I’ll be honest. I was looking forward to Amazon Prime Day up here in Canada. But it wasn’t to be this year. Prime day has been postponed in Canada because the company wants to focus on the safety of their employees. I suspect it has more to do with supply chains being stretched. Prime day did occur in the US, with sales being “soft” compared to last year. Likely to do with the stimulus checks.

What a lot of people don’t know is that Amazon doesn’t make much profit on the retail side. The real money comes in with their cloud contracts with the government. Yesterday saw big news for the tech giant.

The Pentagon cancelled their $10 Billion JEDI (Joint Enterprise Defense Infrastructure) Cloud Contract that Microsoft and Amazon were fighting for. This contract is intended to modernize the Pentagon’s IT operations. Microsoft was awarded this contract in 2019, beating out Amazon Web Services. The deal did not go well with Amazon. The company filed a lawsuit in the US Court of Federal Claims claiming President Trump’s bias against Amazon and Jeff Bezos influenced the Pentagon’s decision to award the contract to Microsoft.

The contract is cancelled BUT the Pentagon said it plans to solicit proposals from both Amazon and Microsoft for the contract as they are the only cloud providers that can meet its needs. So in summary, Microsoft loses the JEDI deal, while Amazon potentially gets to split it. Amazon is the real winner here, and the company gets their hand back into the government cookie jar.

Quick side note: some analysts are even saying IBM is the dark horse here and can get a piece of the Pentagon pie.

Amazon stock gained 4.69% yesterday and broke out into all time record highs. Jeff Bezos’ net worth hit a record of $211 Billion on the Pentagon move. Speaking about Bezos, July 5th was his last day in charge of Amazon. The date was chosen because the company was incorporated on July 5th 1994. Andy Jassy, the head of Amazon Web Services, will take the mantle of CEO, but Bezos will still have a role as an executive chair. The billionaire will be focusing on Blue Origin, and is set to fly into space on July 20th.

