It’s been a few weeks since we last caught up with Gold Mountain and their wholly-owned 21,187-hectare Elk Gold Project in the mining-friendly region of Merritt, B.C. Late last week, the Company dropped an eagerly awaited headline.

Gold Mountain Delivers First Shipment of Ore to New Gold Inc.

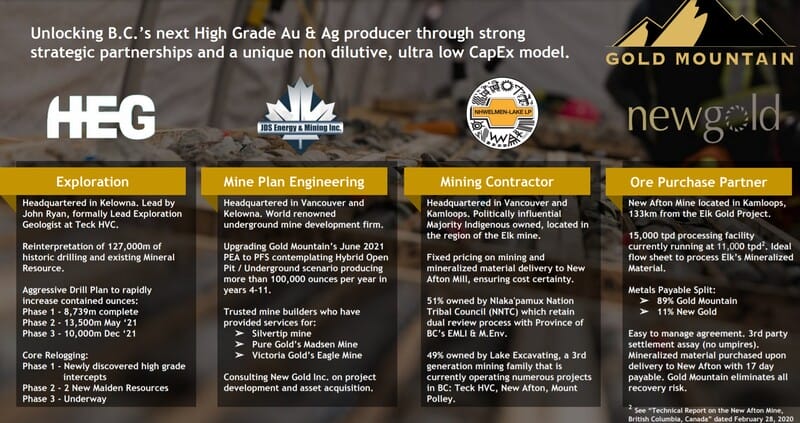

Gold Mountain has systematically de-risked the Elk project since acquiring it from Equinox Gold roughly two years back.

With the above headline, I think it’s fair to state that the fundamentals currently underpinning this play have changed.

This first load of ore delivered to New Gold’s New Afton mill marks the official commencement of production and the beginning of cash flow and revenue generation for the Company and its shareholders.

What we have here is a freshly minted Producer.

Highlights from this February 3rd press release:

- Following the extended provincial review and approval of New Gold’s custom milling permit, the Company is now positioned to deliver high-grade ore to accommodate its Year 1 production profile.

- The material was mined from the 1300 vein near historic Pit 2, which was last mined from 2012 to 2014 at an average grade of 16.7 g/t.

- This initial delivery marks the Company’s transition into cash-flow and revenue generation.

- Under the terms of the Ore Purchase Agreement with New Gold, the Company will be paid on a monthly basis for all ore delivered.

- Ownership of ore transfers to New Gold upon delivery, eliminating all risks of recovery for Gold Mountain.

Kevin Smith, CEO:

“Since purchasing the project from Equinox, our primary focus has always been putting the mine back into production. When going public in December of 2020, we had a goal to restart the Elk and develop a million-ounce producer. We are very pleased to deliver this update to our loyal shareholders. The Elk project has always been an execution story and I’d like to thank all those involved in bringing the Elk Gold mine back to life. Looking forward, we plan to ramp up high-grade ore delivery to New Gold, continue aggressively drilling out our highly prospective land package, and kick off the technical work necessary for our proposed Phase ll production expansion.”

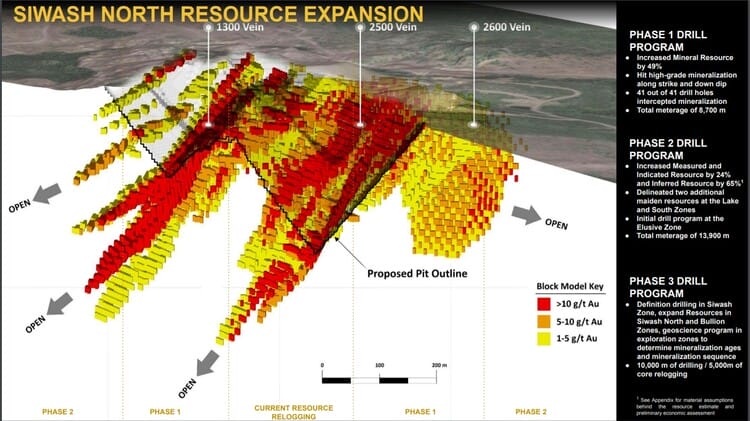

As noted above, this first load of ore-grade material comes from the 1300 vein near the footwall of the historic #2 Pit (above map). Elk is slated to produce roughly 200 tonnes per day (tpd) for the first three years of operation.

The operation

Once extracted, the gold-rich rock is crushed and batched on site. Ore is then loaded onto trucks and weighed. Before they’re sent off to the mill, a 21-kilogram sample is pulled from each truckload and sent to a 3rd party lab in Kamloops to determine the gold and silver grades.

