Gold looks ready folks. Just as we called the bottoming and breakout trigger on Silver, the yellow metal is looking ready to follow in Silver’s footsteps. In this Market Moment I will briefly explain why, and then break down what I am seeing on the chart. I will also talk about how I got clapped trading Gold recently. Hopefully it provides a valuable lesson for investors and traders.

Gold is seen as the inflation hedge. We are hearing about supply chain issues causing rising prices. True. But I, like many others, see inflation as a currency issue. A currency crisis may be a better way to put it. Inflation is when a currency is losing value, which means consumers are losing purchasing power. It now takes more of the weak currency to buy something which translates to higher prices. Remember the days when the pandemic monetary policy began? Tons of people, including well known billionaires, warned about inflation.

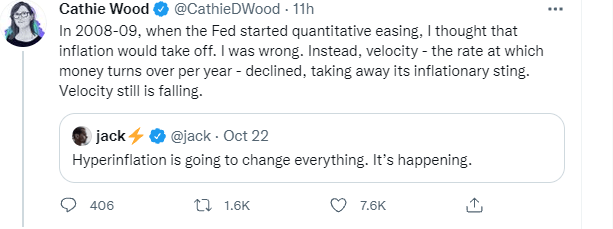

The average market participant thought this was rubbish because inflation was not happening at the time. But these things take time to develop. And one thing was key: lockdowns did not allow for money velocity to increase with all that new money being printed. Inflation is upon us, and it is only just beginning. If all of this is true, then anything out of the central bank control will rise. Gold, Silver, Copper, other hard assets and commodities, and yes, I include Bitcoin and other cryptocurrencies in this category. In the past, I have introduced the term ‘confidence crisis’ to my readers. When people begin losing confidence in both the government and central banks is when Gold has its day. And when you look around the world, it seems we are at the precipice of a confidence crisis.

The Federal Reserve has kept markets calm with their ‘inflation is transitory’ phrase. Earlier on, they blamed transitory inflation on the re-opening. And there was a case to be made for that. Money velocity is a key factor in inflation. Hyperinflation occurs when people spend their money as quickly as possible on goods because they think the currency will weaken the next day. Confidence is fully lost in this case. More on hyperinflation in just a bit. But money velocity, especially the retail sales data, will be what we are going to be watching. Even Cathie Wood chimed in on this point:

Back to the Fed. So re-opening was causing transitory inflation. Possible, but the retail sales data at the time wasn’t backing the Fed’s thesis. Funnily enough, today retail sales are higher, and the Democratic administration is saying inflation and empty shelves in parts of America is not occurring due to supply chain issues, but because of how strong the US economy is. Americans are buying lots of things and supply cannot keep up with demand! We will have to wait and see how things play out shall we? But I believe we can make a case for rising inflation based on recent commodity moves.

