We know that diamonds are a girl’s best friend, but will they also be an investor’s best friend? My experience with diamonds is quite the story. To be honest, I was never a big diamond guy, but was fascinated with the market. Diamonds of course are a luxury item which has seen stable and steady gains. Most people look for stocks or cryptos to be the top performing asset of the year. It may come as a surprise for my readers to hear that art, old wine and whiskey, watches, antique cars and even diamonds, have been top performing assets in years gone by.

In this article, we will take a look at the diamond market fundamentals, and then a possible way to invest in diamonds through Diamond Standard.

My Diamond Experience

I’m a gold and silver guy but I love following all the other commodities. I regularly check the charts of precious metals, base metals, agricultural commodities and energy. Commodities run the world and following these markets are akin to having your fingers on the pulse of the world. When I initially began reading about mining, I came across a lot of information about diamonds. It always interested me. But there was no chart that I could follow to track diamond prices. However there actually is, but is accessible through a Bloomberg monitor.

During my time working for a boutique investment bank, The Economist magazine put out an article which shook the diamond industry. In 2016, an article titled “Why aren’t millennials buying diamonds“. It seems like an obvious thing to say now, but back then it was big. I would say it marked the beginning of ESG investing principles. The Economist was basically saying the demand for diamonds would drop hard and synthetic diamonds would dominate as millennials want ethical sources.

I remember attending PDAC and chatting with my contacts at Stornoway Diamonds, whose stock price was near $1 on rumors of a buyout. Everyone in the diamond industry knew about this article and hated it. Diamond companies had to put out a strong response. They did so by stating that demand for diamonds remains strong and growing.

One highlight for me personally was a meeting with Lucara Diamonds, which is still traded by the way.

At the time they were a fascinating company because they were paying a dividend. They also found some of the largest diamonds ever discovered in their diamond mine in Botswana. I had a meeting with William Lamb, who was the CEO of Lucara Diamonds at that time. We had a nice chat on the fundamentals of the diamond market and I remember his words about The Economist. When it came to sourcing ethical diamonds, Mr. Lamb said a lot of these writers have not even been to Botswana and other diamond mines run by large companies. No child labour going on there, and these are well run mines hiring locals and giving back to the community.

At that time, Lucara was selling their Lesedi La Rona diamond. This is one of the largest diamonds ever found at 1,109 carats in 2015. It even has its own Wikipedia page! At that time the buyers were likely going to be Royal families from the Middle East. However, it was sold to Graff for $53 million. Mr. Lamb was kind enough to show me a life size model recreation of the diamond. I didn’t know rough diamonds could come out that large but this was a historic find. Being able to speak with the management and being there when large offers were coming in, is an experience I will never forget. Forever being a small part in this diamond’s story.

In recent years, my interest in diamonds has perked largely from watching Youtube videos showcasing diamond jewelry selling for millions of dollars. The wealthy are picking them up as investments, and I did not know how difficult it is to find diamonds of the same size for a specific jewelry piece. Producer Michael has done some amazing videos with Beverly Hills jeweler Peter Marco, whose clients include major Hollywood celebrities, musicians and top athletes.

Producer Michael himself invests in diamonds, even investing up to $1 million in rare red diamonds. Let’s just say I learned a LOT about diamonds from these videos in an entertaining way.

When it comes to lab grown diamonds, I really suggest you watch this:

Even Producer Michael himself was shocked…and maybe hoping his diamond investments retain their value.

Diamond Market fundamentals

When it comes to diamonds, think Russia and India. Russia has the largest diamond reserve in the world, and leads the world in diamond mine production. Oh you are already thinking about it right? Yes, sanctions on Russia are impacting diamonds. Other major producing countries include Australia, Canada, the Democratic Republic of Congo, Botswana and South Africa.

In terms of diamond cutting and polishing, it is mainly done in India due to the low costs and highly skilled labour.

The largest diamond company by revenue is Alrosa which is a Russian company traded on the Moscow stock exchange. De Beers is what mainly comes to mind when people think of diamonds. The major diamond company runs 22% of the global diamond production share.

My brother is proposing to his long time girlfriend. She has a specific diamond ring that she wants. The experts say diamond demand will take a dive because millennials and younger generations will stop buying. I don’t see evidence of that from my social group and family who come from different backgrounds. The symbol of the diamond for love and marriage is holding strong.

Diamond Demand

So what does the future for diamonds look like? Pretty positive. In its annual report, Bain & Company stated the diamond market is expected to be strong through the first half of 2022, supporting growth across all segments. The report also adds production is expected to hit 120 plus million carats in 2022 but is unlikely to reach pre-pandemic levels within the next five years. Strong demand and less supply. Guess where prices go?

