Follow the money. We have all heard that term. Look at what people or institutions are doing rather than saying. When it comes to the Bank of Canada, I saw data that made my jaw drop. I have been following the Gold markets since 2012. For those that consider Gold to be the world currency and/or an inflation hedge, it has always made us Canadians feel a bit uneasy that Canada sold off their Gold reserves.

Here is a quote from Finance Department Spokesmen David Barnabe back in 2016:

“The decision to sell the gold was not tied to a specific gold price, and sales are being conducted over a long period and in a controlled manner,” Finance Department spokesman David Barnabe wrote in an email to CBC News.

“The government has a long-standing policy of diversifying its portfolio by selling physical commodities (such as gold) and instead investing in financial assets that are easily tradable and that have deep markets of buyers and sellers,” he said.

Oh and this from the journalist back in 2016:

Canada may be one of the world’s biggest gold-mining nations, but the government of Canada hasn’t been a big buyer of gold coins, or any other gold, for years. That’s not too surprising, since no country now uses a gold standard to value and back its currency.

I remember economists here basically saying Gold is nothing but a pet rock. But oh have things changed. And you must be paying attention. Long time readers know my take on inflation and the upcoming currency crisis. They go hand in hand since inflation by definition is the weakening of one’s currency. Precious metals, hard assets, and perhaps even crypto’s, essentially anything that is NOT fiat currency, tend to do well in these types of environments. Gold in particular when there is a confidence crisis: when people are losing confidence in government, in central banks and thereby the fiat currency. When I look around, I see people hating the government, central banks got it wrong with the transitory inflation narrative, and prices are rising for basic things. Lot of the criteria of the confidence crisis are already being met.

For those in the Gold community, we know countries are adding onto their Gold positions. China, Russia, Turkey are among them. Jim Rickards calls it the Axis of Gold, how enemies of America are accumulating Gold frontrunning a US Dollar collapse…or preparing to collapse the Dollar. The Central Bank of Russia gives us a good example. With US sanctions, the Ruble weakened. However, Gold vs the Ruble appreciated. Since Russia has a large Gold position, the Central Bank did not feel the impact as much. It allows nations to hedge themselves against US hegemony and the hegemony of the US Dollar, being it is the world reserve currency. Let’s see how Turkey copes as the Turkish Lira is weakening to the lowest levels ever, but the Central Bank does hold Gold.

We know Central Banks like the Fed are buying Bonds and Mortgage Backed Securities. We know Central Banks like the Bank of Japan and the Swiss National Bank are either buying ETFs or actual stocks. It is also known, but less mentioned among economic and trading circles, that some Central Banks are buying Gold. If a Central Bank is buying, I am buying. When it comes to Gold, an asset many people despise or say it is irrelevant, the Bank of Canada buying should sound some alarm bells within you.

In my humble opinion, the Bank of Canada knows inflation is coming. And it will be worse than they thought. They are preparing before they get caught with their pants down. Or, they simply just think supply and demand mechanics are favorable in Gold and are taking this as a trade.

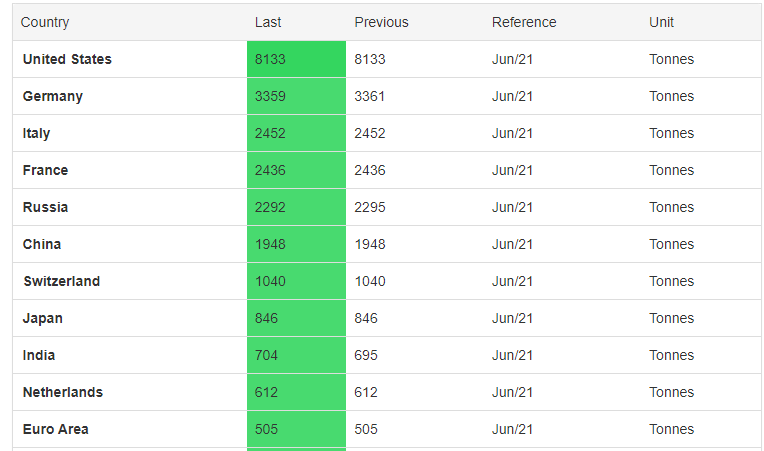

Before we discuss what Canada has done, let me share this 3 minute video with you. Came out in 2018, so things have changed, but it gives you a good perspective on Gold reserves around the world. Mind you, it is likely these blocks are BIGGER, since I don’t know of any Central Banks selling off their Gold:

The US by far has the largest Gold position in the world. Part of it is thanks to Gold being confiscated starting in 1933 and made illegal to own until 1974. All this Gold is sitting in Fort Knox. Apparently. Nobody has seen it, there hasn’t been an audit, but people say it is still there. Many wonder if the US followed in the footsteps of Canada and sold their Gold. For America’s sake, let’s hope they haven’t.