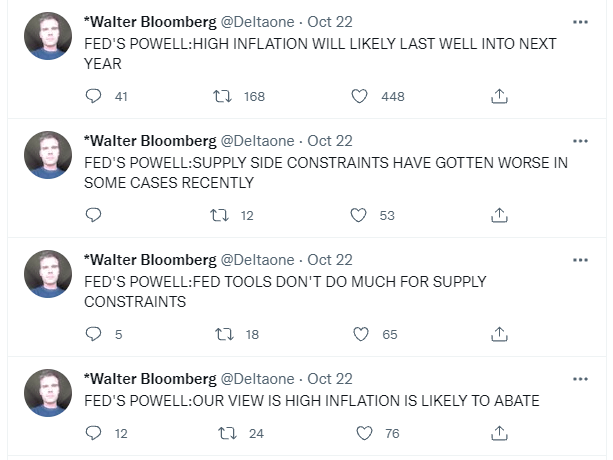

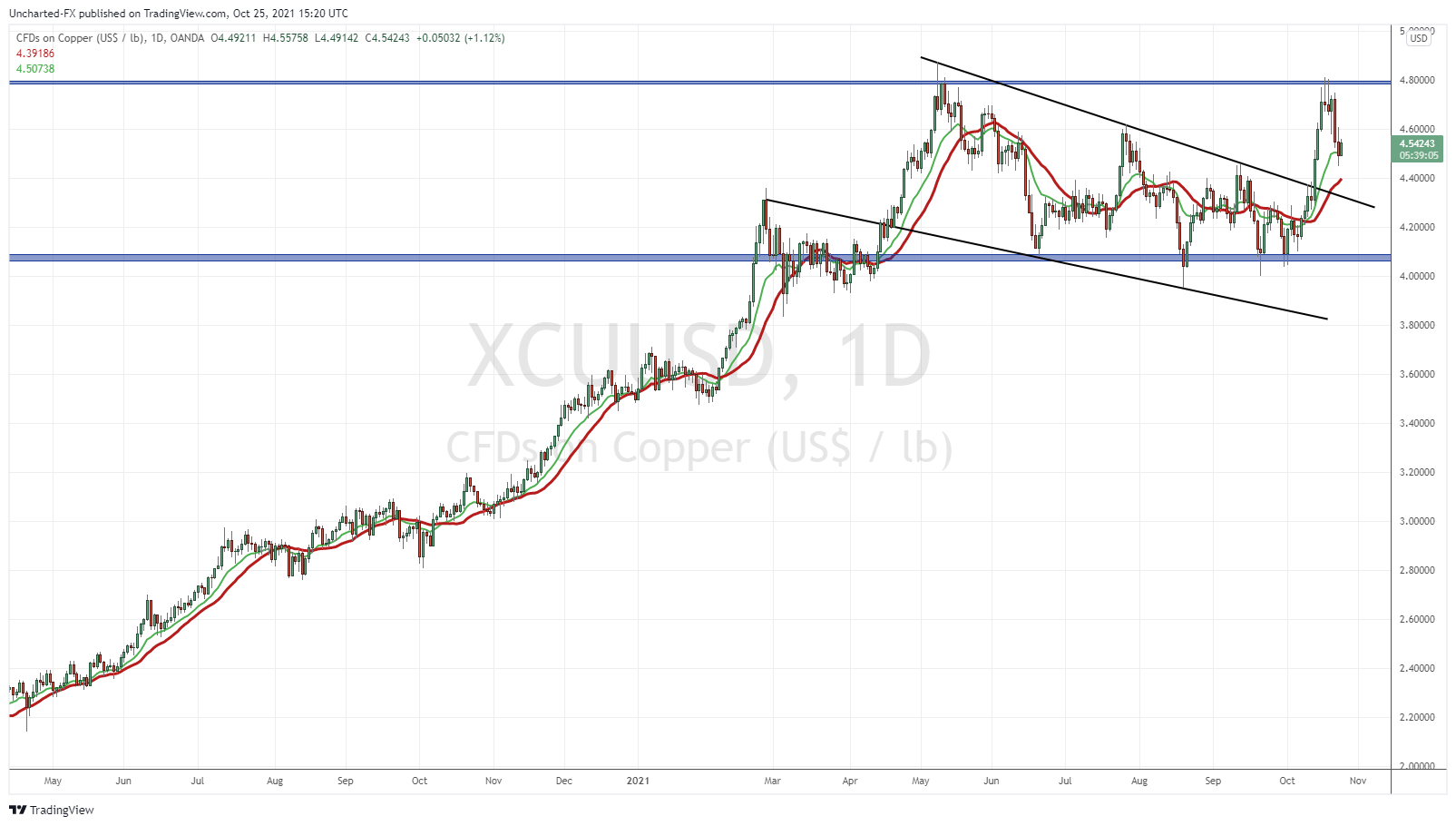

Last week caused my jaw to drop. The Fed went from transitory inflation, to now saying Inflation will last due to supply chain constraints. Now I don’t want to be that guy, but to us monetarists, it just seems like a cover for their monetary policy. We were telling people inflation was coming over a year ago. Before any sort of supply chain issues etc. If we are correct, then inflation unfortunately will get worse and not abate. Inflation doesn’t seem so transitory anymore. Here are some quotes from the Fed chairman himself:

I have to be honest, but speaking with other traders and economists after his comments…I can say people are beginning to question the narrative. The Fed got the transitory inflation story wrong, and perhaps they are losing grip on inflation. Some say they didn’t have control over it as soon as they released the inflation genie out of the bottle with their pandemic monetary policy.

Over the weekend, some more drama occurred. Twitter and Square CEO Jack Dorsey came out and issued a dire warning. That HYPERINFLATION is coming to America and the World. And it is coming ‘soon’. Once again echoing what other billionaires like Druckenmiller, Dalio (cash is trash) and Tudor Jones have been saying, albeit a bit more discreetly than Dorsey.

