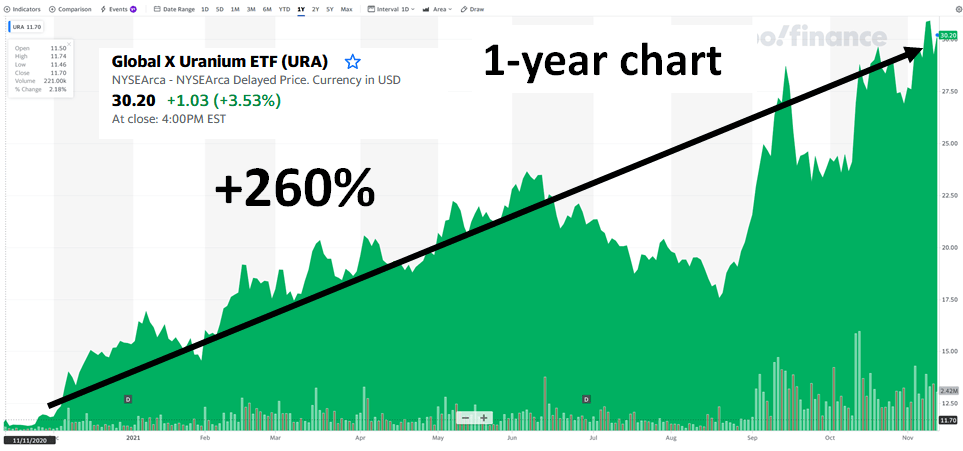

“After years of stagnant prices, a 37% rally in prices for nuclear fuel uranium has helped attract investors back to the sector,” reports the Financial Times on October 11, 2021, “The price of raw uranium, known as yellowcake, rose to its highest level since 2012 at $50 a pound last month.”

Uranium is required to power nuclear reactors. Nuclear reactors are required to stop the planet choking in smog. For the survival of our species, there is no other way forward.

Nuclear energy now supplies 10% of the world’s electricity and is responsible for one-third of global carbon-free electricity. In the United States, nuclear energy provides 20% of the country’s electricity and over 50% of its carbon-free energy.

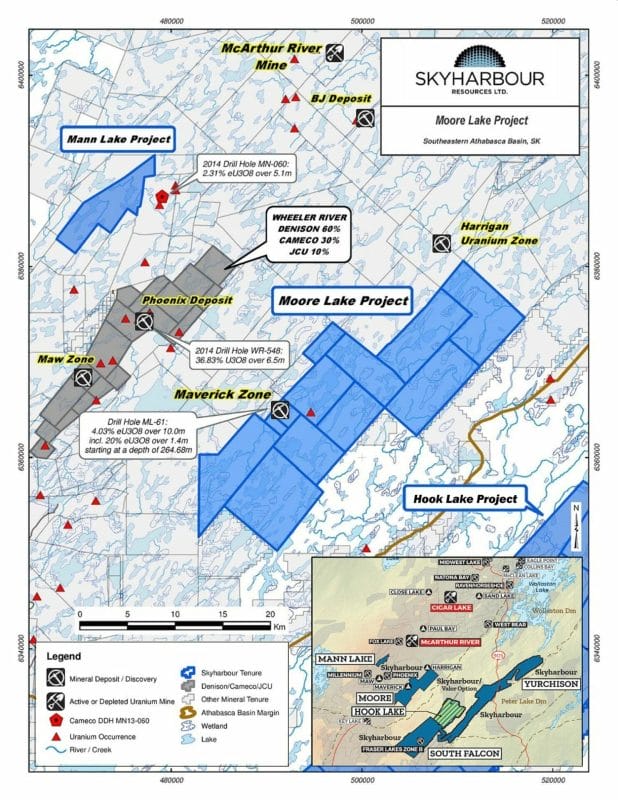

Skyharbour Resources (SYH.V) is an $86 million company that holds an extensive portfolio of uranium and thorium exploration projects in Canada’s Athabasca Basin.

The company has eight drill-ready projects consisting of over 250,000 hectares.

Skyharbour has acquired from Denison Mines, a 100% interest in the Moore Uranium Project which is located 15 kilometres east of Denison’s Wheeler River project and 39 kilometres south of Cameco’s McArthur River uranium mine.

Moore is an advanced stage uranium exploration property with high grade uranium mineralization at the Maverick Zone that returned drill results of up to 6.0% U3O8 over 5.9 metres including 20.8% U3O8 over 1.5 metres at a vertical depth of 265 metres. The Company is actively advancing the project through drill programs.

