Valeo (VPH.C), a specialty pharma company, announced early today that it has obtained listings for Redesca from two group purchasing organizations (“GPO”) on behalf of +700 hospitals and health care facilities across Canada.

Redesca is a low molecular weight heparin biosimilar specialty product. It is an injectable drug used primarily to treat and prevent deep vein blockage and lung circulation clots. They have also listed three other hospital products (Amikacin, Ethacrynate Sodium, and Benztropine)

For those, like myself, who are unaware of what these GPOs are, or do you can think of them simply as entities that help healthcare suppliers, such as hospitals, nursing homes, and home health agencies, realize savings and efficiencies by accumulating buying capacity and using that clout to negotiate discounts with manufacturers, distributors, and other vendors.

The key details of the listing agreements are as follows:

- 2 GPO listing agreements cover, Redesca and Redesca HP, as well as 3 other Valeo hospital products

- The 2 multi-year product listings commenced on October 1, 2021

- The GPOs together represent more than 700 hospitals and healthcare facilities across 5 provinces including Ontario

This is what the Chief Executive Officer, Steve Saviuk, had to say about the deal,

“These listing agreements significantly expand the number of Canadian hospitals that can now access Redesca. Increased hospital accessibility, coupled with extensive public and private reimbursement coverage, provides a solid foundation to support the continued growth of Redesca. The Canadian hospital market is highly sought-after and competitive, our commercial team continues to deliver results in this environment”

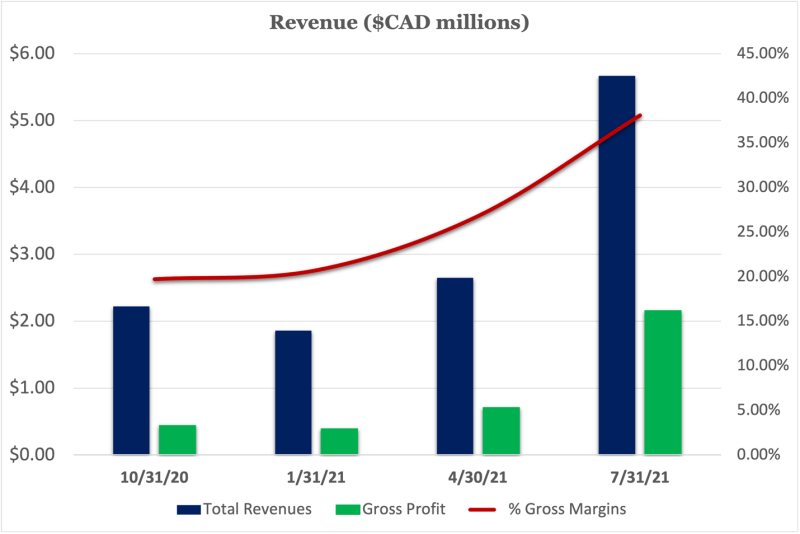

This listing agreement only adds to the company’s successful 2021 campaign. Just for a quick reminder on how the companies performed so far, I have produced the revenue and gross profit table below for reference.

Over the last 12 months, the company was able to generate $12.4 million in cumulative sales of a base of $7 million of sales at the end of 2020. Since December of 2020 the company has produced more business at the same time margins have increased every quarter. These added contracts and listing agreements further enhance the company’s top line figures allowing it to better serve its customers.

As of their latest reports they had 8.99 million in cash on hand, 2.85 million in total receivables (2.62 in accounts receivables), 5 million in inventory, 3 million in payables, and only 1.58 million in long term debt obligations.

The accounting numbers seem to confirm what Frederic Fasano, the Chief Operating Officer, said on the GPO contract signature:

“Our new corporate structure and commercial platform allow us to successfully pursue and develop strong partnerships with leading GPO across the country and better service their evolving needs. The support provided by our dedicated team of key account managers and medical affairs professionals combined with the strong supply chain in place make Redesca’s value proposition very attractive for hospitals”