Once the lab returns the assay values, it’s simple math: Grade x Tonnage = the total metals value of each truckload of ore.

Gold and silver prices are determined based on the monthly average of the official AM/PM London Bullion Market Association for gold and London Metals Exchange for silver.

The Ore Purchase Agreement (OPA) Gold Mountain negotiated with New Gold is a good one—their take is 89% of the total metals value of each load it delivers to New Gold’s mill (the New Afton mill is a 133-kilometer ride via paved highway).

The OPA differs from a traditional “toll milling” arrangement in that Gold Mountain is paid based on the value of the ore delivered to New Gold and bears no risk of processing recovery.

Costs associated with every aspect of the operation are either fixed or locked in via strategic partnerships over the life of the mine (LOM).

The economics

Elk’s economics are compelling. The LOM all-in sustaining cost (AISC) is $554 per oz. This puts Gold Mountain at the lower end of the cost curve for a gold producer.

These are (potentially) high-margin ounces. Again, it’s simple math:

- Gold currently trades at roughly $1,800.00 per oz

- $1,800 – $554 (AISC) = $1,246 per oz

- $1,246 per oz x 19k ounces (projected rate of production per annum) = $23,674,000

An annual production rate of 19k ounces is projected for years one thru three. Beginning in year four, as per an enhanced OPA with New Gold, the Company plans to scale the operation via increased delivery commitments to the New Afton mill—from 70,000 to 350,000 tonnes. This 400% bump is expected to produce 65,000 ounces per annum. Once the Company fires on all cylinders, we could see yearly production top 100,000 ounces via multiple open pits and an underground operation.

The increase in tonnage delivered is subject to both the Company and New Gold obtaining the necessary regulatory and Indigenous approvals.

Kevin Smith, CEO:

“Our ability to demonstrate resource and mine plan scalability has been a recurring theme in our conversations with institutional investors. With recent drilling encountering deeper vein extensions and JDS’s trade-off study recognizing a case for transitioning to a potential open pit-underground hybrid mine plan, a very clear path is forming to showcase the Elk Gold Project’s long-term expansion potential from both a resource and production perspective. Over 118,000 ounces of our richest mineralization is beneath the current PEA pit shell. This latest underground concept allows us to consider those well-defined ounces and reduce the project’s overall strip ratio to continue chasing the deep, high-grade mineralization at the Elk“.

A summary of Elk’s economics as per an updated PEA:

- An (after-tax) NPV5% of C$231M;

- AISC = $554 per oz;

- CapEx = an (extremely) modest $9M;

- A 1 year (after tax) payback period;

- The first 3 years of production will see roughly 19k ounces per annum;

- Beginning year 4, management hopes to expand production to 65k ounces per annum;

- Life of Mine = 11 years;

- (price inputs = $1,600 Au)

Note the $9M CapEx. This ultra-low buildout cost puts the Company in an enviable position, especially considering its tight share structure at 70 million shares (approx. 85.1 million f/d). Management intends to protect that tight structure by channeling proceeds from production to growing the current 1M-plus ounce count (stepout drilling), exploring the regional potential of its 21,187-hectare land base, and accelerating development as they prepare for that 400% Phase-2 bump in delivery commitments to the New Afton mill.

A PFS is in the works and due to arrive this qtr.

The ounce count

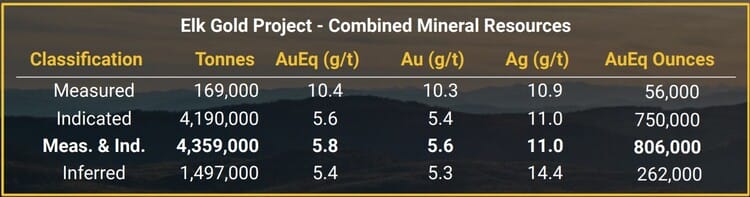

When Gold Mountain first acquired the project, Elk’s resource was a modest 375,000 ounces. Twenty months later (on December 8, 2021), the Company updated Elk’s high-grade ounce count pushing it past 1 million AuEq ounces. Note the higher confidence Measured and Indicated components (table below).

A recent Guru offering on the subject offers additional insight into this resource upgrade: Gold Mountain tables landmark 1M-plus oz resource estimate at flagship Elk Gold Project

Exploration upside

A 10,000 meter Phase-3 drill campaign—a combination of infill and stepout drilling along the Siwash North zone—kicked off late last year. Phase-3 assays should begin to flow next month (assay turnaround times = 5-8 weeks).

