A lot of things have been happening in China. Much of the media headlines recently have been focused on Shanghai lockdowns and the Evergrande/real estate issues. But in March, huge news came out from the People’s Bank of China (PBoC). It was the PBoC’s equivalent to Mario Draghi and the ECB’s “whatever it takes” moment. Before the Fed rate hike on March 16th 2022, the PBoC surprised markets by keeping rates unchanged and “maintaining banking system liquidity reasonably ample“.

Many analysts attribute the stock market rise on the Fed’s interest rate hike the day after on the market pricing in this move in China. For more info, take a look at this video by Real Vision regarding markets not paying attention to the PBoC:

Chinese stocks even on the American exchange saw a nice pop on this news. Take a look at the bottom on March 15th on the Golden Dragon China ETF:

We do have a bit of a cup and handle forming on Chinese stocks, but the breakout has not been triggered just yet. If we do, it might be time to jump into some Chinese stocks.

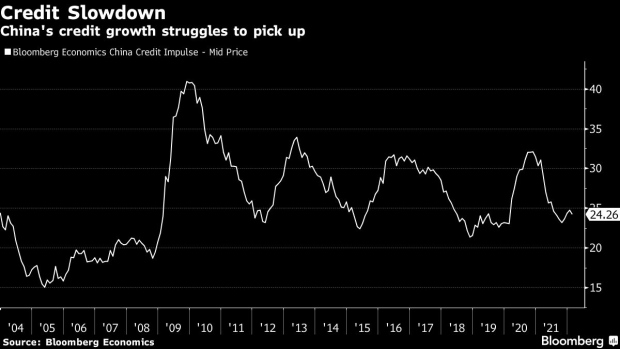

With the PBoC expected to ease monetary policy, a divergence from the Fed and other western central banks, will cheap money see more lending to boost the economy in China?

We haven’t seen that pick up just yet, but perhaps it will rise when the PBoC cuts rates in the future. If you believe cheap money will result in more lending, then I have a play for you!

Enter Tenet Fintech (PKK.CN). A fintech company in the $25 Trillion Chinese commercial lending space with a successful business model and exponential growth.

Tenet Fintech is the parent company of a group of six innovative financial technology (Fintech) subsidiaries operating in China’s commercial lending industry. Through its subsidiaries, Tenet uses technology, analytics and artificial intelligence to create an ecosystem of lenders, borrowers and other participants in China’s commercial lending space where lending operations are conducted rapidly, safely, efficiently and with the utmost transparency.

Now I am not going to pretend I am an expert on Chinese credit markets, but Tenet Fintech highlights issues in their corporate presentation. Over 100 million small businesses in China have had a hard time getting access to credit within the past three years.

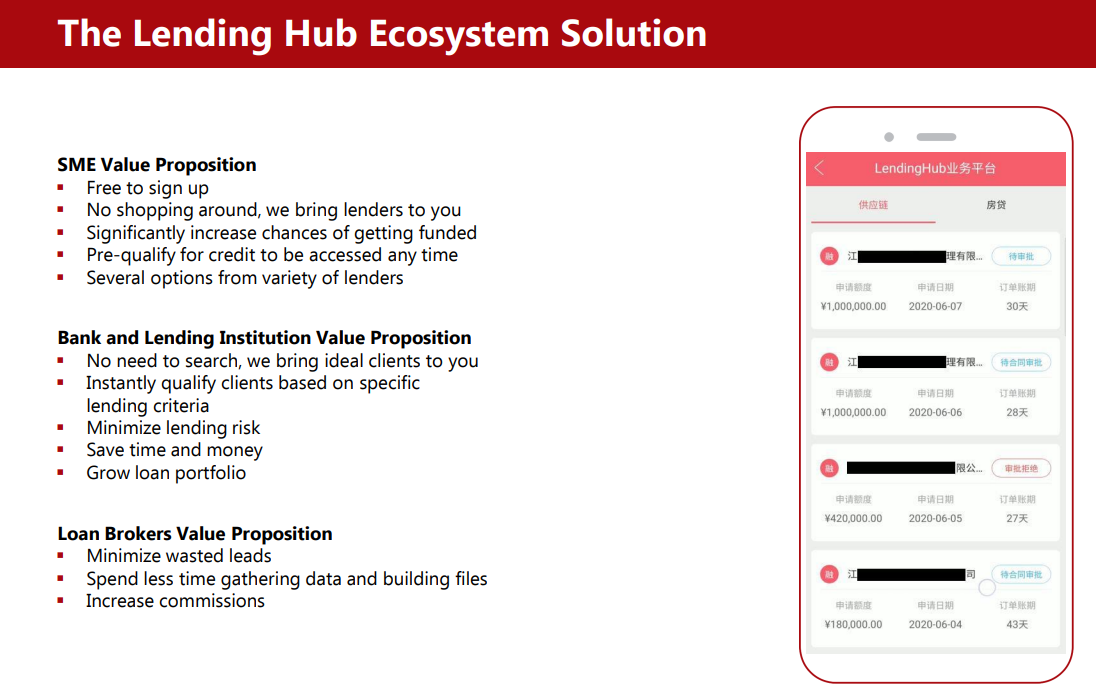

But Tenet Fintech has a solution, bringing lenders to businesses. Their Lending Hub Ecosystem Solution which is free to join and only pay per transaction. The hub saves time and money by qualifying clients based on specific lending criteria and brings the ideal client to businesses.

