Business Overview

Canntab Therapeutics is a Canadian biopharmaceutical company focused on the manufacturing and distribution of a suite of hard pill cannabinoid formulations in multiple doses and timed-release combinations. Canntab’s proprietary hard pill cannabinoid formulations provide doctors, patients, and consumers with medical-grade solutions which the operators believe that they incorporate all the features one can expect from any prescription or over-the-counter medication sold in pharmacies around the world.

This $20 million firm in his managed buy a great suite of operators and their profiles are below:

The company currently has 38 million shares outstanding and of that, the chief executive officer Mr. Larry Latowsky owns 244,000 of the shares outstanding. The companies’ co-founder and chief financial officer Mr. Richard Goldstein owns almost 13% of the total shares outstanding, and finally the chief science officer Joshi Laxminarayan brings with them over 20 years of experience in the pharma space.

The operators have a strong IP portfolio of products with 3 patents granted, with 7 more patents pending in the United States and Canada covering their proprietary processes and hard pill formulations.

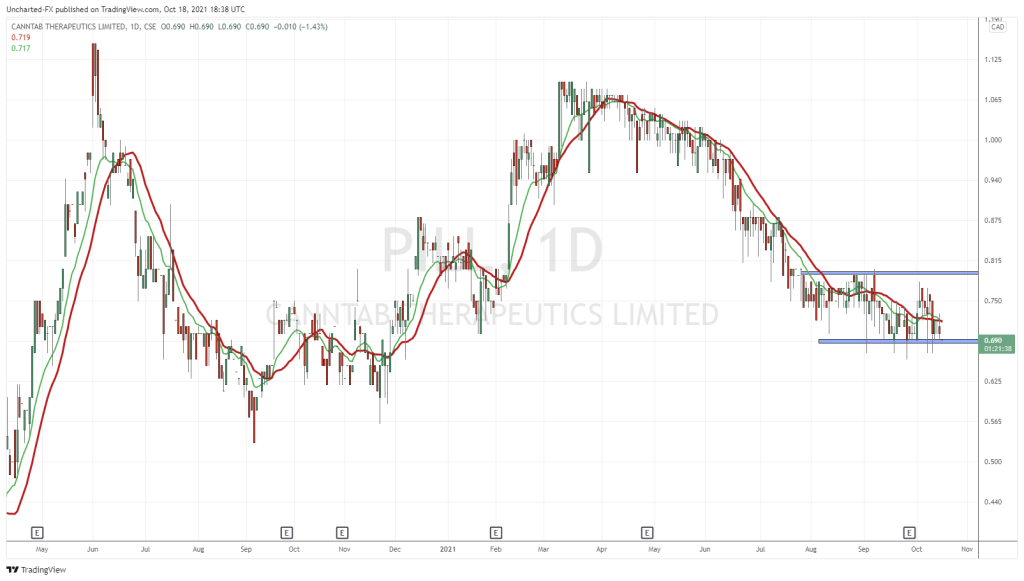

Stock Price Overview

For more details on how people are trading the stock in the short term, I invite readers to go straight to our great technical analysts’ written work on how the market has been trading the common.

The best I can do with price action is what has already happened so I will focus my energies on this exciting endeavor. Our starting point will be October 2020 where the stock was trading at $0.65 Canadian. From October till December there wasn’t much activity excluding a jump from November lows of 61 cents to a high of 0.88 cents. From that point onwards the stock shot up to a high of $1.09 in May 2021 and has since lost 35% of its market value from the peak. As of this writing, this stock is trading for $0.70 per share and this is in between the price range of $1.09 which is the 52-week high, and $0.56 which is the 52-week low.

During this period management issued $3 million in common stock at the end of 2020 and only $1 million of stock as of their latest reporting period ending May 2021. Once we get to the financial highlight section, we will talk about how they used their cash more in detail and exactly how they have structured their balance sheet to take advantage of the protected process system to generate sales and create shareholder value.