On November 10, 2021, Skyharbour announced the second set of geochemical assay results and completion of its 2021 summer/fall diamond drilling program which totaled 19 holes in 6,598m at its 100% owned Moore Uranium Project.

The Moore Project comprises 35,705 hectares, about 15 kilometres east of Denison Mine’s Wheeler River project and near regional infrastructure for Cameco’s Key Lake/McArthur River operations in the Athabasca Basin, Saskatchewan.

Highlights:

- Hole ML21-13 intersected predominantly basement-hosted mineralization and returned 0.994% U3O8 over 5.7 metres from 270 metres to 275.7 metres including an interval of 1.51% U3O8 over 2.5 metres from 273.2 metres to 275.7 metres.

- The mineralized intercept in hole ML21-12 returned 0.33% U3O8 over a 6.0 metre interval from 282.5 metres to 288.5 metres downhole.

- Substantial portions of the 4.7 kilometre long Maverick corridor remain to be systematically drill tested leaving robust discovery potential along strike as well as at depth in the basement rocks.

- At the Grid 19 target area, exploratory drillholes ML21-07 to -09 were the first holes drilled where two prospective EM conductors were identified by this winter’s SML-EM geophysical program. All three holes intersected highly encouraging altered, graphitic and sulphide bearing basement lithologies.

- Final assay results are pending for six more drill holes.

“Skyharbour is well positioned to benefit from the accelerating uranium market recovery with strong discovery potential and upcoming news flow from its continued drilling at Moore as well as at partner funded projects,” stated Jordan Trimble, President and CEO of Skyharbour, “We now have five partner companies with Azincourt Energy, Valor Resources, Basin Uranium Corp. and Medaro Mining each planning upcoming exploration and drill programs at the East Preston, Hook Lake, Mann Lake and Yurchison projects, respectively.”

“Perhaps best characterized as a cash-rich Athabasca Basin land baron, Skyharbour holds an extensive portfolio of projects beyond its flagship property,” wrote Equity Guru’s Greg Nolan on October 21, 2021, “all strategically located—all boasting significant discovery potential”.

“In order to push these projects further along the exploration/development curve, management deploys the Prospect Generator Model (PGM), where strategic partners fund exploration and make cash/share payments for a majority stake in the project.

Multiple irons in the fire via these partner-funded programs = multiple shots at a new discovery.” – End of Nolan.

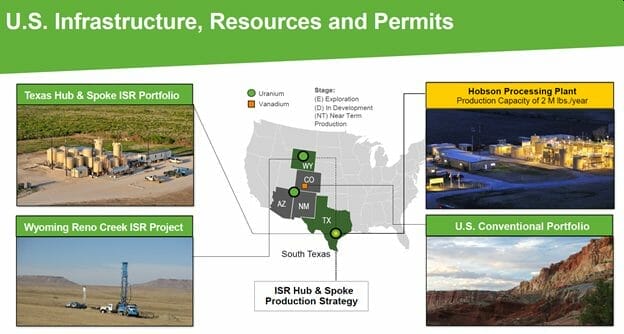

Uranium Energy (UEC:NYSE) is a $1.4 billion company advancing the next generation of low-cost and environmentally friendly In-Situ Recovery (ISR) mining uranium projects.

In South Texas, the Company’s hub-and-spoke operations are anchored by the fully-licensed Hobson Processing Facility which is central to its Palangana, Burke Hollow, Goliad and other ISR pipeline projects.

“UEC is ideally positioned to be the leading supplier of American mined uranium for the domestic utilities and the U.S. government,” stated UEC CEO Amir Adnani, “We control the largest resource base of fully permitted ISR projects in Texas and Wyoming of any U.S. based producer.”

On November 9, 2021 UEC announced that is acquiring 100% of Uranium One Americas (U1A) for a total purchase price comprised of $112 million in cash and the replacement (with corresponding payments to the seller) of $19 million in reclamation bonding.

The Acquisition is fully funded with UEC’s existing balance sheet, which as of October 26, 2021 had over $235 million of cash and market value liquid assets.

The U1A assets are primarily situated in the Powder River Basin of Wyoming; the most productive in-situ recovery (ISR) uranium mining district in the western hemisphere.

