There’s no such thing as a sure thing/safe bet in mining, particularly where exploration and development are concerned. But there are a few noteworthy standouts in the junior arena—strategically positioned companies run by adept rock kickers and project developers… crews that meet investor expectations as a matter of routine.

Gold Mountain told the market they had one million ounces in their crosshairs for a pending resource update—a lofty goal considering they only had a 375,000-ounce resource when they acquired the project 18 months back. As per usual, the Company delivered, dropping an impressive 43-101 yesterday—an updated resource estimate of some 1,068,000 gold equivalent (AuEq) ounces at their flagship Elk Gold Project. On top of that, this current ounce count substantially populates the higher confidence Measured & Indicated resource categories.

Prior to acquiring the project back in May of 2019, there was a widely held belief that Elk’s subsurface stratum was tapped out—that all of the exploration upside was exhausted. Nope. Not by a long chalk.

Once again, this top-shelf crew has proven the nay-sayers wrong.

Before we dig into the details of this watershed news event, a summary of the Company’s rapidly evolving fundamentals is in order.

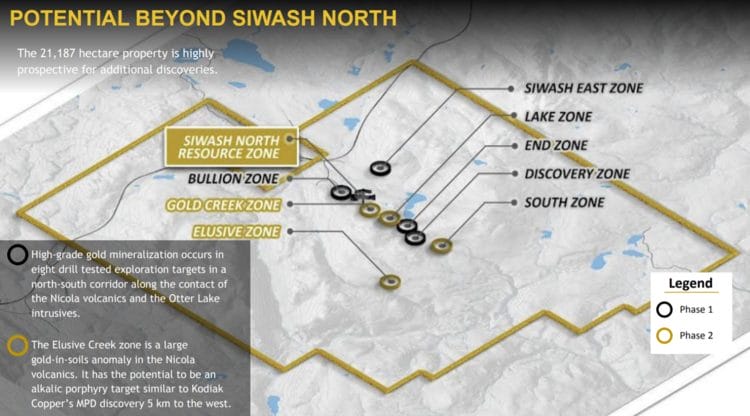

The wholly-owned 21,187-hectare Elk Gold Project is located in the mining-friendly region of Merritt, B.C.

Since acquiring the project in 2019, with the inclusion of yesterday’s news event, the Company has succeeded in tripling the resource base at Elk—an extensive network of high-grade veins is emerging here.

For a junior, delineating a weighty ounce count is one thing, but doing so while ramping up to commercial production is quite another.

A recently revised mine plan, which broadened an ore purchase agreement that was already in place with New Gold, pushed the project further along the curve.

This revised mine plan eighty-sixes previous designs to build a mill on-site for production years 4 thru 11—ore delivered to the New Afton mill will increase markedly, from 70k to 350k tonnes per annum. This move not only slashes the project’s CapEx, but will also drive down Elk’s all-in sustaining costs (AISC) from $735/ounce to $554/ounce.

Management’s capacity to brainstorm these alternate development scenarios could go a long way towards increasing shareholder value, especially for those playing the long game.

A relevant quote from my recent Q&A with Gold Mountain’s CEO, Kevin Smith:

Nolan: You recently decided to opt-out of building a mill on-site for production years 4 thru 11. Can you elaborate on the benefits of this revised mine plan?

CEO Smith: This really came down to economics. We hired JDS Energy & Mines, who are the best in the business, to not only complete a PFS on the Elk, but also design our underground mine plan. One of the key pieces that came out of their extensive trade-off studies was that the economics on building a mill do not really pencil until you get up to around 100,000-120,000 ounces of annual production. Eliminating that CapEx had a dramatic effect on our Economics and the high-grade ore we will produce can easily absorb the short highway haul to New Gold’s Mill in Kamloops. You can really see the effect of these changes and moving to an underground/open pit hybrid mine plan, based on the bump in the latest PEA we released in June. Another big factor for this change in strategy is when you avoid building a mill and tailings storage facility on site, the permitting and environmental impacts also drop off significantly which we anticipate will help streamline the permitting and community consultations required for expansion.”