Maybe this was his way of pumping Bitcoin and crypto’s, but the message is clear: persistent and higher inflation is coming.

The Treasury Secretary Janet Yellen was quick to alleviate any inflation fears. Stating that the US is NOT losing control of inflation. She is also famous for saying there would be no more financial crisis’ in our lifetime. She also changed her stance from inflation is transitory to inflationary pressures likely to last into next year so yea…

When I think inflation, I think hard assets. Commodities but more specifically, the monetary metals such as Gold, Silver and Platinum. The saying goes like this: Silver is the metal for the middle class, Gold is the metal for Kings (I would add central banks too), and Platinum is the metal for the wealthy. I like all three, but Gold has the obvious monetary link. It really is the true decentralized currency, or world currency. To me Gold is not a commodity. It is money. And the best one to be in if a currency crisis is coming. Remember, our definition of inflation is a weakening currency.

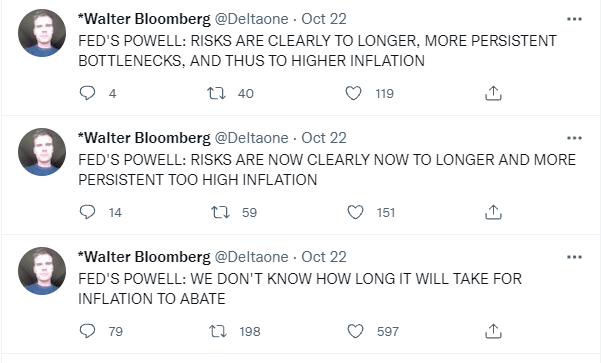

On this front we are seeing inflation in parts of Africa already. I advise my readers to keep Turkey on the radar. If there was to be some sort of Black Swan, it would come from Turkey. The currency is inflating and the weakest it has ever been. Remember Dorsey saying hyperinflation would happen world wide?

The Turkish Central bank cut interest rates by 200 basis points…sort of the opposite of what you would do to strengthen the currency. It looks like there are other credit issues in the background.