The largest short-term threat is new coronavirus strains that might disrupt production and logistics again. Major new projects have not been announced and investments in exploration are limited, so production growth will likely stay at 1% to 2% per year during the next half-decade. Promising demand growth and production scarcity support stability or further price growth for rough diamonds.

Two possible scenarios in the report are titled “continued rebound” and “short-term readjustment”. In the continued rebound scenario, the expectation is for the US and China to continue sustained growth momentum while other regions return to pre-pandemic levels, all supported by successful vaccination programs, limited lockdowns, and resumption of inter-regional travel. In this scenario, diamond jewelry sales are expected to grow and create strong demand for polished stones. Continued growth in demand and limited supply of rough diamonds will benefit both miners and midstream players, supporting further strong price growth for polished and rough diamonds.

The short-term readjustment scenario implies a possible slight correction in diamond jewellery demand starting toward the end of 2022 and the beginning of 2023, with a gradual return to pre-pandemic trend levels and growth rates in 2024—similar to how the diamond market strongly rebounded and then readjusted to its historic trajectory during past recessions.

Diamond affordability relies heavily on the pace of economic growth and consumers’ disposable incomes. Being a luxury good it isn’t a necessity. The middle class is being pinched by inflation and rising interest rates. However, we have seen that the luxury goods market tends to hold well given the spending from the wealthy.

Diamond Market Trends

Miningdigital.com recently put out this article highlighting the top 10 trends in the diamond industry. I will list them below, but for more detailed information, check out the full article here. It looks quite positive.

10: Diamond industry sees ‘spectacular reversal’

9: Diamond Demand soars in H2 2021

8: Depleted inventories translate into price growth

7: Margins across value chain return to pre-pandemic levels

6: No shortage of diamond financing

5: Lab-grown diamonds drive affordability

4: Polished and rough diamond demand to grow

3: Miners increased volumes to meet strong demand

2: A year rich in mergers, acquisitions and joint ventures

1: ESG agendas rise in investor and consumer importance

The Opportunity: Diamond Standard

One booth really stuck out for me at the Vancouver Resource Investment Conference (VRIC). Because I have more than the normal exposure to diamonds by watching videos on Youtube, I really thought this diamond booth was for lab made diamonds. I was wrong. Diamond Standard is a company that is attempting to make investing in diamonds accessible and easy. I’m a fan.

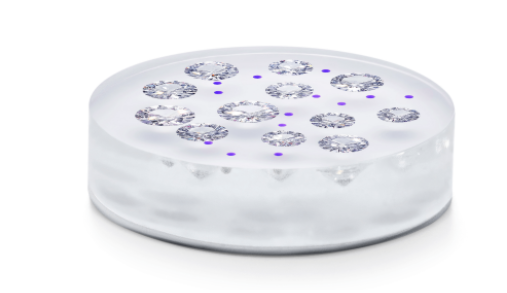

I had the privilege of speaking with Neshiva Chan and Cat Jordan from Diamond Standard. We had a great chat about the diamond market, diamond fundamentals, and Diamond Standard. Even allowing me to hold and inspect their Diamond Standard Coin offering which goes for $6,440.

