SKRR Exploration Inc. (SKRR.V) is a junior mining company that operates as a precious metal explorer with its head office in Vancouver BC. It explores gold deposits and holds a 100% interest in the Manson Bay South property in Saskatchewan. It also has options to acquire interests in Olson, Cathro, Ithingo, Irving, and Leland projects also situated in Saskatchewan.

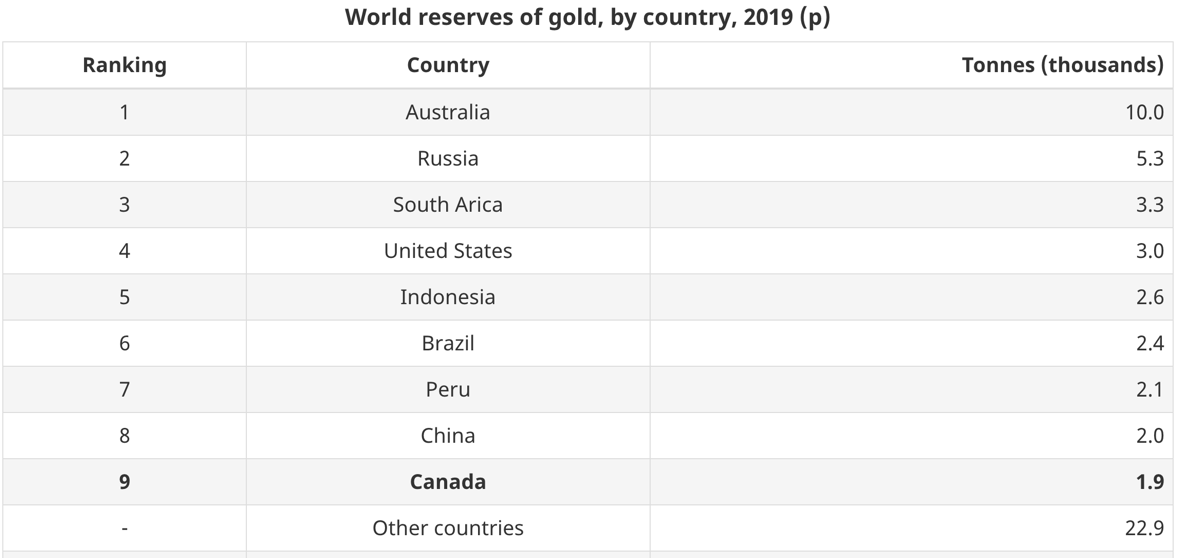

Gold is Canada’s most valuable mined mineral, with a production value of $C10.3 billion in 2019. The value of Canadian gold exports in 2019 was $22.3 billion, a 28.9% increase from the previous year’s total of $17.3 billion. And we were the 9th largest holder of gold reserves in 2019. (See table below)

Saskatchewan produced a record amount of gold in 2019. The province’s only active gold mine, the Seabee gold operation, owned by SSR Mining Inc. (SSRM), produced 112,137 ounces. This trend has only continued as gold prices hit new record highs. Although the spot price took a slight dip in 2020 it is trending up again as inventors move to inflation hedges.