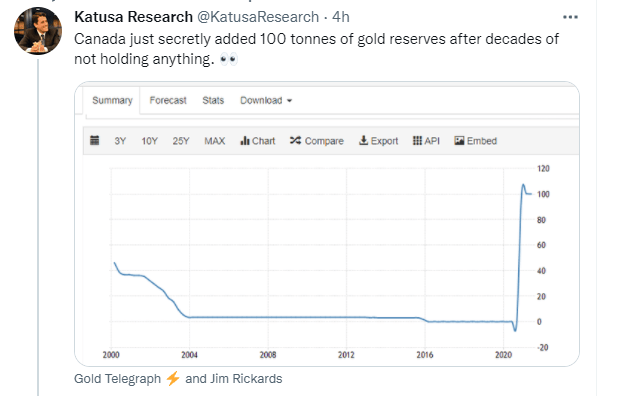

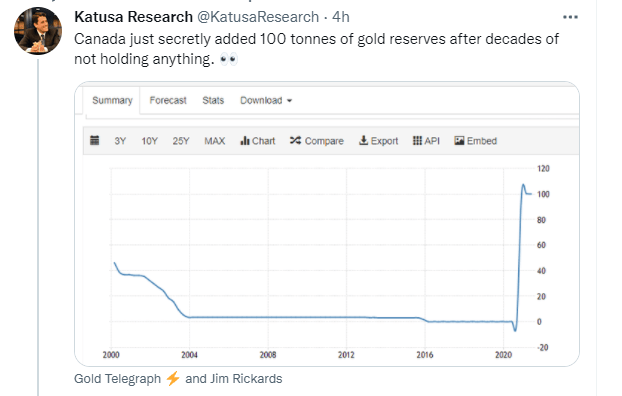

Yesterday I was scanning Twitter when I saw Vancouver’s own, and resource investor legend, Marin Katusa post this:

After decades of no Gold position, or less than 1 ton, Canada added 100 tonnes of Gold in 2021. This is big news. As I said before, they know what’s up. They are preparing. Or they are just bullish Gold, which is great for us Gold investors.

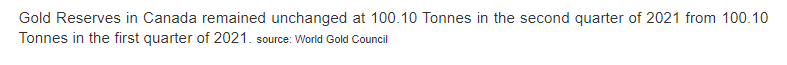

The crazy thing about all of this is how quiet the purchase of Gold has been. In fact when I go to Canada Gold reserves on Trading Economics, or the CEIC, heck even the World Gold Council, it shows Canada still has 0 tonnes of Gold. But I think this is because it has not factored in October’s data…if this month is when Canada bought their Gold. Here is the problem. Even though trading economics shows a chart of 0 tonnes, this is the comment above their chart:

I find it a bit fishy, because apparently Canada had 100 tonnes since Q1 of this year, but none of the data is reflecting it. Nonetheless, if the Bank of Canada is buying Gold, you should own some too. I hope I am wrong about what is coming ahead, but so far, things are unfolding as I have been predicting.

EDIT: The drama continues as the World Gold Council came out stating they made a mistake:

Canada did NOT add 100 tonnes of Gold. Some of us just can’t find this a bit shady. How do you just make a mistake about 100 tonnes of Gold. I don’t want to be that guy, but if I were adding a conspiracy element to this, you wouldn’t want the public to know. Canada buying Gold after having none for decades would freak people out.

