The S&P 500 and other US markets are dumping here at the open. Over on Equity Guru’s Discord Channel, and right here on Market Moment, I have highlighted the market structure indicating further downside. And what I want to see to nullify this.

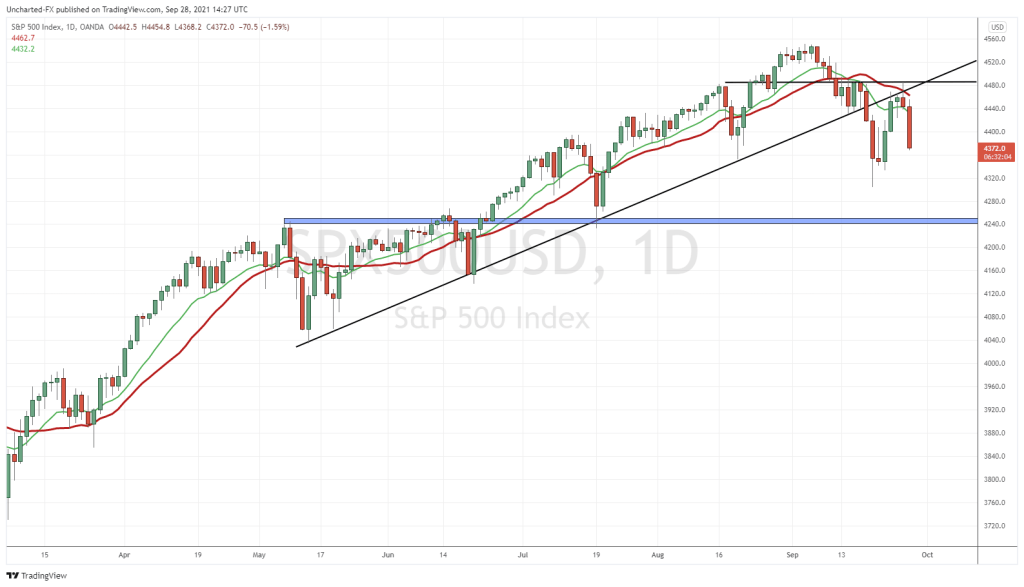

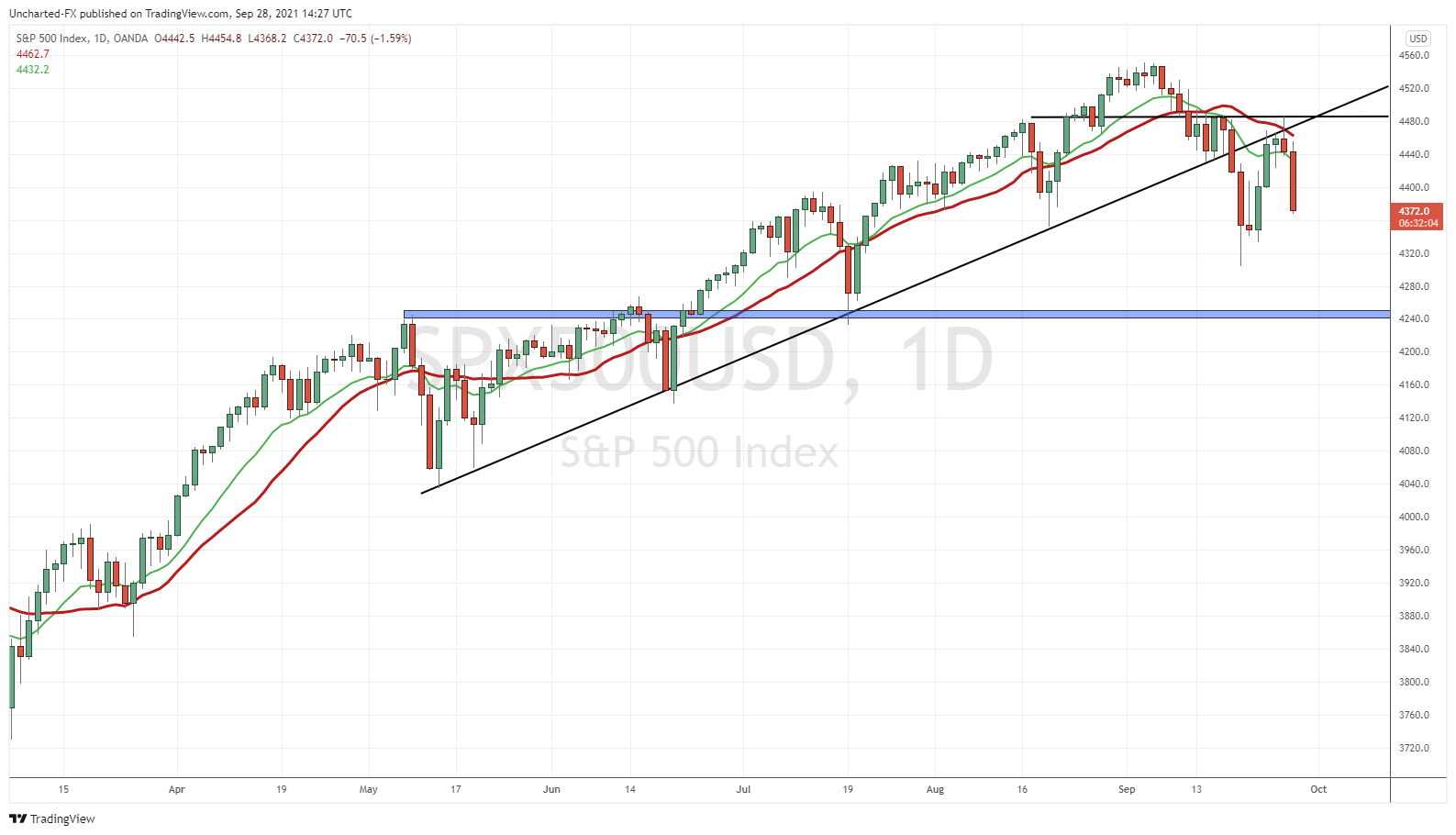

I predicted the first dump with the breaking of a major S&P 500 trendline. More information on my thought process can be read here. I highlighted the fact the stock markets could jump to retest the breakdown before continuing lower. This point was made clear on the stock market pump day. Traders were warned to not turn uber bullish just yet. The market structure still indicated a pullback to retest the breakdown zone.

Before I detail what happened and where we go next, let’s quickly explore some other charts and themes.

