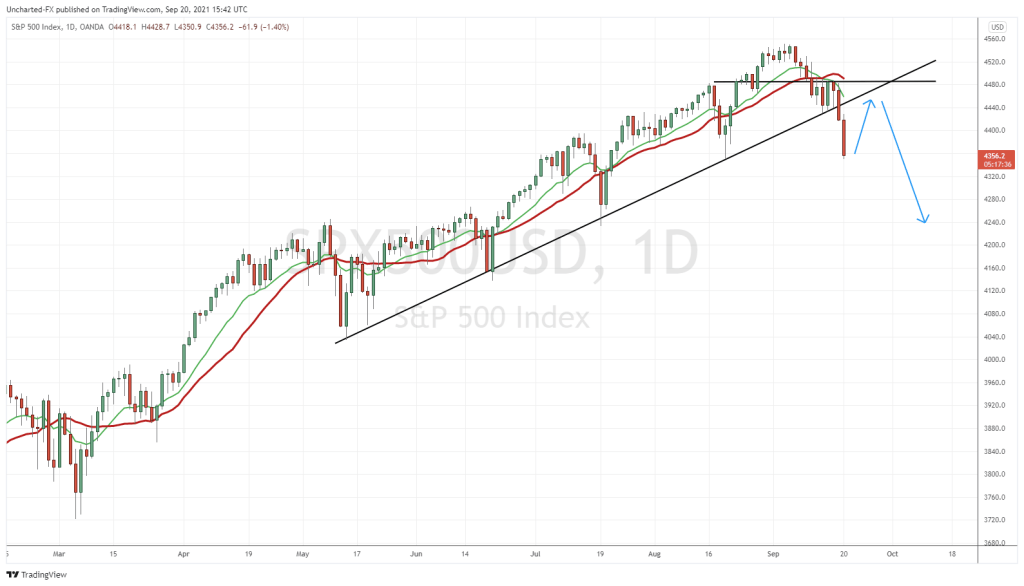

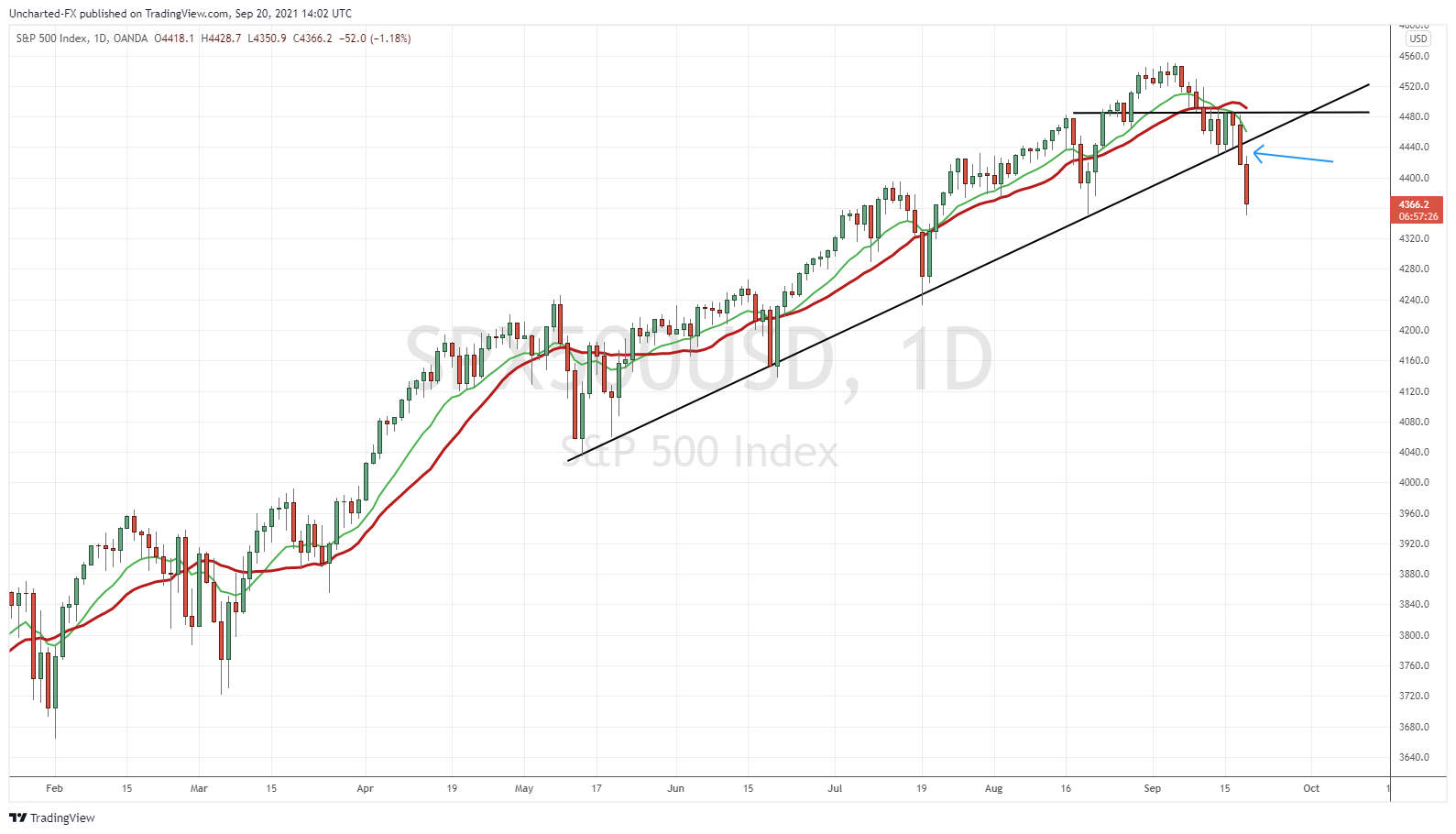

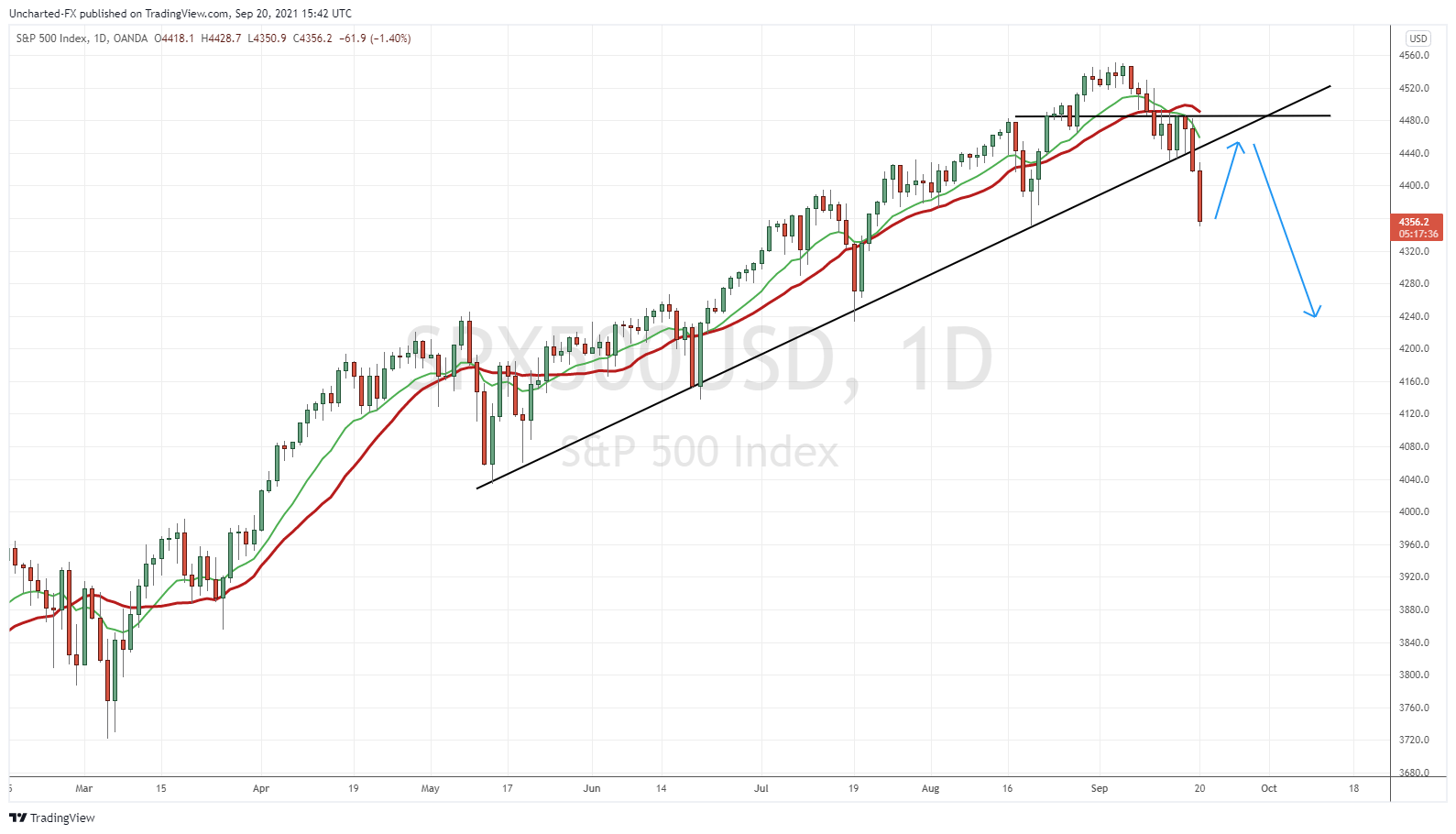

Last week I highlighted the S&P 500 chart, in the aptly named piece titled, “Is the Stock Market About to Crash?“. Members of the Equity Guru Discord Channel were probably fed up with me warning about that trendline last week. The breakdown happened on Friday. We closed BELOW the trendline. Setting up for a down day on Monday. Some were even using the term ‘Black Monday’ over the weekend in anticipation of the Monday open.

