Last week, I was asked at least a dozen times by market professionals, “What sector do you like right now?”

Normally that’s an easy question to ask as there’s always something going on a run, even if that run is likely to be a short one. But currently I find myself shrugging and saying, “Uranium is having a moment…”

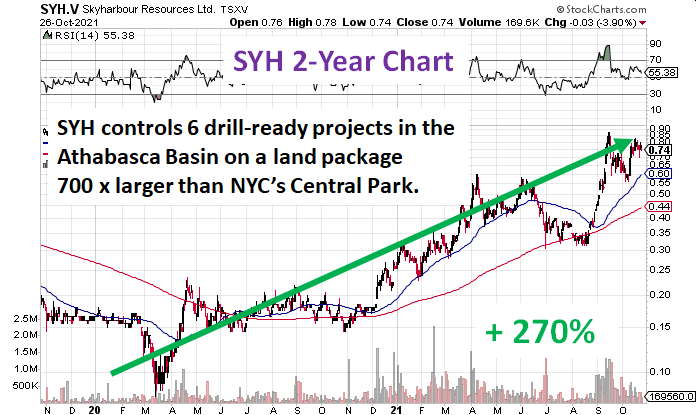

It is, but uranium has been threatening to have a moment for several years now. If you’re paying attention to Equity.Guru, you’ll have seen us yapping up Skyharbor Resources (SYH.V) for some time, and if you believe what you read, you’re enjoying its run a lot.

If you dig mining technical talk, our Greg Nolan breaks this down in detail in his recent Skyharbor round-up.

Perhaps best characterized as a cash-rich Athabasca Basin land baron, Skyharbour holds an extensive portfolio of projects beyond its flagship property, all strategically located—all boasting significant discovery potential.

Our take on this one is, you’re betting on the jockey as much as the horse, with the Trimble family having made countless Canadians wealthier over the years with good deals seen through, and long term thinking paying dividends. That said, the horse is a good’un too, with ongoing work showing a significant de-risking.

If you believe in uranium, and we do, as an environmentally beneficial energy source (catastrophes notwithstanding), and you see the sector starting to bring in real interest, there’s likely juice left in this one. Check out our Investor Roundtable on SYH.

Lastly, our own Investor or Not crew takes an unbiased look at the company and asks whether it’s time for you to buy in..

ALSO: ZUCKERBERG MAKES THE METAVERSE A THING AND AMPD STOCK RUNS

If there’s one thing a CEO needs on their side to be a success on the markets, it’s timing, and Anthony Brown at AMPD has FINALLY caught a break on the timing front, announcing a raise for his high performance computing company right as Mark Zuckerberg, the alien being running Facebook, announced to the human world that he’s turning his social media platform into THE METAVERSE.

If you don’t know what that is, that’s been Brown’s struggle for the last few years, as he’s been building a platform that will be bandwidth friendly enough to make such a thing possible.

Here’s what the Metaverse is, from Steven Spielberg’s recent movie, Ready Player One.

Cool. Zuckerberg’s version is shittier, ramping up the levels of awkwardness and leaving you scratching your head as to why you’d bother taking part in something as awful as Facebook only with a heavier download.

“Wow, a dog picture! I’ll share that with my dad, he’ll be super-stoked!”

The reality with technology that supersedes reality is that Big Tech has been trying to get it going for 40 years, but has been missing the one single piece of infrastructure that would make it possible – bandwidth.

Just as early streaming 20 years ago was hamstrung by AOL levels of internet speeds, and early Netflix streaming faced a ton of ‘buffering’ issues when not everyone had fiberoptic internet, the current breed of the internet across the globe isn’t built for two-way video. It’s why you don’t have a Netflix-style video game platform yet that would allow you to pay one fee and play anything you want on someone else’s server. As things stand, you need to have the game working locally so the only thing being sent back to the internet is your controller moves, not actual graphics.

For the Metaverse to work, we need to completely re-tool the internet with heavy computer power designed to run more than an Etsy store or put through your cornflakes purchase. It needs to be able to generate 3D imaging on the fly, with masses of information heading both to and from your communication networks.

AMPD has been working on that, and has existing customers using their systems and pipelines to do things like render video animation, or perform AI tasks, or host video games. They’re doing that in relative obscurity, because the big dogs, Amazon, Microsoft, and Google, have made billions selling one size fits all hosting, which means venturing out into bespoke server systems with heavier lifting capabilities eats into their existing deal.

Facebook sees this as a means of catching up, and is applying millions of dollars and 10,000 employees into ‘what comes next’. Yes, they made it look lame as hell, but that’s on brand for The Social Media Platform of Old People and Russian Disinformation Trolls.

AMPD stock went on a big run the moment Zuckerberg rolled out his ‘hello fellow humans’ video – RIGHT AS THEY ANNOUNCED A BIG RAISE.

