A big day for BlackBerry both technically and fundamentally. After the closing bell, BlackBerry will be releasing Q3 2021 earnings. Consensus estimate for an adjusted loss per share is pegged at 6 cents, which indicates a decline of 400% from the year-ago quarter’s reported figure.

The Canadian based company has been busy and making moves. During this quarter, BlackBerry enhanced the integration of BlackBerry Unified Endpoint Manager (UEM) and Microsoft 365 so that enterprises can benefit from BlackBerry’s leadership in security while using Microsoft’s products. BlackBerry’s SecuSUITE for Government solution was upgraded to support group phone calling and instant messaging with certified end-to-end encryption. It safeguards government and enterprise customers against increasing cases of eavesdropping attacks. BlackBerry partnered with Deloitte to help original equipment manufacturers and those building mission-critical applications secure their software supply chains. BlackBerry was selected by Mahindra & Mahindra, a leading automotive company in India, to power a Cockpit Domain Controller. Good foundations for future income, but no consensus on an earnings beat today.

Recently, the company has been putting out a flurry of press releases. Many of which were covered by our very own Kieran Robertson here at Equity Guru.

BlackBerry is investing in carbon removal and achieves carbon neutrality. This kind of stuff is becoming incredibly important not just for the planet, but for a new investor class. Millennials and younger generations value companies that are doing good. The whole ESG investing trend is still in its early stages but will attract a lot of money.

On December 14, 2021, BlackBerry announced that it has achieved carbon neutrality across Scope 1, Scope 2, and material Scope 3 emissions, the three groups that categorize the emissions a company creates, as classified under the Greenhouse Gas (GHG) Protocol Corporate Standard (GHGPCS). For context, the GHGPCS provides requirements and guidance for companies and other organizations preparing a GHG emissions inventory, a list of emission sources and their associated emissions.

BlackBerry has committed to the United Nations Global Compact (UNGC), a voluntary initiative based on CEO commitments to implement universal sustainability principles. Ultimately, the UNGC aims to support companies in doing business responsibly by aligning their strategies and operations with the Ten Principles of the UNGC, which are comprised of human rights, labor, environment, and anti-corruption principles. In summary, the UNGC provides a principle-based framework, best practices, and resources to ensure companies do business responsibly and keep their commitments to society.

BlackBerry is working with the Restore the Earth Foundation (REF), a non-profit corporation on a mission to restore the Earth’s essential forest and wetland ecosystem. In doing so, the Company is working with the REF to help reforest the Mississippi River Basin, commonly referred to as “North America’s Amazon.” With this in mind, the Mississippi River Basin is the third largest watershed on Earth, encompassing over 40% of the contiguous United States, spanning 31 states and two Canadian provinces.

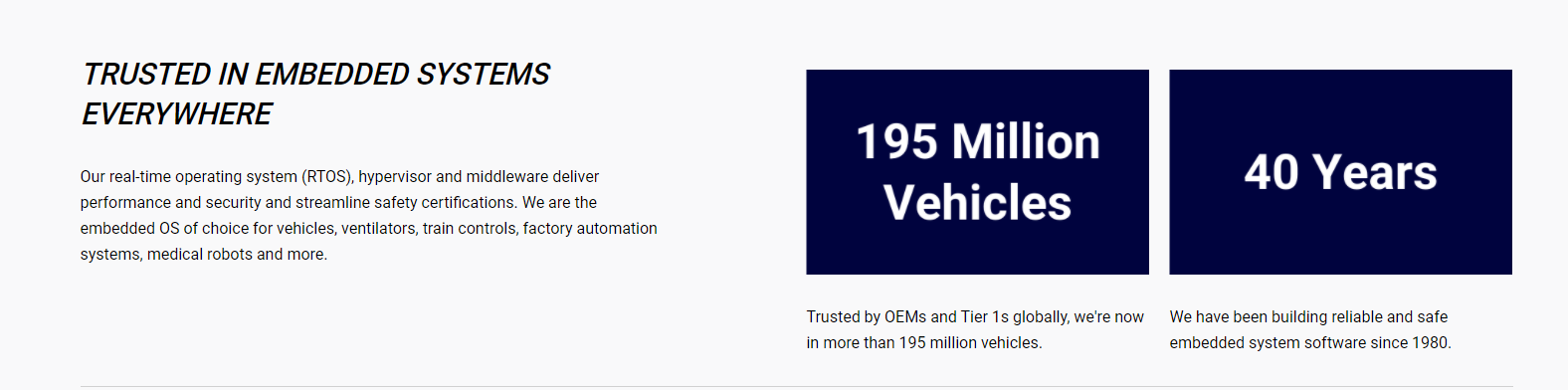

BlackBerry also entered an agreement with BMW group for QNX. BlackBerry QNX is a supplier of commercial operating systems, hypervisors, development tools, support, and services built for some of the world’s most critical embedded systems (CES). To put things into perspective, CES are systems in which failures can potentially be catastrophic. For example, critically embedded systems are commonly used for military, rail transportation, medical, industrial, aviation, and several other industries. If a CES were to fail in any of these industries, it would likely result in serious injury or death, damage to equipment, or environmental harm.

