Philosophical absurdity, or simply ‘The Absurd’, is a reference to the inherent conflict between man’s tendency to look for value and meaning in life, and the general inability to actually accomplish this aim with any certainty. The general idea is that the universe and human mind do not act to cause the absurd, but the absurd forms naturally because of the contradictory nature of the two existing at the same time.

We as humans come with certain expectations about the way reality is supposed to work, but we’re limited creatures in scope and capacity, and we cannot possibly fathom every potential probability. The universe in comparison is expanding and contains multitudes, which sometimes perceive as contradictory. But given the notion that given a long enough timeline everything can and will happen, generally accompanied by entropic forces breaking everything down into new forms, then it only makes sense that everything we know (or think we know) will eventually be wrong.

That’s the last time you’re going to hear any kind of weird academese in this article. Promise.

So with that in mind—let’s talk about crypto this week.

RadioShack gives us a dose of the absurdity of existence by getting into DeFi

Radio Shack is one of those brands that comes up whenever anyone brings up the ‘date yourself with a brand’ meme. It signifies a certain time in North America where everyone piled into radio shack to buy most of their tech gadgetry. Which is rather peculiar, actually, since this company effectively turned 100 sometime this year.

No. Seriously, it was foundered in 1921. I found that out a few days ago. Anyway, its most recent incarnation, after a 2015 dance with bankruptcy, is an online focused brand and now as a cryptocurrency exchange. They announced RadioShack DeFi, a market where folks can swap Radioshack’s proprietary token, RADIO, as an alternative to centralized exchanges like coinbase.

Here’s how Radio Shack puts it:

“The brand is resolutely embedded in the global consciousness — ripe to be pivoted to lead the way for blockchain tech to mainstream adoption by other large brands.”

The brand pivot here is hard to qualify. This is the place our parents took us when something electrical went pop and bathed us all in darkness. Our Dad would pick up a few wires, some circuitry and go home and tell us to go play outside while he fiddled around with schematics and tried not to electrocute himself.

Now they’re getting into cryptocurrency—and not just crypto, but decentralized finance. Offering their own coin. Creating what sounds like a DEX where you can swap crypto.

What?

Oh, we’re only getting started.

Tokens.com Announces Additional Investment in Metaverse Group and the Purchase of Additional ETH

If you think about cryptocurrency—and I mean really think about it—the absurdity of the whole project comes full circle. It’s fancy math done by computers that produces a long string of letters and numbers that we ascribe value, and we can trade for real world fiat. We typically as a species assign value to goods and serves that have functional utility—and Bitcoin has none.

This isn’t the same as the ‘it’s going to zero’ argument that states that bitcoin has no intrinsic value and when people wake up and realize this, they’ll bail out like rats abandoning a sinking ship. Because gold and diamonds and most of the shiny rocks we pull out of the earth have no intrinsic value, and we’ve placed exorbitant value on them. This is the recognition that we’ve effectively pulled this long string of numerals out of nothing and placed value on it. By definition, it takes our idea of value and turns it on its head.

Naturally, though, we’ve gone one (or honestly, many) steps further with this idea. The tech involved in producing these coins has been used to produce certain tokens, which when taken in an aggregate give us smart contracts, non-fungible tokens and now an entirely new world, where the doors of entertainment and commerce have been opened for everyone to explore.

And Tokens.com (COIN.NE) , a publicly-traded company involved in investing in Metaverse, DeFi coins, and NFTs completed an investment in Metaverse Group‘s $6 million financing. In fact, they were the lead investor and retain a 67% majority ownership.

“This latest financing capitalizes Metaverse Group with the ability to purchase additional marquee properties in the metaverse and build out its services business. We are extremely pleased with the progress at the company and the exciting things in store for 2022,” said Andrew Kiguel, CEO of Tokens.com. “Metaverse Group is well positioned to use this new capital to generate exceptional growth and purchase strategic land assets in the metaverse.”

Let’s bring this one home.

Metaverse Group is a vertically integrated NFT based metaverse real estate company. They sell digital land in the global digital world called Decentraland, and actually have a digital headquarters in Decentraland’s Crypto Valley, from which they manage an eight figure real estate portfolio across many different iterations of the metaverse.

Tokens.com can continue to extract tens of millions of dollars in revenue from people interested in buying customizable digital land that you can’t grow food on, or raise a family on, or really do anything but maybe host other digital denizens of the metaverse.

Still, the metaverse is a hot commodity right now. Lots of folks are getting in.

