A few weeks ago, I boldly stated that EarthRenew (ERTH.CN) has the best looking chart in Agriculture. A company that remains under the radar and undervalued compared to its peers.

Since my call, the stock has moved up over 50% from the pre-breakout levels mentioned, to recent highs printed at $0.28. This is a play that met my market structure criteria. However, we also had fundamental reasons in terms of news flows and in terms of the macro environment.

If you have read my previous Agriculture roundups, a lot of larger fertilizer companies are expecting a shortage. We shall see if this is true when the Spring planting season starts. For more information, you can read my fertilizer roundup here. Even though the Russia-Ukraine situation seems to be cooling down for now, any future escalation in that area will also impact fertilizers. Want to know why? Read my article on how the Russia-Ukraine situation can impact agriculture. Ukraine, as some of you may remember from high school history/social study classes, is the breadbasket of Europe.

To make a long story short, I am bullish on fertilizers. You have seen big moves in larger fertilizer companies as they beat out in earnings AND put out a very positive forward guidance. Even some smaller companies like Verde Agritech (NPK.TO) continue to ramp up and I mean ramp up hard. At time of writing, the stock is up 15% for the day and took out recent highs above $5.40. Stunning rally in the past few months.

I am betting that EarthRenew will follow as fertilizer plays ramp up as we head closer to the Spring planting season.

On February 4th 2022, I put out an article stating that EarthRenew confirms our breakout. As mentioned earlier, the fundamentals are ripe, and now the technicals have confirmed a reversal. A winning combination.

Before we get into the chart, a quick summary about the company and recent news.

