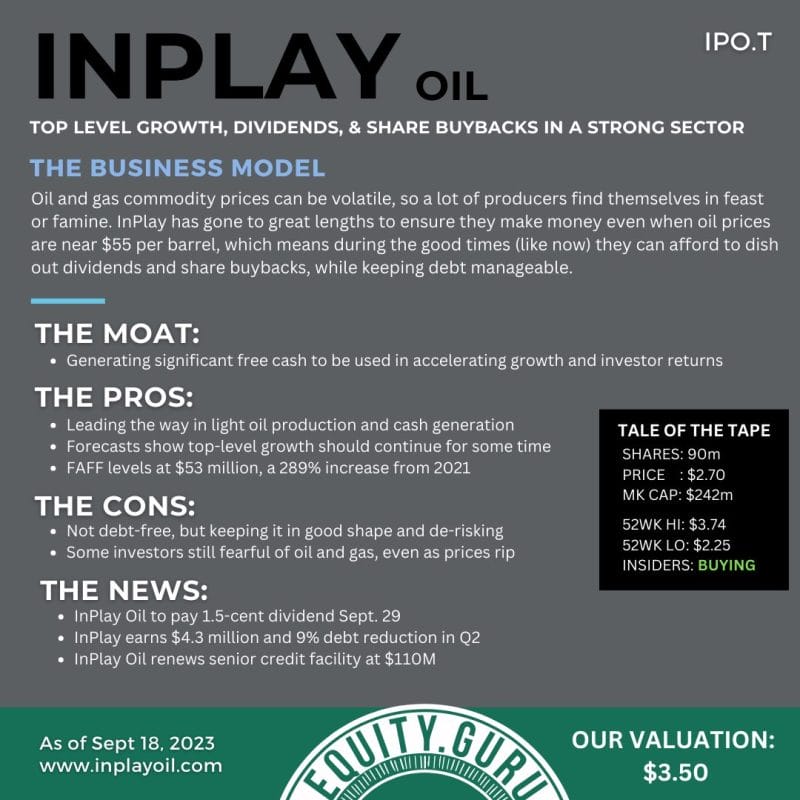

InPlay Oil (IPO.T) is building a light oil production portfolio in Alberta.

IPO operates “long-lived, low-decline properties” with drilling development and enhanced oil recovery potential as well as undeveloped lands with exploration possibilities.

Six weeks ago, InPlay announced that it has acquired 100% of Prairie Storm Resources (PSEC.V).

The acquisition of Prairie Storm enhances its Cardium consolidation and sustainability strategy, positioning InPlay as a sizable producer and acreage holder with significant drilling inventory in the light oil window of Central Alberta’s Cardium fairway.

Three weeks ago, a man called named “Dave” called into BNN Bloomberg’s “Market Call” to speak with Bruce Campbell, Founder and Portfolio Manager of StoneCastle Investment Management.

Dave: Regarding InPlay Oil, I have a question – they used to do about 2,000 barrels a day, I believe last year – now they’re doing around 7,000 barrels a day. How much do they have to do before they’re a midsize company instead of being a small cap?

Campbell: They have been increasing their production aggressively. They recently did an acquisition where they bought a private company and brought on some more production. Now I believe they’re right on the doorstep of around 10,000. I kind of wish that we had a participated in the financing they just did to close the acquisition.

BNN Bloomberg: Would you be a buyer of InPlay right now?