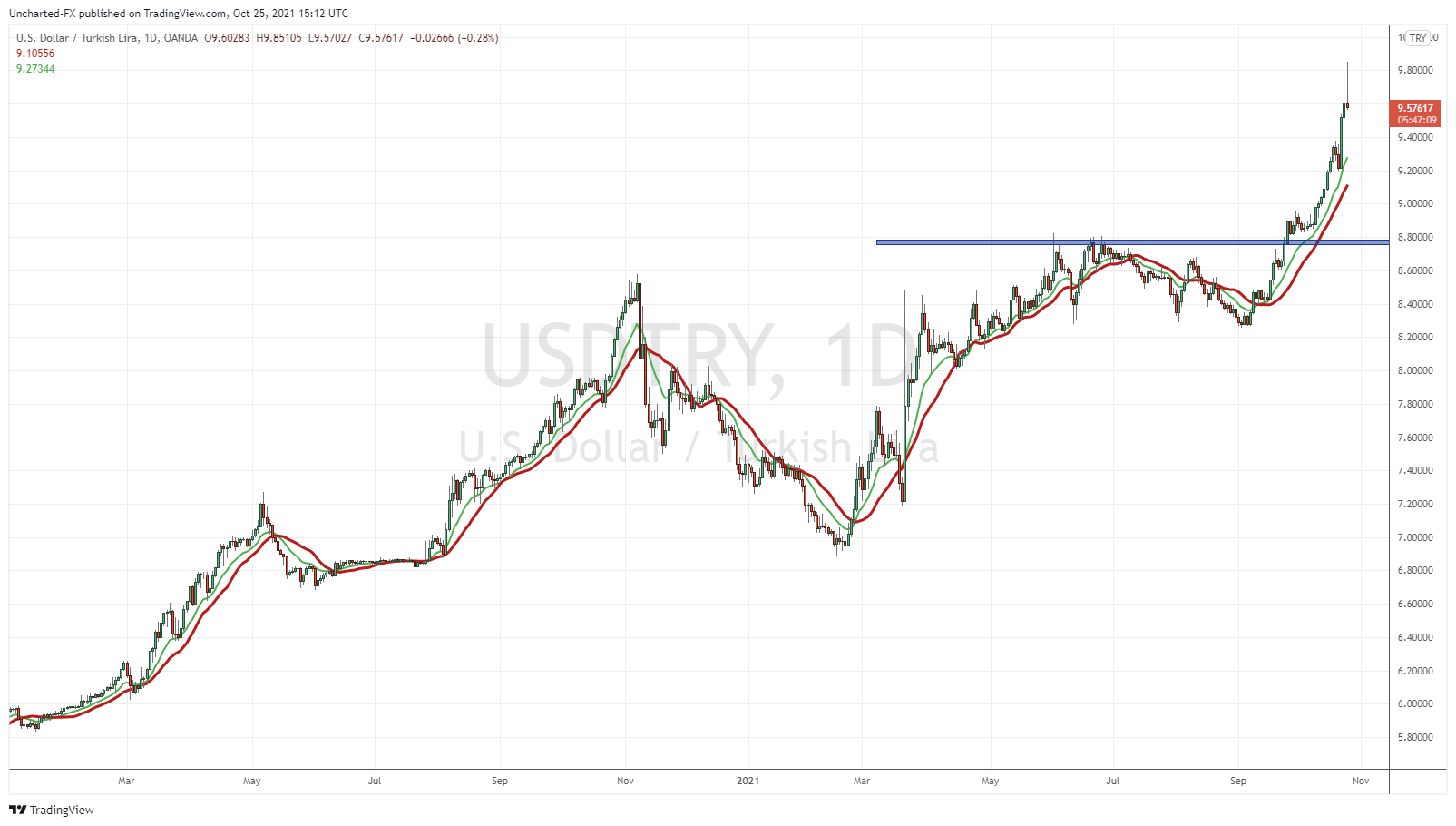

Meanwhile Gold vs the Turkish Lira made new all time record highs. Be prepared to see more new records on this one.

I hope I have convinced some of you to buy some physical Gold, Silver and/or Platinum. I think the protecting purchasing power trade is on. Will stock markets go up? Yes. I mean tons of millionaires were made in Weimar German, Venezuela and Zimbabwe. But if the gains are in fiat and the fiat currency itself is hyperinflated, it doesn’t really matter. Protecting purchasing power is the key in this type of environment. Wealthy families that have maintained their wealth for centuries have done it by owning agricultural land, Gold and Art. But it also helps that they are banking families and own banks.

