The times are definitely changing. We’re beginning to see the social disruptive aspect certain technologies, including non-fungible tokens, and the departure of one of the biggest proponents of Bitcoin.

Jack Dorsey steps down

Twitter (TWTR.Q) founder and CEO, Jack Dorsey, himself a large proponent of Bitcoin, vacated his social media throne this week.

“I want you all to know that this was my decision and I own it,” Dorsey said in an open letter to Twitter employees.

This leaves a question open as to what exactly is going to happen with Dorsey’s plans for a decentralized twitter, an idea he came up with last year and hasn’t done much with yet. It’s still a decent, viable alternative to the den of thieves and idiots that make up the platform now.

Maybe I’m not being charitable. Regardless, Dorsey is nothing if not ideologically consistent. He stated that he views companies that are ‘founder-led’ as having a single point of value—a lot like a centralized network. He’s also stated that he’s worked hard to make sure his company can survive without him.

Presumably, he’s going to retire to somewhere tropical and roll around in his money, and maybe occasionally show up for board meetings at his other company—Square.

His former CTO, Parag Agrawal takes over in his absence.

BIGG Digital’s excellent good quarter

BIGG Digital Assets (BIGG.C) dropped their financials this week.

They’re basically what you’d expect for a company dealing in blockchain peripherals in the middling to end part of a bull-run.

- Gross operating revenue of $2.625M (up 308% YoY), with $2.198M for Netcoins and $427k for Blockchain Intelligence Group (“BIG”)

- Netcoins revenue for Q3 represents 462% Year over Year (YoY) growth and 1205% growth versus the same nine months in 2020

- Customer accounts grew 15% in Q3, Funded accounts grew 13%, and new customer fiat deposits exceeded $90M in the quarter

- Gross trading margins were in excess of 1.3%, up from 1.2% in Q2

- Bigg revenues increased 70% YoY, and gross margins were at 85%

- Bigg recorded a $2.3M comprehensive income for Q3, versus a comprehensive loss of $425k in the year prior

- Bigg also reports a $6.8M unrealized gain on its digital currency inventory

Further Highlights:

- As of November 29, 2021, Bigg’s cash and crypto holdings equal roughly $73 million. The Company has no debt

- Bigg currently owns 500 Bitcoin, valued at approximately $37M

- Netcoins currently has customer Assets Under Custody of approximately $90M, up approximately 80% from $50M at June 30, 2021

- Netcoins registered users now exceeds 100,000

- Blockchain Intelligence Group’s compliance suite (QLUE and BitRank) now supports 8 blockchains, including 300,000+ ERC-20 based tokens, and has risk scored 3.5 billion addresses across these chains

The question about a bull run is whether or not we can lay these excellent numbers at the feet of CEO Mark Binns, or whether or not this is the case for a potential cryptocurrency bubble, and BIGG’s just riding the waves of good times.

Hard to tell. Bitcoin may be down right now, but it’s still up by close to %300 on the year, and said cryptocurrency is the rising tide that lifts all boats. At least in this space.

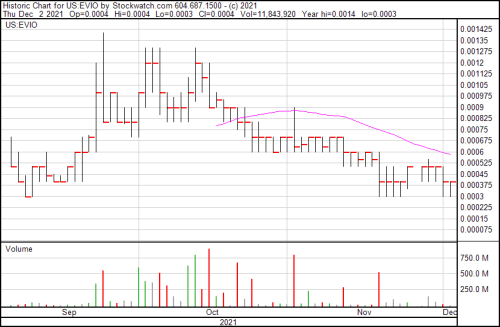

EVIO’s latest partnership comes with a free NFT gift that you actually might want

Cannabis is one of those industries where blockchain technology can do a lot of good. Enough, in fact, that it’s relatively surprising how few companies have employed the technology to better track the veracity and purity of their strains.

There’s TruTrace Technologies (TTT.C) (featured below) that uses proprietary blockchain tech to ensure that what you’re buying is exactly what it says it is, and Global Cannabis Applications (APP.C), which does much the same as TruTrace. And now there’s EVIO (EVIO.OTC), which signed on Chroma Signet, to offer their customers blockchain verification services for hemp, cannabis, CBD and other related products.

