According to Daniel Fisher, the CEO of Physical Gold, bullion is becoming a popular gift for family members and friends.

A year ago – in the midst of the pandemic – gold buying jumped 2,000% on his platform.

“We couldn’t pick up the phone fast enough,” Fisher told Quartz.

“Some people wanted to pass down money to their kids or grandkids in a way that it didn’t lose its value over time, or they wanted them to learn the value of investment,” reported Fischer.

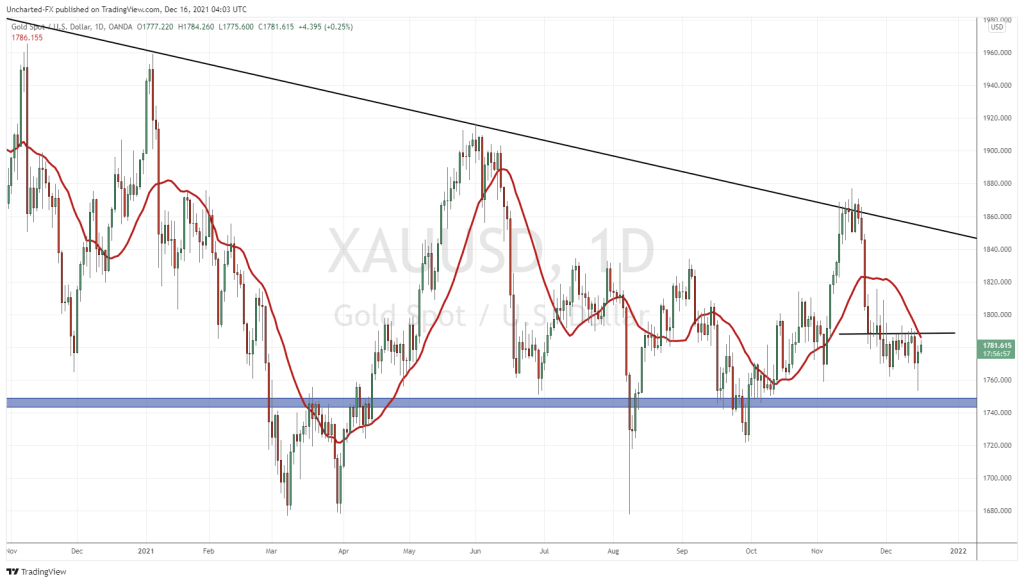

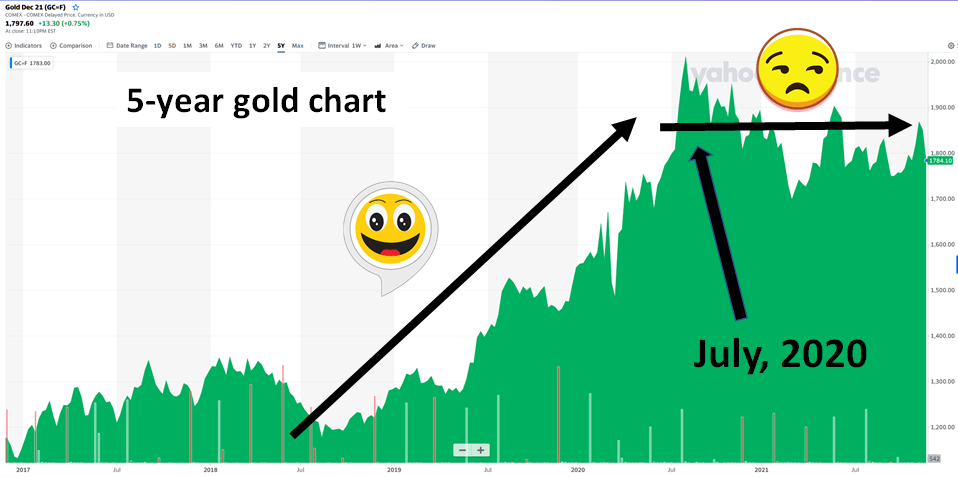

Macro economic data (money printing, global debt) supports bullish gold sentiment. But new-fangled concepts like cryptocurrency have outperformed gold in recent years.

And exhilarating 2-year gold price surge ran out of steam 16 months ago.

If the price of gold does go up, junior developers typically exploded to the upside.

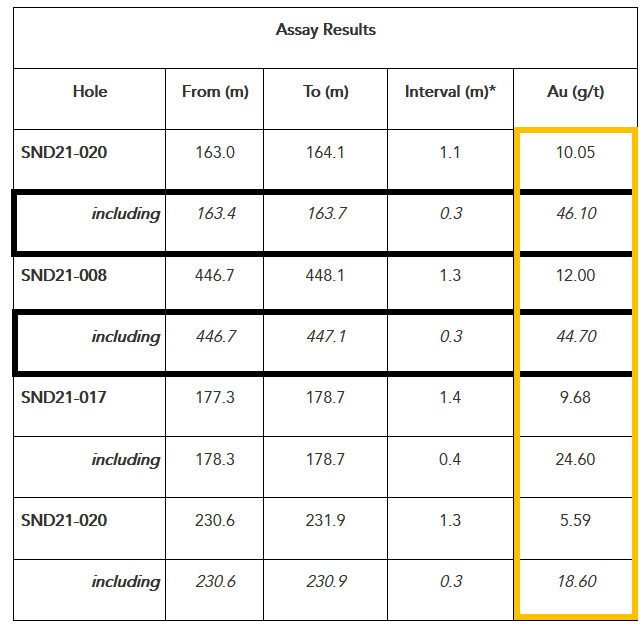

On November 25, 2021 Gold Mountain Mining (GMTN.V) announced additional assay results from its Siwash North portion of its Phase II drill program at the Elk Gold Project.