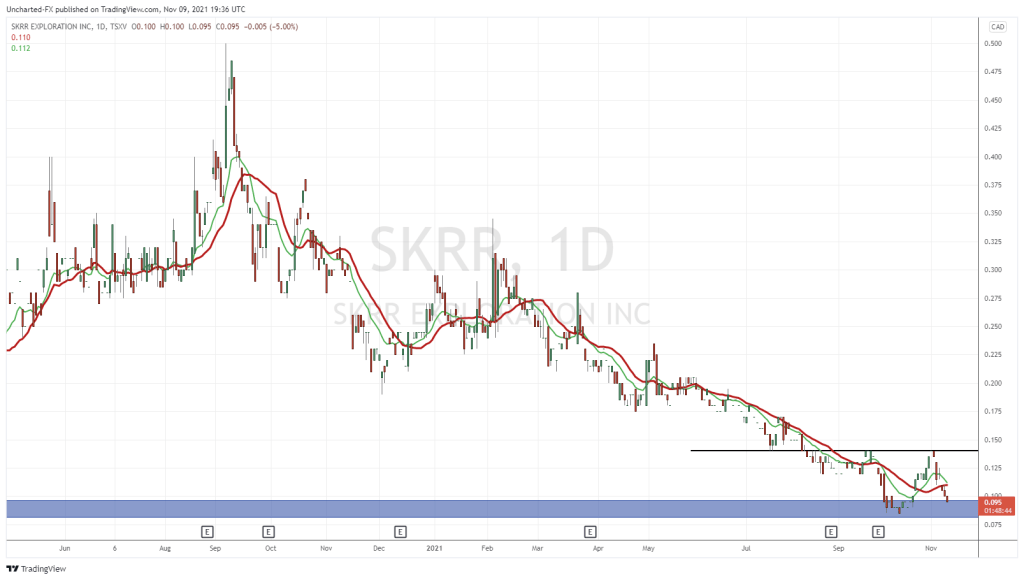

Companies like SKRR should benefit from this correlation, even if they have not generated any sales from the production of gold. The common for gold exposes firms usually experiences positive explosive price action in their price. The SKRR seems to be doing the exact opposite. Year over year (YoY) the stock is down 70%. The question that most investors would have is what is causing the stock to trade at such a low valuation?

The only way to know for sure, ignoring the price action for a second, is to analyze how well the business has been doing with shareholder money. For more on the technical setup of the common, I direct readers to the great work of Vishal the Equity.guru chart master who dives deep into the price action structure.

Quarterly Financial Performance Highlights

Since the company has not generated any sales from the production and exploration of the gold deposits, we will focus on how its structured its balance sheet. This will give us an indication of how they are financing their operating expenses.

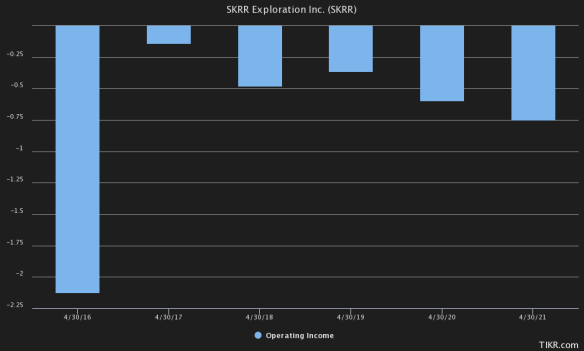

The total operating expenses have shrunk by 15% from $C2.12 million in 2016 to $C750,000 in 2020. In the last twelve months, the company has spent $C280,000 on administrative expenses, $C510,000 on stock-based compensation, and $C2.95 million on capital expenditures.

Now we can approximate that the company needs around $C1 million to fund its corporate overhead and another $C1 million on capital expenditures. Now we can look at the company Assets and liabilities, its working capital, and its debt to equity to get an understanding of how they have financed their operations and CAPEX thus far.

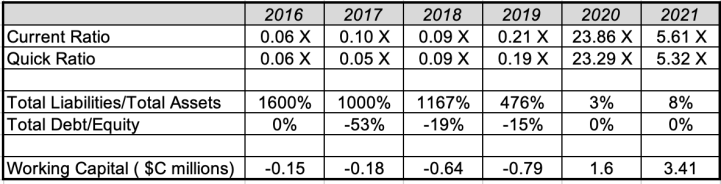

Above I have generated all the quick ratios we can use to get a quick glimpse of how the operates have managed their capital since 2016. the first ratio we will look at is the current ratio which shows us the company’s ability to pay off its short-term obligations (things like accounts payables and short-term debt) from its current assets (cash and accounts receivables).