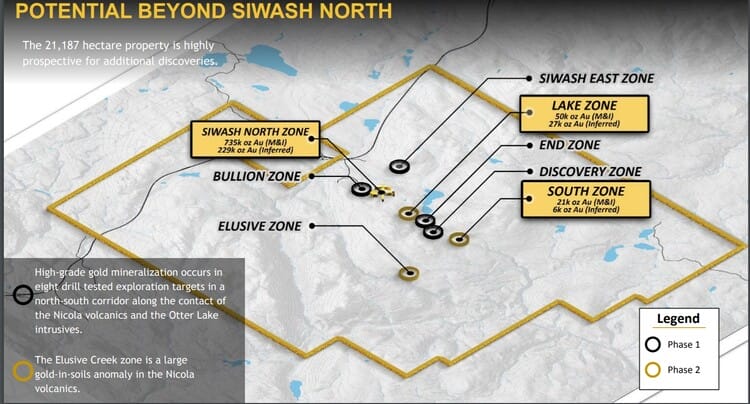

There’s significant exploration upside at Elk—multiple high-grade zones within easy reach of the main Siwash North resource base are already demonstrating tonnage potential (map below).

The consistency in grade and structure established along Siwash North and these satellite zones lays the foundation for a (potential) multi-million-ounce global resource at Elk (Siwash North itself could ultimately bring more than one million ounces).

Another example of Elk’s resource expansion potential: On Dec. 1st, 2021, the Company reported a 2.4 meter hit grading 20.2 g/t Au (including 0.4 meters of 127.0 g/t Au) in a 75 meter step out along the 2600 vein. This mineralization remains open to the east and will see follow-up drilling during the Phase-3 campaign.

At the Elusive Zone, where the Company has a copper/gold porphyry in its crosshairs, seven holes were drilled during the 13,900 meter Phase-2 campaign. Drill hole assays from this monster target could drop any day now.

The Indigenous Communities

While the Provincial review and the corresponding Mine Review Committee process have come to a close, Gold Mountain is aware and acknowledges each respective Indigenous Nation’s decision-making process will continue independently from the Province of British Columbia.

Over the past 21 months, the Company has made a concerted effort to build strong relationships with communities that are affected by the development of the Elk Gold Project. Gold Mountain looks forward to continued collaboration with all Indigenous Nations that have interests in the Elk Gold mine. The Company also wishes to communicate that there is no time limit on direct engagement and consultation between the Company and each respective Indigenous Nation.

Sustainability

By selling high-grade ore directly to New Gold, the Company avoids the need for an on-site mill and tailings storage facility. This arrangement drastically reduces the Elk Gold Mine’s environmental impact and minimizes the effects it has on surrounding ecosystems and habitats. As a result, the Company reduces its carbon emissions by 11,500 tonnes/annum, power consumption by 10.2 Mwh/year, and annual water consumption by over 14,000,000L **.

This transition to revenue generation should enable the Company to fund future exploration and development without going to the market. But if it sees something it likes in the way of a new (accretive) acquisition, it has the financial flexibility to execute (on November 5, 2021, the Company announced conditional BCSC approval for a $50M base shelf prospectus).

The Company had its fair share of skeptics, those convinced that its timelines were far too aggressive. But delivering this first load of ore on schedule clearly demonstrates this crew’s capacity to execute and deliver shareholder value.

Final thoughts

There aren’t too many Jr producers out there with < 100M shares out. 2022 could prove interesting as newsflow accelerates on multiple fronts—production, earnings, exploration, etc.

With lower production profiles and lean project pipelines, the Mids and Bigs are on the hunt. Companies boasting high-grade deposits with high-margin ounces are, now more than ever, in the crosshairs of these resource-hungry predators.

The New Afton mill has the capacity to process 15k tonnes per day (tpd). It’s currently operating at only 11k tpd. It wouldn’t surprise me, not in the least, if New Gold makes a move on Gold Mountain at some point in the not-too-distant future.

We stand to watch.

END

—Greg Nolan

Full disclosure: Gold Mountain is not currently an Equity Guru marketing client. The author owns shares.

** 100,000 L diesel/month using:https://www.epa.gov/energy/greenhouse-gases-equivalencies-calculator-calculations-and-referencs

Based on comparison toto 1.5 MW mill contemplated in 2020 PEA = 30,000 kwh/day * 0.4L Diesel/kwh = 11,500 tonnes CO2/year and to the 900 tonne/day processing mill contemplated in the Company’s 2020 PEA, a copy of which was available on the Company’s SEDAR profile on September 24, 2020.