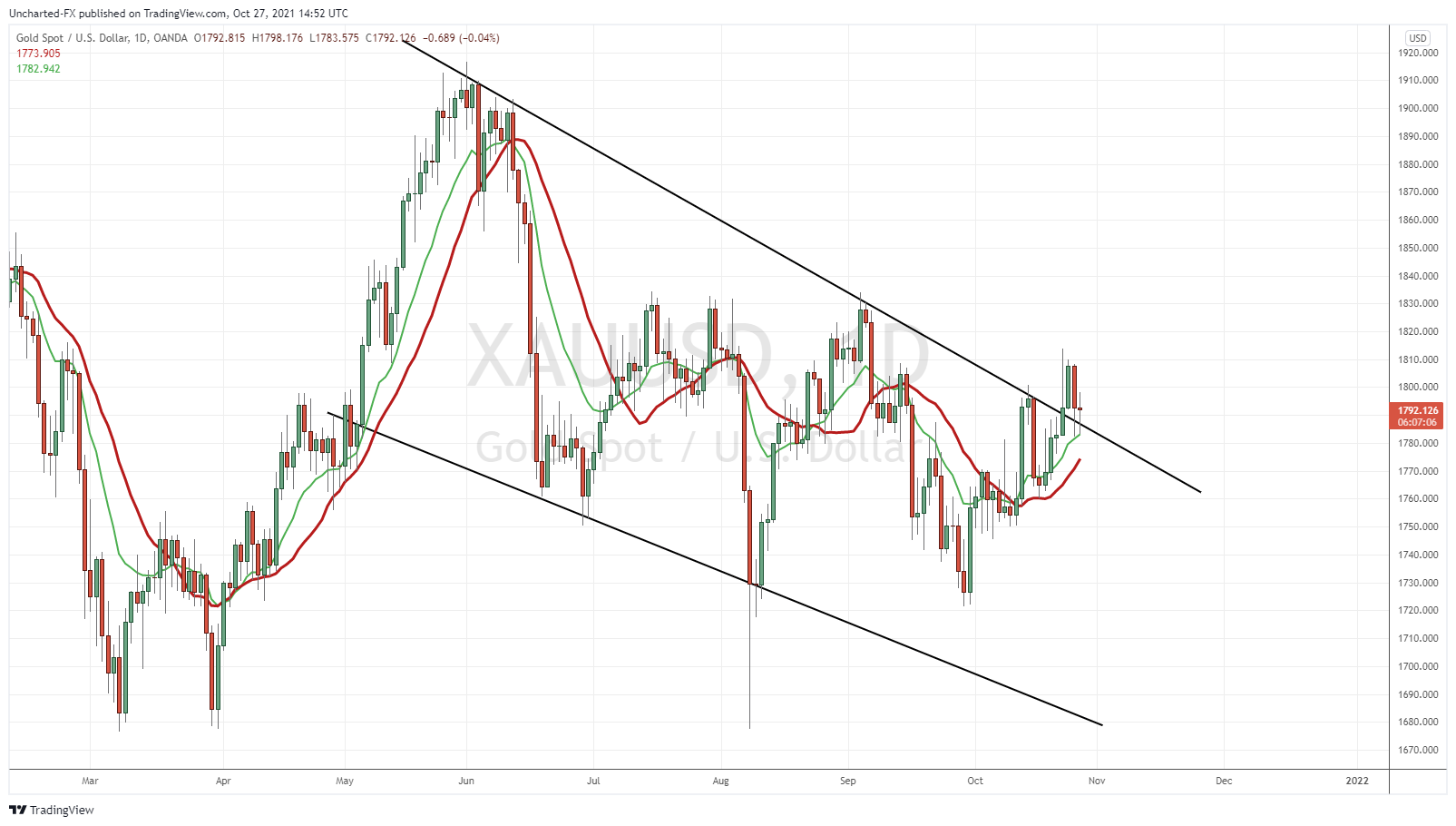

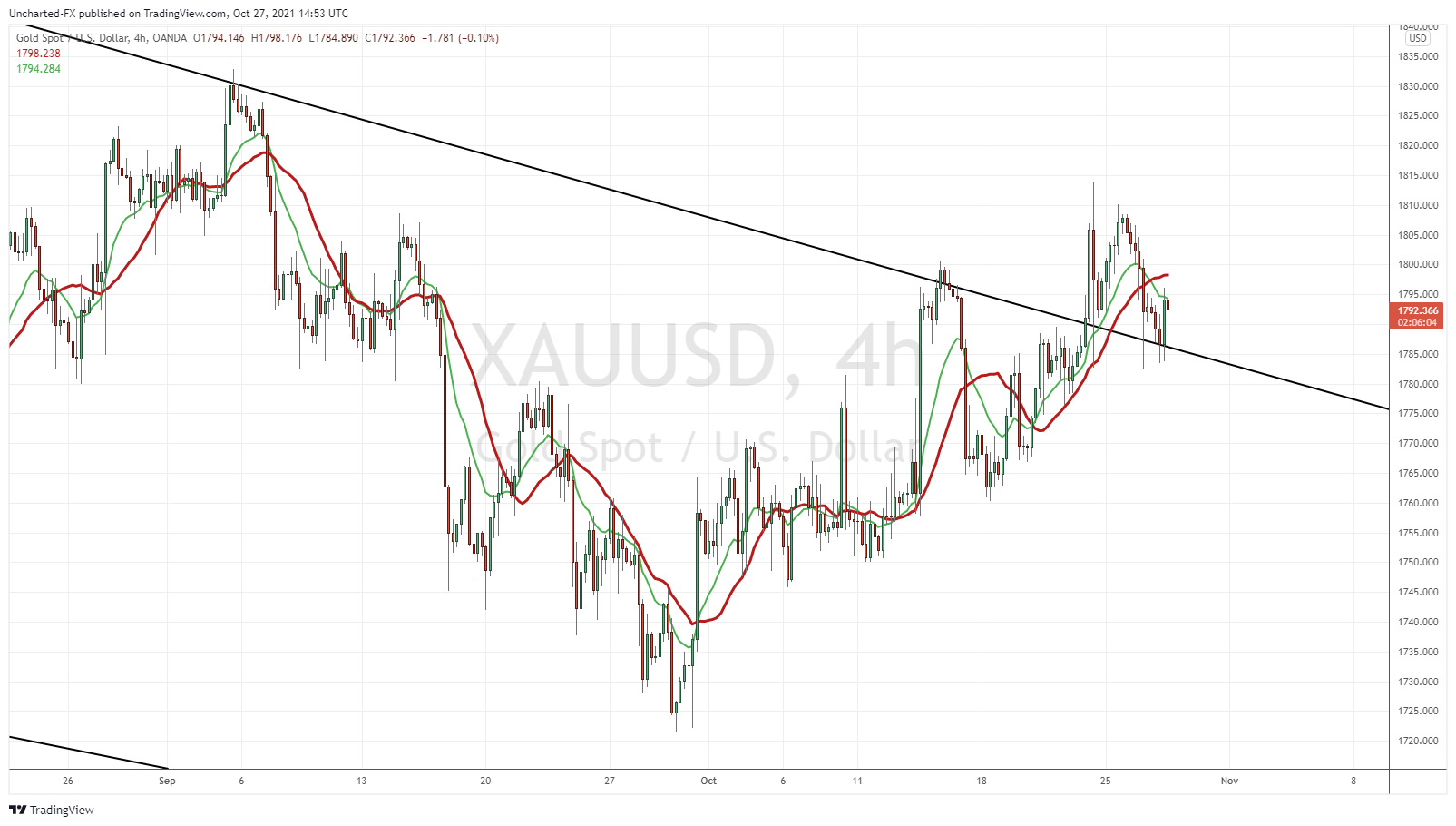

Before I end, a quick look at Gold technically, but I covered the breakout in detail a few days back in this article. Gold broke out of a flag and this is what we have now:

I like the breakout confirmation on Monday October 25th, and the subsequent pullbacks afterwards. Nothing to fear right now. Let me zoom into the 4 hour chart to explain why.

Beautiful retest of the trendline so far, and we are seeing buyers step in at the retest. Look at the wicks and the recent engulfing candle from our trendline. I remain bullish as long as the DAILY close remains above the trendline. If the daily candle closes below $1783, and below our breakout, the uptrend momentum will be neutralized.

In summary, if the Bank of Canada is buying Gold you should be too. Or at least buy some juniors, explorers, miners, royalty and streamers. Heck, even my preferred hard asset, physical Silver. If you don’t think the inflation narrative is coming then that’s fine. The Bank of Canada is obviously buying if they think the price of Gold will be moving higher. It’s a good trade regardless of what angle you take. But keep in mind, it has been decades since Canada accumulated Gold on this sort of level.