It has been over a year since I wrote the article “Why I am Buying BlackBerry Stock for the First Time“. In that article I highlighted why the QNX system will be so important going forward. Long time readers know what happened after. We got the Amazon Web Services announcement, and then… WallStreetBets came along. Readers who got in under $10 since I began covering the stocks technicals had a wild ride up to $36.00.

The most recent press release has to do with a major update to BlackBerry guard. Through this update, BlackBerry Guard® now also delivers a managed extended detection and response (XDR) service. I still think this is BlackBerry’s bread and butter. I have always been a long time BlackBerry user because of their security. Good enough even for the government at one time. Recently, the company has been playing on this strength, and I do believe it warrants investors keeping a close eye on the company. Sure, a new BlackBerry phone might still be coming, but the real revenue deals will be on security and QNX, which basically is security for self-driving vehicles.

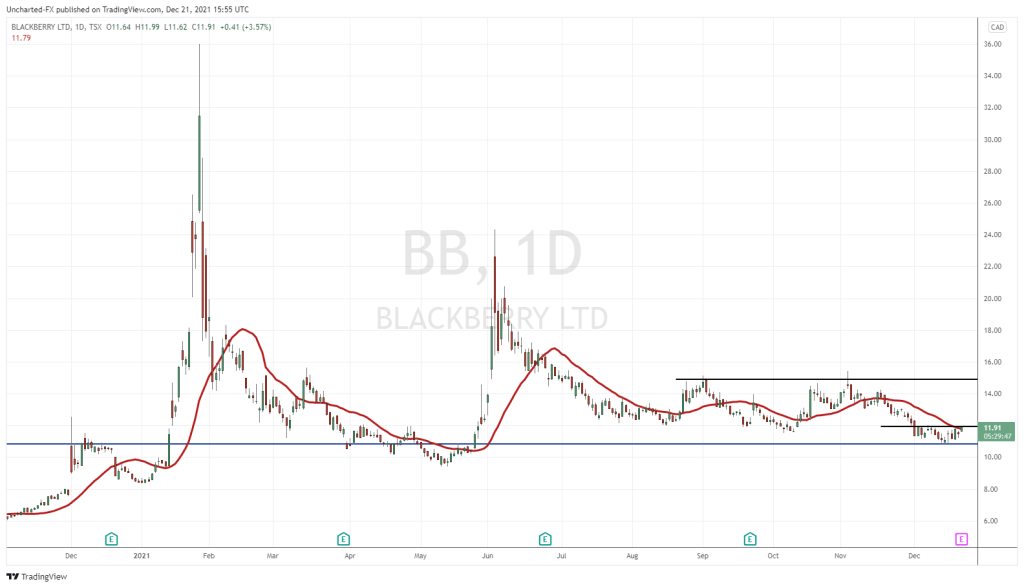

Technically, BlackBerry looks ready for a breakout. The breakout obviously will be determined by the major upcoming catalyst: earnings. Equity Guru Discord members know this term, but BlackBerry has once again become ‘BasedBerry’. Yup that’s right. BasedBerry. BlackBerry is basing at a support level. In fact, the stock has been basing here for 13 full trading days.

Zooming in, and we can get a better look at the structure. Price is beginning to shift above my moving average which is a great sign, but the breakout confirmation will be our trigger. Basically a close above this resistance at $11.90. So far so good, but when we have a high risk event like earnings upcoming, I think it would be prudent to wait until after the earnings. One could enter a smaller position now, and then fully allocate tomorrow. I just prefer waiting for the earnings release, because if the numbers come out worse than expected…the breakout close we may get just before, would get easily neutralized. False breakouts and fake outs suck. Especially when this happens the day after you enter a position. Allowing high risk events to pass helps in minimizing the risk.

Targets to the upside? The next resistance zone comes in close to $15.00. In the long term, if we manage to break above $15.00, then $19.00 becomes the second target. All of this is possible if price breaks out from this range. Remember, a breakout here means we are beginning a new uptrend. A trend which could have multiple higher low swings taking us to these resistance zones. Not in one straight line, but in ebbs and flows. This is what we want to do as swing traders. Ride these ebbs and flows, especially when the trend shift is about to occur. Just like it could on BlackBerry.

I will be watching this chart and the earnings this week. There is one final note and that is to do with WallStreetBets. Just going through the reddit group, I don’t see many posts on BlackBerry. A lot of the posts are memes regarding losing money. I am not entirely sure if BlackBerry still has a cult following on WSB, but if the stock can get this breakout confirmed, I am sure someone will notify the apes over at WSB. It would be tempting too since the chart looks better than GME and AMC, and is the cheapest of the bunch even for my American friends trading BB.