Acquisition highlights:

- Positions UEC, a U.S. corporation headquartered in Texas, as the largest American uranium mining company, amid a new era of domestic and global support for clean-air nuclear energy as essential to the realization of a low-carbon global economy;

- Creates Wyoming hub-and-spoke operations for UEC, anchored by U1A’s Irigaray plant which is one of the largest central processing facilities in the United States with a licensed capacity of 2.5 million pounds U3O8 per year;

- Incorporates U1A’s production-ready assets including Christensen Ranch ISR Project with four fully installed wellfields, and six additional permitted or development-stage satellite ISR projects, combining with UEC’s Reno Creek Project;

- Anticipates significant capital expenditure savings and deep operating synergies with UEC’s permitted and nearby Reno Creek ISR Project which is 45 miles away from the Irigaray plant;

- Secures approximately 37.6 million pounds U3O8 in historically estimated Measured and Indicated Resources and 4.3 million pounds U3O8 in historically estimated Inferred resources with considerable growth potential based on independent technical reports prepared for U1A. These historical resources are not treated by UEC as current and the Company plans to complete and report current resources post-closing of the Transaction;(1)

- Adds a dominant land package of approximately 100,000 acres in Wyoming’s prolific uranium producing Powder River and Great Divide Basins consisting of dozens of under-explored, mineralized brownfield projects, backed by detailed databases of historic uranium exploration and development programs, thus greatly enhancing the potential for resource expansion; and

- Provides for significant tax loss carry forwards to be applied to offset future income.(2)

“This is a highly accretive transaction for UEC and represents great value to our shareholders,” stated Amir Adnani, President and CEO The purchase price is equal to only 12% of our current enterprise value, yet the acquisition doubles the size of our production capacity in three key categories: total number of permitted U.S. ISR projects, resources, and processing infrastructure.”

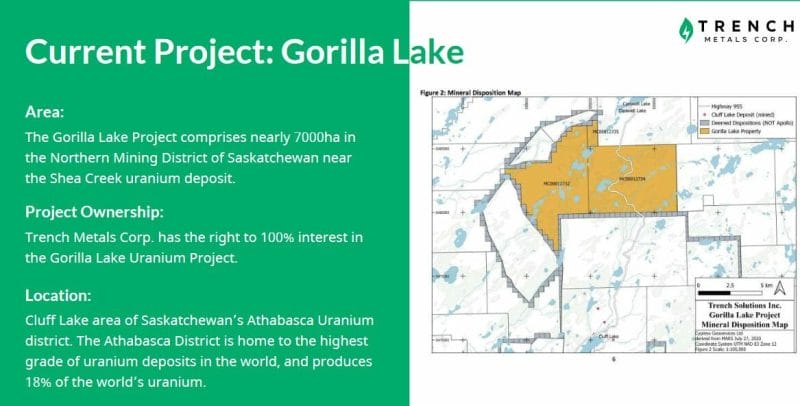

Trench Metals (TMC.V) is a $39 million dollar company identifying and developing uranium deposits in an environmentally responsible and cost-effective manner.

Trench Metal’s objectives are clear. They plan to invest in previously confirmed resource-rich land in Canada’s Athabasca Region.

In the last year Trench Metals stock price has increased 600% – from .18 to 1.10.

A press release from November 7th, 2021, states that Trench Metals has started preliminary work on its Higginson Lake Uranium Project, home to two reserves, totalling 4,800,000 lbs of U308 (uranium).

Higginson Lake has been mainly unexplored by the uranium industry since 1976.

The long drought of exploration activity on the Higginson Project means that Trench Metals can now employ 21st Century techniques to further their process of mining. These techniques include all new and improved geophysical and geochemical techniques that have been successful on other properties.

This is in addition to Trench Metal’s Gorilla Lake Project.

The Gorilla Lake Project’s highlights are as follows:

- A 2005 airborne magnetic and MEGATEM survey identified a magnetic “button” anomaly approximately 1,500 metres south of Gorilla Lake shown as a distinct green anomaly in the centre of the Total Magnetic Intensity RTP.

- A 2016 gravity survey confirmed this anomaly, and also identified two significant gravity anomalies to the east and west of Gorilla Lake.

- A 2006 exploratory program confirmed the presence of uranium in the area of previous hole CAR425. It also found uranium mineralization intersected in drill holes CLU-01 and CLU-07 identifying a virtually untested structure extending over at least 700 metres and is a prime target for drilling.

- Previous geological exploration has focused on the North-West margin of the property, and has largely ignored the property to the east, despite the presence of prominent EM conductive units.

- No significant portion of any of the previous drilling programs have focused on deeper drilling.

- Dave Billard, B.SC., P.GEO, author of the report, suggests significant exploration expenditures are justified on the property.

The Athabasca Region is home to the highest grade of uranium. It’s also the source of almost 20% of the world’s Uranium.

Anfield Energy Inc. (AEC.V) is a $36 million dollar uranium and vanadium development and near-term production company aiming to become a top-tier energy-related fuels supplier through sustainable, efficient growth in its assets.