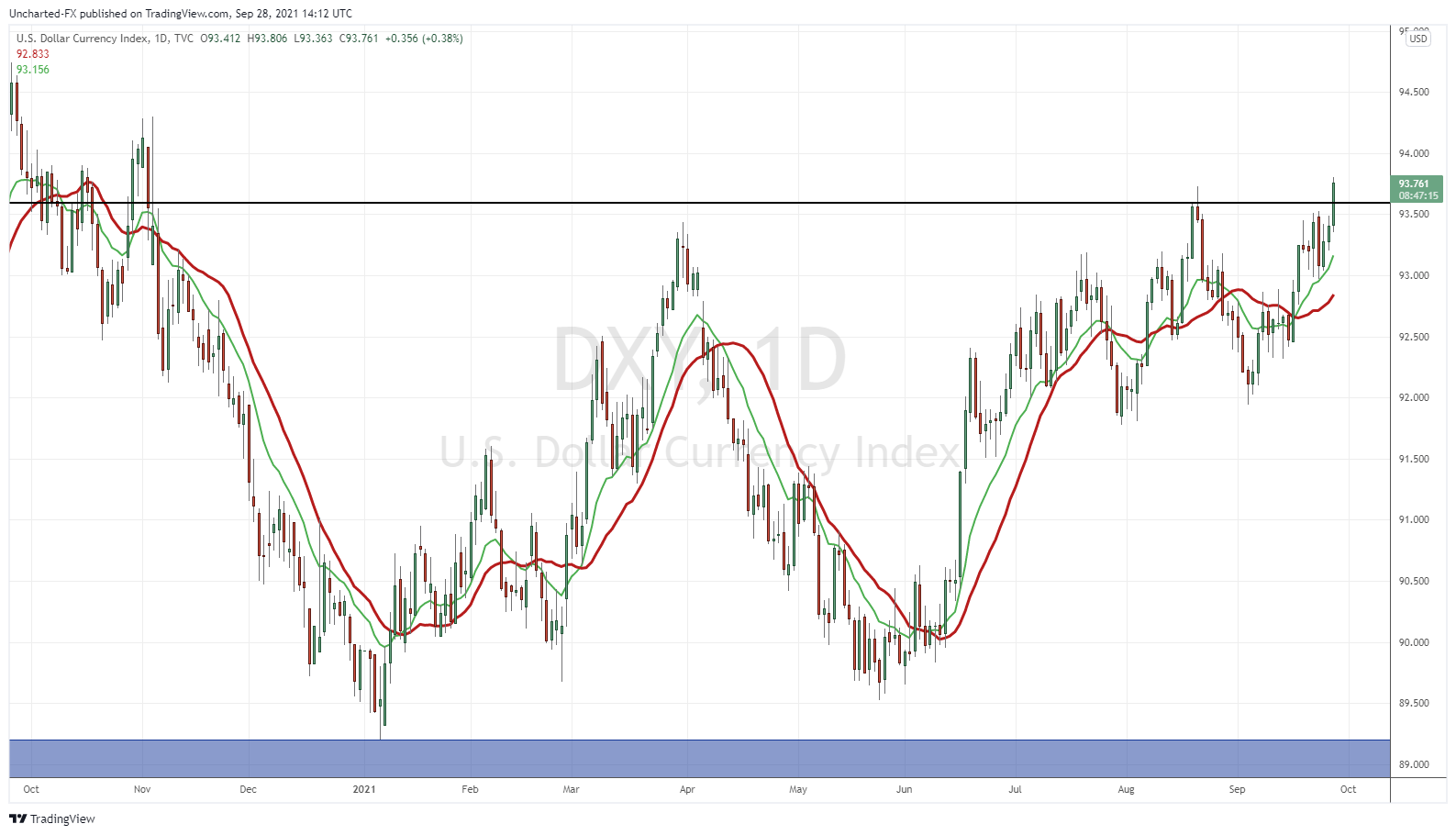

In yesterday’s post regarding Silver, I mentioned how the US Dollar chart is one of significant importance. Bond yields were rising…and still are at time of writing. The stock market saw this as a sign of tapering around the corner. Bonds were being sold off in anticipation the Fed would sell off their bonds when they taper. The US Dollar was the key for confirmation.

If the market believes the Fed is going to taper, then we should expect to see the US Dollar pop. And it is. Not too great for precious metal and crypto traders. Although Crypto’s provided us hints technically that another leg lower was coming. More on that tomorrow.

Tapering is not the only thing the stock markets are afraid of. We also have a looming government shut down on October 1st. Something that wasn’t expected since the Democrats control both the House and Senate. Let’s not forget Evergrande and China. The property developer has 30 days beginning last week to meet its bond payments. Let’s add Covid and cases as the cherry on top.

So yes, lot of fundamentals for the stock market to be worried about, but the technicals were giving us signs before these fundamentals made media headlines.

The daily chart that some of you are probably sick off since I have posted it multiple times in recent weeks. But for us to turn bullish, we needed the close back above the trendline. Didn’t happen. Notice how for three days we tried to close back above our trendline (and lower high at 4480) but no luck. The wicks were indicating selling pressure. Yesterday (Monday) changed that with a red close.

That was an early trigger short for us. The retest was confirmed with sellers piling in and giving us a red candle close.

