After carving out some serious price trajectory earlier this summer, uranium stocks have re-discovered gravity and are currently plumbing multi-months lows.

Though still in the throes of a correction—most sectors in the resource space continue to resemble medieval battlefields at dawn—the fundamentals underpinning this energy-dense metal remain strong, compelling.

Uranium is currently trading in the mid-$40 range, well below the price needed to incentivize new mine development.

Uranium funds and holding companies—Sprott, Yellowcake, Kazakhstan—are picking up the slack where the physical market is concerned.

A December 12th Bloomberg…

How a Less-Than Six-Month-Old Fund Shook the Nuclear Fuel Market

“Six months ago, the Sprott Physical Uranium Trust didn’t exist. Now it holds almost a third of the world’s annual supply — and it’s getting bigger.”

Among other things, China intends to build 150 nuclear reactors over the next 15 years—a buildout commitment that upsizes anything witnessed globally over the past 35 years.

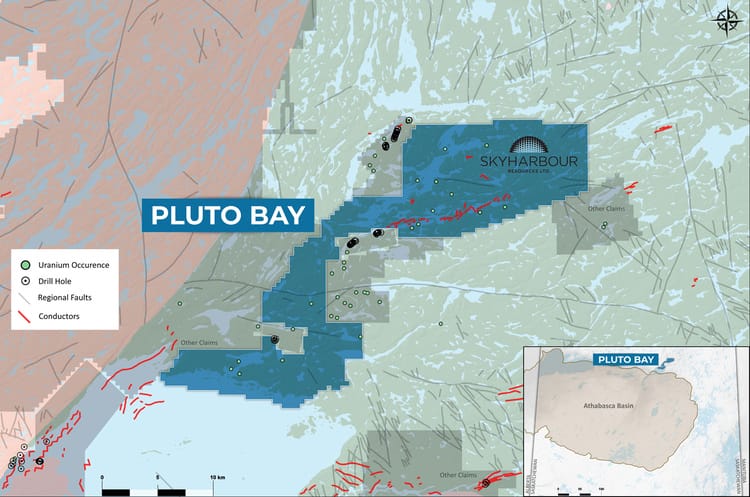

In a recent RDS Interview with Skyharbour’s CEO Jordan Trimble, this sector-wide correction is characterized as “healthy.” Fair enough.

Are we grinding out a bottom here?

CEO Trimble seems to think so.

Skyharbour continues to grow the prospect generation side of its business, monetizing its secondary projects in the process.

(Prospect generation is a business model that brings in strategic partners who make staged cash/share payments and commit to exploration expenditures for a majority stake in the project)

On Dec 14th, Syharbour bulked up its uranium project portfolio in the prolific Athabasca basin of mining-friendly Saskatchewan via the following headline:

Skyharbour Stakes Six New Athabasca Basin Uranium Properties Totalling 147,510 Hectares

These new acquisitions have been in the works for several months. The product of online staking, the Company’s total hectare count in the Basin is closing in on 386,000.

Investors ask, “isn’t Skyharbour obligated to spend significant sums on exploration to keep these newly staked hectares in good standing?” Good question. The fact is, Skyharbour has a 2-year window before it’s required to commit funds to these new additions. This 2-year breather allows the Company ample time to find suitable partners to do most of the heavy lifting in pushing the projects further along the exploration and development curve. I suspect we’ll be hearing news from the JV front in the not-too-distant future.

Up till now, the Company’s primary focus was on the southwest/southeast side of the Basin. These new projects expose the Company to the (discovery) potential along the northern rim of the Basin.