The timing was perfect, leading that raise to upsize as big dogs looked for a $0.30 arbitrage on a now $0.38 stock.

The company is now expected to issue and sell up to 16,666,667 units, instead of the previously announced 11,666,667 units, at a price of 30 cents per unit for aggregate proceeds of up to $5-million, instead of the previously announced $3.5-million.

The money being raised was slated to buy into The Departure Lounge, which couldn’t be more on brand.

The company has signed a non-binding letter of intent with Departure Lounge Inc. and its shareholders. Departure Lounge is a company based in Vancouver, B.C., pursuing various technology and content initiatives related to the development of the metaverse. [..] Departure Lounge recently signed an agreement, through its operating subsidiary, 1310675 B.C. Ltd., with leading 4-D holographic capture provider, Metastage Inc., to build a Metastage holographic capture facility in Vancouver, B.C. Departure Lounge will build on this initial foundation with a range of metaverse-related technology and content initiatives.

The stock flew on the announcement.

FUEL PRICES FUEL OIL AND GAS SECTOR RUN

If you’ve noticed it’s getting more expensive to fill up at the pump – again – it’s perhaps not a surprise that oil and gas deals are going to another run.

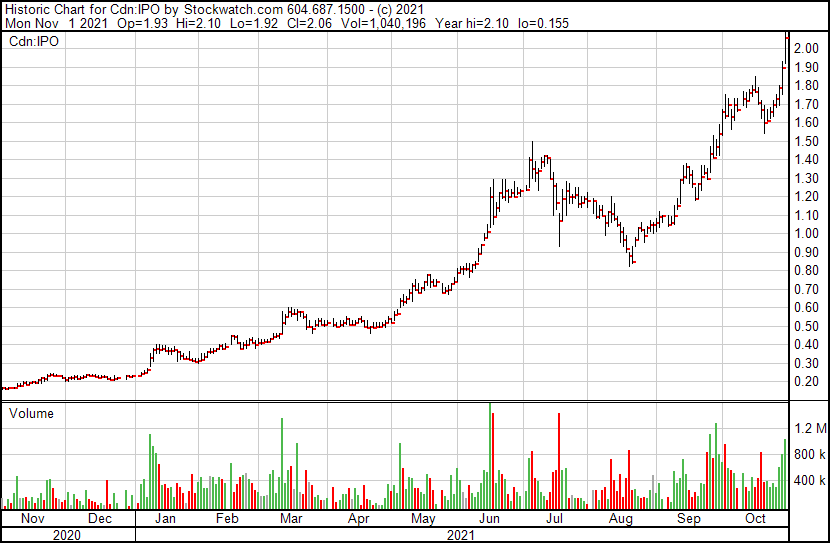

Primary among them is one we told you about a few months back that, if you got on board, you’ll be doing cartwheels over. InPlay Oil (IPO.T) is a-boomin’.

This is what I said back in July when the stock was a massive win at $1.30.

InPlay Oil (IPO.T) torquing at just the right time as oil prices trend upwards

Now?

$2 just got passed.

I don’t know what to tell you, guys, you either take me seriously or you don’t. But the ‘seriosos’ are winning.

REVIVE KEEPS REVIVING

Revive Therapeutics (RVV.C) started out the Covid era being laughed at by some for ‘chasing’ a hot sector, being as it had been in cannabis medications and psychedelic medications and just plain old vanilla medications before that, and suddenly thought it had a sniff at using existing IP as a Covid treatment.

The thing was, and is, Revive has never strayed from being in the healthtech field, all that pivoted was the use cases for what it owned.

Revive has proven the naysayers wrong, making us a significant stack through the last 18 months, and today it jumped another 20% on news it’s moving those Covid trials forward.

Revive Therapeutics Ltd. has provided an update on its U.S. Food & Drug Administration (FDA) phase 3 clinical trial to evaluate the safety and efficacy of bucillamine in patients with mild to moderate COVID-19. The study is a randomized, double-blinded, placebo-controlled trial, and the safety and efficacy data at each interim analysis time point, in which the final interim analysis will be at 800 completed patients, are only made available to the Independent Data and Safety Monitoring Board (DSMB) for review and recommendations on continuation, stopping or changes to the conduct of the study.

The DSMB supported continuation of the study in its last meeting as there was no serious adverse events or safety concerns reported, and it is expected that the final interim analysis meeting, which will take place at 800 completed patients to be held in Q4 2021.

The trial is taking place at 46 sites in 14 states and Puerto Rico. Real stuff.

Hot damn, folks, not bad for a ‘pump and dump’ as so many called it back in late 2019, for the temerity of not just staying on the weed wagon.

Flexibility and evolution; it’s a good thing, folks.

— Chris Parry

FULL DISCLOSURE: Revive and Skyharbor are Equity.Guru clients. AMPD and InPlay are EG holdings.