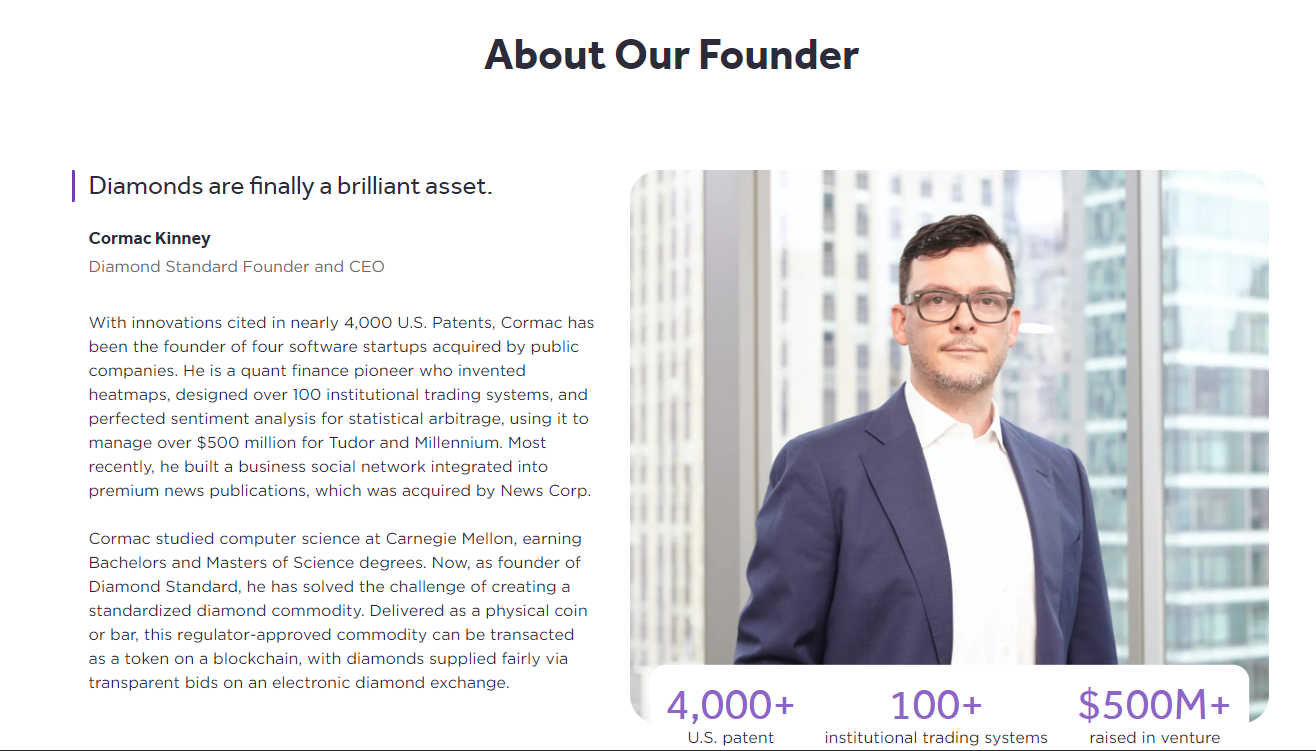

Diamond Standard is the producer of the world’s first diamond commodities. Diamond Standard is a technology developer, diamond market-maker and commodity producer, headquartered in New York City. The goal is to make natural diamonds a hard asset for investors just like gold, silver and platinum. To do this, the company works with regulators, auditors and financial sponsors to ensure fairness, transparency, consistency and liquidity.

So why diamonds?

