Introducing YDX Innovation and Versus Systems. One has great products, but sales are collapsing, and the other is picking up sales and locked and loaded with cash.

YDX Innovation Corp (YDX.V) is a technology company that was founded in 2007 that develops augmented and virtual reality, esports events, and interactive exhibitions technologies in Canada and Brazil. Its Arkave VR Arena division operates a gaming platform for virtual reality experience to location-based venues. Arkave Studios is responsible for the development of experiences for companies like Coca-Cola (KO), Shell (RDSA), Cisco (CSCO) and exclusive games with partners like Disney (DIS) and the Liquid Media Group (YVR).

The company’s YDreams Global division develops interactive experiences for conceptual spaces and exhibitions. Its offers Game on Festival, a format of esports events that combines digital storytelling and competitive gaming. It has have developed over 1,300 interactive and immersive experiences for clients all over the world such as Disney (DIS), NBA, Adidas (ADS), Cisco (CSCO), Nokia (NOKIA), Nike (NKE), Mercedes-Benz (DAI), Coca-Cola (KO), Santander (SAN), Ambev (ABEV3), Qualcomm (QCOM), Unilever (ULVR), City of Rio and Fiat.

They also have Purple Mage Advisors division that is a research and data analysis firm that specializes in player recruitment and development in the gaming industry. The last division is RENDER a professional video production studio specializing in crafting video content for YouTubers, Streamers, Teams, and Brands.

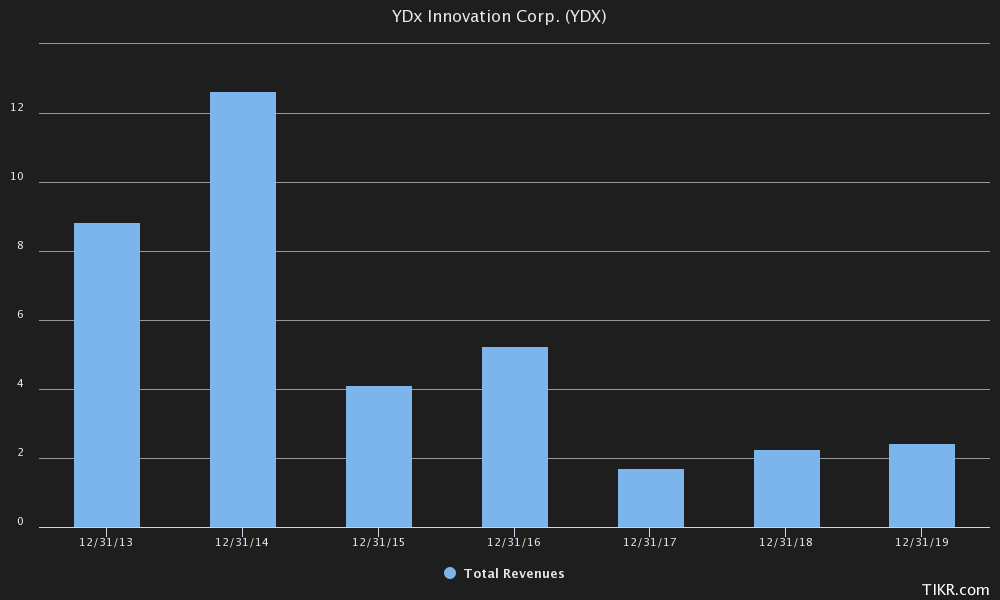

All this and the company has a market capitalization of $C4.74 million with 35 million shares outstanding. This could be due to the variability they have experienced in sales.

In 2014 the sales were around $C12.65 million and over the last 12 months sales have dropped down to $C1 million generating a total net loss of $C4.8 million. Their balance sheet has a total of $C50,000 in cash, $C390,000 in depreciated property, and 2 million in current liabilities putting it in an illiquid position.

Over the last year, the stock is up 125% but they are down 95% since 2017.

Versus Systems (VS) develops and operates a business-to-business software platform that allows video game publishers and developers to offer prize-based matches of their games to their players in Canada and the United States. The Versus platform can be integrated into streaming media, TV, mobile, console, and PC games, as well as mobile apps. Boasting a market cap of 56 million and a cash pile of 7 million the company means business.

The stock is up 26% over the last year and up 123% since 2013. Sales have been picking up since 2019 where they managed to generate $C660,000. In 2020 sales went up to 1.86 million and over the last 12 months, they generated 1.43 million.

Their main product’s mission is to help their clients entertain and connect with fans.

VS believes its platform is equally beneficial across three targets.

- Content providers gain increased contact with their media experience.

- Brands see an extended increase of interest from players and consumers viewing their goods as a positive win rather than a distraction from the content.

- Players and consumers want to interact with content that provides access to these wins, increasing the value of the content as a supplier of opportunities, of the brands as prizes, and of the experience itself as an interactive and desirable challenge.

The firm’s platform permits buyers to become active ad members seeking a claim to placed brands as

victories won through interactions with a variety of media experiences. “Users are no longer “just” winning a game or streaming their favorite film.” These exchanges now bequeath bragging rights that extend past the media’s original purpose, resulting in winning real-world goods and gaining access to experiences.

The key elements of the long-term growth strategy include:

- Increase Applications and Verticals

- Integrate into More Devices and Software Languages

- Develop a Global Reach

- Add More Prizing Partners

- Constantly Improve Outcomes

- Grow Revenues and Market Share

On November 1, 2021, the company published a blog article where they outlined the three things that their platform does for audience engagement.

- The Social Wall Makes Spectating a Group Experience

- Predictive Gaming Brings an Element of Chance

- Turbo Trivia – Supercharging Fan Engagement

None of these VS features operate alone. Instead, teams can employ the full set: Social Wall, Predictive Gaming, Turbo Trivia, and many more features. Together, the company believes these features work to create the most interactive sports-watching experience. This goes hand in hand with their long-term growth strategy.

Just these two companies how wide the universe is in the gaming sector. The gaming ecosystem is comprised of game publishers, broadcast platforms, fan communities, and other content creators. The industry has changed rapidly over the past several decades as consumer preference has largely determined the pace of change. The rise in popularity of gaming has attracted the attention of advertisers given high levels of consumer engagement and a large targeted audience and some companies are taking advantage of this tailwind.