In 2019 the online gambling market was estimated to be at a total size of 58.9 billion U.S. dollars and grew to $66.7 billion in 2020. Most experts believe that in 2023 the total value of the market for online gambling will be closed in 92.9 billion U.S. dollars. This is a compounded growth per annum of close to 8.64% from 2020 until 2023. although it might not be as explosive as the gain in E-commerce or E-sports it is still a high clip of returns on market value.

So, I thought this week would be great to focus on some of the top online gambling stocks that I could find using a simple screener. I also thought it would be interesting to introduce these companies and some of the product offerings that they have.

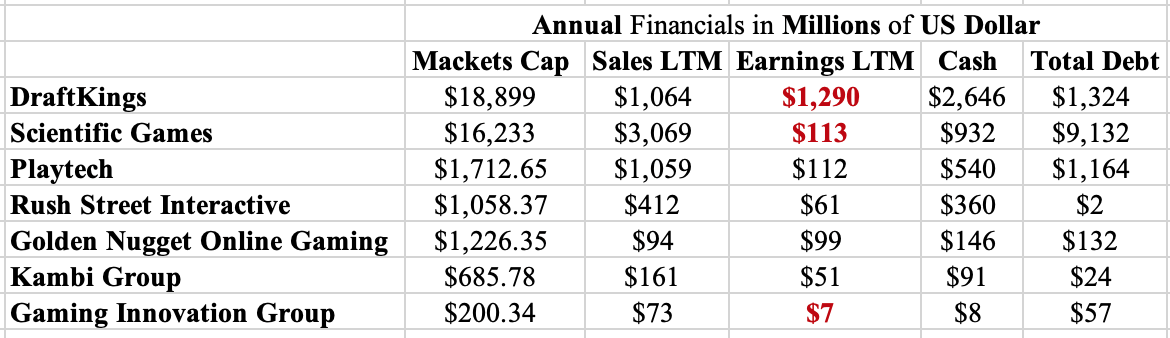

From the random stock Screener that I used the table above is the top results for the companies in the online gambling market or exposed to the online gambling market. the first thing I noticed was the wide variety in market capitalization. the largest company had a total market cap of $18 billion as of this writing, and the smallest was just above $200 billion and some change. the largest company in the group generated $1 billion in sales in the last 12 months compared to $73 million in sales for the smaller market capitalized firm. Both firms produced losses,1 billion and 7 million respectively, and the large firm had $2 billion in cash and 1 billion in debt compared to the small firms of $8 million in cash and 57 million in debt.