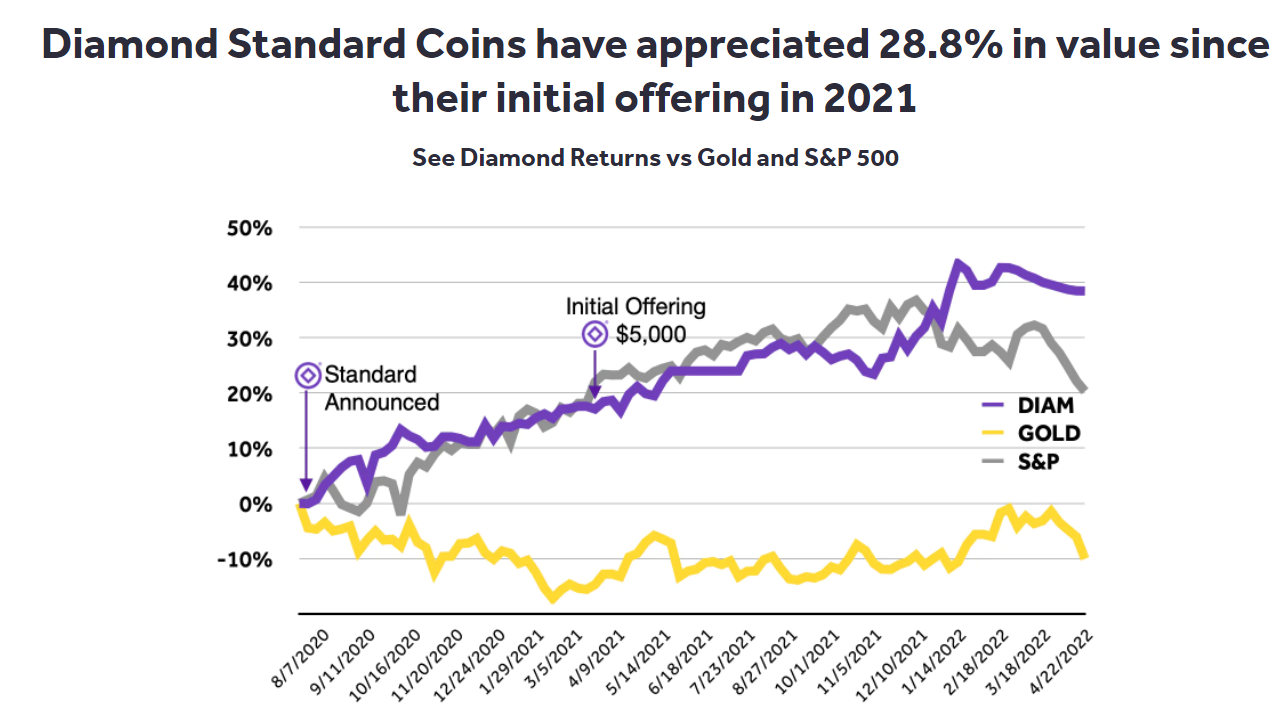

Diamond prices have surged amid strong demand and lack of supply. Since Diamond Standard’s regulatory approval, diamonds have outperformed gold, silver and stocks. It also helps that diamonds have a minimal correlation to precious metals. Nobody is selling their diamonds to run into the safety of cash when you know what hits the fan. A safe haven asset that is really under the radar.

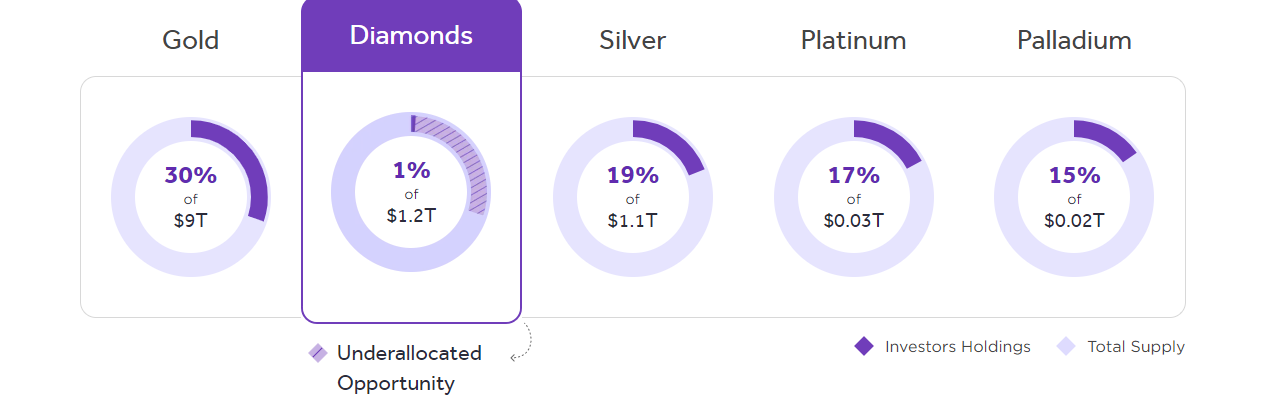

The investment thesis looks more attractive when you see that diamonds are an underallocated opportunity. Investors hold 15% to 28% of precious metals, but with diamonds, that share is only 1%.

In terms of investment options, one can buy the hard commodity itself, or invest in it through a fund.

Here is a Diamond Standard Coin regulated offering. Think of this as your 1 oz .999 standard gold or silver coin. Natural diamonds are optimized into equivalent sets and assembled into a physical market-traded spot commodity. Each Diamond Standard coin contains the equivalent geological scarcity of carat, cut, color and clarity.

It is a physical commodity composed of a statistically calibrated set of natural diamonds and an embedded digital blockchain token used to transact it in the near future. In the near future, you will be able to use the token to transact (sell, lend) your token inside our network.

The diamonds are also ethically sourced and come with GIA/IGI certification.

There is also a fund which offers a convenient and cost effective investment vehicle enabling investors to gain exposure to the Diamond Standard Commodities. This is available for accredited investors and details can be found here.

When speaking with Neshiva and Cat at VRIC, they told me an ETF is in the works. Still some ways to go, but it is in development. This gets me excited. Why? Let’s face it, the diamond market has a couple of problems for me. First off the illiquidity of the market, and secondly, the lack of price transparency. Diamond Standard is taking steps to address these problems and is making investing in diamonds easy. An ETF would really be a big and exciting step.

For now, one can invest in diamonds through stocks by buying diamond mining companies. I mentioned Lucara diamonds above, but some more to consider are Rio Tinto, Anglo American, Signet Jewelers, Gem Diamonds, Mountain Province Diamond, and Petra Diamonds to name a few. For tickers and indices, you can find a full list here.

So what do my readers think? Are diamonds going to be an investor’s best friend? Or are illiquidity, price transparency, and (some) millennial shunning be too much hurdles for diamonds to be a proper investment vehicle? Let me know in the comments below or on Twitter. I am excited to follow the Diamond Standard story and see where things go!