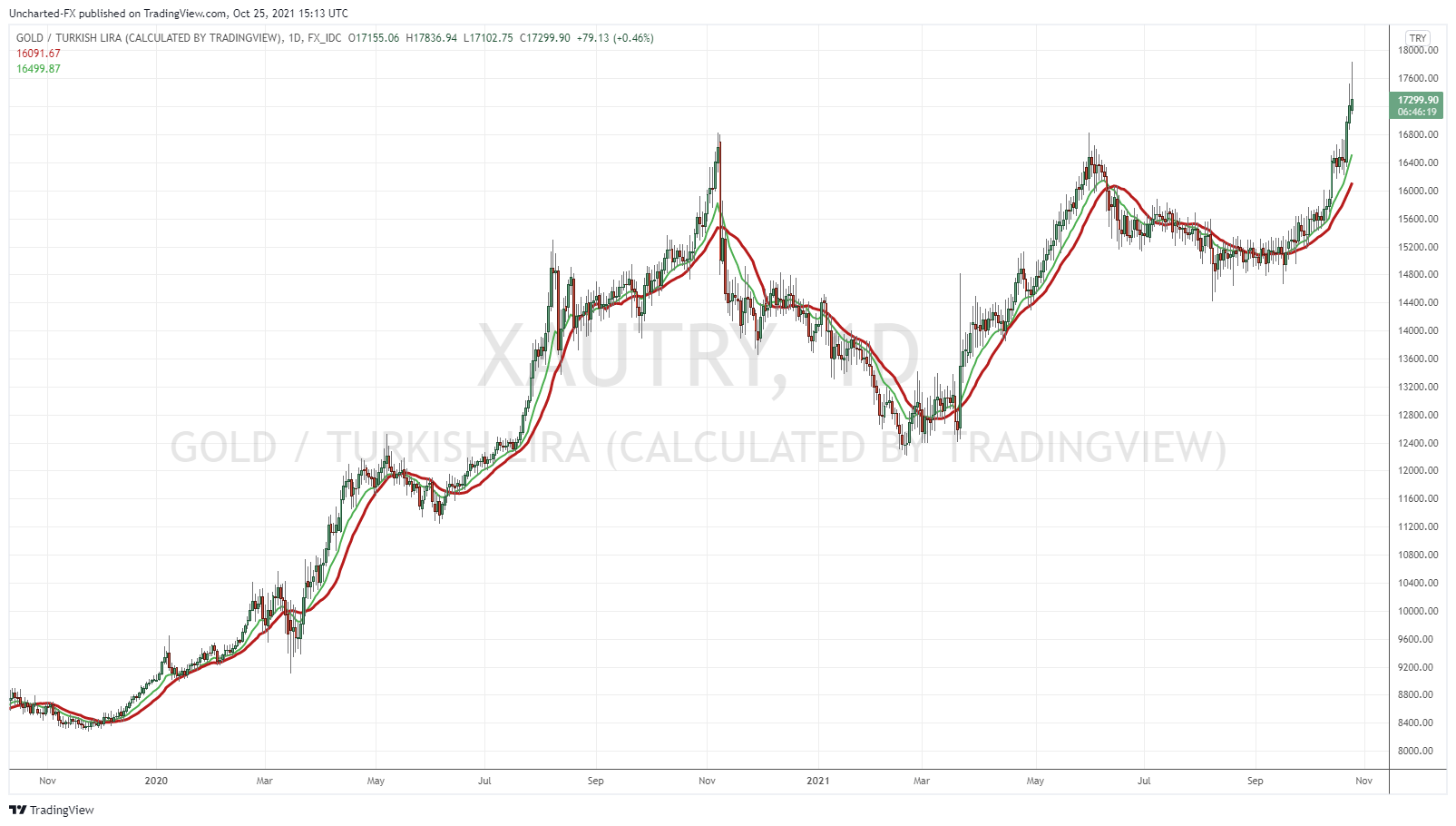

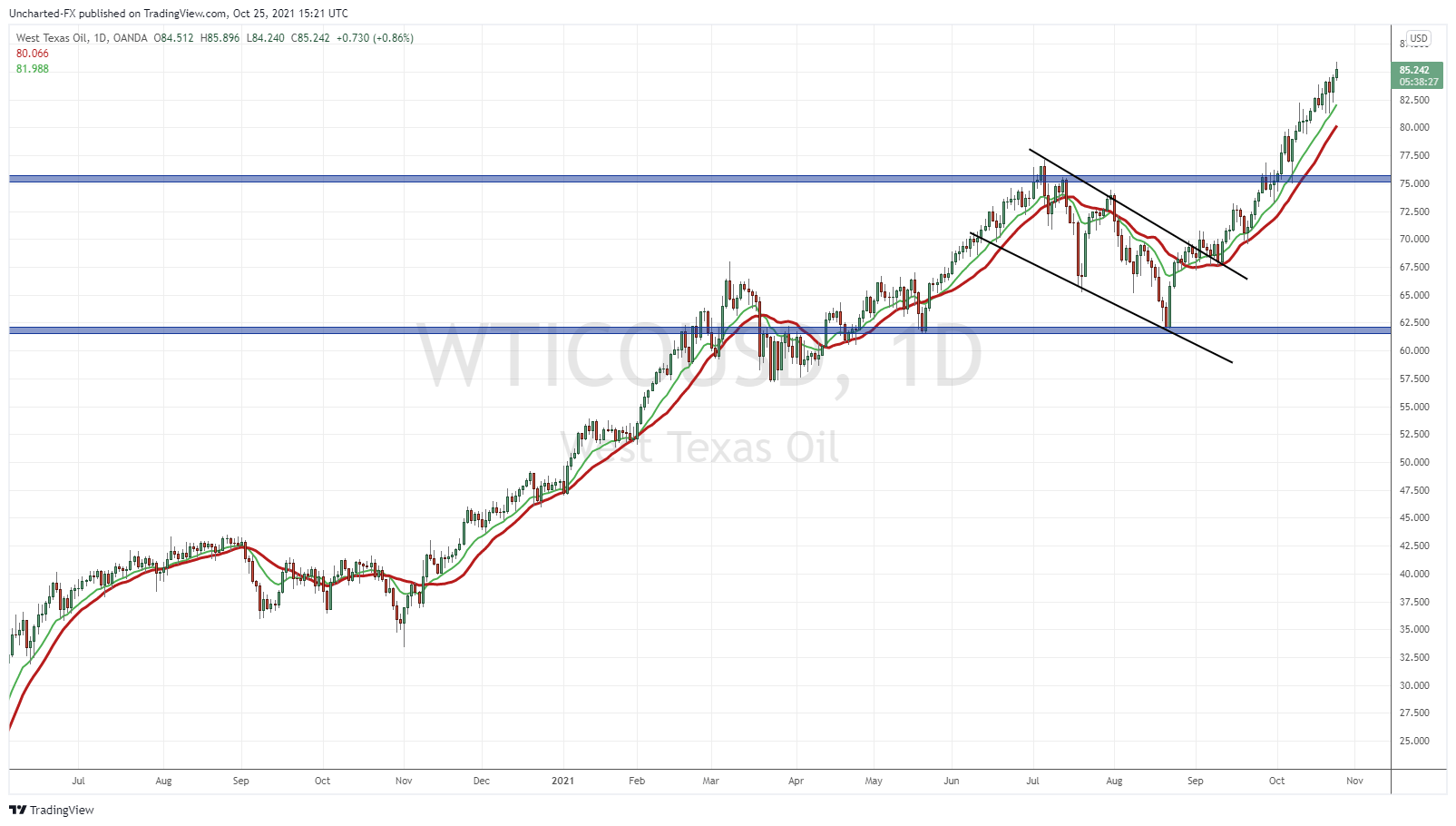

If Gold is not in your budget (remember you can buy 1/10th of an ounce) then grab some Silver bullion at least. As mentioned earlier, we nailed the Silver bottom, and hope to do so with Gold. Before I show you guys the Gold chart, let me show you the Copper and Oil charts.

I want to draw your attention specifically to the flag pattern. When the breakout triggered, we popped higher. Oil keeps on going, while Copper tagged the previous highs at $4.80. I love this pattern right now.

