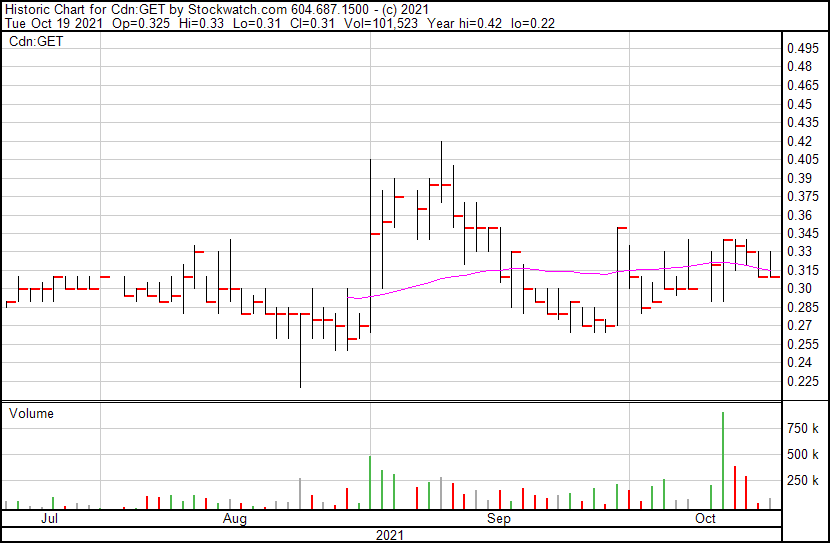

GameOn Entertainment Technologies Inc.

- $20.14M Market Capitalization

GameOn Entertainment Technologies Inc. (GET.C) is a leading technology company powering the most-watched content in the world. How? Through its unique offering of white label engagement technologies, which the Company provides to broadcasters, TV networks, OTT platforms, leagues, tournaments, sportsbooks, and even NFTs with interactive, social experiences centered around sports, television, and live events. With this in mind, GameOn is committed to bringing fans closer to their favorite sports and entertainment content. Traditional fan-focused products leverage standard, linear features that have no meta and poor primary motivations. This results in a mundane experience characterized by low engagement, retention, and viewership for content owners. On the contrary, GameOn’s technologies support improved engagement, social interaction, and monetization.

So, what sets GameOn apart from the pack? GameOn keeps things interesting by enabling fans to connect, make predictions, track live scores, and be rewarded during pivotal moments of their favorite sports, TV shows, and live events. Think Squid Game, but less gruesome. For example, on October 14, 2021, GameOn announced the launch of its cricket predictor games with MX Player and Willow TV for the International Cricket Council (ICC) Men’s T20 World Cup. For context, MX Player is an Indian entertainment super app, whereas Willow TV is the premier broadcaster of cricket in the United States and Canada. How does it work? By correctly predicting scores and events that occur during the tournament, fans are able to move up the leaderboard. By the match’s end, the top-ranked players earn status, recognition, and rewards including subscriptions, merchandise, and cash. User incentives aside, this represents a significant milestone for GameOn. Cricket is the second-most followed sport in the world, watched by an estimated 2.5 billion fans. Keep in mind, MX Player boasts an impressive 1 billion downloads and is watched by more than 280 million viewers monthly. Furthermore, the Company’s free-to-play prediction games will be available to 3.5 million homes across North America via Willow TV.

Business Model

I have never had a convincing poker face. Toss me in a casino with $500 and I will leave with crippling debt. Personally, I would much rather bet on someone else than pretend like I can count cards like Rain Man. With this in mind, GameOn provides a perfect opportunity for those looking to try their hand at gambling outside of the casino. Let’s talk a little bit about GameOn’s business structure. While the Company does build products for end consumers, its business model is business-to-business (B2B). That being said, GameOn creates white label products that are intended to bolster rights-owners in the sports and entertainment markets globally. To date, GameOn has established agreements and offers its products to:

- MX Player – one of the most popular over-the-top (OTT) platforms in India, providing free video streaming service to more than 280 million users globally. Furthermore, MX Player features a streaming library of over 150,000 hours across 12 languages including English, Hindi, and Tamil.

- Blockparty – a Non-Fungible Token (NFT) Marketplace providing collectors and fans access to premium NFTs. Don’t ask me how I feel about NFTs…ask Joseph instead!

- Willow TV – operates the world’s leading portal for 24/7 HD Internet streaming of all Cricket events in the United States and Canada. Willow TV is the official broadcaster for various cricket Boards, including the Indian Premier League, ICC, and the England and Wales Cricket Board, to name just a few.

- LiveLike – a technology company dedicated to empowering digital experiences by providing its partners with customizable tools for transforming passive audiences into engaged communities. Its interactive and social features have connected fans to some of the biggest live events, including the Super Bowl, FIFA World Cup, and NCAA March Madness. Not to be confused with Live Leaks.