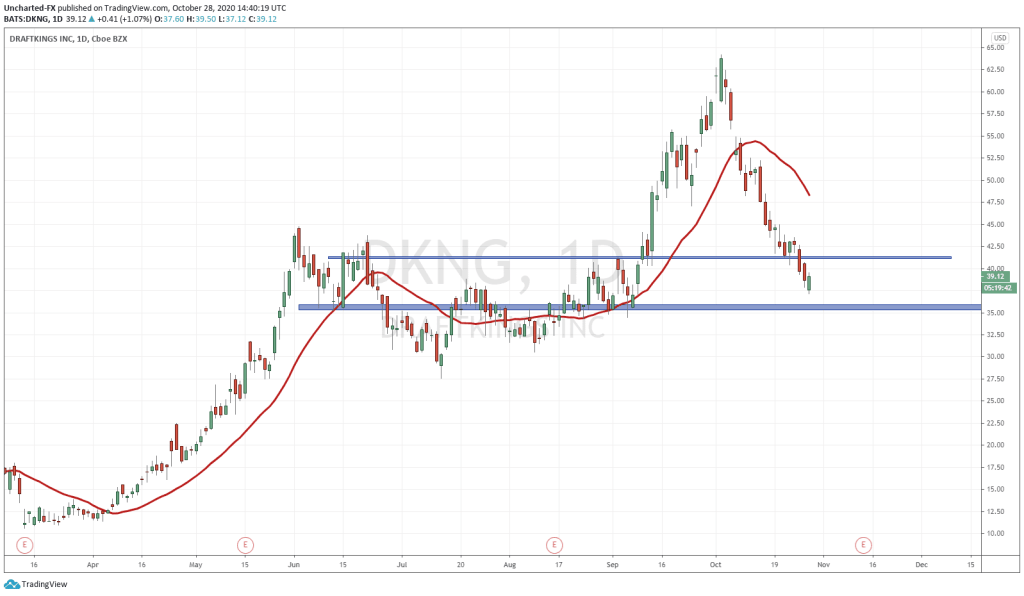

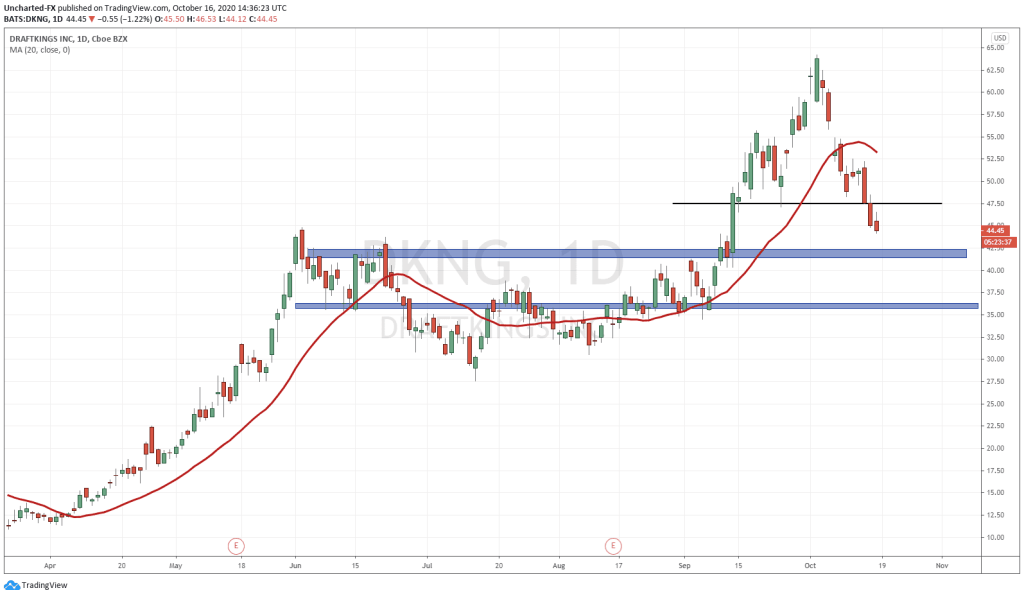

DraftKings is the largest firm in the group with a total market cap of $20 billion (I made an error of 2 billion in the table above and the quoted number is the enterprise value of 18 billion.) and trades under the ticker symbol DKNG. The common stock is currently trading at 49.36 dollars per share and the corporate treasury has thus far issued 405 million shares outstanding.

Of those 405 million shares outstanding the Vanguard Group holds 24 million shares which is 6% of the shares outstanding followed by T Rowe Price Associates who oh 19 million shares bringing their total shares held to 4.79% and then interestingly enough Walt Disney owns 18 million shares which totals to 4.57% of the total shares outstanding or a total market value of $900 million in marketable securities. Fun fact Disney has 16 billion in cash 4 billion in long-term investments meaning their DKNG position is 0.045% of their aggregate cash and long-term investments.

DKNG is a sports entertainment and gaming company that operates in two segments, (1) Business-to-Consumer and (2) Business-to-Business. The company provides users with daily sports, sports betting, and iGaming prospects. On top of their core business, they are also involved in the design, development, and licensing of sports betting and casino gaming platform software for online and retail sportsbooks, and casino gaming products. In 2020 the company spent a total of $168 million on research and development, $11 million on capital expenditures, $178 million on cash acquisitions, and $35 million in purchases of intangible assets. It’s no doubt, excluding the recent issuance of common stock, why this firm is so large.