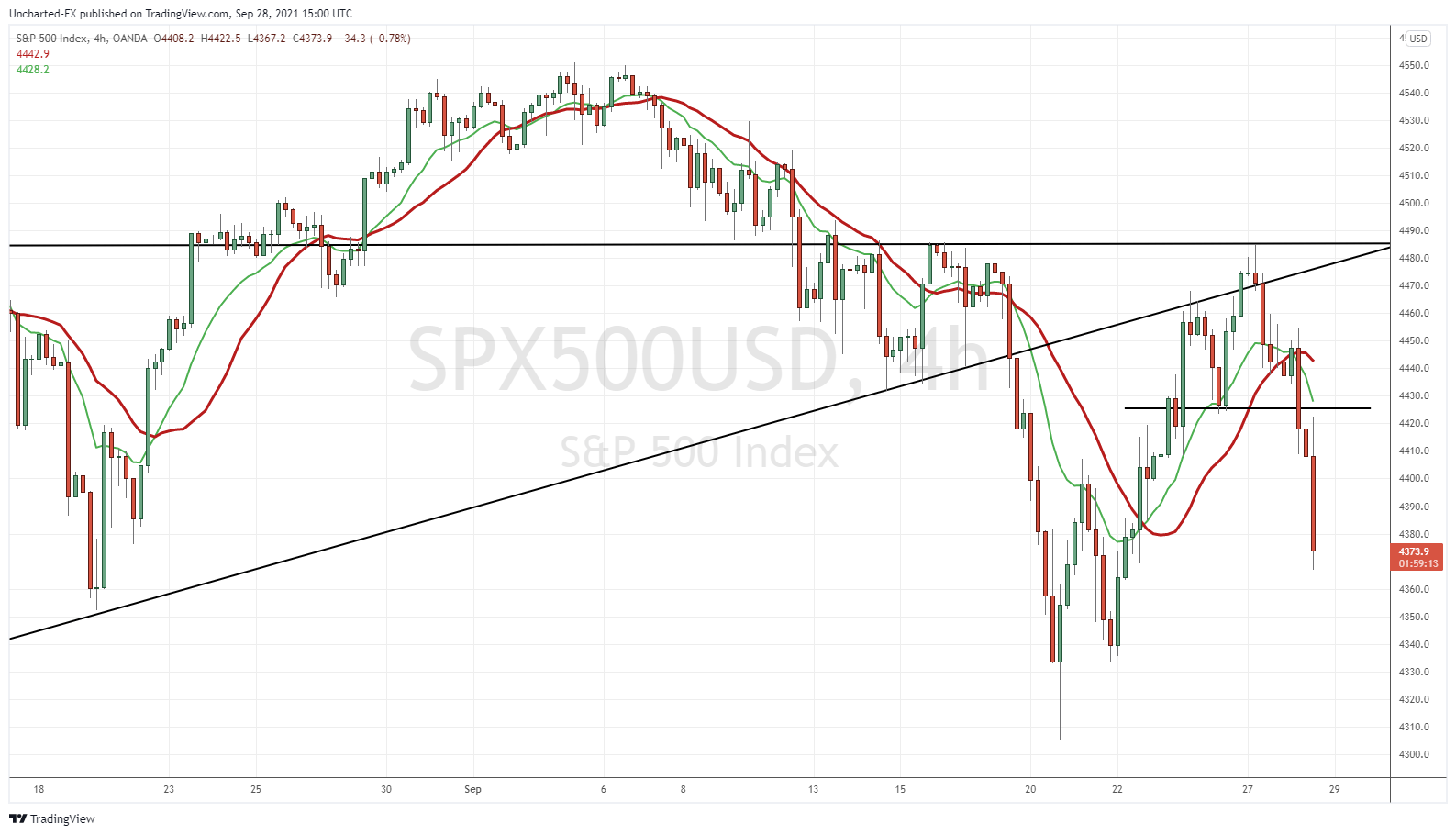

Let’s take it to the 4 hour to go through another short confirmation.

Notice the shorter horizontal line? Well that marks the higher low on the 4 hour chart. According to market structure, a market is in an uptrend as long as that higher low swing is held. Overnight futures saw the S&P 500 break and close below. Then we saw the dump on the US open. Another good confluence.

So what am I watching for next? To flip bullish, I still want to see the close above the trendline on the daily chart. If we can climb back above 4430 on the 4 hour chart, that would also be a positive sign. But I am thinking another leg is coming. If the daily candle closes below recent lows of 4350…very bearish. I would be targeting 4240. A major flip zone.