The company they’ve only recently been able to cover their short-term liabilities and the trend has always been going upwards hitting a peak of 23 times in 2020. In 2020 the company had $C1 million in cash and 70,000 in accounts payables, in 2021 the company has $C2.78 million in cash and $C160,000 in total current liabilities meaning it has enough cash to cover its obligations to creditors for the next 5 years if the payables balance stays stationary.

This sort of high liquidity has been a benefit for the company since it needs this cash to use for its day-to-day operations as well as keeping up its working capital position. The company has religiously had a negative working capital position meaning that it had more payable than it did receivables forcing it to use more cash from its operations. But recently, from improving equity markets, the company has been able to raise cash and use these proceeds for CAPEX and OPEX.

The company has issued more stock than it has total debt and now currently has a total debt to equity ratio of 0%, meaning the majority of the balance sheet is funded through equity and some short-term liabilities. This low debt and high equity position are favorable if the company can generate a Return on invested capital (ROIC) that is greater than the cost of equity (r). If r is lower than ROIC then this position is favorable for the company but if r is greater than ROIC the company is destroying economic value and might need to use debt to optimize its capital structure from the tax-deductibility of interest payments.

As for now, the company has $C2,355,407 in cash, $C212,051 in GST receivables, $C 421,550 in short-term investments in Taiga Gold Corp. (“Taiga”) and MAS Gold Corp. (“MAS”) shares and warrants, and $C136,043 in prepaid expenses. We will assume they are able to liquidate all these in the 80% to 100% range giving them a book value of $C3,125,051 and a liquidation value that is a little lower than 3 million in current assets.

The company has also been capitalizing on some of its fixed assets and this is reflected in the balance sheet with a valuation of $C5,148,575. The majority of the capitalized assets are drilling expenses for the Olson Gold project in 2020 at around $C2.1 million and a total value of 2.5 million. The Leland Project is the second largest with a value of 1 million followed by their Ithingo Lake project at $C500,000. Assuming the company was to be liquidated they would be able to get at least 50% to 65% of their Exploration and evaluation asset factoring in the depreciation. This gives them a salvage value of about $C3 million assuming there are no gold discoveries.

The company has $160,000 in liabilities on their books that should be subtracted from the liquation value at 100%.

Having done all this we know that the firm can be liquidated for around $6 million (they have a tangible accounting book value of 8.1 million) with a current market value of $4.43 million this means they are selling below their quick liquidation value and book value.

But if we assume the firm is not liquidated and has a book value of 8.1 million, with 2.3 million in cash, needs 2 million for OPEX and CAPEX the firm has 2 more years of cash to fund its operations and capital plans. This is assuming they do not raise more cash from the market when their stock is selling near its 52-week low. This would reduce the book value by 2million giving us a liquidation value close to our market cap.

I feel the market is applying the second case with no liquidation and the continuation of operations for the next two years giving it a market value of close to $4 million. This can also be seen as the worst-case scenario due to the market’s irrational dip in the last few months for the common stock. The key now would be to watch how management uses the money they currently have and the assets they’ve already deployed to create value for the shareholder’s overtime. At the moment it’s very difficult to tell but when we look at the key financial highlights from their previous quarter, we can see some progress.

Quarterly Highlights

- Completed first drill hole at the Manson Bay Gold Project.

- Acquired Father Lake Nickel Property in Saskatchewan

On capital management, the company states that,

The Company’s objective when managing capital is to safeguard the entity’s ability to continue as a going concern. In the management of capital, the Company monitors its adjusted capital which comprises all components of equity (i.e., capital stock, reserves, and deficit).

The Company will require financing from external sources, including the issuance of new shares or debt to continue to develop its mining projects however, the working capital as of July 31, 2021, will fund operations for approximately twenty-four months

The Companies’ prediction for an extra 24 months with their current working capital is close to our two-year prediction of operating and capital expenditures from our brief analysis. But if one was to roll the dice the expectation is that the company would unlock the value from the capitalized assets in his gold deposits allowing the book value to increase and hopefully this stock would increase over time as the business continues to perform. As for now, the market has priced in a 24-month worst-case scenario.