Scientific Games trades under the ticker symbol SGMS and trades at $86 per share with a total float of 96.37 million shares outstanding bringing its total market cap to 7.8 billion dollars (I made an error of about 6 billion in the table above and the quoted number is the enterprise value of 16 billion.). Of the 96 million shares outstanding 9.2 million are held by Caledonia Investments, 9 million are held by Fine Capital Partners LP, and 8.2 million by the vanguard group. The most interesting shareholder was the Harvard management company who own a steak that has a total market value of $200 million owning 2.78% of the outstanding shares meaning they had close to 2.6 million shares in their portfolio. For the most recent fiscal year, which ended on June 30, 2021, the return on the Harvard endowment was 33.6% and the value stood at $53.2 billion. 14% of the endowment’s assets were in public equity.

SGMS develops technology-based products and services, and related content for the gaming, lottery, social and digital gaming industries in the United States and to a lesser extent internationally. Its Digital segment provides digital gaming, iLottery, and sports betting solutions and services, including digital RMG and sports wagering solutions.

In 2020 the company made $2 billion in sales, which is $1 billion higher than DKNG, and spent $166 million on research and development, $190 million on capital expenditures, $13 million on cash acquisitions, and did not buy any intangible assets. the company’s expenditures on future projects seem to be in line with the spending habits of DKNG but the market has applied a higher valuation to DKNG. the reasons for this pricing could be multi-faceted and further investigation would be needed to come to a conclusion about which business will create value for shareholders over the long term. but for our purposes, the simple comparison of the two enterprises is enough to warrant in addition to the investors’ online gaming watch list.

Playtech was founded in 1999 and is based in Douglas, the Isle of Man. The company trades for 4.24 GBP per share ($5.79 USD per share) under the ticker symbol PTEC. The company has a market cap of $1 billion in USD and has 298 million shares outstanding. Of the 298 million shares outstanding Setanta Asset Management owns 26 million of them bringing their total percentage of shares held to 8.7% with a market value of $152 million.

Setanta is an independent investment management firm based in Dublin, Ireland. Established in 1998, Setanta has successfully applied a long-term value investing approach to its global equity and multi-asset funds.

The Setanta investment approach is straightforward

- they invest their portfolios in good quality businesses that are durable

- financed conservatively

- run by trustworthy management with a shareholder focus and under-appreciated by investors at large for one reason or other

Their Global Equity Fund managed by David Coyne & Sean Kenzie, CFA had a Q1 2019 performance of 5% compared to their benchmark of 6.3%. Over a 10-year period, they have returned 11.9% compared to 11.8% for the MSCI world index.

Since they believe in investing in “good quality businesses” we can only assume they think PTEC is a good quality business with a durable moat that is financed conservatively and run by trustworthy management with a shareholder focus. PTEC is a tech firm that provides gambling software, services, content, and platform technologies worldwide. The company offers various product verticals including casino and live casino platforms, sports betting, and virtual sports arenas. They also provide bingo and poker services.

In 2020 the company made $1 billion in sales and spent nothing on research and development but used up $839 million to finance its selling and general https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses. In the same. The company made $366 million in cash from operations and spent $41 million on capital expenditures, it also made $11 million and cash acquisitions and bought $89 million in intangible assets. The company has a return on equity of 27% and a return on capital of 3% as of the last 12 months.

I can see why the team at Setanta has put 152 million to work in this business!

And that’s all I have for you this week. Next week we’ll look at the other firms on the list and go into the same detail about specific key points that come up from a quick analysis. once you’ve gone through the full complete list, I’ll ask on social media for any suggestions of companies on this list or any other firms you can find that I would dig deeper into.

So far it seems to me like a market that is growing, and the tailwind is stronger than the headwind. I will be keeping my eye on the bearing table.