Many people are freaking out about the stock markets. Makes sense. I get it.

However, the market you SHOULD be watching is the bond/debt markets. Not only because they are the largest in the world, but the fact that central banks are in the process of raising interest rates to tame inflation.

Oh and the fact that the western world is used to artificially low interest rates which has caused an everything bubble. A bubble that could be on the verge of popping if interest rates rise more than people expect. I don’t need to tell you what this would mean. Assets (stock markets, real estate etc) would have to fall much lower… and this has the potential to hurt people.

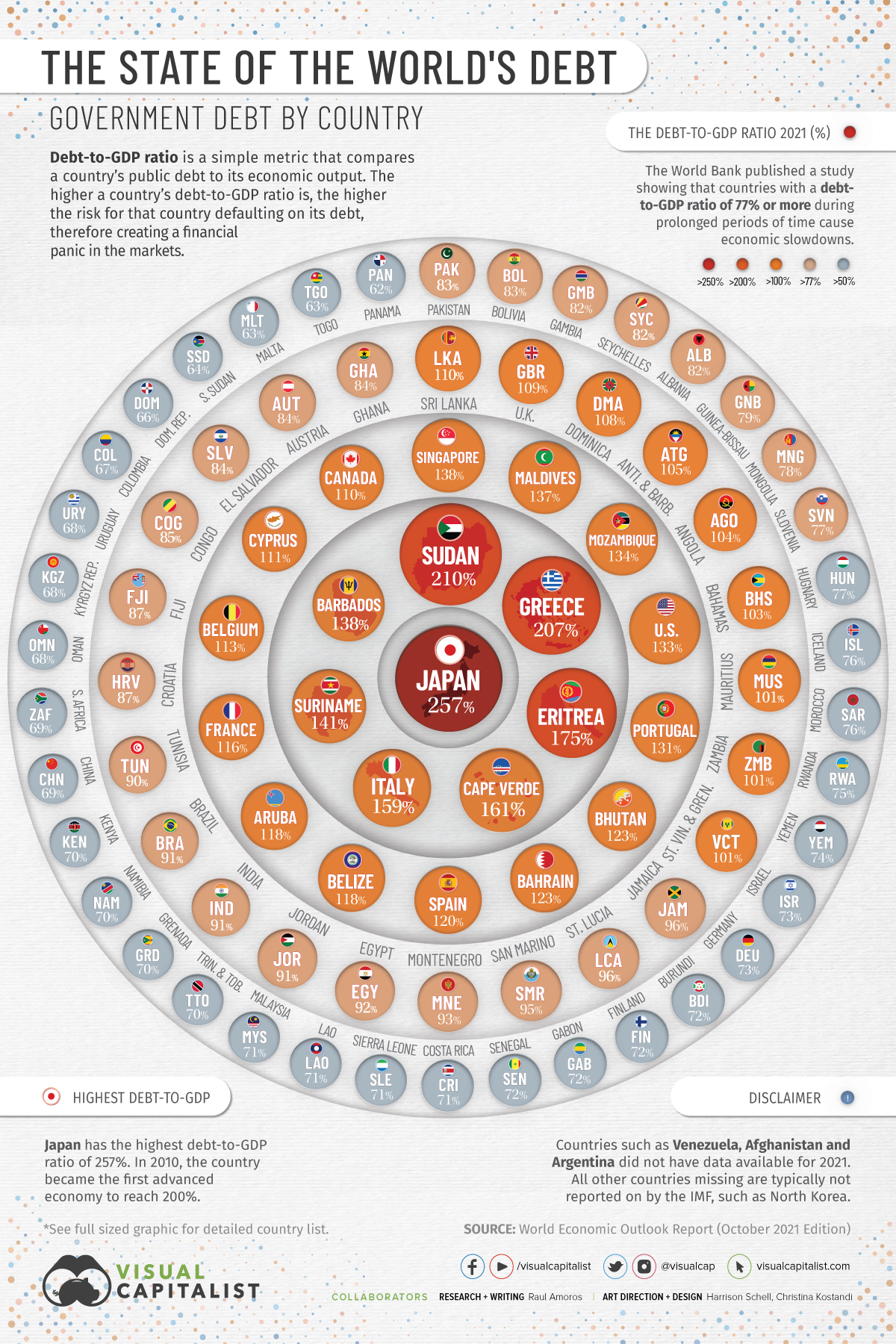

The middle class isn’t the only ones with a lot of debt. Many governments are indebted! If interest rates rise too much, some countries could be in a situation where their tax revenue only covers their interest payments on the debt!

A great image by the visual capitalist. Japan is smack down in the middle with the highest debt to gdp ratio. Although the US would be right beside them if you factor in their off balance sheet debt.

