Digital Medicine Society

The world is on fire, inflation is through the roof, and there is a literal war occurring in Ukraine. While I believe it is important to remain knowledgeable on current events, drowning in negative headlines can be detrimental to our health. In fact, according to The Washington Post, 56% of American adults have identified media as a significant source of stress in their lives. That being said, a little good news never hurt anyone, so let’s talk about an inspiring development in the medical sector.

According to Fierce Biotech, some of the largest drugmakers are banding together in a united front to combat Alzheimer’s disease and its related dementias. In a collaboration led by Digital Medicine Society, a non-profit organization, big names in the pharmaceutical industry, including Biogen, Eisai, Eli Lilly, and Merck, have come together to establish a core set of digital measurements that can be applied in their clinical trials.

Furthermore, they will be supported by researchers from Boston University, Oregon Health & Science University, and the Alzheimer’s Drug Discovery Foundation. Ultimately, the group is aiming to select and develop the most effective tech-enabled biomarkers. For context, a biomarker refers to a biological molecule that is indicative of a normal or abnormal process, or of a condition or disease.

With this in mind, biomarkers developed by this group are intended to help determine whether prospective treatments are actually working to slow the cognitive decline associated with neurodegenerative conditions. However, the pharmaceutical market is highly competitive, so why team up? Put simply, these companies are collaborating before a point where any competition begins. In doing so, they are increasing each of their chances of getting treatments approved and into patients’ hands.

In other words, by helping others, these companies are simultaneously helping themselves. Bearing all of this in mind, there is a lot of work to be done. To put things into perspective, the Digital Medicine Society maintains a library of digital endpoints that have been applied in various industry-sponsored studies. This library contains 302 different measurements employed by over 90 companies, yet only three endpoints are being used for Alzheimer’s. So, what else is going on in the medical sector?

Lexaria Bioscience Corp.

- $19.192M Market Capitalization

Lexaria Bioscience Corp. (LEXX.Q) is a biotechnology company recognized for the development of DehydraTECH™, the Company’s proprietary drug delivery technology. In addition to enhancing the speed and efficiency of orally-delivered fat-soluble active molecules and drugs, the Company has also demonstrated early-stage effectiveness in improving delivery through human skin for the potential development of topically-administered products such as patches, creams, and lotions.

Development for DehydraTECH began in 2014 and has since blossomed into something quite impressive. Through various animal studies evaluating the quantity of drug delivery across the blood-brain-barrier (BBB) utilizing DehydraTECH technology, data suggests a gain of as much as 1,900%. With this in mind, Lexaria’s DehydraTECH has the potential to improve the delivery of certain central nervous system (CNS) targeted drugs against Alzheimer’s Disease, Parkinson’s Disease, and other CNS diseases.

Latest News

On March 15, 2022, Lexaria announced the initiation of the first phase of its epilepsy research program EPIL-A21-1. Furthermore, the Company announced that the DehydraTech-CBD test articles needed to commence dosing have already been manufactured and delivered to the third-party laboratory engaged to complete this research program. While Lexaria has typically stuck to improving CNS diseases like Alzheimer’s and Parkinson’s, the Company is broadening its horizons this time around.

Lexaria’s EPIL-A21-1 research program will assess the seizure inhibiting activity of DehydraTECH-CBD compared to the world’s only FDA-approved CBD-based seizure medication, Epidiolex®. For context, Epidiolex is an oral CBD solution to treat Lennox-Gastaut syndrome and Dravet syndrome in children two years of age and older. Through this program, the Company hopes to demonstrate superior performance based on the proven drug delivery capabilities of DehyraTECH.

The EPIL-A21-1 research program will consist of two main studies to be performed in rodents following the first phase, which is a pilot animal model currently underway. The two main studies are expected to begin in May or June and will involve both an acute seizure model induced by electrical stimulation (MES) and a chronic chemically induced seizure model (RISE-SRS). PSA: I hate and do not condone animal testing.

However, Lexaria has selected these models because they have been previously employed by other researchers studying the antiepileptic effects of CBD, including select study work funded by GW Pharmaceuticals PLC, the developers of Epidiolex. This research program will be conducted by a leading US-based independent laboratory and will be fully funded through existing Lexaria resources. Now that Lexaria is gaining some traction, I just want to say I was pumping their tires before it was cool!