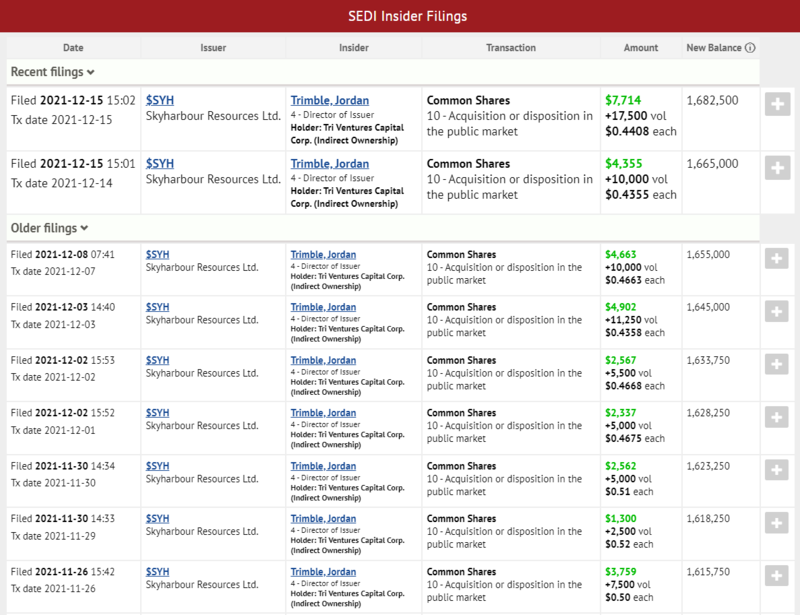

The Company’s entire Athabasca Basin project pipeline is neatly laid out on the following map.

Though these projects have seen some historical work, most have yet to be subjected to modern age exploration technologies and methodologies.

New acquisitions highlights bullet-pointed:

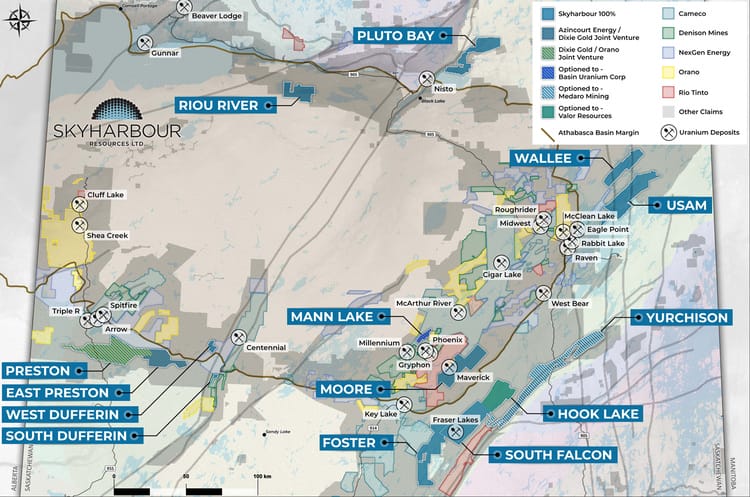

- Riou River Project – 18,227 ha along the Riou River within the Athabasca basin, contains over 40 km of discrete undrilled EM conductors along a magnetic low and anomalous boulder geochemistry.

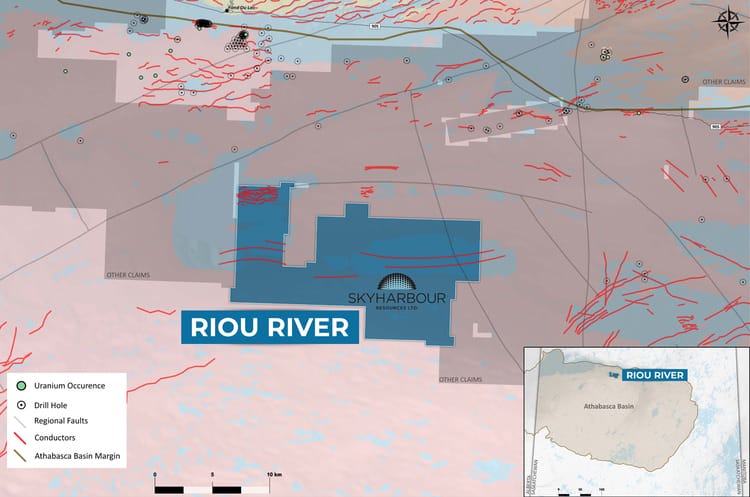

- Pluto Bay Project – 28,840 ha northeast of Black Lake hosting numerous uranium showings and several EM conductors east of the regional Black Lake fault.

