A random conversation about globalization over the weekend brought to mind companies like Tenet Fintech (PKK.C). The conversation in question surrounded an alarming popular premise that recent geopolitical and economic movements have us barrelling towards a new world order, and while I’m not quite so dramatic about it, it’s not entirely without merit.

Globalization has introduced opportunities to our generation and the subsequent generations after us that our parents didn’t have. There are more opportunities for wealth development due to a much more free flow of capital than ever before.

Just to be sure we cover all of our bases, globalization has its downsides as well: widening wealth stratification, capital flight and environmental damage aren’t great, but they’re not really what we’re talking about here.

What we’re talking about is China. They’ve been in the news over the past few years and generally not for the right reasons. They’re swiftly becoming the biggest competitor to the hegemony of the United States and as such the US has turned their media on them. Granted, China’s human rights record and growing authoritarianism isn’t exactly helping matters much, but if you were to look closely at the US, you’d note they’re moving swiftly along the same path.

Pot meet kettle.

The increased attention on China is because of their swift economic growth. Look at most of the things you own—they’re probably made in China—and if you’re like me, then you’ve probably wondered how you could find a way to benefit from China’s swift and rapid growth.

There’s a general consensus that China’s GDP will eventually overtake the United States, but there’s confusion as to when and there’s been a tendency to move the goalposts whenever the year arrives and it still hasn’t happened. The number I was quoted in 2013 was 2019, and that didn’t happen. Then it was 2024 and that seems unlikely. Now they’re shifting the goalposts again to 2030, and Bloomberg has chimed in and said that China’s GDP will be 70% of Americas by 2050.

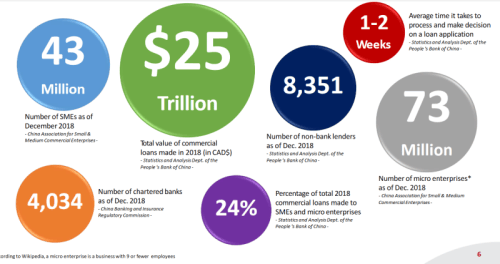

One fact is for certain and that’s China’s growth has been remarkable. In the past three decades, China GDP growth has been roughly 13% while the United States halved to 4.5% per year. If they’re going to continue that development they’re going to need to start promoting the success of their businesses, and that’s where companies like Tenet Fintech comes in.

The logic of globalization has it that economic growth happens from the ground up. Micro-sized companies become small, which grow over time into medium. Large. Mega. You get the idea. But there’s got to be some kind of catalyst to get through the micro and small stages. Most companies die there—otherwise good companies that would have survived if they had some infrastructure support where they were weak.

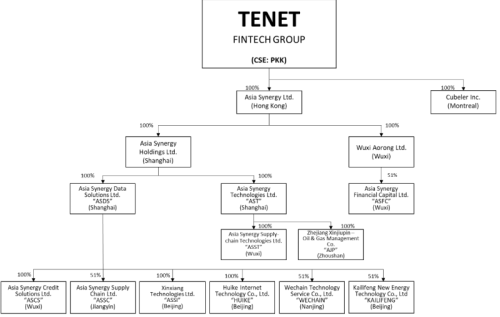

That’s one of the services that Tenet Fintech provides. They’re the parent company of a group of innovative financial technology and artificial intelligence (AI) companies, and one of their functions is as a lending agency, using artificial intelligence and analytics mitigate risk. They use something called the Cubeler Lending Hub ecosystem to automate the onerous processes by which lenders find and qualify borrowers. This lets banks and lenders safely increase their volumes while contributing to the efficiency of China’s commercial lending industry.

Let’s go deeper.

What is Tenet Fintech

Tenet Fintech is the parent company of a host of financial technology subsidiaries which provide a grab-bag of services ranging from lending to insurance to create a global ecosystem where analytics and AI are used to create opportunities and facilitate business-to-business transactions. While they’ve recently expanded beyond simple lending to include more infrastructure assistance to micro and small cap companies, their primary source of revenue is still in providing the bridge between financial institutions and business to create what they called business hubs, where analytics and artificial intelligence facilitate interactions between members. That may change in the future as they develop.

They were called Peak Fintech until November of last year.

Cubeler is their chief subsidiary and the one driving the majority of their expansion.

It provides small and medium sized enterprises no cost access to a number of different options, including funding, advertising, networking opportunities and specific market intelligence reports. The benefits its provides to the company include 90% of their revenue, as well as infrastructure to expand their Business Hub on a global scale, thereby removing geographic barriers and offering businesses avenues to find revenue generating options in markets that would have been unavailable to them. It’s the engine of this company’s global expansion.

What have they been doing lately?