Lexaria’s share price opened at $3.2169 on March 24, 2022, up from a previous close of $3.16. The Company’s shares were up 2.06% and were trading at $3.22 as of 11:37 PM EST.

BriaCell Therapeutics Corp.

- $177.393M Market Capitalization

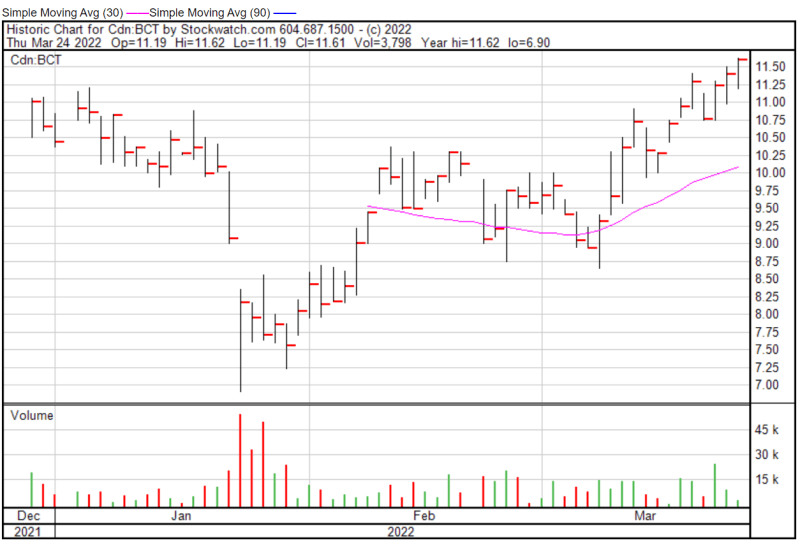

BriaCell Therapeutics Corp. (BCT.T) is a clinical-stage immuno-oncology focused biotechnology company developing targeted and effective approaches for the management of cancer. BriaCell believes in the potential of immunotherapies to use the body’s immune system to destroy cancer cells, offer higher levels of safety and efficacy compared to chemotherapy, and prevent cancer recurrence.

BriaCell currently has a non-exclusive clinical trial collaboration with Incyte Corporation (INCY.Q) to evaluate the effects of combinations of novel candidates. Under the agreement, Incyte and BriaCell will evaluate novel combinations of compounds from Incyte’s development portfolio with BriaCell’s drug candidates in advanced breast cancer patients. This includes the Company’s patented lead candidate, Bria-IMT™, BriaCell’s targeted immunotherapy being developed for the treatment of advanced breast cancer.

Latest News

Speaking of this collaboration, on February 28, 2022, BriaCell announced that it has recruited two additional clinical sites for the screening and enrollment of advanced breast cancer patients in a Phase I/IIa combination study of the Company’s Bria-IMT and Incyte’s checkpoint inhibitor, retifanlimab, and its immunomodulatory, epacadostat. The two new clinical sites include Atlantic Health Systems, New Jersey, and Tranquil Clinical Research, Texas.

“These outstanding clinical sites greatly expand our geographical reach allowing more patients to access our innovative therapies as part of our ongoing study…There is an urgent need for well-tolerated and effective treatments for advanced breast cancer patients, and we look forward to working with the leading oncologists and care providers at these clinical sites to make these treatments available,” stated Dr. Bill Williams, BriaCell’s President and CEO.

Furthermore, BriaCell’s clinical sites are working closely with Cancer Insight LLC to manage the clinical and regulatory aspects of the Phase I/IIa clinical trial. With this in mind, including the Company’s two additional clinical sites, the following clinical sites are now open and actively enrolling patients:

- Atlantic Health System (NJ)

- Tranquil Clinical and Research (TX)

- Mary Crowley Cancer Research (TX)

- St. Joseph Health-Sonoma County (CA)

- Cancer Center of Kansas (KS)

Keep in mind, these are some fairly reputable clinical sites. For example, Atlantic Health System has established a network of more than 17,000 members and 4,800 physicians. Moreover, it serves over one million patients annually across 400 sites of care, including seven hospitals, 300 physician practices, and 16 urgent care centers, among others. Similarly, Tranquil Clinical Research boasts over 30 years of experience.