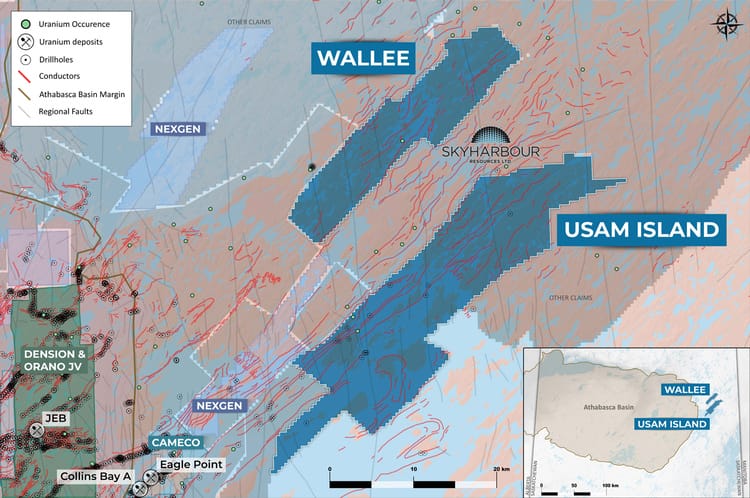

- Wallee Project – 20,765 ha about 35 km northwest of Cameco’s Eagle Point Mine, numerous untested EM conductors coinciding with significant magnetic and/or gravity lows in the Wollaston Domain.

- Usam Island Project – 42,186 ha approximately 21 km northeast of Cameco’s Eagle Point Mine, contains numerous EM conductors situated along significant magnetic lows of the Wollaston Domain.

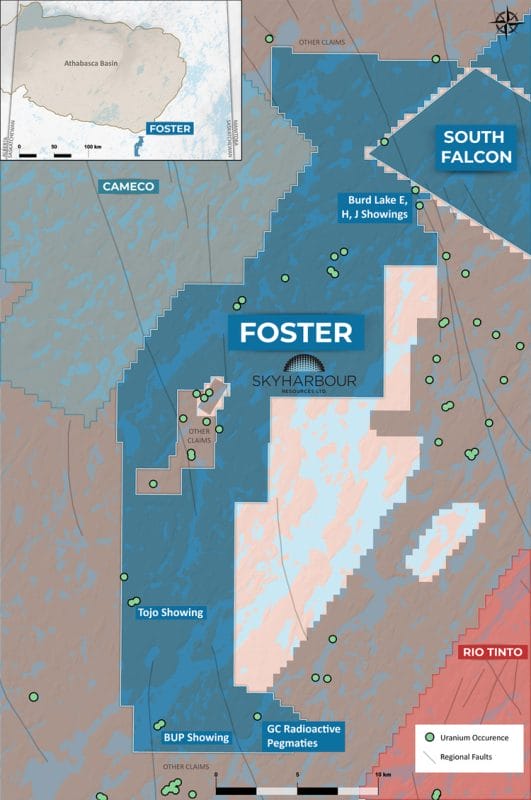

- Foster River Project – 37,529 ha southwest and adjoining Skyharbour’s South Falcon Point project, numerous uranium showings including up to 1.25% U3O8 in grab samples.

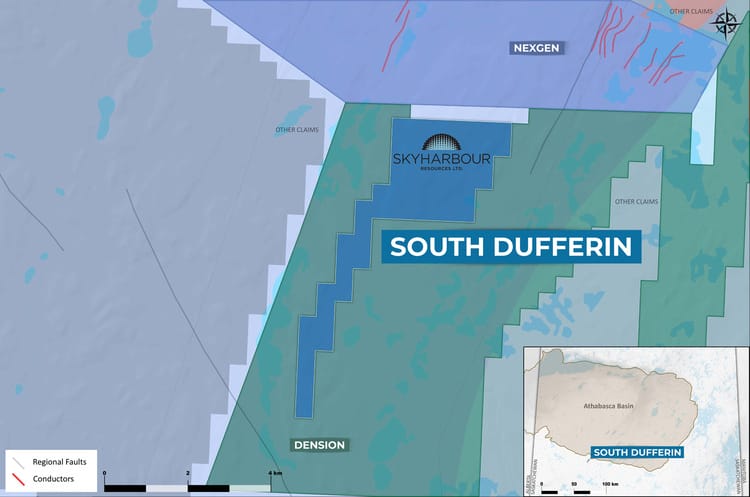

- South Dufferin Project – 922 ha along the trend of the Virgin River Shear, which hosts Cameco’s Centennial high grade uranium deposit 32 km to the north.