What is value? What does the word even mean anymore?

Cryptocurrency mining and the uncertainty principle

Alright. I’ll go through the preamble about miners right now. Proof of Work mining is a perfect example of philosophical absurdity for reasons I’ve already stated. It’s fancy math that pulls a commodity out of the air, which could change the world or go to zero tomorrow, and you can exchange it for tens of thousands of dollars a unit. But it’s functionally worthless.

So it’s a lucrative business model for an asset which maintains some variety of value superposition depending on how you look at it. Somewhere Werner Heisenberg is rolling over in his grave, but for the rest of us who still have to navigate these absurdities in our everyday life, here’s a few companies to look at.

TAAL Distribution Information Technologies (TAAL.C) finished buying Chief Fuels and with it came a 60,000 square foot facility in Grand Falls, New Brunswick. TAAL also brought in access to 50 metawatts of clean energy, which the company anticipates will give it what it needs to power up to two million trillion hashes per second (also known as a Exahash) of bitcoin mining.

Once filled to capacity, the Grand Falls facility is expected to have 50 megawatts (MW)of power to mine bitcoin at an industrial scale:

- 50 MW of energy will power up to two Eh/s of mining capacity;

- New Brunswick-based facility will become TAAL’s cornerstone bitcoin mining asset;

- New Brunswick power corporation supplies energy to industrial and residential customers in the province of New Brunswick that is over 80 per cent non-emitting, over 40 per cent from renewables.

Next is Canadian-based cryptominer and power supplier, Cryptostar (CSTR.V). This company not only mines Bitcoin but also provides space and power through colocation agreements to other companies to mine crypto. In this case, they had a power supply agreement with an Alberta numbered company doing business as Avila Energy for non-compliance with a power supply agreement they signed for up to 30 megawatts.

The two companies are presently working to resolve the issues, but CSTR expects delays in deployment dates for their equipment hosting agreements. This is probably the closest we get to a non-absurdist take on business. Companies have been signing these and breaching deals for as long as companies have been in existence.

It’s when you realize what the deal was over that brings it all back crushing down. Cryptostar hired Avila to give them access to energy stores so Cryptostar could continue to mine their digital number money, which costs a lot of energy to mine.

Our penultimate entry into this week’s crypto-miner sub-roundup is TeraWulf (WULF.Q), which added another 15,000 S19 XP Pro Miners from crypto-ancillary company Bitmain to their holdings. The miners will be delivered between July and December 2022, and it’s their second order of S19s. They anticipate having 800 megawatts of capacity by 2025, giving them 23 exahash per second of expected hashrate.

“The expected deployment of these miners in 2022 is further indication of TeraWulf’s continued momentum, and the announcement of this important order comes in a month in which TeraWulf raised approximately $200 million in debt and equity financing from a group of leading institutional and individual investors, closed on its business combination with IKONICS and began trading as a public company on the NASDAQ exchange,” said Paul Prager, Chief Executive Officer and chair of the board of TeraWulf.

Finally, Graystone Company (GYST.C) executes a master purchase agreement to buy Bitcoin mining equipment with Blockware Solutions. It will mean access to inexpensive electricity, and hosting services at a competitive rate.

“We are excited to be working with one of the industry leaders in Bitcoin and Cryptocurrency mining, that offer services in the United States,” said Anastasia Shishova, CEO of The Graystone Company. “In addition to acquiring mining equipment, the agreement allows for hosting with flexible terms at a low-cost facility. We are looking forward to growing our mining operations alongside Blockware and have confidence in our long-term partnership with them as they also become one of the largest US-Based mining pools.”

Non fungible tokens or how we are learning to love the absurdity

After awhile you just grow to accept that the rules we used to live by don’t make sense anymore. We can extract value from nothing, monetize it and sell it, and make millions of dollars from it. We can use computers to mint software that confers ownership in an immutable way that’s actually better than the traditional fashion, because it’s decentralized.

Think about it: home deeds can burn up in a fire. Files can be corrupted or stolen. But a decentralized real estate deed secured on a blockchain and referred to by an NFT is forever. Realtors aren’t necessary anymore when smart contracts can be used to close deals. We can extract that out to include artistic aggregates like Spotify, and even streaming services like Netflix. If we can connect directly with the the artist—pay a premium for access to an NFT, which points to a piece of art or music, codified on a blockchain—then functionally, most of these industries are superfluous. Artists can finally get paid for doing what they love, and outsource blockchain functionality elsewhere.

