Expansion Continues

- $116.588M Market Capitalization

Wellfield Technologies Inc. (WFLD.V) announced today the Company’s financial results for the year ended December 31, 2021. Additionally, Wellfield has provided a summary of its latest developments thus far in 2022, including the acquisition of Coinmama, which is planned for Q2 2022.

“…Our team has made substantial progress positioning Wellfield to deliver next-generation fintech solutions based on blockchain technology beginning later this year. The acquisition of Coinmama, which we expect to close in Q2 of 2022, will add approximately USD$130 million in annual sales to Wellfield’s top line,” said Levy Cohen, CEO of Wellfield.

Announced on March 24, 2022, Wellfield’s acquisition of Coinmama, an Israel-based digital asset dealer, is expected to augment the Company’s distribution and reach on a global scale. Seeing as Coinmama operates a global platform for consumers to buy and sell digital currencies, I’d say Wellfield’s expectations are pretty reasonable.

Through this acquisition, Coinmama will integrate Wellfield’s DeFi protocols into its current platform, therefore, enhancing the monetization of Coinmama’s 3.5 million users. By expanding from a single offering model to a multi-product platform, Coinmama will be able to establish itself as a recurring revenue business leveraging DeFi protocols and self-custody.

Partnerships & Investments

What’s in it for Wellfield? As previously mentioned, this will strengthen the Company’s reach on a global scale. Furthermore, Coinmama is a successful company, bringing in outstanding sales of USD$130 million in 2021. In addition to Coinmama, Wellfield announced on February 28, 2022, a partnership and strategic investment into Verif-y, a US-based leader in the Digital ID space.

Verif-y is credited for developing and commercializing Distributed Digital Identity and Credentialing Services, which are already in use by established financial institutions and government entities. Through this partnership, Verif-y will provide its identity Authentication and Verification services to Wellfield for integration into the Company’s MoneyClip app. Wellfield will also purchase a minority interest in Verif-y.

Earlier this year, on January 19, 2022, Wellfield announced a partnership with Exaud LDA, a global software solutions provider, to establish a development hub in Portugal, with a mandate to support the Company’s Seamless development pipeline. For context, Wellfield’s Seamless brand refers to the Company’s mission to address the necessary needs of the DeFi ecosystem, including:

- making Bitcoin compatible with DeFi

- cross-blockchain trading

- decentralized prime broker-like services

Once established, Wellfield’s development hub in Portugal will take part in developing products to address these opportunities. In addition to providing a summary of recent events, Wellfield has summarized its financial information for the year ended December 31, 2021. According to Wellfield, the Company had a cash balance of CAD$17.6 million as of December 31, 2021.

“Coinmama brings 3.5 million registered users to the Company, a trusted consumer-facing brand and millions of unique visitors per year, beyond its current user base. We will engage with these audiences to enable the rapid launch of our blockchain-based products and services later this year, and have identified several opportunities to grow Coinmama’s user base and enhance the monetization of these users, over the next several years,” continued Levy Cohen.

In total, Wellfield reported a net loss of CAD$5.3 million in FY2021, including a non-recurring expense of CAD$2.4 million related to the Company’s TSXV listing. This represents an increase from CAD$0.1 million in FY2020. Overall, Wellfield has quite a few developments underway, namely, the Company’s acquisition of Coinmama, a development hub in Portugal, and the continued expansion of its Seamless pipeline.

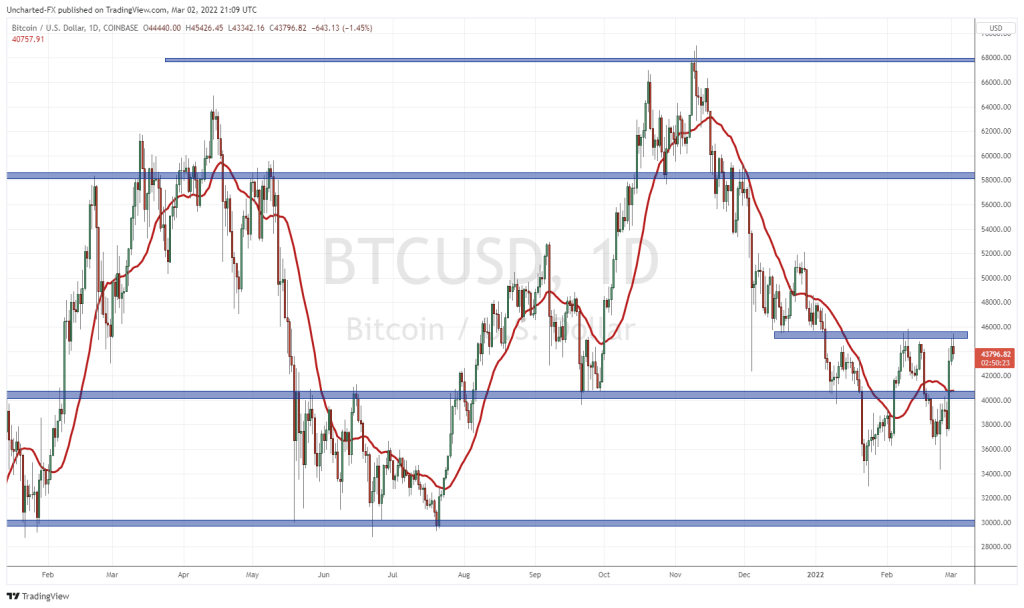

Wellfield’s share price opened at $1.20 today, up from a previous close of $1.17. The Company’s shares were down -2.56% and were trading at $1.14 as of 10:45 AM EST.