Chroma’s platform gives cannabis and hemp companies the ability to safeguard their products with product authentication and associated labels. Where this deal differs from APP or TTT is that it also has its own Decentralized Autonomous Organization (DAO) where customers can get a specialized NFT representing a namespace that allows customers to verify the origin of cryptographic signatures attached to cannabis products throughout the supply chain.

Like a bad weed digital decoder ring.

“For years, the cannabis and hemp/CBD industry has been challenged with product authentication. Improper tracing of genetics, arbitrary assignment of strain names, and counterfeit test results that cause both commercial and safety concerns. The EVIO-Chroma Signet partnership will help solve these problems. This marks EVIO’s first step towards its broader plan to enter into the blockchain space,” said Lori Glauser, CEO.

Alright. That’s fairly neat.

Trutrace Technologies is more than what they seem

Speaking of TruTrace Technologies, their most recently partnership with Laava, an Australian company, is to drive product provenance and traceability. You know—doing the exact same thing I said they were doing in the previous section.

“Upon our introduction to Trutrace we could clearly see that we shared the belief that producers and brand owners deserve to protect the quality of their products, and that consumers should always get what they pay for,” stated Gavin Ger, joint chief executive officer and commercial director of Laava. “We believe that together we will find ways to improve the traceability and authenticity within the product supply chain in order to help meet these goals.”

This one, though, isn’t for weed. TruTrace doesn’t just provide blockchain services for weed. They offer it for neutraceutical, food and pharmaceuticals as well. This one is none of those, though. Laava is the developer of the Laava Smart Fingerprint, which is a digital identification mark put on products ranging from cherries to wine, personal protective equipment (PPE), documents and NFTs.

Coinanalyst wants to make it easier for artists to reach their audience

This company is called Coinanalyst (COYX.C) and they’re relatively new to the CSE, only having gone live last month. Their latest offering is a little value-add to non-fungible tokens that could be a game-changer.

One of the ways NFTs could be seriously disruptive is through its effects on traditional media. Normally, big name labels pound their artists into the dirt with aggressive contracts, reducing the people you used to see on MTV and MuchMusic into peons, pushed into servitude. Yeah. It’s a bad scene.

But NFTs could change that.

“An area of particular focus for the Company will be the music industry. Musicians and artists are at the forefront of the passion economy and are seeking alternative ways to monetize. Through partnerships, CoinAnalyst intends to leverage exclusive content which feeds into our big data analytics platform, and ultimately, to our subscribers,” said Pascal Lauria, CEO of CoinAnalyst.

The passion economy. Kind of a cute little moniker, but it lacks the same utility or cachet as say, knowledge economy, which actually does and means something. What the passsion economy is, by this definition, is an economy that rewards artists monetarily for doing what they love.

Sadly, that’s not how the world works. But there is something to be said for NFT being an alternative way or musicians or other artists to claim ownership, and monetization opportunities.

It does, however, mean that the days of the big contracts are through. Could be a good thing.

Globalblock loses $3.23-million in Q3

Globalblock Digital Asset Trading (BLOK.V) dropped some financials this week. The highlights will be below, but we should probably go over who and what this company is and what they do. They operate primarily through their subsidiary Globalblock Limited, which is a UK-based digital asset broker with a telephone brokerage service and mobile app.

They do the handling of your crypto so you can get on with your day.

Apparently, it’s a lucrative business proposition.

Here are the 2021 highlights:

- Earned three and nine month revenues of $838,433, for the period from the acquisition of Globalblock UK (July 2021) until September 30, 2021 and a three and nine month loss of $3,238,781 and $3,682,889 respectively, inclusive of a one time charge for transaction costs of $2,288,572. The transaction costs were primarily related to the fair value of the finders’ shares issued pursuant to the acquisition of Globalblock UK.

- As at September 30, 2021, the Company had $6.1 million in working capital (December 31, 2020 – $4.3 million) and cash on hand of $5.7 million (December 31, 2020 – $4.4 million).

- Continued expansion of Globalblock UK’s team with senior hires across technology, marketing and sales to support current and future operations.

- Globalblock UK continues to increase its offering of digital assets where clients have the ability to trade across Globalblock UK’s combined service offerings of telephone, online trading platform and mobile app, increasing from 80 digital assets in October 2021 to over 100 in November 2021.