The following offers a little more depth, as per the guts of this December 14th press release:

Riou River Project

The Riou River Project comprises 18,227 hectares along the Riou River located entirely within the Athabasca Basin. The sandstone is estimated to be 200 to 300 metres thick in this area and overlies basement rocks of the Archean-aged Tazin Gneiss Group. The property lies south of a significant east-northeast trending magnetic lineament, indicative of significant crustal offset in this area. There are several discrete EM conductors totalling nearly 40 km on the property alongside magnetic lows and coinciding with geochemically anomalous boulders. A major swarm of EM conductors of unknown significance also exist on the northwestern extent of the property. Historic exploration on nearby claims immediately to the north of the property identified sandstone and outcrop occurrences ranging from 72 to 375 ppm U, 3 to 7 ppm Th, and 8.24% P2O5. These values in sandstone are considered geochemically significant for uranium exploration. It should be noted that the property has never been drill tested.

Pluto Bay Project

The Pluto Bay Property consists of 28,840 hectares northeast of the communities of Stony Rapids and Black Lake. The property lies just outside of the Athabasca Basin within rocks of the Trans-Hudson Mudjatik Domain. This property hosts numerous uranium showings within prominent magnetic lows that appear to be subsidiary structures to the regional Black Lake fault. The underlying rocks on the property have been mapped as felsic intrusive rocks along with metasedimentary and amphibolite gneiss units. The northern portions of the project are located northwest along strike of the historic Charlebois Lake uranium deposits where uranium values of up to 1.57% U3O8 were identified historically. Irregular, discontinuous EM conductors flank the showings that were identified in this area. The property has lain largely unexplored since the mid-1970’s and as such has not seen any exposure to modern exploration methods, especially geophysics and geochemical sampling programs.

Wallee Project

The Wallee project contains approximately 20,765 hectares in four claims 35 km northeast of Cameco’s Eagle Point Mine (Rabbit Lake Operation). The project is underlain by Wollaston Supergroup metasediments, including highly prospective graphitic pelitic gneisses, as well as Archean granitic gneisses. The project lies outside the currently mapped extent of the Athabasca Basin sandstone; however, several small outliers of sandstone have been found in the surrounding area which indicate the Basin extended over this area in the past. Multiple untested EM conductors are present on the property that coincide with magnetic and/or gravity lows, which are locally disrupted by faulting including multiple N-S trending faults related to the Tabbernor fault system and a couple of NE-trending faults.

Several geophysical surveys have been completed on the project and surrounding areas along with some prospecting and geochemical sampling, with the vast majority of the work being carried out in the 1960’s through to the 1980’s. However, no drilling has been completed on the property itself to date. Work in the surrounding area has revealed several U-Th-REE mineralized (up to 1.15% U3O8) basement showings in outcrop and boulders, suggesting the basement rocks on the property could be sources of basement-hosted, unconformity-related uranium deposits.

Usam Island Project

(above map)

The Usam Project consists of eight claims totalling 42,186 hectares and is located approximately 16 km northeast of Cameco’s Eagle Point Mine (Rabbit Lake Operation). The project has numerous EM conductors that are associated with significant magnetic lows of the Wollaston Domain. While the project is outside the current confines of the Athabasca Basin, the area was overlain by Athabasca sandstones historically. Basement rocks on the property include Wollaston Supergroup metasediments and Archean granitoid gneisses, with highly prospective pelitic to psammopelitic gneisses (including graphitic varieties) making up the largest proportion of the basement rocks. Several north-trending faults related to the Tabbernor fault system cross-cut the property.