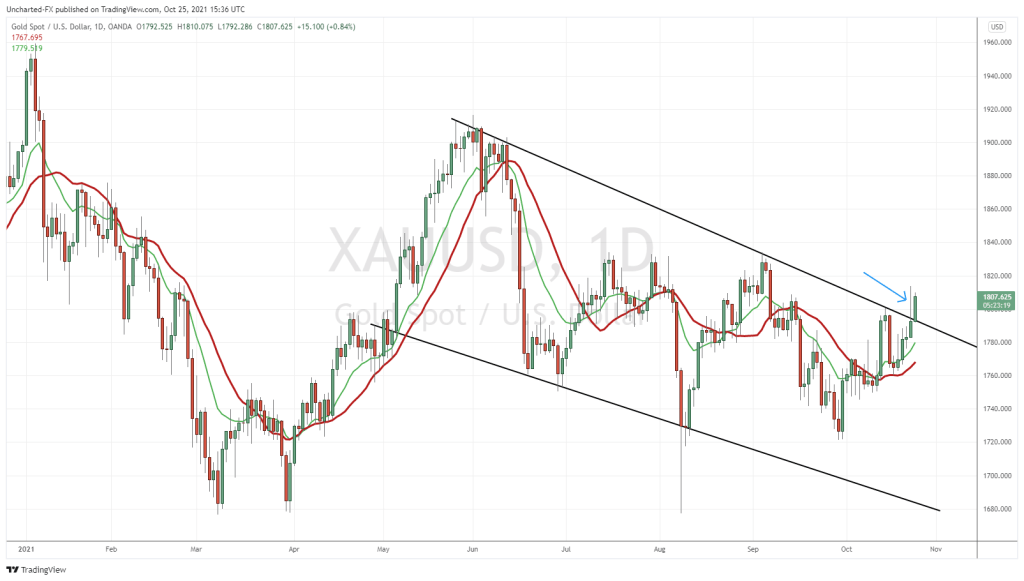

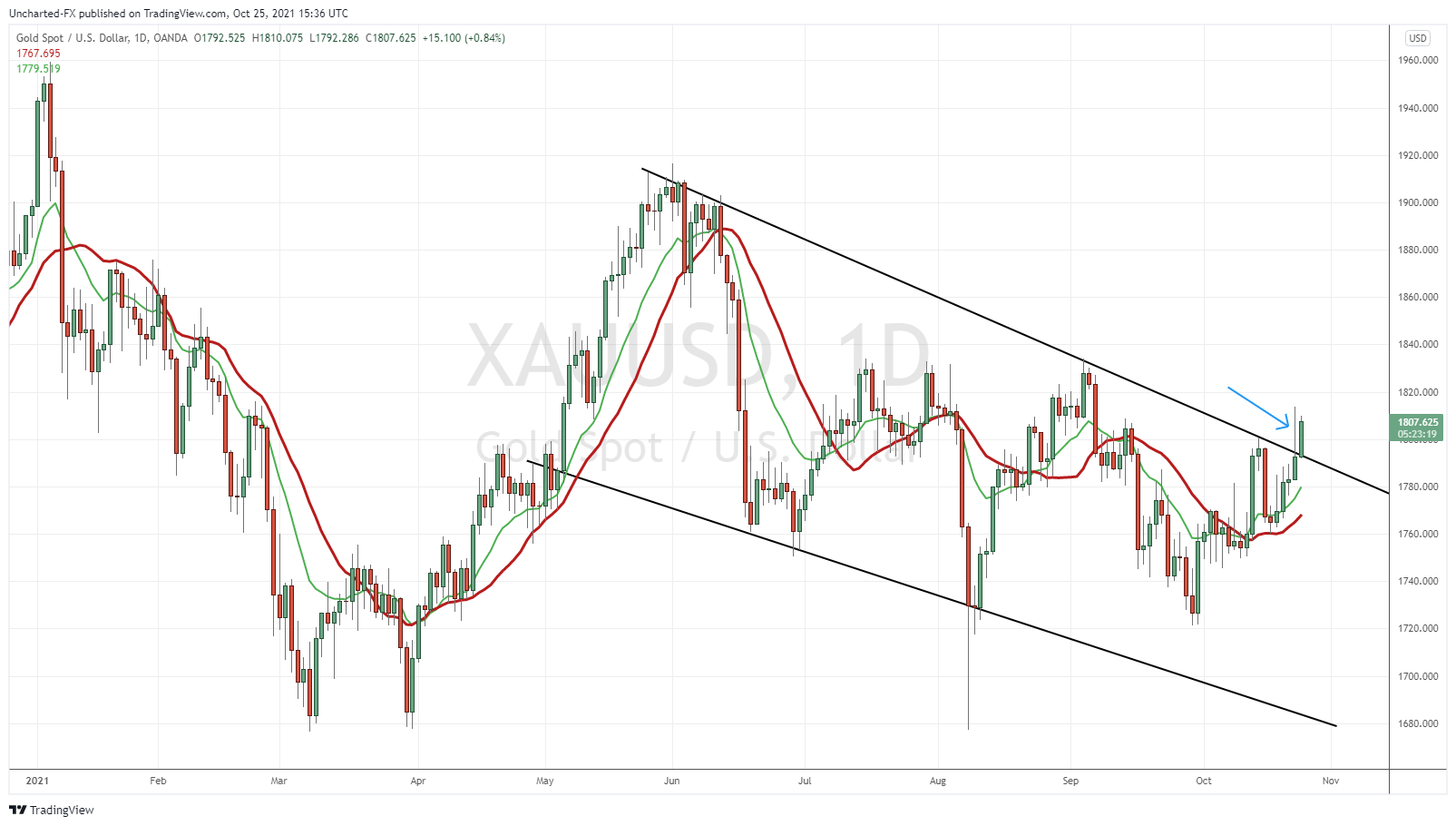

As you can see, Gold has the same flag pattern set up. The breakout is all that is required to confirm the trigger. $1800 has been a major resistance zone recently, and we failed to confirm a breakout close on Friday. I promised I would give you a lesson. A lesson on patience. It happens to the best of us, but on Friday, I saw Gold breaking out. It was such a strong move that I entered a position. Near the end of the day, the daily candle showed heavy selling a push back below the flag. The breakout was NOT going to be confirmed. I took a close. Now some of you may say, ‘oh that was stupid, you would be up if you held today’. Sure, but the lesson I want to impart is that I broke my own trading rules. I wait for the confirmation of breakouts, and I jumped the gun on this one. I got punished for breaking my rules. Gold could have easily sold off today instead of breaking out like it is today. I don’t want to jinx it, but we still have a few more hours before the daily candle is confirmed. I will be looking to enter Gold longs only if the daily candle finally closes above the flag.

