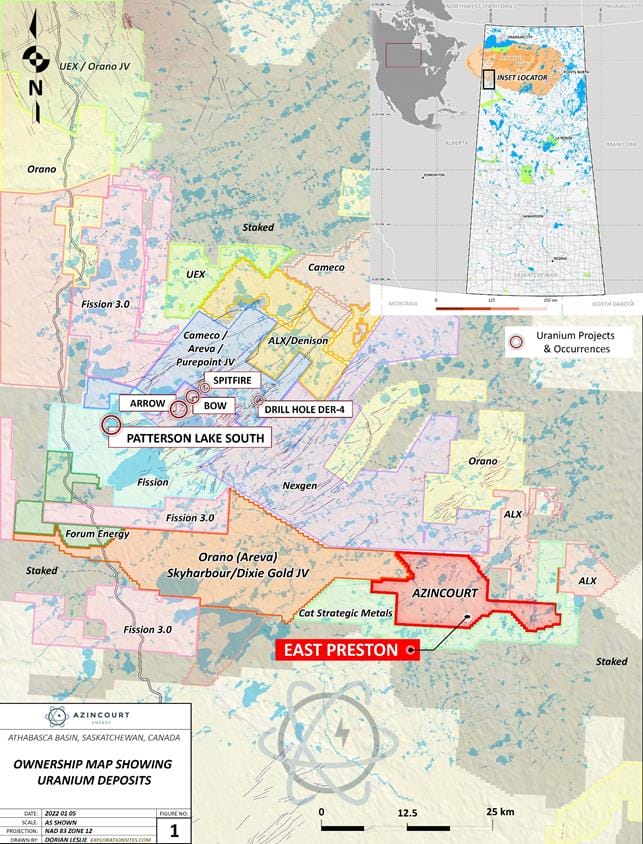

If you read my last article on Azincourt Energy (AAZ.V), I expressed my thoughts on the company’s long journey to the Athabasca Basin and its flagship East Preston uranium project. I stated then and will repeat now, that Alex has steered the corporate ship into an active direction and doing what many juniors fail to do or do not want to do – put drills in the ground.

Azincourt controls over 70% interest in East Preston as part of a joint venture agreement with Skyharbour Resources (SYH.V) and Dixie Gold.

Last year, Azincourt had to pull up stakes due to inclement weather, but the uranium junior is back with both guns blazing at East Preston and is in the middle of its 21/22 drill program which picks up where last year left off and pushes ahead to complete a total depth of 6,000 metres and 30-35 holes.

So far, Azincourt has completed 3,208 metres in 13 drill holes, as it combatted extreme cold weather and all the issues that arise from freezing temperatures. It’s extensive exploration of the the conductive corridors from the A-Zone, through to the G-Zone (A-G Trend) and the K-Zone through to the H and Q-Zones (K-H-Q Trend), is already creating smiles as company V.P Exploration, Trevor Perkins, reported in a news release at the beginning of March:

“Both the G- and K-Zones are responding incredibly well, and the team is very excited by what they are seeing in the core. The results show that there is still a good deal of work to be completed in these areas and I can’t wait to see what the follow-up drilling reveals.”

The company began its efforts on the northeast trending G-Zone, completing eight holes with one in progress. Preliminary results have indicated extensive alteration as well as evidence of east-west cross-cutting structures along the southern portion of the zone.

Hole EP0030 provides the best example of this with an extensive interval of hydrothermal hematite alteration and significant evidence for a steep east-west fault cross-cutting the main northeast trending structure and graphitic lithologies.

Okay, what does that mean to someone without a degree in geology?

Uranium deposits form in mineral alterations as uranium leached fluids are forced through faults in the crust under high temperatures and pressures. Uranium tends to bind to hematite as these super-heated fluids pass through the reddish-black mineral.

So, these preliminary results are not a definite sign of deposit-size uranium mineralization, but they do show promise as company president and CEO, Alex Klenman, goes on to describe:

“Alteration features are a crucial guide to locating uranium mineralization. Given what we know about alteration zones and their relationship to some very well-known discoveries, finding this at East Preston is certainly an encouraging development.”

Still more work to be done to get a better picture of what lies beneath East Preston, but Azincourt is more than ready. Exploration efforts for the moment will continue to focus on the K-Zone in hopes of further defining the extent of the alteration and the type of mineralization involved.

Azincourt’s stock price and market cap remain at the lower end of scale when it comes to uranium miners operating in the Athabasca Basin and could be considered a buying opportunity when its assets, location and promising exploration results are tallied in.

You aren’t going to get a uranium mine next week however, so this investment would be a slow burn, building on result catalysts until the company gets taken out by a major uranium player like Cameco. When that happens is up for debate.

So is it worth the faith and the wait?

Uranium is on a tear with other commodities since Russia flexed its neo-colonial muscle and walked into the Ukraine, but the radioactive mineral’s upswing began well before Putin once again proved his tyrannical nature.

The impending green energy revolution requires a baseload generator as the mountain-sized batteries required by intermittent sources such as solar, wind and tidal aren’t practical and, if Tesla’s power storage efforts in Australia are any indication, dangerously combustible.

‘New’ nuclear power generation technologies being perfected at TerraPower, a nuclear power innovator backed by Bill Gates, are based on breeder reactors which produce infinitely less radioactive waste, no heavy water and can safely be shut down without causing a meltdown.

As such, we will need uranium from domestic jurisdictions, avoiding the industry’s dependence on fissionable material extracted in Kazakhstan, China, Russia, and Uzbekistan which combined, supply over 56% of the world’s uranium.

Athabasca Basin contains the highest-grade uranium deposits on the planet, so digging in at Athabasca as a uranium investor may very well bring great returns and help the free world secure a safer, cleaner future. Azincourt may just be the basement opportunity you’re looking for. Please remember to do your due diligence, do NOT make any portfolio decisions without consulting an investment professional.

If you would like a deeper technical breakdown of the uranium sector and Azincourt, check out Vishal’s piece here.

We get into it once again and give viewers our take on Azincourt and the opportunity it may present in the latest Investor Roundtable Video here.

Alex Klenman recently sat in with Chris Parry and ran the gauntlet in our new video series, The Gauntlet with Chris Parry. Check it out!

Jody Vance spoke with Alex Klenman a while back to get the human angle of the company and its prospects in a recent First Glance with Jody Vance.

–Gaalen Engen

*Full disclosure: Azincourt is a marketing client of Equity.Guru