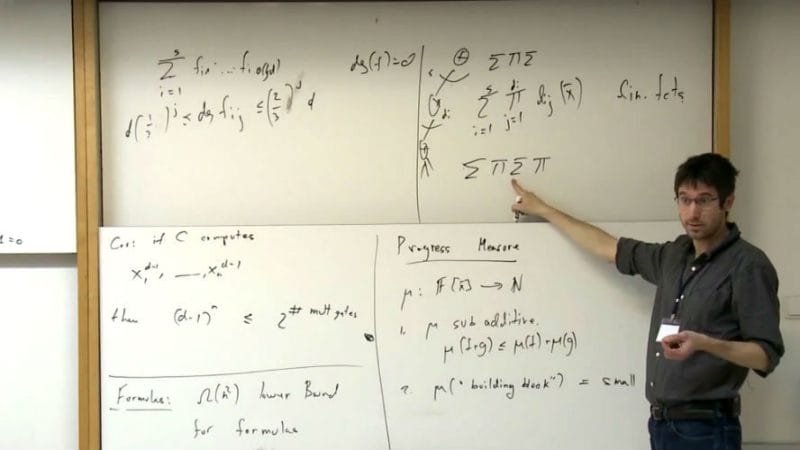

Wellfield Technologies (WFLD.C), a company focused on building open and accessible decentralized protocols and Blockchain-based consumer DeFi products, has added a homerun hitter to their advisory board, a monster brain with a monster reputation that has been integral to putting together their business model and tech. But nobody in the retail investor space knows who he is because our brains aren’t as big and we don’t travel in theoretical math circles.

The brain in question is Professor Amir Shpilka, a world recognized computer science expert from Israel, who currently serves on the faculty at the Blavatnik School of Computer Science at Tel Aviv university and has been a visiting scientist at Berkeley.

If you were selling widgets, Professor Shpilka doesn’t add much value. But if you’re in the business of creating an entirely new means of engagement in the world financial markets, this is a big get.

Prof. Shpilka graduated with a Ph.D. in Computer Science and Mathematics from the Hebrew University in Jerusalem in 2001 under the supervision of Prof. Avi Wigderson. Prior to moving to Tel Aviv University, he was a professor of computer science at the Technion–Israel Institute of Technology. He supervised students that are now professors at leading institutions such as Princeton University, University of Illinois at Urbana Champagne and the Technion–Israel Institute of Technology. Most recently, Prof. Shpilka has been studying questions at the intersection of algebraic geometry and algebraic complexity, and questions concerning codes for storage.

The professor has been involved in Seamless Logic Software, a wholly owned subsidiary of Wellfield, since its early days, so while this advisory board spot makes sense, a legion of defi companies and projects have been trying to lure him into coming aboard for some time. Wellfield is his first advisory role.

He’ll be in good company. Recently Wellfield announced another Tel Aviv University professor and global financial consultant, Dr. Tamir Agmon, would also be joining the advisory board, making it the place to be for Israeli math megaminds.

Dr. Agmon is one of the founding partners of Seamless Logic Software and is actively engaged in research regarding decentralized trading and the decentralized financial market. Currently, his research is focused on the applications of financial economics in the DeFi ecosystem. His recent research (to be published soon) considers the conceptual basis of bitcoin in a portfolio of growth capital securities with different risk profiles.

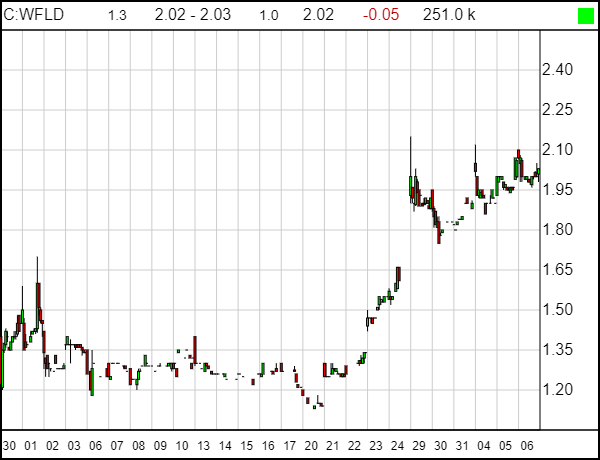

Wellfield burst out of the blocks on its market listing debut, quickly running from $1.20 territory to over $2 as DeFi investors and enthusiasts began to piece their business model together.

The company announced Thursday that it has established plans for the year that involve:

- Making Bitcoin more compatible with DeFi, rather than a simple store of wealth

- Cross blockchain trading, to do away with intermediaries and open P2P commerce as an option

- Establish decentralized prime broker capabilities

- Build and release a full service user-friendly DeFi application in Moneyclip

- Develop solutions based on Distributed Identity

- Develop deeper integration with DeFi communities

The TL;DR version of the above comes down to the Wellfield Seamless brand establishing a platform that allows users to trade cross-currency on the blockchain without the need for intermediaries, and the Moneyclip app providing an elegant front facing app that permits users to engage in transactions without needing to read a whitepaper to do so.

Wellfield has built MoneyClip with the vision of creating an everyday financial application powered by blockchain, that can act as a primary point for consumers to secure and utilize their money. The App currently offers P2P payment functionality, and Wellfield has a multi-year plan to integrate new blockchain infrastructure, as it becomes available, to provide consumers with access to a full range of DeFi and traditional finance services.

The big beef many have with the DeFi world is the same beef people had with internet commerce back in the late 90’s: that to make it work required a lot of trust in an insecure system that takes work to understand and engage with.

Just as Paypal came along and made internet commerce easy, so too is Wellfield looking to make commerce on the blockchain a simple task.

If they can make that happen, established legacy systems like Western Union will be obliterated quickly, and credit card companies could come under pressure soon after.

That makes Wellfield a tasty acquisition target, or an investment vehicle with potentially ridiculous upside.

Those who followed us into this deal early on are drenched in profits in just the first month of its public markets existence. Though our usual play is to take some profits off the table when hitting a double, we still feel this valuation is very defensible considering the multiples being bestowed on DeFi first movers so we’re still buying.

— Chris Parry

FULL DISCLOSURE: Wellfield Technologies is an Equity.Guru marketing client and we own stock in the company