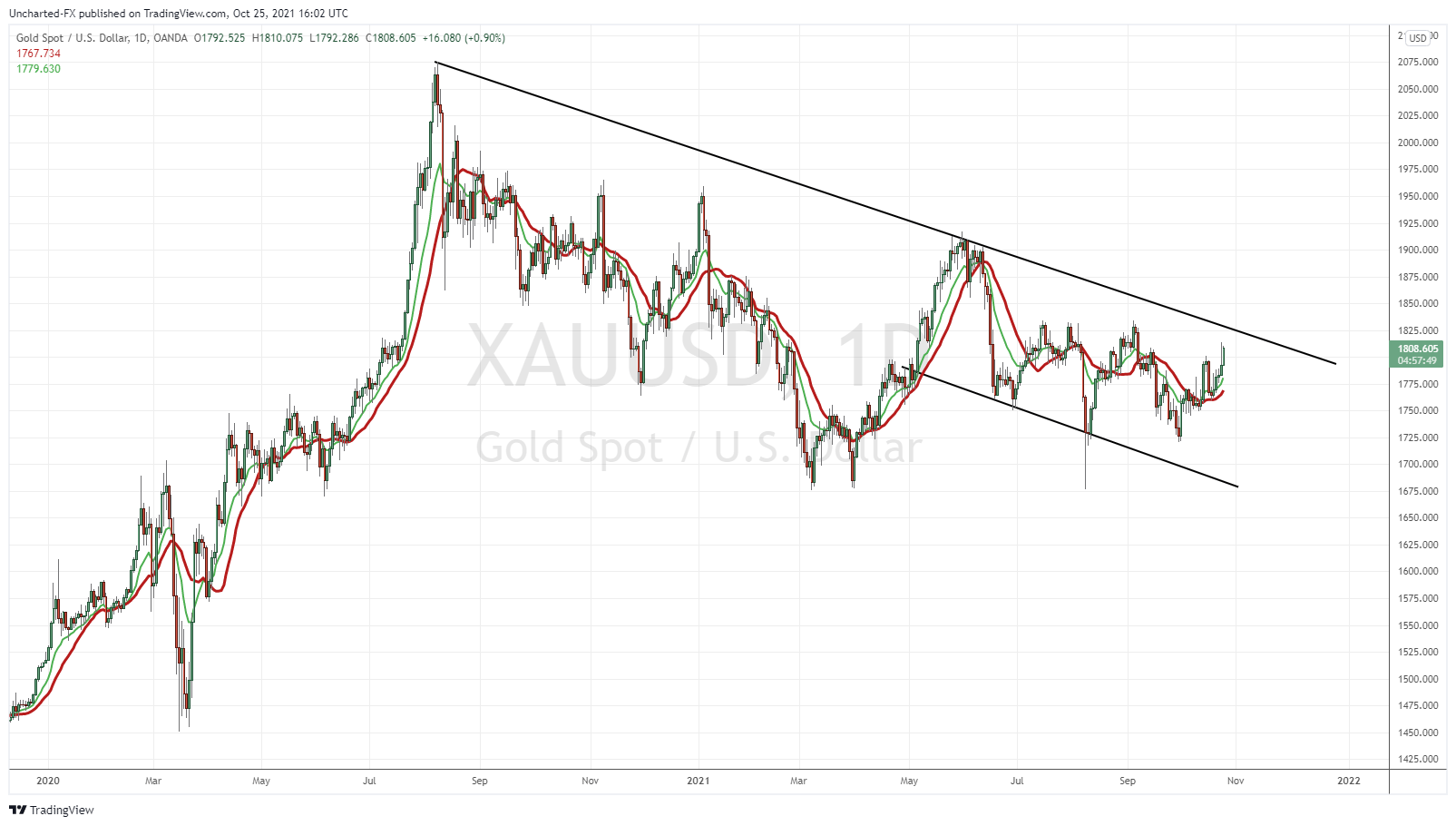

A quick take on the trendline. Some may disagree with this flag. Because they are looking at it on a wider timescale like this:

Connecting the previous all time highs. This trendline is valid too. But mine is as well because it meets my criteria of three touches. For a trendline to be strong and valid, meaning the market acknowledges it and we can use it for technicals, it needs 3 or more touches. We have that. The way I am playing this is to enter half of my position for the swing trade with my flag breakout, and then add the other half on this wider trendline break. If we get above this one then we would be looking for a longer term run up to $2000 and higher once again.

So in summary, I believe the inflation trade is on. Financial media is telling you this is all about supply chains etc, but we monetarists told you inflation was coming based on monetary policy. Watch that money velocity. Of course economists want to see the economy recover, but that means that money velocity will have to increase. With many people trading markets, we have a situation where there are people with more money competing for the same number of goods and services.