Foster River Project

The Foster River property consists of seven claims totaling 37,529 hectares approximately 20 km east of Cameco’s Key Lake operation, and adjoining the southwestern end of Skyharbour’s South Falcon Point Project. The claims are situated in the Wollaston Domain just outside of the currently mapped extent of the Athabasca Basin, with several small outliers of sandstone located regionally in the area. The basement geology consists of psammopelite, calc-silicate, diorite, pelitic gneiss and graphitic pelitic gneiss of the Daly Lake Group, accompanied by minor felsic orthogneiss. Prospective graphitic pelitic gneiss packages are exposed at the surface. The property contains numerous uraniferous showings including the Tojo, Burd Lake, and BUP showings, where grab samples returned uranium values ranging from 262 ppm U to 1.25% U3O8 in pitchblende veins. Although historical drilling is limited in the area, a historic hole drilled in the 1950’s returned elevated uranium values of 0.012% U3O8 over 27.7 m. Significant untested potential exists on the Foster River project for basement-hosted, unconformity-related uranium deposits like those further to the north in the Wollaston Domain (i.e. Eagle Point, Rabbit Lake, Key Lake and others).

South Dufferin Project

The property comprises a single claim totaling 922 hectares and lies 13 km south of the Athabasca Basin margin, 32 km south of Cameco’s Centennial deposit and 15 km south of their Dufferin Lake Zone. The property lies within the Snowbird tectonic zone, which is demarcated by the Virgin River Shear Zone. The Virgin River Shear Zone is a fertile uranium corridor, host to numerous zones/showings, the most notable of which are the Centennial Uranium Deposit and the Dufferin Lake Uranium Zone. The basement rocks are comprised of Archean mafic/felsic gneisses of the Taltson domain, which were affected by middle and retrograde amphibolite facies regional metamorphism overprinting granulite facies regional metamorphism. Boulder samples near the property have returned anomalous uranium up to 0.099% U3O8, while anomalous gold mineralization up to 1 g/t was found in outcrop grab samples near the property. Numerous drill-ready targets exist on the property, based upon the results of several high quality airborne gravity and VTEM surveys flown in the 2000’s by JNR Resources.

These new acquisitions, broadening an already robust project pipeline in the Basin, hold the potential to buoy the Company’s prospect generation biz model.

And these newly acquired properties will NOT go unnoticed by companies seeking exposure to highly prospective, largely untested ground in the Basin.

“We have been actively staking claims and adding to our dominant uranium project portfolio in the Athabasca Basin. These newly acquired projects are strategically located and are geologically prospective with very little modern exploration having been carried out on them. They complement our more advanced-stage exploration assets including Moore Lake and South Falcon Point, and provide additional ground to option or joint-venture out to new partner companies as a part of our prospect generator business.”

Among Skyharbour’s projects that have already been joint ventured out to strategic partners:

Azincourt Energy, having earned a 70% interest in the 20,647 hectare East Preston Project through exploration expenditures, cash, and equity payments, will be drilling high-priority targets early in the New Year in an aggressive campaign that should see 6,000 meters drilled.

ASX-listed Valor Resources stands to earn up to 80% in the 25,846 hectare Hook Lake Uranium Project via exploration expenditures, cash, and equity payments. Valor is looking to test a high-grade surface showing along the property’s northern edge with a 2,500 to 3,000-meter campaign, also in the New Year.

Elsewhere on the JV partner list, the recently optioned 3,473 hectare Mann Lake Uranium Project is a JV with Basin Uranium. Basin Uranium’s price of admission: $850,000 in cash and $1,750,000 worth of BDX common shares PLUS a minimum of $4,000,000 in exploration expenditures spread out over three years.

In another recently inked deal, Medaro Mining can earn an initial 70% in the 55,934-hectare Yurchison Project by (i) issuing $3,000,000 worth of MEDA common shares, (ii) making aggregate cash payments of $800,000, and (iii) adhering to a $5,000,000 exploration-spend spread out over three years. Medaro may go on to acquire the remaining 30% by (i) issuing $7,500,000 worth of MEDA common shares and (ii) making a cash payment of $7,500,000.

Clearly, Mann Lake and Yurchison didn’t go cheap. Both projects will see active field campaigns in 2022. Medaro has already tabled plans for Yurchison. See details here.

Skyharbour’s 49,653-hectare Preston Uranium Project is a JV with Dixie Gold and industry-leader Orano Resources Canada. Under the option agreement terms, Orano can earn up to 70% in the project by contributing cash and exploration expenditures totaling $8,000,000 over six years. Orano has so far secured a 51% interest in the project having spent $2.8M on exploration and making cash payments totaling $200k. Over a dozen high-priority drill targets have been delineated across multiple prospective corridors.

