Cybersecurity Giant

- $2.044T Market Capitalization

Microsoft Corporation (MSFT.Q) has always been a part of the big three, otherwise known as Apple, Google, and, well, Microsoft. Personally, I have always loved to hate on Apple, yet I have owned at least one Apple product since I first coerced my parents into getting me an iPhone in high school. Apparently, a PowerPoint presentation was enough for my parents. It wasn’t until recently I started showing some love to Microsoft via the purchase of a Microsoft Surface laptop.

However, Microsoft’s revenue increase of $8.7 billion, or 20%, in Q2 2022 wasn’t driven by the Company’s Personal Computing sales, at least not primarily. Growth was achieved across each of Microsoft’s segments, however, in particular, the Company’s Intelligent Cloud revenue has increased substantially in the last year. On January 26, 2021, Satya Nadella, Microsoft’s CEO, announced that its security business had achieved $10 billion in revenue, representing a more than 40% increase year-over-year (YOY).

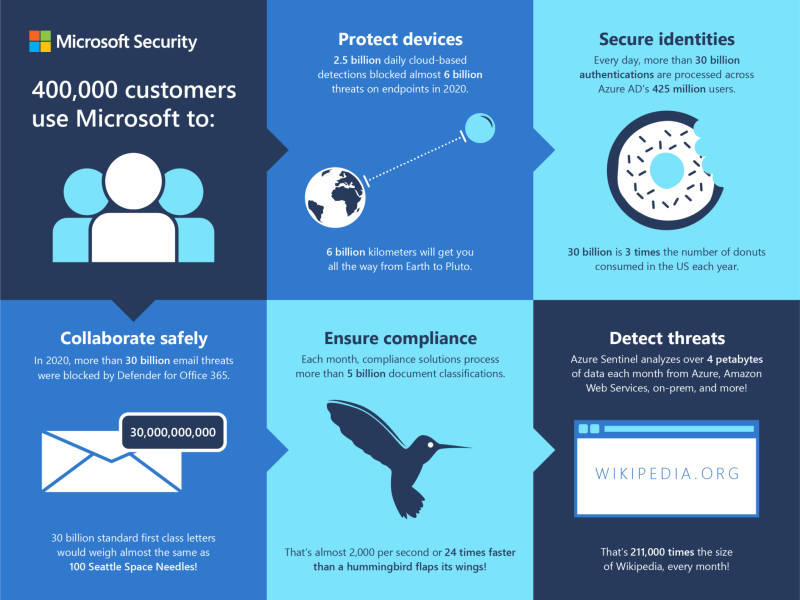

I am just as surprised as you are. If you aren’t surprised, then you’re likely already aware that Microsoft secured more than 400,000 customers across 120 countries, including small businesses and large enterprises. In fact, 90 of the Fortune 100 use four or more of Microsoft’s security solutions. In particular, Microsoft Defender blocked almost six billion malware threats on endpoints in 2020 alone.

I have always viewed Microsoft Defender as cheap bloatware intended to create the illusion of security. It comes preinstalled on every Windows computer, the UI is unimaginative, and it’s free. Can you blame me for being a little hesitant to trust Microsoft Defender? In reality, I am probably responsible for three billion of the six billion malware threats Microsoft Defender blocked in 2020.

Latest Performance

Recently, in January 2022, Nadella provided an update demonstrating that Microsoft’s security growth was continuing to accelerate, expanding at almost 45%. The Company credits this growth to various small acquisitions, and revenue, which totaled $15 billion a year. In particular, Azure Sentinel, now known as Microsoft Sentinel, security solution appears to be excelling, with more than 15,000 customers utilizing the cloud-based security information and event management (SIEM) solution.

With this in mind, Microsoft’s security business is growing faster than all other major segments of the Company, which has caught many off guard, including me. As it stands, the global cybersecurity market was valued at USD$184.93 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.0% from 2022 to 2030. Having revealed itself as a cybersecurity leader, Microsoft is well-positioned to reap the benefits of this market.

According to Microsoft’s earnings release for Q2 2022, Microsoft Cloud’s gross margin percentage decreased slightly to 70%. However, excluding the impact of the change in accounting estimate for the useful lives of the Company’s server and network equipment, Microsoft Cloud’s gross margin percentage increased by 3 points, driven by improvements in Azure and other cloud services. If you’re interested in Microsoft, stay tuned since the Company has an earnings call planned for today, April 26, 2022, at 5:30 PM EST.

Historically, Microsoft has beaten Earnings Per Share (EPS) estimates on multiple occasions. For example, in Q1 2022, Microsoft beat the EPS estimate by 9.24%, achieving an EPS of USD$2.27 compared to an expected EPS of USD$2.08. Similarly, in Q2 2022, the Company beat the EPS estimate by 6.90%, achieving an EPS of USD$2.48 compared to an expected USD$2.32. As for today’s earnings call, Microsoft’s expected EPS is USD$2.20 with expected revenue of USD$49.05 billion. Let’s see if Microsoft can once again exceed expectations.

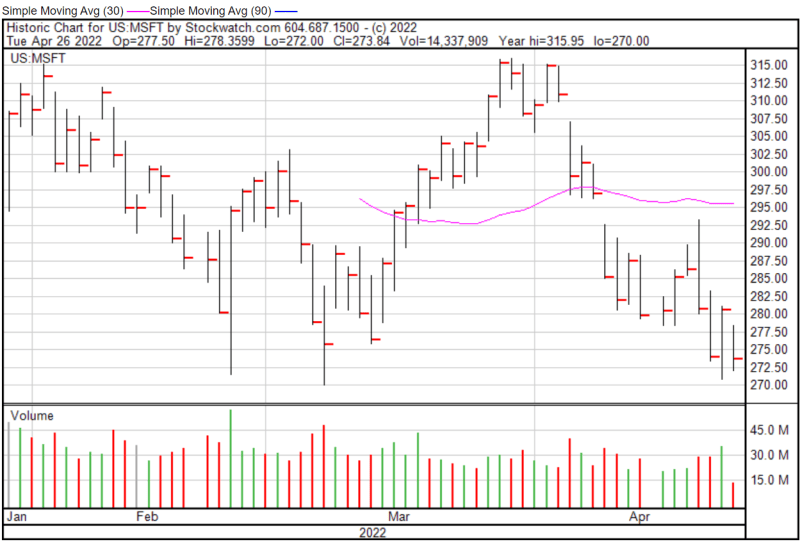

Microsoft’s shares opened at $277.50 today, down from a previous close of $280.72. The Company’s shares were down -2.47% and were trading at $273.85 as of 12:15 PM EST.