Technical Tactics

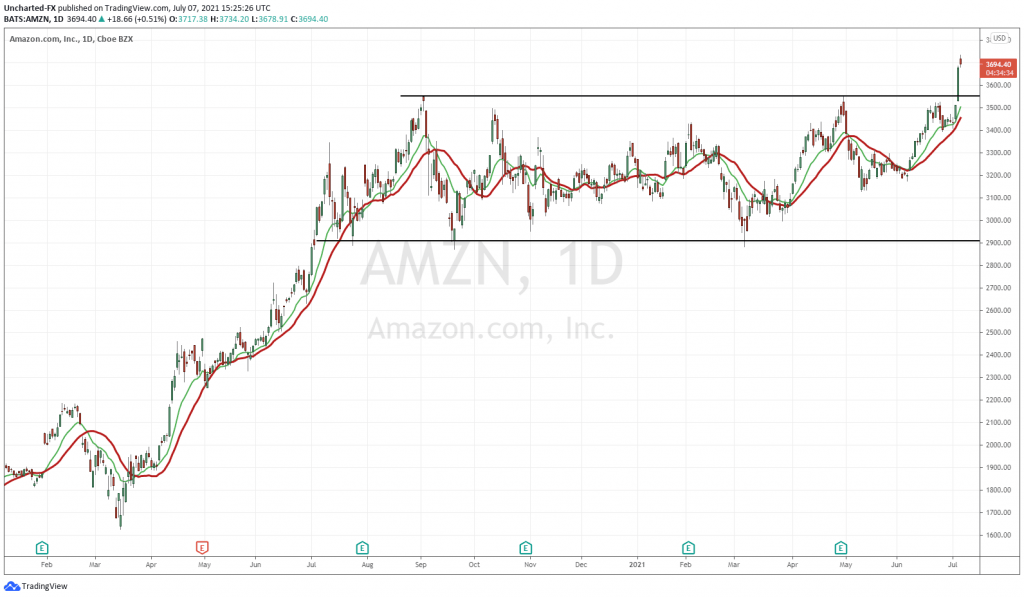

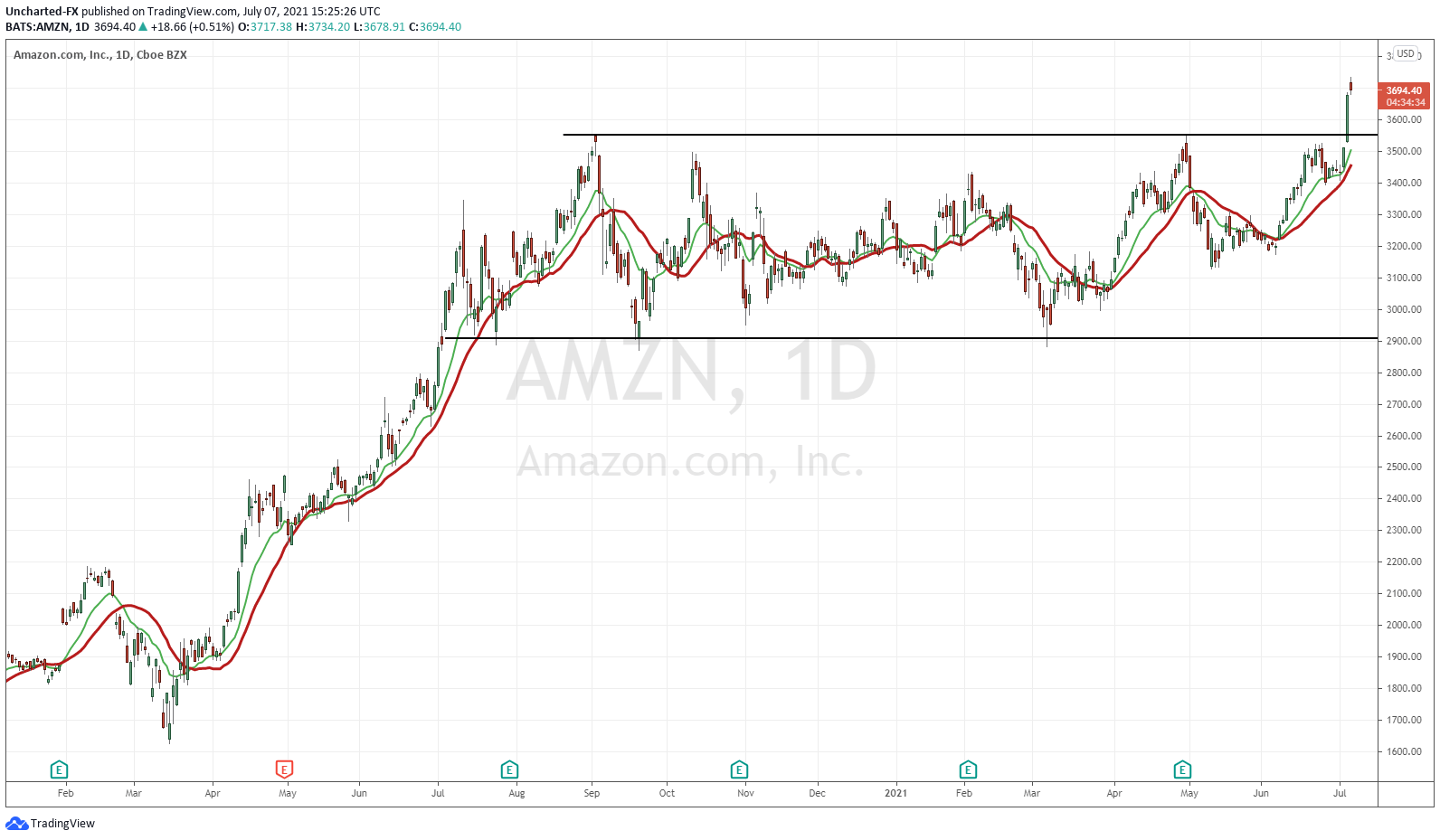

Amazon stock ripped yesterday and was green in a sea of red. Technically, the breakout above $3550 is huge. We have broken out of a range that has held since August of 2020. Eleven months!

The question is what comes next? Markets were dumpy earlier this morning, although at time of writing, they are being bought up and have recovered about half of their losses. I am watching for institutional buying on Amazon.

$3550 is our support going forward. As long as price remains above this zone, new highs are coming. With this significant technical breakout, and the fundamental news of government contracts, institutions are likely to be adding. The signs for institutional buying have to do with volume and momentum.

We want to see multiple days of follow through. This would mean multiple days of Amazon making record highs. VERY similar to what we have seen recently on Facebook and Microsoft. This indicates institutions are buying because they tend to have large orders which can take days to fill. Ideally we want to see this happen with RISING volume. Pullbacks like today are okay. The stock is pulling back with lower volume, and what we want to see is how quickly this gets bought up. If we see buyers jump back in late in the day and tomorrow, it indicates strong buying and a powerful breakout. I expect this just given the large green candle breakout we had yesterday. A very powerful and bullish green candle.