If you focus on Japan, you might understand why the Bank of Japan (BoJ) is reluctant to raise interest rates. For those wanting the scoop, I suggest you read my two pieces covering the Bank of Japan. I really do believe it is one of the most important central banks right now. If it wasn’t for Japan, interest rates around the globe would be much higher. Stock markets and real estate would be much lower. Kuroda and the BoJ’s easy monetary policy is literally keeping the financial world intact. To find out why, check out my articles here and here.

Rising borrowing costs have made news in Europe.

A few weeks ago, the European Central Bank (ECB) said that they would unveil some new tool to combat rising rates in certain EU countries. The markets thought the ECB would begin purchasing bonds to lower rates. This is huge because the ECB has just ended their bond purchasing program and is going to be raising interest rates. But now they are reverting back to bond purchasing…which puts some doubt on the ECB actually hiking interest rates.

This month (July 2022) will be huge for Europe as the ECB is still set to raise interest rates for the first time in 11 years. Just remember they are still at -0.50%, so a 25 basis point hike would keep them in negative territory like Japan and Switzerland.

The one chart which spooked the ECB was rising yields in Italy. There were failed budget talks with Italy, which also led to an emergency ECB meeting where they told markets they would unveil a tool to combat rising borrowing costs in some European countries.

The Italian 10 year debt has fallen from highs at just below 4.40%. The highest borrowing costs since 2013-2014. We are testing a major support zone here, but Europe will rest easy once yields drop below 3%.

There has been crazy bond action in the US. My readers know that the US 10 year yield is the first chart I look at when I get up in the morning. The 10 year yield, brew some coffee, and then take a look at stock markets. The importance of the 10 year just increases given the current macro backdrop.

The markets were freaking out when the 10 year yield broke above 3% and hit recent highs of 3.50%. With the 10 year now below 3%, some people can rest easy.

But the big question is why? Why are yields dropping? Let me first give you the accepted reason.

Recession fears. Tons of signs of a recession. Take a look at copper and many other commodities which are now in bear markets. The agricultural commodities included!

With fears of an economic slowdown, the markets are beginning to price in the end of central bank rate hikes. It makes sense. In a recession, central banks CUT interest rates as a way to make money cheap to spur economic growth. The thing is that what central banks do and don’t do is out the window. I mean they have been raising interest rates in a weak economy. Something they wouldn’t do but had to in order to deal with inflation.

A positive outcome of a recession is that it can tame non-monetary inflation. Oil and other commodity prices drop as demand drops. This then will translate into cheaper prices. The monetary inflation is a different story.

Back to that 10 year yield. If the markets are pricing in recession and central banks having to reverse policy, then bonds yielding at these levels won’t be around for too long. Investors/funds therefore buy bonds. Keep in mind there is an inverse correlation between bond prices and yields. When yields drop, bond prices go up and vice versa. Buying bonds is a trade betting on a recession and central banks having to cut interest rates.

In my opinion, market participants are not buying bonds for the yield. They are buying them as a trade so they can sell bonds at a higher price when yields begin to drop. If you think about it, if we factor in inflation, bonds are still yielding negative in real terms even at this level.

The other thinking is that investors are afraid. The fear trade is on. They are running into the US Dollar and the safety of government debt. This is known as a risk off environment as opposed to a risk on environment where money flows into riskier assets such as stocks.

But now, indulge me for just a minute.

I understand the reasoning for buying bonds here betting on lower rates. But maybe there is something else. Maybe the central banks are getting involved. It is no secret that the ECB wants to unveil a tool to lower rising yields. Perhaps they are buying?

I think one can make the claim for the Federal Reserve. Here’s why:

We have seen a major spike in US mortgage rates. They are at levels not seen since 2008! The Fed probably has some incentive to keep borrowing costs low.

Now I don’t say things without backing up my claims. I want you to take a look at the Federal Reserve Balance Sheet:

A rising balance sheet is beginning to flat out. What we should expect from a central bank that is reducing their balance sheet. But let’s take a closer look.

I want you to take a look at the balance sheet from June 1st onwards. The balance sheet is rising. Why is this a big deal? Well June is when quantitative tightening began. The Fed was supposed to be selling off treasuries and mortgage backed securities. I don’t know about you, but this doesn’t look like tightening to me.

So the question becomes, where is the money going? What has caused the balance sheet to rise in June. I might not be the world’s famous detective, but some basic detective work leads me to believe the Fed is buying up bonds again to keep yields from rising.

I don’t think this sounds crazy. In fact, most people (especially contrarians!) wouldn’t find this as a surprise. This goes back to what we have been saying since the current rate hike cycle began: central banks are stuck. They might not be able to raise rates above 5% to tame inflation without causing a system meltdown.

Not only will I be keeping an eye on the 10 year yield, but also the Federal Reserve balance sheet. I recommend that you do the same.