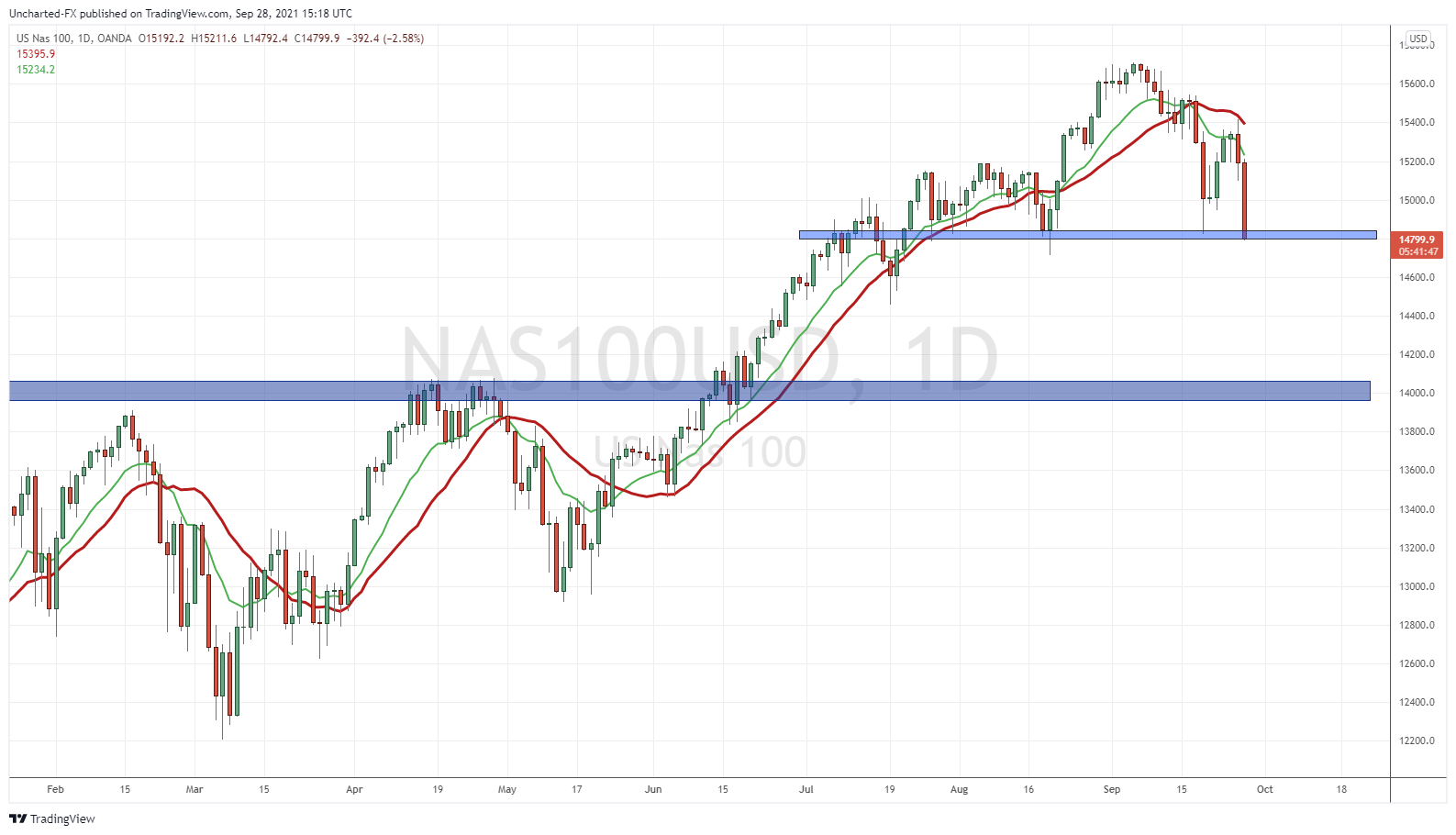

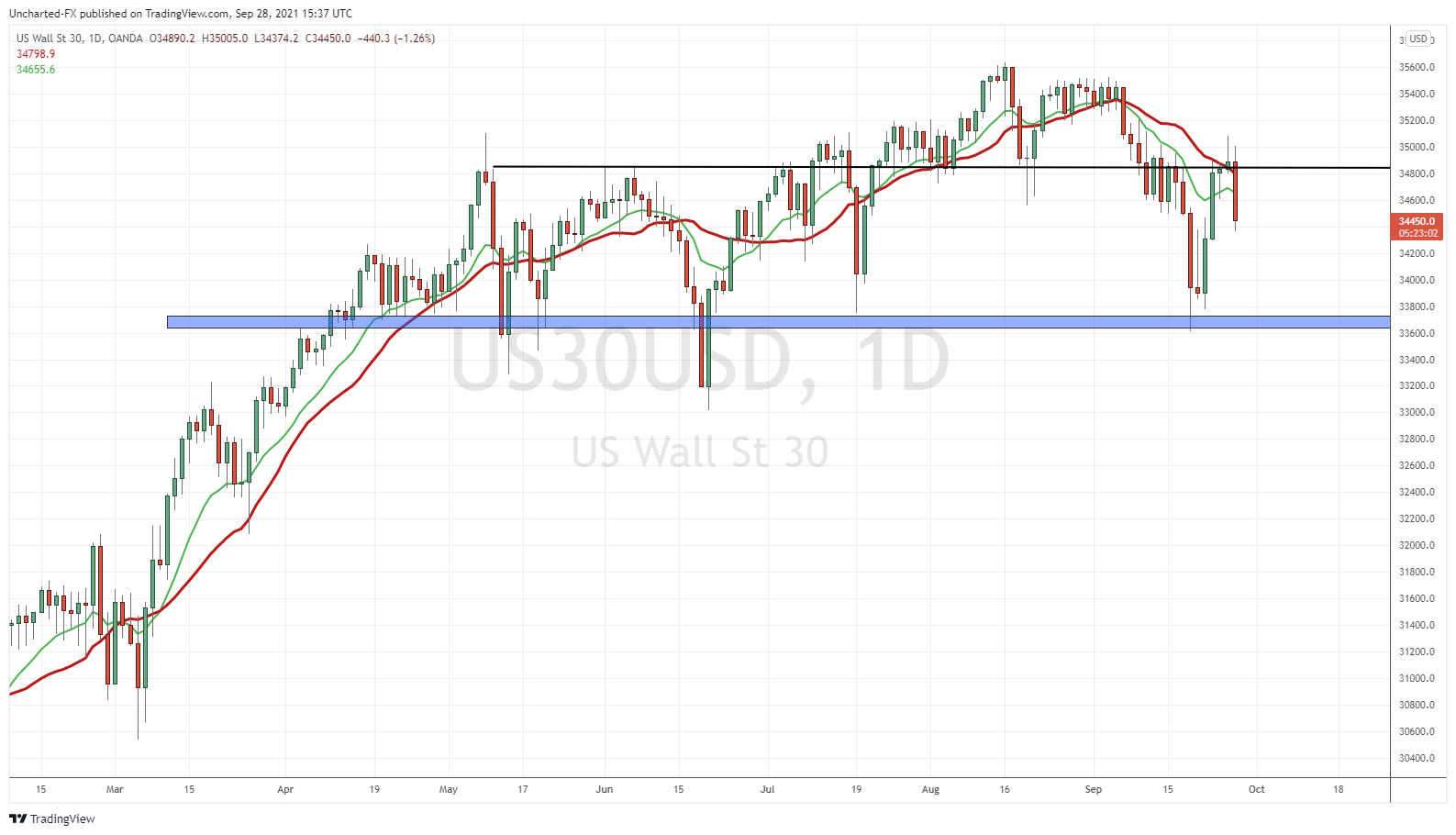

Before I say goodbye, a quick peek at the Nasdaq and the Dow:

The Nasdaq at a major inflection point. We are testing the neckline support of the head and shoulders. If we close below, then things look bad. But there is hope. Still have a few hours before the end of the day for this to be propped up. Watch this Nasdaq close.

The Dow pulled back to retest resistance, and then the sellers stepped in as can be seen from today’s daily candle so far. In terms of risk vs reward, the Dow provides a better entry for a short if stock markets continue to fall.