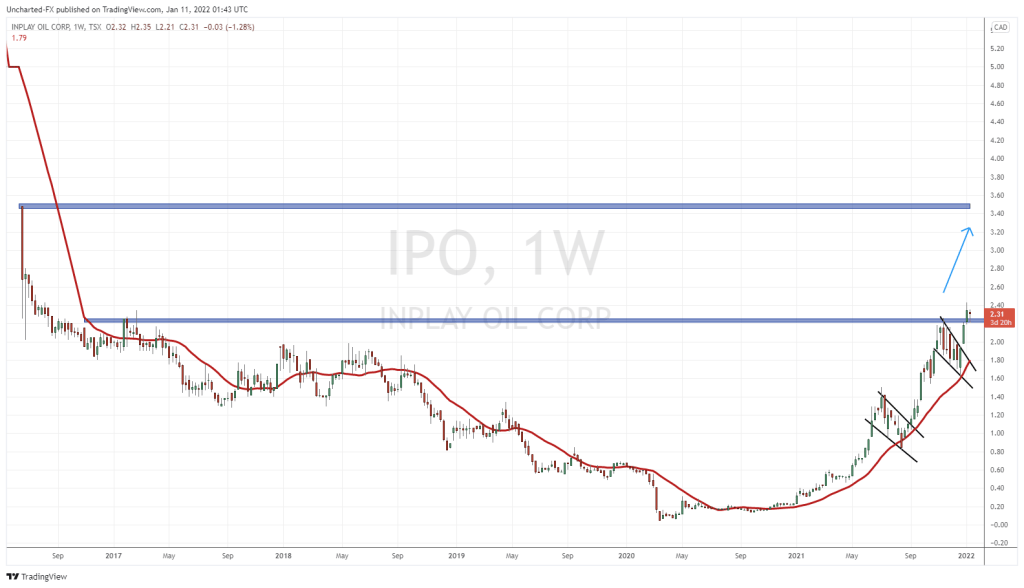

Campbell: It certainly looks attractive. We’ve been waiting for a pullback that just hasn’t materialized at this point in time.

“It’s taken a hot minute for the memo to get out that oil is a thing again,” wrote Equity Guru’s Chris Parry last summer, “Companies that were drilling in 2019, generally weren’t in 2020. Companies that were selling what they produced for a decent price in 2019, generally weren’t in 2020. And companies that were running at a loss in 2019 were getting group euthanasia discounts in 2020.”

“Take InPlay Oil (IPO.T), a big board resource producer that did some quick math during the pandemic and set themselves up for glory while the plague was setting upon us, by picking up cheap assets, hedging their sales, and streamlining operations.

InPlay timed their run through the worst of times in the oil and gas sector absolutely perfectly.

Currently the company is a little laggy on revenues [Editor’s note: a lot has changed in 6 months], but that’s not a bug, it’s a feature, because last year they locked in hedge contracts in order to keep their heads above water”. – End of Parry.

At the time of Parry’s 2021 summer write-up, InPlay Oil was on a tear, surging to $1.25 per share. Since then, the share price has doubled again.

Two months ago, InPlay Oil announced its financial and operating results for the three and nine months ended September 30, 2021.

Third Quarter 2021 Financial & Operating Highlights

- Achieved record quarterly production for the second consecutive quarter with third quarter production averaging 6,011 boe/d ( 1) (64% light oil and NGLs), an increase of 61% compared to 3,742 boe/d (1) (69% light oil and NGLs) in the third quarter of 2020 and an increase of 12% compared to 5,386 boe/d (1) (68% light oil and NGLs) in the second quarter of 2021.

- Increased operating netbacks (2) by 168% to $37.09/boe from $13.85/boe in the third quarter of 2020 and by 12% from $33.11/boe in the second quarter of 2021.

- Realized increased quarterly record operating income (2) and operating income profit margin (2) of $20.5 million and 65% respectively compared to $4.8 million and 44% in the third quarter of 2020 and $16.2 million and 64% in the second quarter of 2021.

- Continued to reduce operating expenses to a quarterly record $12.23/boe compared to $14.42/boe in the third quarter of 2020 and $12.51/boe in the second quarter of 2021.

- Generated free adjusted funds flow (“FAFF”) (2) of $5.1 million compared to $1.6 million in the third quarter of 2020 and $3.6 million in the second quarter of 2021.

- Decreased net debt by 6% during the third quarter of 2021 from June 30, 2021 while also achieving production growth of 12% over the same respective period.

- Strengthened our net debt to quarterly annualized earnings before interest, taxes and depletion (“EBITDA”) (2) ratio to 1.1, compared to 5.2 in the third quarter of 2020 and 1.9 in the second quarter of 2021 achieving the lowest quarterly leverage ratio in our corporate history.

Goldman Sachs’ Jeff Currie recently told CNBC’s ‘Squawk Box’ “We’re at the beginning of a commodities super cycle.”

“Take oil right now,” stated Currie, “Today it’s at a 2 million barrels per day deficit. That’s 2% of the market that is missing. Inventories are now 5% below the 5-year average.”

“The fundamental setup is spectacular right now,” continued Currie, “Investors don’t like this space, the overall participation is quite low.”

Last quarter, InPlay Oil generated record quarterly adjusted funds flow (“AFF”) of $15.6 million ($0.23 per basic share), an increase of 675% compared to Q3, 2020.

Full Disclosure: Equity Guru owns InPlay Oil shares.