On November 11, 2021 AEC congratulated Uranium One Americas and Uranium Energy Corporation (UEC) for their purchase transaction.

“Anfield has worked with Uranium One since 2014 and remains well-positioned to pursue uranium production in Wyoming – via its existing Resin Capture and Processing Agreement – once the transaction closes,” stated Corey Dias, Anfield CEO, “We look forward to working with UEC in this regard.”

Resource updates

Through 2021, Anfield has positioned itself to take advantage of the rising uranium price through its work with BRS to update both uranium resource and exploration targets and also determine economics of various projects within its portfolio.

BRS is also assessing the prospects of drill programs for Anfield’s ISR projects in Wyoming.

Anfield’s focus remains on its Charlie Project in Wyoming as its primary production target, and believes that its estimated pre-production cost of $6.7 million and its low operating costs and favorable economics, as shown in BRS Engineering’s Preliminary Economic Assessment of Charlie, provide an attractive near-term opportunity for the Company and its Shareholders.

Uranium price has increased by 80% over the year could be set for further increases due to production cutbacks in primary supply, the entry into the uranium spot market by the Sprott Physical Uranium Trust and the plan to build 150 nuclear reactors in China within 15 years.

Landholding management

Anfield completed the transfer of the Colorado-based West Slope uranium/vanadium properties in 2020, and replaced the nine reclamation bonds associated with these projects with a surety bond in 2021.

Equity funding

In 2021, Anfield has raised approximately $4.8 million via a private placement and received approximately $5 million in warrant exercises, resulting in a current cash balance of close to $5 million.

Blue Sky Uranium (BSK:V) is a $53 million company that controls a district-scale (300,000-hectare) uranium and vanadium exploration project in southern Argentina.

Nuclear energy now supplies 10% of the world’s electricity and is responsible for one-third of global carbon-free electricity.

Vanadium is used as a steel additive in crankshafts, gears, tools and knives. Brain surgeons typically use vanadium scalpels.

After a series of deadly building collapses, the Standardization Administration for the People’s Republic of China, announced a new rebar standard – requiring the use of vanadium.

BSK is part of the Grosso Group, lead by Joe Grosso. The group has a vast network of local and regional contacts in Argentina. Joe Grosso is in the Argentina Mining Hall of Fame.

“Joe Grosso can get a meeting with anybody in Argentina at any time,” confirms Niko Cacos, President and CEO of Blue Sky.

A Preliminary Economic Assessment (PEA) on the Ivana deposit, confirmed an inferred mineral resource estimate of just under 23 million pounds of uranium and 11.5 million pounds of vanadium.

“The PEA numbers indicate that if the project was in production today, it would rank amongst the lowest operating costs on the planet,” stated Cacos.

BSK has also identified at least four areas as compelling targets with a high potential for making additional new uranium-vanadium discoveries, similar to the Ivana deposit.

On October 21, 2021 Blue Sky reported that the 3,500 metre RC drilling program at its Ivana deposit is now underway with 50 holes totaling 293 metres completed to date.

Additionally, permits have been received to complete the initial drilling program at the Ivana Central target, which is the second tranche of a separate exploration drilling program at the Company’s wholly-owned Amarillo Grande Uranium-Vanadium Project in Rio Negro Province, Argentina.

The aim of this initial drilling program is to further assess the potential of the Ivana North and Central target areas and to provide vectors to focus subsequent drilling programs.

The Ivana Central and Ivana North targets, located at 10 and 20 kilometres north of the Ivana deposit, respectively, are interpreted as being located along the same regional REDOX front as the Ivana deposit.

“Argentina is a nuclear country,” stated Cacos, “They’ve been in the nuclear business since the 1950s. They have a pilot enrichment plant not far away from our project. They also having three nuclear plants, with more coming on line”.

“The only thing Argentina does not do, is mine uranium,” explained Cacos, “they have to import it and they’re paying a long-term contract price of about $50/lb to Kazakhstan”.

That contract expires in the next couple years. Blue Sky’s objective is to supply Argentina with a domestic source of uranium, and export whatever is left over.

“China has pledged to increase nuclear power generation to 70 Gigawatts by 2025, from 50GW currently, as part of President Xi Jinping’s plans to move away from coal,” reports the Financial Times.

“At the same time,” added the Times, “President Joe Biden’s U.S. administration has said that nuclear energy will be included in its ‘clean energy standard’ that would mandate utilities to produce power that is carbon-free by 2035.”

Full Disclosure: Skyharbour Resources is an Equity Guru marketing client.