I started buying silver 3 years ago for around 21.00 Canadian hoping it was going to the moon. Well I started feeling kind of foolish in the last couple of months when I could have bout it for the same price. I could have spent my money on any other investment and at least got interest. I’m glad to see Canada at least bought some gold. Makes me think some thing is on the horizon.

if you had 200 tons of gold you could leverage the borrowing power by 7 so every year you could loan the value of your gold and at 7 % interest that gold tonage would double every seven years well atually at 7times 7% you could double it every two years but money being what it is with inflation repoes and default inloans it takes seven years to double your gold add 49 years and now you have 25,000 tons or 2times the us claimed gold deposits to double this again not only are you buying most of the worlds gold production you are buying everyone elses gold and dont forget about 50% tio jewlery dentistry chips medicine caaltlsts fuel cells ect so to really get a grip on gold buying you lend your money to gold mining and write contracts for a ertian percentage of the gold at production costs like a royalty.well like abank you an do the same thing with out all the gold hene no gold reqquired untill you do so ehenn the bricc s start issuing real gold curency dollars in the form of the bimetallic to limit counter feiting and shaving of the actual edge of the coin removing some of the coin the toownie is a good exsample and with a 4g 6k gold cente the coin would have a face value of sixty to 120$ depending on the price of 24k gold i have advocated till for ovr fifty years as this is th only way to counter inflation without creating more inflation instead of bit oin a ponze scheme and amoney laundering system true gold value currency is the only way to defeat all the rachetering in the monitary system including counterfirting like senso rmatic a chip implant in the coin would be another level of countermeasure but allso retirive smuggled coins and return to country of origin remember canada spends about 50 to 100m per year flying back repaitriated coins and as the perfered go to money maker in the world canada could produce the worlds currency needs and back all the currency with gold as to 30$ gold is now 2500 and set to sky rocket if this measure isnt adopted implimented and poliferated accross the planet if the worlds currency system colapsed and the money became worthless all we would need to do is retrive all our coinage and add two zeros to the cions demomonation making a monetary system backed by gold and stable for everyone with a small perentage actually containing the.one third to one half gram of gold.and would end the endlles payment system failures like compas card

at 15 trillion $ worth of gold canada could back this vventure with the 12 trillion dollars it has in he internatonal monitary fund somthing happens to digital money inthat it tends to seep towards entities and coorporations alaedy loaded with capital investment reserves and that the infrastruture deelopment dollar through the imf dosnt floww back to the people and only makes resouces of the lenders more expensive and removed from access to the many to fewer and fewer individuals if anyone wants to repeat the failure of an inadquite monitary supply like 1929 so as an example ev are 3x ice to buy and will excede ice fueling costs with accoss the board 80cent kwhr electricity with an extra cash outflow of 15k per month if an xtra 45 trillion dollars annually isnt added to the money supply this crash will occur just to adopt evs for 300 million drivers

so a3trillion per year as the us has done it will take 15 years to adjust money supply to adopt evs guess how much coorporations will have to invest to bring back goods to american industry gutted by globalization and offshore manufacturing instead they are buying back shares inreasing share prices and making the rich richer if you sat down and realized that fentinal the replacement for herion is worth 3 million dollars a pound making ivermectin look like a joke at 100k per pound when used for christmas trees and pork production.at dollars per pound if ammonia is and will be adopted major water pollution will stop and be abated gasoline replacement prices will drop to 12 cents per litter allowing equvilant taxation and partiule air pollution adding trillions to health care will recede and maybe clintons legislation for the airline industry to make english more comprehensible and esier to use for non speaking nations as the pilots have requested be applied to the dictionary to eliminate the bewidering complex spelling of words .and if quebec trully wants canada to be bilingual the french languge broadcasts on the th medis could have ose caption instead of ovoice over or no translation service as in four out of five services. with the ability to capture the essencce of the french canadian laugage which is severly corrupted in the voice over service.remidiated with close caption in both languages to capture and immerse into and adoptee the language for true culturisium and diversity with the unbalanced touting of ai and algoriythms it strikes me as decimatory not to have this provision as part of the crtc mandate and failure of.