Over 612% in revenue for calendar 2021 over 2020, driven by an increase in clients and high trading volume. Also, no marketing during the period. That’s interesting. All of that growth through word of mouth. Imagine if they had a marketing team with strong distribution. Maybe they wouldn’t have lost $3.23 million.

Oh well.

Mobilum Technologies deal with Wyre is a portent of things to come.

Digital asset management tech purveyor Mobilum Technologies (MBLM.C) inked an agreement with Wyre, a fiat-to-crypto and payment infrastructure company.

As the United States and Canadian government begin their crackdown on cryptocurrency exchanges we’re going to start seeing a lot more companies like Wyre make an appearance. There’s going to be an opening for it as legislation leads to banks no longer accepting (or offering) funding for cryptocurrency related projects. We’re already starting to see it in Canada as banks like the Royal Bank of Canada have effectively shut down frontloading your crypto account using your RBC Visa. It’s likely the same throughout most of our banks.

There are going to be accepted (and acceptable) exchanges—those that bow to regulations, or even better, come up with regulatory regimes of their own—but they’re going to be limited in what coins they can offer by government whim.

Regardless, here’s what Wyre offers in their own words:

“Wyre leverages blockchain technology to provide easy-to-integrate APIs that enable thousands of developers to bring crypto to the masses. The company has on-ramped over 15 million end-users to their partners and has processed over $10 billion in payments since inception. Wyre has been an active player in the crypto space since 2013, supporting customers in over 100 countries worldwide, and empowering them with seamless access to blockchain technology.”

Now they have spread to the United States.

Blockchain Foundry talks NFT product focus

A former equity guru client from way back, we don’t hear much about Blockchain Foundry (BCFN.C). This is presumably not because they prefer to stay tight lipped about what they’re doing—they don’t, with the exception of liking to have a fait accompli to chat about in a press release or a podcast rather than a promise. That’s one of the interesting things about this company—they plan for big things, chase them and get them. See syscoin, their proprietary coin, for details.

Right now, though, they’re into non fungible tokens, like every other blockchain-centric company:

- NFTGen (NFTGen.com): a technology pipeline for marketing, deploying and minting NFT offerings.

- LastKnown Marketplace (LastKnown.com): a white-glove service for content creators to bring NFTs to market expedited by BCF’s proprietary technology pipeline.

- NFKeys Web3 NFT Loyalty Platform (NFKeys.com): a web3 loyalty platform backed by NFTs focused on creating a networked loyalty system across multiple decentralized blockchain based platforms.

And why not? It’s a huge market with lots of upside. For now.

Riot Blockchain Acquires ESS Metron

Riot Blockchain (RIOT.Q) continues the quest for efficient electricity useage with their latest acquisition of Ess Metron for approximately $50 million in a mix of cash and shares.

Here are the specifications:

- ESS Metron is a leader with over sixty years of experience in designing and producing highly engineered electrical equipment solutions, many of which are mission-critical to successfully deploying Bitcoin mining operations at scale.

- Acquisition assists in ensuring Riot’s timely miner installations by de-risking procurement of mission-critical infrastructure.

- Acquisition enhances Riot’s competitive position across the electrical supply chain, as ESS Metron is also a leading supplier to numerous third-party clients.

- Transaction valued at approximately $50 million, $25 million payable in cash, and remainder in issuance of up to 715,413 shares of Riot’s common stock.

ESS Metron is presently a supplier to Riot’s facility in Whinstone, Texas, and makes sense given their overall goal of upgrading said facility to 700 MW.

“The successful acquisition of ESS Metron marks yet another milestone in establishing Riot as a leader in Bitcoin mining,” said Jason Les, CEO of Riot. “Riot’s strategic position across the electrical supply chain is significantly enhanced as the Company will benefit from ESS Metron’s existing relationships with leading electrical suppliers globally. In addition, Riot will continue its fast-tracked expansion project as the Company benefits from internalizing ESS Metron’s engineering and industry expertise. We are thrilled to welcome the talented ESS Metron team to the Riot family and look forward to growing our future together.”

They provide highly engineered, custom products to help Riot reduce inefficiencies in their Bitcoin mining infrastructure, thereby reducing cost. Not to mention that ESS Metron has been a big part of Riot’s immersion cooling tech.

—Joseph Morton

Thanks for this one, I’ll check out TTT and COYX. MBLM is on my watch list.