in the bid to secure our domestic helium supply, protecting our borders, advancing science, and enhancing our manufacturing capabilities for years to come. The best part about their story is the growth potential and east investment entry for retail investors looking to capitalize on this necessary and ever-dwindling resource. Go ahead, help create a better world. Please do your due diligence before making any investment decision.

Check out our Investor Roundtable Video for more opinions on the helium sector.

–Gaalen Engen