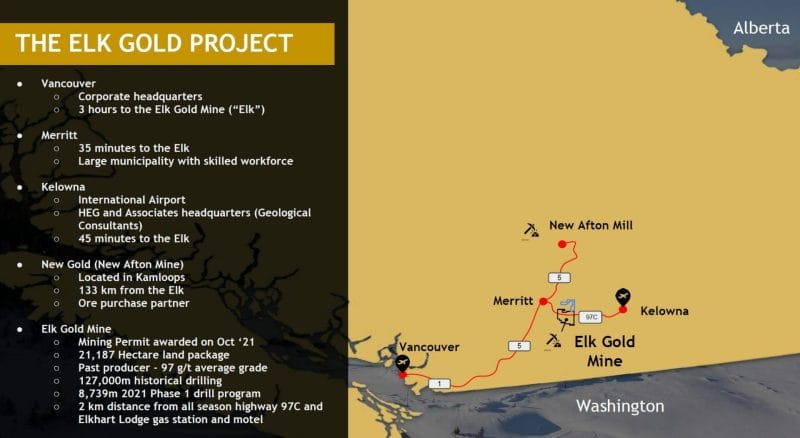

Gold Mountain is a gold and silver exploration and development company focused on resource expansion at the Elk Gold Project, a past-producing mine located 57 kilometers from Merritt in South Central British Columbia.

GMTN continues to uncover high-grade mineralization along its well-established vein systems near the project’s open pits, which show strong grade continuity and openness on strike and at depth throughout the Siwash North zone.

Drilling Highlights Include:

- 1.10m grading 10.05 g/t Au including 0.30m of 46.1 g/t Au

- 1.30m grading 12.00 g/t Au including 0.30m of 44.7 g/t Au

- 1.40m grading 9.68 g/t Au including 0.40m of 24.60 g/t Au

- 1.30m grading 5.59 g/t Au including 0.30m of 18.60 g/t Au

“These results from our Siwash North drilling reinforce the consistency and grade continuity in the mineralization surrounding our open pits,” stated CEO and Director, Kevin Smith.

“Our best intercepts were struck on different veins 300 meters apart and show strong resemblance in both widths and grade,” added Smith, “This gives us confidence they’re beginning to converge as we extend our geological model to the west.”

“With mine production now ramping up and the first two batches of assay results from our Phase II program delivering as expected, we continue to showcase the scalability of the Elk.”

Phase II Drilling Program

Gold Mountain and its exploration management partner HEG & Associates continue to intercept high-grade mineralization by stepping out and infilling the Siwash North’s well-established vein systems. These highlight intercepts came from the 1300, 2600 and 2700 veins, showing strong grade continuity as the company extends its vein model to the west.

Satellite Zones

The Elk Gold Project has eight additional exploration zones that were drill tested by previous operators. To date, 9,000 meters of drilling have been performed in the Elk’s Satellite Zones which do not currently contribute to the project’s resource estimate.

For the first time, Gold Mountain is exploring in the satellite zones and will look to develop maiden resources in multiple areas on the Elk claims. By coupling historical drill data with strong visual mineralization in new core samples, the Company is confident that these satellite zones will showcase similar grade and structure as the Siwash North zone.

“Another batch of assays have come in from our Phase 11 Siwash North drill program and we’re continuing to hit high grade intercepts as high as 46 grams per tonne,” confirmed Smith on November 25, 2021.

“I’m standing on one of our drill pads below 220 meters north of our open pits where we were able to intercept high grade on our 2600 vein,” states Grant Carlson, COO of Gold Mountain.

“What’s also exciting is about 300 meters from here south of pit one, we were able to intercept similar grade and width on the 1300 vein,” added Carlson, “This demonstrates the consistency of our high-grade mineralization and gives us confidence that this vein system is starting to converge.”

“Scale has always been a perceived issue at Elk but with our infill and step out program continuing to hit high grade mineralization, we’re starting to shine a new light on the potential of this project,” stated Smith.

Below is a table of Selected Core Drill Results.

“Amongst a flurry of news events in H2 of 2021—while the Company was picking off one key milestone after another—management dropped a revised mine plan for the Elk project, one that sidelined any notion of building a mill on-site for production years 4 thru 11.,” reported Equity Guru’s Greg Nolan on November 8, 2021.

“The new mine plan involves broadening an ore purchase agreement that was already in place with New Gold, by scaling the volume of ore delivered to the New Afton mill from 70k to 350k tonnes per annum.

Aside from (dramatically) slashing the project CapEx, putting the kibosh on plans to build a mill on-site will drive down Elk’s all-in sustaining costs (AISC) from $735/ounce to $554/ounce,” added Nolan.

One man “spent a long time discussing how he could best shrink his inheritance tax by gifting his grandchildren gold,” reported Quartz about gold gift-buying.

“The conversation landed on coins, because those are also free of capital gains tax,” Fisher – the CEO of Physical Gold reported. “He ended up gifting his grandkids 30 or 40 coins apiece.”

“Last week, U.K. precious metals research firm Metals Focus said that they expect jewelry consumption to increase by 140 tonnes this year,” reported Kitco, “a 10% increase from 2019. The analysts look for jewelry demand to rise to its highest level in 12 years”.

“When we acquired the Elk Project from Equinox in 2019, it only had a 375,000-ounce resource,” stated Smith, “Fast forward today we’ve more than doubled the resource and have a goal of pushing it over a million ounces before 2021 is complete”.

Full disclosure: Gold Mountain is an Equity Guru marketing client.