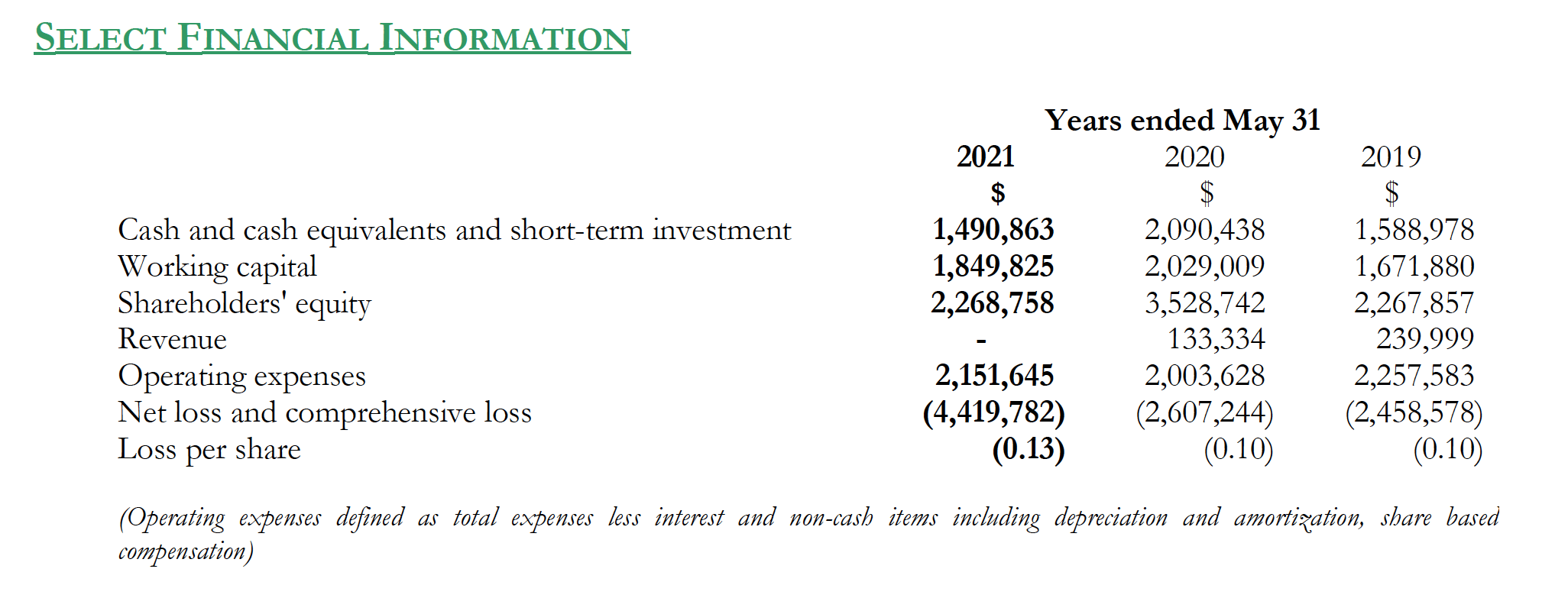

Financial Highlights YEARS ENDED MAY 31, 2021, AND 2020

- The company has done reasonably well over the last three years having an average of $1,500,000 in their balance sheet of which was almost 80% of their working capital. The rest of the working capital is tied up in inventory and accounts payables.

- In 2019 the company made $239,000 in sales but spent close to $2.5 million in their operating expenses giving them a net loss of close to 2.4 million. In 2020 sales dropped to 133,000 but the company was able to manage its operating expenses and reduce than by close to 200,000.

- Although they managed to reduce the operating expenses the reduction in sales increased the net loss by $200,000 giving them a net loss of $2.6 million at the end of 2020.

As mentioned earlier the company’s ample cash to invest in their portfolio to further expand their book of business as they continue to commercialize their product. Over the last few years, the company has spent between 170,000 to 270,000 in capital expenditures meaning they don’t need a lot of money to expand their line. The majority of the money they raise and get from their sales is used to find the selling and general expenses and these small research and development department.

The cannabis or biopharmaceutical sector is still relatively new although it’s been around for a while. Companies have come and go and now more than ever investors are seeking profitable returns by looking for the companies that have the greatest upside potential with the limited downside due to financial operational risk. The added sector risk or market risk from the common stock would force most investors to look for an appropriate margin of safety or add depressed stock with a great cash pile and an addressable market that is being tapped into to gain the greatest exposure to the sector.

The management team has all the experience and the cash needed to take advantage of investors’ uncertainty with the industry by leveraging their operational efficiencies to create value for their shareholders. This won’t be easy for those who are short-term-minded because the company will still sustain large losses as it builds up its portfolio of business. those future investments will allow the business to generate cash flow later. The big question is how long you are willing to wait with the stock that might not go up in the near term or might even continue to go down.