Their two latest moves are working to provide ease of access at varying links of the supply chain.

Their latest move involves a partnership with Industrial Bank Co (CIB) which allows members of Tenet’s Chinese Business Hub to open accounts linked to their Business Hub accounts.

The bank accounts provide an alternative to Tenet’s lending on virtual bank accounts on their China UnionPay network. China UnionPay is China’s state-owned interbank network that connects all their ATMs. It’s also the largest card payment organization in the world, ahead of Visa and Mastercard.

These accounts are meant for larger clients reliant on the Business Hub’s services that otherwise might not be available through virtual bank accounts. They sport over 2,000 branches and outlets, more than 50,000 employees and assets in the US$975 billion range, and are the eighth largest bank in China and 31st in the world.

It’s a big step.

On the other end of the supply chain, they have launched a shipping platform for its Chinese Business Hub ecosystem, so they can offer a shipping and transportation vertical for transactions that happen on the hub.

It’s a decent idea. Road freight is the primary way cargo gets from place to place in China. They have the largest road networks in the world, with the United States taking the top spot. Ten ports in mainland China are in the top 30 to container ports in the world with Shanghai being the busiest. It’s only going to get bigger as China’s continues to grow domestically. According to global research firm IBISWorld, the industry’s revenue should hit $127-billion in 2022.

The industry isn’t without deficiencies. Trucks are responsible for more than 80% of China’s goods, but the trucking industry remains fragmented and inefficient. There are anywhere between 18 million to 30 million truck drivers in China, most of whom own their truck. Those trucks are empty about 40% of the time because their owners spend on average three days finding shipments for them, according to the South China Morning Post.

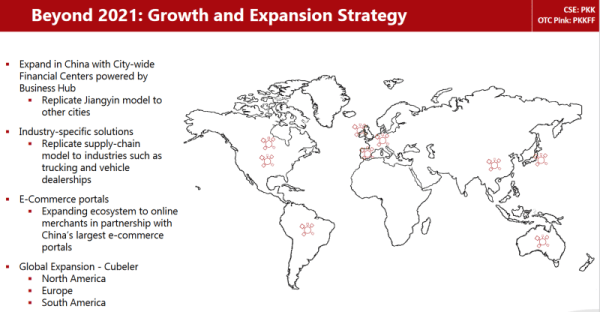

Globalization and Global Expansion

Thus far we’ve only talked about what Tenet has going on in China and globalization is all about expansion.

The next stage in their development is the EU and North America. Towards that end, they’ve opened an office in Toronto to attract tech talent, and started the full court globalization press into the North American markets.

“Given the challenges small businesses have gone through over the past three years in this country, I believe the launch of our Canadian business hub will be more relevant than ever in terms of its value proposition to Canadian entrepreneurs. We couldn’t be more excited to start working with them because we have no doubt that we can contribute to their success. So, to small business owners across the country, if you want easy access to funding to promote your products and services, to connect with and network with other business owners, and to have access to exclusive content and market intelligence, all for free, please accept this as a personal invitation to join the hub,” said Johnson Joseph, Tenet chief executive officer.

The Numbers

The companies latest financial drop in November showed a $36 million cash position, which suggests enough runway to not only keep the lights on but maybe make a few purchases along the way. It’s exactly what they’ve done, using it fuel their expansion into North America by dropping off an office in Toronto.

The story of the numbers, though, begins in 2020.

Tenet hit their stride in Q4 2020 with a series of business development initiatives, lucrative investments and partnerships. They continued with that winning formulation in Q3 2021 with events and investments, and brought in USD$30.6 million for the company’s first ever quarterly profit.

They dropped to $26 million in revenue in Q3 due to the lack of a major draw like the 618 Shopping Festival which happened in Q2, but they did use the quarter to plant the seeds for future growth and expect big things in the coming few months.

- Closing of short form prospectus financing of $52-million;

- Positive impact of integration of China UnionPay fund transfer and payment processing services to business hub;

- Strategic investment in China UnionPay subsidiary Rongbang Technology Ltd.;

- Rebranding of ecosystem from lending hub to business hub;

- Launch of Link-Steel steel trading platform;

- Signing of binding agreement to acquire Cubeler Inc.;

- Acquisition of Heartbeat insurance brokerage platform;

- Listing on Nasdaq stock exchange.

The objective set back in Q1 2021 was to raise $15 million through a public offering to help with their short-term plan in China and springboard their expansion beyond China. Instead, they raised $52.6 million in Q3, which gave them the ability to create two more business hubs, one each in the United States and in Canada.

This is a company poised for growth riding China’s great expectations. It also represents a significant opportunity for you to get some of that globalization money. If you’re game.

—Joseph Morton