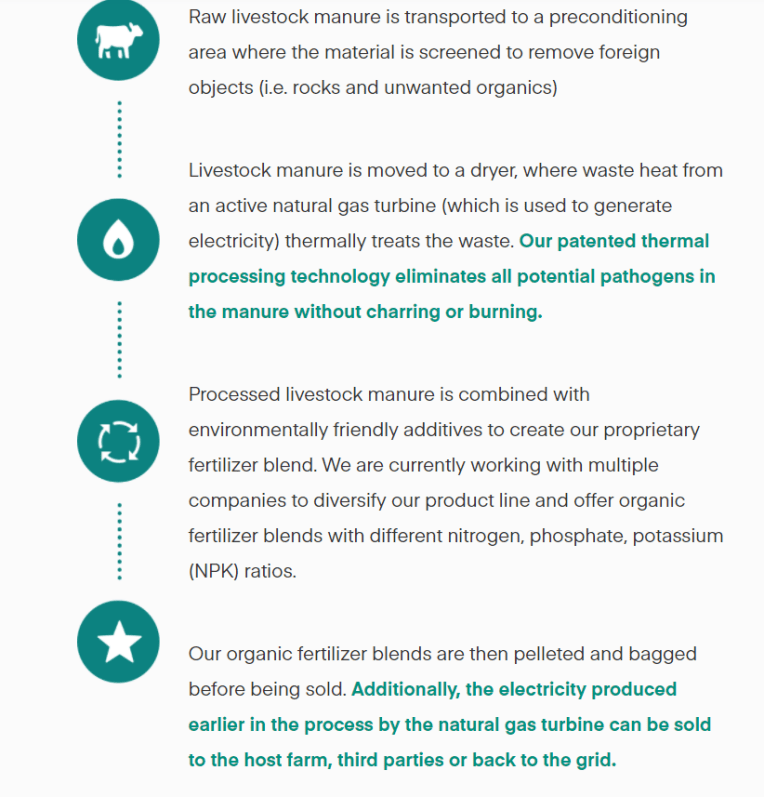

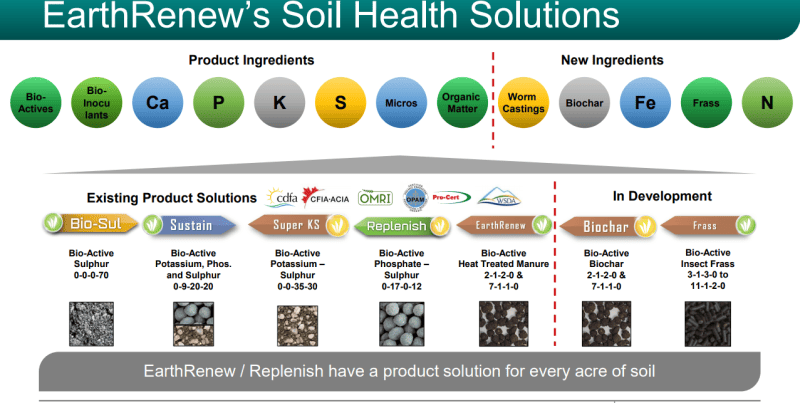

EarthRenew produces and sells organic fertilizers from livestock waste in North America and Europe. It also produces electricity from natural gas using an industrial-sized gas turbine and supplies to electrical grids and cryptocurrency miners. The company sells fertilizers under GrowER and GrowER Biochar names.

The company produces organic fertilizer production through their patented thermal processing technology transforming livestock manure into the good stuff for plant growth and restoring soil health. This organic fertilizer also offers 20% to 40% higher yields than the equivalent chemical fertilizer! And it’s good for the environment! $70 million has been invested into both the development and commercialization of this technology.

In terms of positive news for our fertilizers macro play, EarthRenew announced it will be expanding its pilot facility in Beiseker, Alberta into a full scale facility. Here are key points from the press release:

- Building on revenue growth from the past year, EarthRenew has expanded its pilot facility in Beiseker, Alberta into a full-scale granulation facility capable of producing an additional 16,000 MT/year of fertilizer production, allowing 20,000 MT/year production

- The expansion of the Beiseker facility will supplement the previous capacity for granulated fertilizer production as well as capacity for blended product enabling higher revenue growth for the coming year.

- The ability to granulate the product allows the Company to fulfill its mission of improving on-farm ROI, accessing new market channels and increasing margin on its products.

- EarthRenew, which supports a farm system focused on soil health, has secured off-take agreements with trusted local and international partners to place this additional volume as well as to support off-take from the planned project with K+S in Bethune, SK

EarthRenew previously announced revenue from regenerative fertilizer of $14 million for the period of January to December 2021, an increase of 106% over 2020, and can now leverage the expanded facility to maintain that growth trajectory into 2022.

A week ago, EarthRenew penned a positive letter to stakeholders providing context to past accomplishments and future catalysts. There is an extensive list, so check out the full piece here, but here are some points:

- Posting positive results from a field trial we began last year to understand the impact of our products on potatoes crops.

- Outcomes of the trial included growing healthier potatoes at an equivalent marketable yield at a lower overall program cost than the standard synthetic program while improving the microbial diversity of the soil.

- A favorable revenue announcement assured the market that EarthRenew’s acquisition of Replenish Nutrients and its innovative suite of regenerative products was a success.

- With revenue of $15.1 M last year (on a proforma basis), EarthRenew is now focused solely on the growth of this business line, adding capacity exclusively to growing Replenish Nutrients’ products. Next year’s revenue expectations are expected to be in excess of $24M

- With the completion of this commercial facility, the company can provide customers with granulated versions of the products they have come to rely on. In this form, the products are easier to transport and store and can be applied with traditional farm equipment.

- As fertilizer prices maintain their unprecedented rise, farmers are reluctant to absorb the price increase and will be looking for more cost-effective solutions. While it has not been immune to the tightening in the Potash market, they have been able to meter its costs to produce products at a price that remains attractive to customers.

Beautiful market structure pattern that always gets me excited every time that I see it. Our key breakout trigger occurred when we took out $0.20. As long as EarthRenew remains above this price level, the uptrend remains intact, and we should expect multiple higher lows and higher highs. It seems as if our first higher low has been confirmed.

Take note of the arrows I drew. I have one pulling back to $0.20, before ripping higher. This is just to illustrate a pullback retest and a higher low. This may have already happened on February 7th. That large red candle took us down to $0.21. Buyers then jumped in and took prices higher to $0.28. I am watching for some resistance at $0.30, but I believe EarthRenew is a play that could begin to see real action come Spring, when more media headlines start talking about fertilizer shortages and rising fertilizer prices.

Full Disclosure: I do own some shares of EarthRenew