At the Company’s flagship 35,705 hectare Moore Lake Project, where we saw an impressive 2.54% U3O8 over 6.0 meter interval drop in mid-September, we’re still waiting on the final six holes from a 2021 summer/fall drill campaign (19 holes for 6,598 meters). These final assays could drop any day.

Skyharbour is planning a fully funded drill program early in the New Year at this flagship project.

At the Company’s wholly-owned 44,470 hectare South Falcon Point Project—a project that holds the Fraser Lakes Zone B deposit (6,960,681 pounds U3O8 Inferred at 0.03% U3O8 and 5,339,219 pounds ThO2 Inferred at 0.023% ThO2)—a Q1 drill campaign is in the planning stage.

That’s makes four, the number of projects that will see the business end of a drill bit in Q1 of 2022.

The following links offer additional (recent) Skyharbour coverage:

Nov. 12th: News round-up: Gold Mountain (GMTN.V) and Skyharbour (SYH.V)

Dec. 8th: A basket of good uranium stocks: AAZ.V; SYH.V; UUUU.NYSE; FCU.T; UEC.NYSE; TRC.V; AEC.V; BSK.V

As the world continues its push to electrify, nuclear is a major component of that ascent along the green energy curve. Skyharbour appears well-positioned to capitalize on that move.

Further South

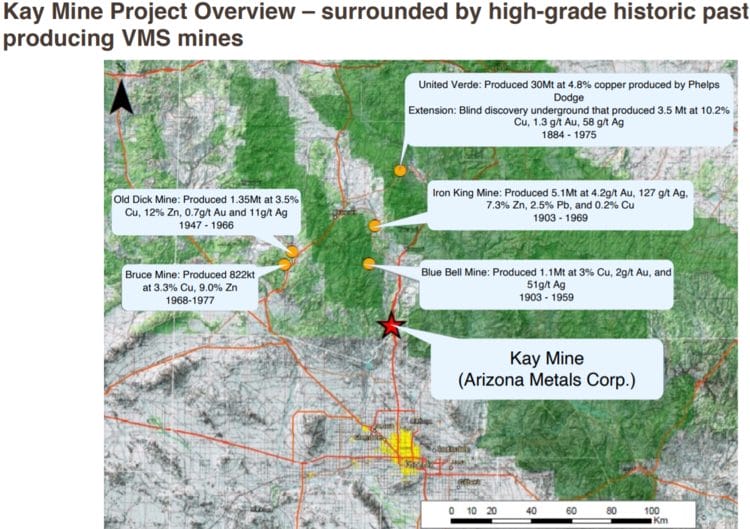

Arizona Metals—one of the better performers in the junior arena in 2021—dropped a headline on December 13th that elevates its standing in the junior exploration arena.

The Company, along with its flagship Kay Mine Project located in mining-friendly Arizona, has been added to the MVIS Global Junior Gold Miners Index—the GDXJ—as of December 10th, 2021. The Company will now garner a 0.42% weighting in the index.

The Company also reported that 4,650,000 of its $0.85 May-2020 share purchase warrants were fully exercised prior to expiry (November 29th, 2021). As a result, the Company now has 104,899,644 common shares issued and outstanding.

This warrant exercise generated gross proceeds of $3.95 million. The Company now boasts a fat cash balance of $57 million. Nice runway fellas.

Marc Pais, CEO:

“Inclusion in the GDXJ Index is a significant milestone in the Company’s continued growth, and recognition of increases in both share price and liquidity. Recent warrant exercises, along with completion of a financing in November, have increased the Company’s working capital position to $57 million. The Phase 2 program is underway with 3 rigs turning, and approximately 35,000 metres of a 75,000 metre program completed to date. The Company currently has 18 drill holes pending assay and release. The Phase 3 program is fully-funded, with a projected drill program of at least 76,000 metres expected to start in early 2022.”

A fair question concerning Arizona Metals’ future: “will the Company get taken out by a resource-hungry predator in 2022?” Good question.

Our recent Arizona Metals coverage includes a November 15th piece titled Arizona Metals (AMC.V): Fundamental Rich—now Cash Rich.

END

—Greg Nolan

Full disclosure: Skyharbour and Arizona Metals are Equity Guru marketing clients. The author is long Skyharbour common shares.