Remember when basketball endorsements used to be a thing?

Back in the eighties and nineties, shoe companies and the NBA were tight. You couldn’t think about Nike or Reebok and not imagine yourself on the court with your friends, dropping step-back threes like Mike. Now the Philadelpha 76ers have signed on with Color Star Technology (CSCW.Q) to do what they do—which in this case, will be primarily make NFTs.

Now basketball endorsements, more often than not, include non fungible tokens. In Color Star’s case, they do NFTs, but they’re also involved in the metaverse construction, so the cooperation between the two will include not only advertising, entertainment tech and other related sectors, but a virtual presence on Color Star’s proprietary metaverse app—called, wait for it, Color Star app.

Okay. A bit anticlimactic there. I know.

“We are deeply honored to cooperate with the Philadelphia 76ers, a top NBA team. NBA games are the most influential sports event in the United States and even around the world; the teams and athletes are loved by fans everywhere. We hope this cooperation will enrich the content of Color Star app, our entertainment metaverse platform, and through NBA events, global audiences can also learn about our metaverse platform. This will help Color Star gain more recognition worldwide and grow our user base. This is a win-win relationship and we look forward to more in-depth cooperation with the Philadelphia 76ers and other NBA teams in the future,”according to Sir Lucas Capetian, CEO of Color Star.

Admittedly, I’m not entirely sure what fans are going to be able to do in the metaverse with the 76ers, but fan engagement does seem to be a useful function for the tech. Even if the whole thing does seem a lot weird. Is all branding in the 21st Century going to invoke the absurdity?

Parker McCollum sells out his NFTs

Remember this guy from an earlier roundup? The one where you got a pony if you made it to the end?

Yeah. He sold out all of his NFTs.

“Our innovative approach to NFT products, matched with the right partnerships, has yielded first-class results yet again,” said Cameron Chell, co-head of MusicFX and executive chairman of Currencyworks. “We were confident that we were developing something special in MusicFX, the response today proves it, and more product announcements from Parker are due very soon.”

MusicFX is Currencyworks (CRWK.V) NFT platform. It’s a new kind of intermediary that connects artist and fan by delivering experiences in exchange for support shown by fans. It’s not exactly the best possible use or iteration of what’s being called the ‘passion economy’ but it’s a step in the right direction. It makes sense, though. McCollum does his music thing—the fans buy it—and there has to be a distribution angle.

That’s what this does.

This is one of those places where the absurdity carries with it a note of positivity, because the old way—the accepted orthodoxy in the entertainment industry, whether it be publishing, acting or the music industry—is that you’re going to have to deal with that industry’s variant of greasy, disgusting Harvey Weinstein. Now maybe not. At least until one of these intermediary types realize how much power they have, and then we’ll return to the status quo. And there’s nothing more absurd than a return to the status quo.

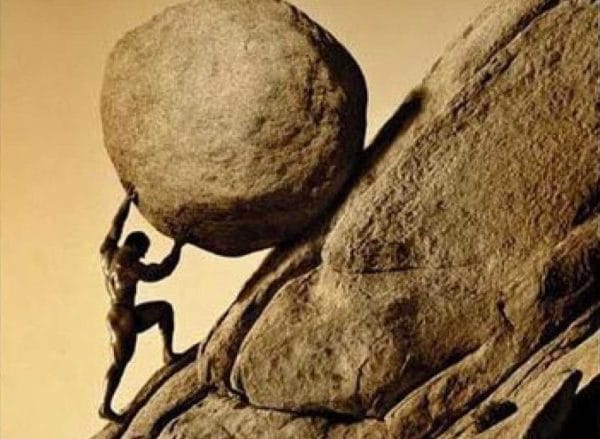

Now that I’m nearly finished pushing this weekly boulder up the hill, I can see the sights.

That’s all of it. The whole philosophical absurdity thing comes to at from a French Algerian journalist named Albert Camus—and last bit of his philosophical masterpiece cum manifesto The Myth of Sisyphus he says the only way to continue living, and living well, once we’ve discovered and been colonized by the absurdity of existence, is to embrace it.

Crypto is emblematic of existential absurdity. Without a doubt. It doesn’t correspond to any of ideas about standard products, utility, value or even commerce-related behaviours like distribution or promotion. But it’s hard to deny there isn’t absolutely a ton of money to be made here. So join us. Dive in. Embrace the absurdity.

—Joseph Morton