BriaCell’s share price opened at $11.19 on March 24, 2022, down from a previous close of $11.40. The Company’s shares were up 1.84% and were trading at $11.61 at 12:12 PM EST.

BiondVax Pharmaceuticals Ltd.

BiondVax Pharmaceuticals Ltd. (BVXV.Q) is a biopharmaceutical company focused on developing, manufacturing, and commercializing innovative products for the prevention and treatment of infectious diseases and other illnesses. To date, the Company has completed eight clinical trials, including a seven-country, 12,400 participant Phase III trial of its vaccine candidate, BVX-010, which was administered intramuscularly twice in older adults and the elderly. It is worth noting that topline clinical efficacy endpoints were not achieved.

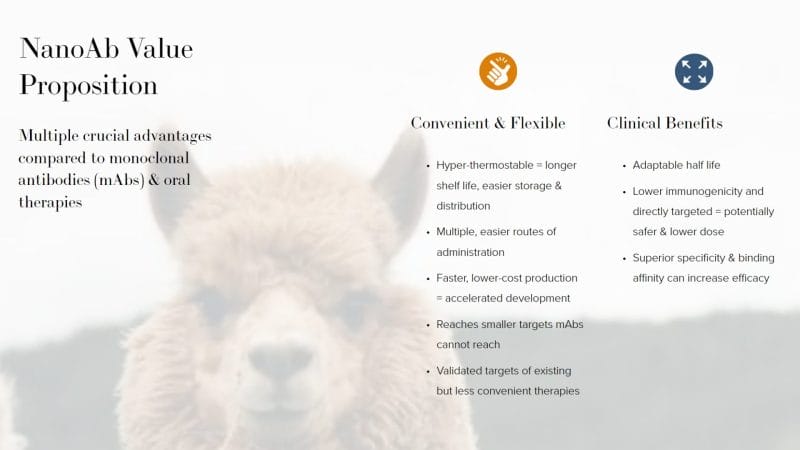

However, BiondVax has developed an expansive pipeline of diversified and commercially viable products and platforms, including the Company’s nanosized antibody, NanoAbs. For context, NanoAbs is intended to provide superior therapies for a wide range of diseases, including COVID-19. According to BiondVax, NanoAbs exhibits significant competitive advantages over existing monoclonal antibodies (mAbs) and oral therapies. After reading the Company’s latest news, there is some merit to this claim.

Latest News

On March 24, 2022, BiondVax announced that it has signed definitive agreements with the Max Planck Society (MPS), the parent organization of the Max Planck Institute for Multidisciplinary Sciences (MPI), and the University Medical Center Göttingen (UMG), both of which are located in Germany. With this in mind, BiondVax, MPS, and UMG have entered into a strategic collaboration for the development of new NanoAbs.

“We are going after targets already validated, but with a proprietary NanoAb that we expect will have meaningful advantages in efficacy, cost, and ease of use and treatment; a true ‘biobetter’ capable of capturing significant market share and expanding the market,” said Mr. Amir Reichman, BiondVax’s CEO.

As mentioned earlier, the NanoAbs previously developed by BiondVax’s collaborators exhibit several valuable competitive advantages over existing therapies including a uniquely strong binding affinity, stability at high temperatures, and potential for more effective and convenient routes of administration. With this in mind, NanoAbs has the potential to capture a significant market share in areas such as psoriasis, asthma, macular degeneration, and psoriatic arthritis.

BiondVax’s latest agreements will be facilitated by kENUP, a civic society organization promoting innovative industries in Europe. According to the terms of the agreement, the Company will have an exclusive option for a worldwide license at pre-agreed commercial terms for further development and commercialization of each generated NanoAb. Oh, and if you’re wondering why there’s an alpaca in the above graphic, initial NanoAb blueprints are extracted from small blood samples of immunized alpacas. The more you know.

BiondVax’s share price opened at $2.18 on March 24, 2022, up from a previous close of $1.37. The Company’s shares were up 34% and were trading at $1.84 as of 2:46 PM EST.