- TiiCKER™ – the world’s first direct-to-shareholder loyalty and engagement platform. TiiCKER™ rewards shareholder loyalty through unique incentives such as commission-free trading and customized content.

With this in mind, GameOn requests upfront fees from its partners to license the Company’s fan engagement technologies. In doing so, this provides GameOn with recurring revenue from period to period, typically by season or annually. Through revenue sharing, which is often as high as 50%, the Company is able to generate as much as seven figures per partner annually. Part of GameOn’s appeal is its 100% programmatic solutions. These same solutions drive multiple monetization opportunities, including programmatic ads, integrated brand partnerships, increased media rights value, and sales of products and collectibles. Just how effective are GameOn’s solutions? Following a partnership with NBCUniversal to test a The Real Housewives of Potomac free-to-play prediction game, new users grew as much as 281% week-on-week while active users increased as much as 144% week-on-week.

Recent News +Financials

Most recently, on October 19, 2021, GameOn announced that it had partnered with TiiCKER™, a direct-to-shareholder loyalty and engagement platform. In addition to providing shareholder loyalty incentives, TiiCKER™ verifies ownership on behalf of the company and offers new ways to connect, engage, and reward its investors. Companies recognized for leveraging the TiiCKER platform include Disney and the Ford Motor Company. So, what’s in it for investors? Well, GameOn investors who register and validate their ownership on TiiCKER™ can qualify for branded merchandise, including hats, duffle bags, hoodies, and more. Furthermore, perks will extend to virtual and in-person events in the near future. Aside from TiiCKER™, GameOn recently signed a partnership with Chibi Dinos, which will utilize the Company’s NFT Prediction Game product to give Chibi Dino’s 10,000 digital dinos utility in gaming. If you’re looking for the bizarre details of this arrangement, I highly encourage you to check out Joseph Morton’s article covering GameOn’s latest partnership.

“GameOn is proud to provide tremendous value to not only B2B partners, but also shareholders…People are at the core of who we are and what we do. Our partnership with TiiCKER allows us to reward retail investors, thanking them for their loyalty through exclusive perks and VIP events,” said GameOn CEO, Matt Bailey.

According to GameOn’s Interim Financial Statement for the six months ended June 30, 2021, and 2020, the Company’s cash position increased substantially from CAD$135,476 on December 31, 2020, to CAD$4,558,166 on June 30, 2021. Similarly, GameOn’s total assets increased from CAD$7,366,212 to CAD$10,263,296 in the same period. On the contrary, the Company’s total liabilities were reduced significantly from CAD$3,368,820 on December 31, 2021, to CAD$1,021,527 on June 30, 2021. For the six months ended June 30, 2021, GameOn reported revenue of CAD$10,081 and a net loss of CAD$4,076,675 compared to Nil in revenue and a net loss of CAD$233,506 on June 30, 2020. Most recently, on June 28, 2021, GameOn issued 400,000 common shares to settle the debt that was incurred for consulting services in the period ended June 30, 2021. The common shares were issued at $0.41 for a total value of $164,000. With this in mind, GameOn raised CAD$5,800,000 in March, resulting in CAD$4,000,000 in the bank. With an estimated CAD$250,000 in spending per month, GameOn has a cash runway of approximately 16 months. Assuming the Company is able to maintain a low cash burn rate, GameOn believes it can achieve revenue in excess of $20 million by 2025.

Keep in mind, GameOn’s market capitalization is currently sitting at $20.14 million at a share price of $0.32. Furthermore, the Company’s trade volume has noticeably increased in recent months, achieving an average trade volume of 93,164. Currently, the Company has roughly 62.54 million shares outstanding. With this in mind, GameOn has plenty of room to grow, supported by a unique product offering of engagement technologies. Moreover, the Company boasts a dynamic and experienced management team led by its CEO, Matthew Bailey who has driven brand partner revenue for various sports teams including the Brooklyn Nets. Additionally, GameOn Entertainment Technologies board members include Jon J. Moses, Shafin Tejani, Liz Schimel, and Carey Dillen, who are recognized for their positions at Take-Two Interactive, Victory Square Technologies, Apple News, and YYoga, respectively. The Company has established multiple partnerships while driving revenue. Having only just recently begun trading on the Canadian Securities Exchange (CSE) as of June 1, 2021, GameOn has done quite well for itself.

GameOn’s share price opened at $0.325, up from a previous close of $0.31. The Company’s shares are up 3.23% and were trading at $0.32 as of 3:41 PM ET (October 19, 2021).

If you’re more of an auditory learner, feel free to check out our Five Easy Questions interview featuring Madelyn Grace here. If you want a more in-depth look at GameOn’s financial position and business structure, check out Vishal’s piece here and TK’s piece here!