It’s now abundantly clear that inflation is not nearly as ‘transitory’ as the Fed would have us believe (they’ve only just recently ditched the ‘transitory’ tag). With inflationary pressures mounting by the day, the timing of this decision couldn’t have been better. Economic studies generated one year ago will almost certainly need to be revised upwards, particularly where a project’s CapEx is concerned.

As fiat currencies across the board lose their purchasing power, inflationary pressure is wreaking havoc across the sector—a bloated CapEx can kill a development project.

Nova Gold’s Donlin Gold Project comes to mind—a feasibility study tabled back in 2011 showed an initial CapEx of $6.68 billion and a sustaining CapEx of $1.504 billion. A Donlin feasibility study update, due to drop sometime in the new year, could demonstrate significantly higher buildout numbers (NnGulp!).

There’s no such threat here.

The following is a summary of Elk’s compelling economics:

- An (after-tax) NPV5% of C$231M

- AISC = $554 per oz

- CapEx = an (extremely) modest $9M

- A 1 year (after tax) payback period

- The first 3 years of production will see roughly 19k ounces per annum

- Beginning year 4, management expects to produce 100k ounces per annum

- Life of Mine = 11 years

- (price inputs = $1,600 Au)

A gentle slope on the permitting curve, an appreciably reduced CapEx, and all-in sustaining costs at the lower end of the range for a gold producer will give rise to fatter profits and greatly reduced project risk.

A November 1st headline marked another significant milestone for the Company…

Gold Mountain Receives Its Mining Permit from The Ministry of Mines

This is the first gold mining permit issued in BC in nearly a decade.

From my November 2nd article (quoting myself): “There was a slight delay in getting signatures put to paper on this final document, but during the procedural ‘downtime,’ it was pedal to the metal for this crew. Management has been busy driving all aspects of development that were in its control—heavy equipment mobilization, drilling-blasting, haul road rehab, stripping waste rock, bringing everything up to code… lining everything up at the starting post for the inevitable wave of the solid green flag.”

Quoting Gold Mountain’s CEO Smith, from our recent Q&A:

“A lot of people thought we were crazy with all the capital outlays we did prior to having certainty on the permit, but management had a lot of conviction in our proposed mine plan and ability to get the permitting across the line. We set extremely aggressive targets for ourselves and knew the only way to achieve all of them on time, we would have to push the pace from the moment the Construction and Development Authorizations were received in April. Big thanks to our mining contractor Nhwelmen-Lake LP for all their hard work on building out the site and getting the project to the stage it is at right now.”

Moving along…

After completing its Phase-2 drill program and updating its geological model, the Company was well on its way to adding considerable bulk to its global resource at Elk.

In a November 8th Guru offering, I opined: “Exploration is advancing across the property. Multiple zones—the Gold Creek Zone, the Lake Zone, the South Zone—are getting a proper probe with the drill bit. These highly prospective satellite zones could add additional tonnage and extend the mine life well beyond the 11 years outlined in a May 27th, 2021 (updated) PEA.”

Growing the resource base and extending the mine-life. Solid plan.

In a Dec. 1st press release updating Phase-2 drilling, the Company reported one of the widest reported high-grade incepts ever recorded on the project—2.4 meters grading 20.2 g/t Au including 0.4 meters of 127.0 g/t Au.

The Intercept

Gold Mountain and its exploration management partners HEG Exploration (“HEG”) hit one of the widest intercepts ever recorded at the Elk, located 150 meters north of its open pits. This mineralization was the result of a 75 meter step out along the 2600 vein, which remains open to the east and will be further explored during the Company’s Phase III drill program. With 127,000 meters of historical drilling on the property, management is confident the Elk is still home to significant, untapped mineralization that will allow the Company to continue to scale its resources.

The 2600 vein is open to the east. Note the reach of this high-grade vein from the pit (far left).