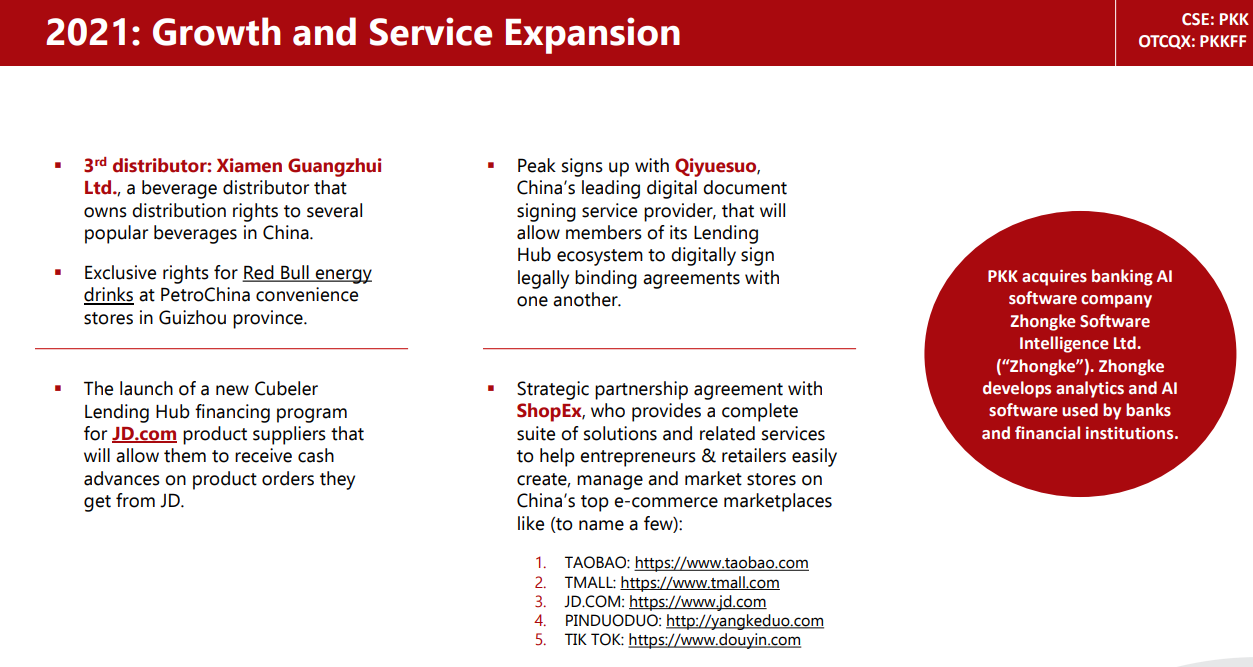

The proof of concept launched in 2018 in the city of Wuxi and resulted in over 2,500 transactions with $1.6 million in revenue. Tenet continued to grow, expanding into multiple cities and increasing revenues. 2020 saw the lending hub in 31 cities across China with recorded revenue of $42.7 million. And here is how 2021 shaped up:

Future plans include city wide financial centers powered by Lending Hub, industry specific solutions (replicate supply-chain model to industries such as trucking), e-commerce portals expanding ecosystem to online merchants, and also possible expansion of the Lending Hub to other countries.

For you technical geeks out there, take a moment to acknowledge the beauty of this chart. It gets me excited for sure. We have a basing pattern, and a bullish technical pattern known as an ascending triangle. We just need the trigger.

The trigger for the initiation of a new uptrend is a close above $5.00. We almost got this on April 7th 2022. In fact, we DID close above $5.00, but breakouts must be strong. We want a strong green candle. We did not get that on the 7th of April and prices sold off because of it instead of building momentum.

What adds to the technical positives is the fact that Chinese stocks as a whole could be bottoming as evident by the Golden Dragon ETF. If we get the breakout there, individual Chinese stocks will follow.

On the opposite side of things, if Tenet Fintech closes below this uptrend line I have drawn, or below $4.00, then the chances of an upside breakout decrease dramatically.

So if you are bullish on China, this is definitely a play to consider, especially given the divergence in monetary policy. China will be keeping rates low or cutting them lower in an attempt to get lending going and boost the economy. It should also be noted that there is an upcoming catalyst for Tenet Fintech. The company is expected to release earnings on April 21st 2022. Results could be the trigger to confirm our breakout trigger.