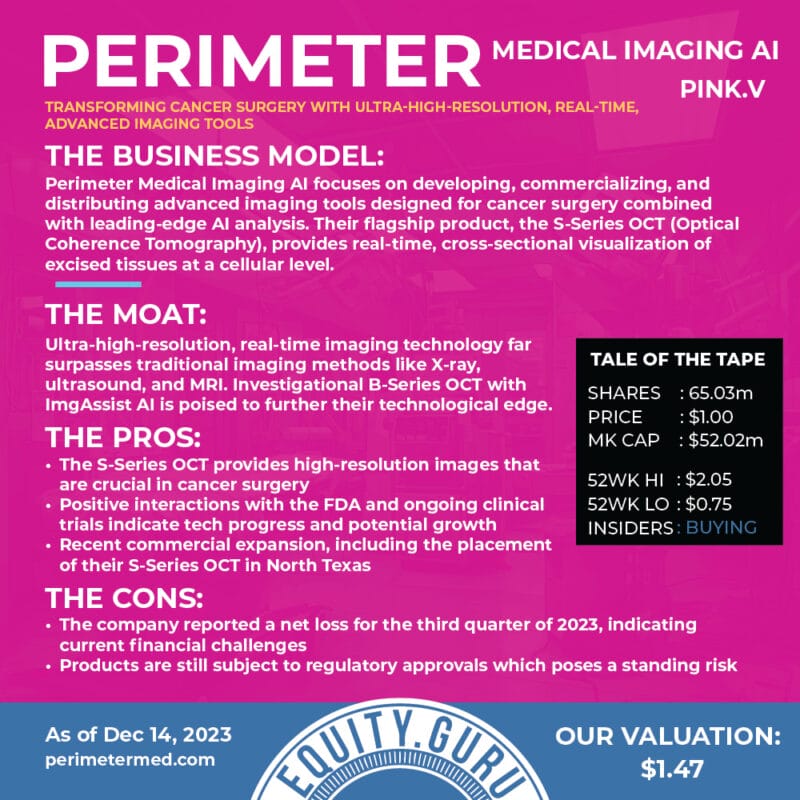

Perimeter Medical Imaging AI Inc.

Perimeter Medical Imaging AI Inc. (PINK.V) is a medical technology company transforming cancer surgery with ultra-high resolution, real-time, advanced imaging tools to address unmet medical needs. With this in mind, Perimeter’s S-Series Optical Coherence Tomography (OCT) platform is capable of delivering 2mm subsurface imaging of excised tissue margins, allowing surgeons to make informed decisions in real-time during an operation.

Ultimately, Perimeter’s technology is intended to reduce the prevalence of positive margins during breast-conserving surgery (BCS). Positive margin refers to when a pathologist finds cancer cells at the edge of the tissue, suggesting that the cancerous legion has not been removed during BCS. That being said, breast cancer recurrence risk doubles when positive margins are not excised, with 48% complication rates for re-operations. For a closer look at Perimeter, check out this article.

Latest News

On March 10, 2022, Perimeter announced that it will be participating in numerous industry events and conferences. This includes the Society of Surgical Oncology’s International Conference on Surgical Cancer Care (SSO 2022), the National Consortium of Breast Centers’ 31st Interdisciplinary Breast Center Conference (NCoBC 2022), and the 23rd Annual Meeting of the American Society of Breast Surgeons (ASBrS 2022).

At the time of writing this article, the SSO 2022 and NCoBC conferences have already passed, however, the ASBrS 2022 conference will take place in Las Vegas, Nevada from April 6-10, 2022. It is worth noting that this date is subject to change. If you are interested, details related to Perimeter’s presentations and webcasts can be found on the Company’s website. I get it, this news isn’t the most exciting or relevant.

If you’re looking for something with a little more substance, check out this article for a deeper look at Perimeter and some of the Company’s biggest news. This includes the expansion of Perimeter’s ongoing pivotal study assessing the Company’s Perimeter B-Series OCT imaging platform combined with ImgAssist AI. The study will examine this combination’s impact on positive margin rates during BCS.

Perimeter’s share price opened at $2.78 on March 24, 2022, up from a previous close of $2.76. The Company’s shares were up 0.72% and were trading at $2.78 as of 1:22 PM EST.

Full Disclosure: Perimeter Medical Imaging AI Inc. (PINK.V) is a marketing client of Equity Guru.