The December 7th watershed headline

Gold Mountain Updates Mineral Resource Estimate at the Elk Gold Property

The highlights from this landmark news event are as follows:

Highlights:

- Gold Mountain increases its resource estimate at its flagship Elk Gold Project to: 806,000 oz of Measured & Indicated Resources at 5.8 g/t AuEq and 262,000 oz of Inferred resource at 5.4 g/t AuEq.

- The updated Resource Estimate represents a 24% increase of Measured and Indicated ounces and 65% increase of inferred ounces.

- 37 new diamond drill holes were completed in the Siwash North Zone which incrementally expanded the vein models along strike and down dip and connected the Siwash North Zone with the Gold Creek Zone, historically viewed as a satellite deposit.

- 10 diamond drill holes were completed in the Lake and South Zones leading to maiden Mineral Resource estimates in the two satellite zones which demonstrate the multiple zone potential for the Elk Gold Project.

- This update to the mineral resources followed the Company’s successful Phase 2 drill program that consisted of 13,900 metres of diamond drilling where all 47 holes hit mineralization.

As highlighted above, the Phase-2 drill campaign, which included infill and stepouts along the Siwash North zone, also succeeded in defining new maiden resources for two additional satellite zones—the Lake Zone and the South Zone. All told, three satellite zones contributed to the current ounce count when you factor in the newly recognized link between Siwash North and Gold Creek.

These satellite zones accounted for 40% of this latest ounce count increase.

The consistency in grade and structure established between Siwash North and these satellite zones lays the foundation for a (potential) multi-million-ounce resource (Siwash North itself could ultimately bring more than one million ounces).

Aside from Siwash North, Lake, and South, six additional drill tested zones are teed up for maiden resources.

The resource update is following Gold Mountain’s 13,900m Phase 2 drill program which began in May and wrapped up in November. The Company continued to step out and infill its well established, high-grade intercepts in Siwash North, increasing the zone’s measured and indicated resource to 735,000oz at 5.9 g/t AuEq and inferred resource to 229,000oz at 5.4 g/t AuEq. This included drilling to the south of the Siwash North Zone which allowed the Company to merge the Gold Creek and Siwash North geological models.

Additionally, Gold Mountain continued exploring the property by drilling in known mineralized Satellite zones including; the Lake and South Zones. By leveraging and evaluating the historical drill data set for these zones, the Company was able to fill spatial data gaps and establish a combined maiden resource of 71,000oz measured and indicated at 4.3g/t AuEq and 33,000oz inferred at 5.7g/t AuEq.

Finally, the Company continued relogging the asset’s historical core that was drilled by previous owners of the property. HEG Exploration Services Inc. identified and sampled core from historical drill holes located in the Siwash North Zone which helped further refine the vein model interpretation and add additional veins to the geological model.

Final thoughts

This 1M+ ounce count takes on much greater meaning now that Gold Mountain is on the cusp of cash flowing.

The Company plans to use proceeds from current production to secure a 2nd rig for an aggressive Phase-3 campaign.

Phase-3 will consist of 10,000 meters of diamond drilling and 5,000 meters of historical core relogging.

Phase-3 drilling is underway.

Newsflow on multiple fronts—production, earnings, exploration—will be nothing short of robust going forward.

To close this one out, another excerpt from my recent Q&A with CEO Smith:

Nolan: What are your longer-term goals as a producer? Do you see Gold Mountain evolving into a mid-tier company?

CEO Smith: A lot of people ask us if we plan to just package up the Elk and sell it. We are building and developing this project like we plan to be here for the next 20-30 years, but if the right opportunity came along that made sense for Gold Mountain shareholders we will give it some consideration. Ultimately, this is a young management team with a lot of ambitions to do something special with Gold Mountain. The Elk project’s cash flow is an excellent foundation, but larger-scale production is definitely on our minds and we intend to continue expanding our footprint within British Columbia. With all the COVID-19 travel uncertainty, being located in British Columbia has been a huge advantage for our team and we look to continue developing projects in our home Province. Going elsewhere is of course not totally out of the question, but it would really have to be a special opportunity in order for us to change what we feel has been a winning recipe up until this point.”

END

—Greg Nolan

Full disclosure: Gold Mountain is an Equity Guru marketing client.