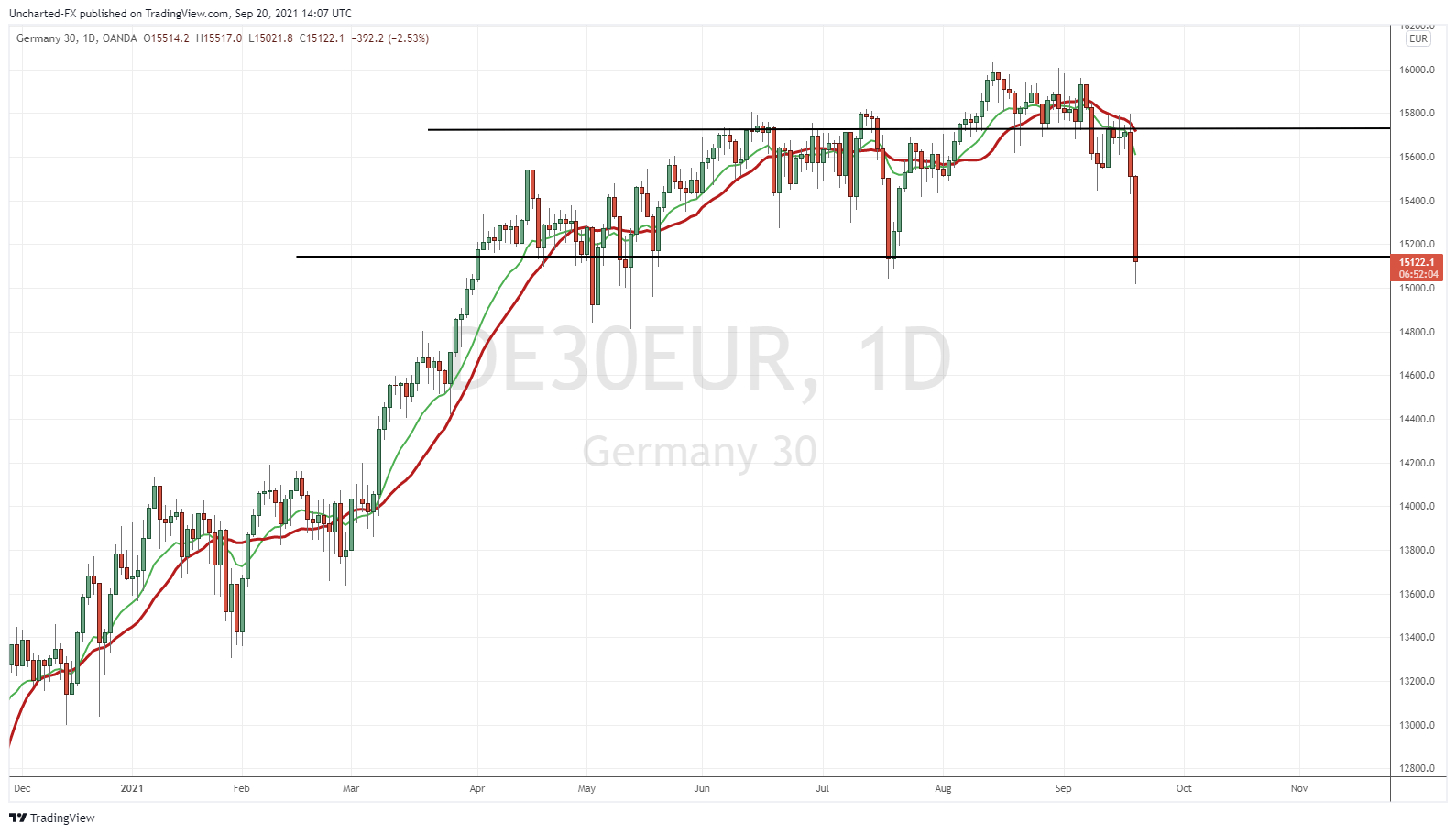

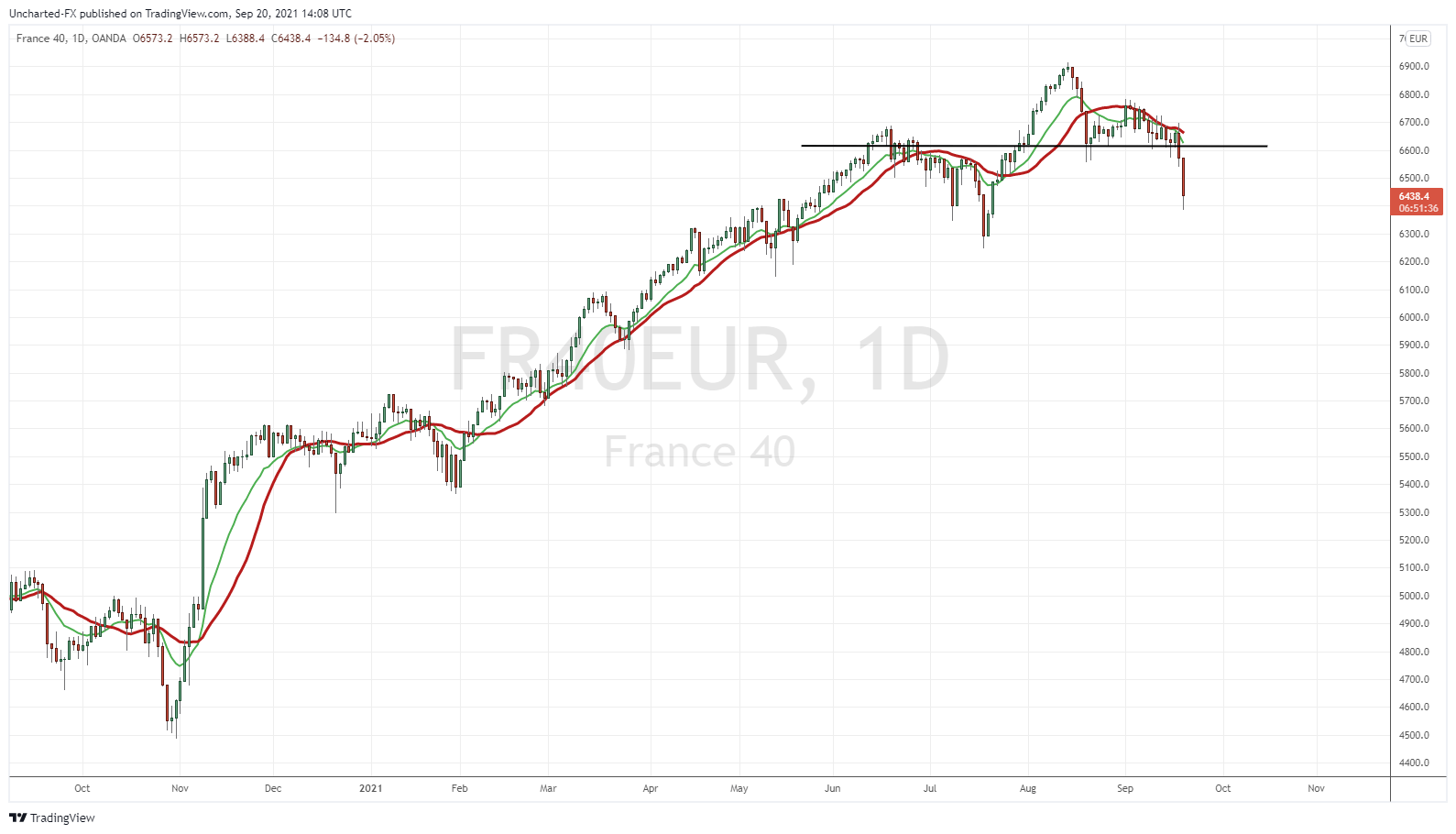

As I woke up this morning, I was quite surprised that even European Markets were down heavily. The German Dax and the French CAC were down over 2%. Others were down over 1%.

You will likely hear me talk a bit more on certain European markets…depending on happens with markets globally. Some major bearish like reversal patterns are setting up.

This brings us back to the question: why? Last week I answered that. The media is saying rising energy prices in Europe. If that is the case, then we will see markets continue to be under pressure as cold weather arrives.

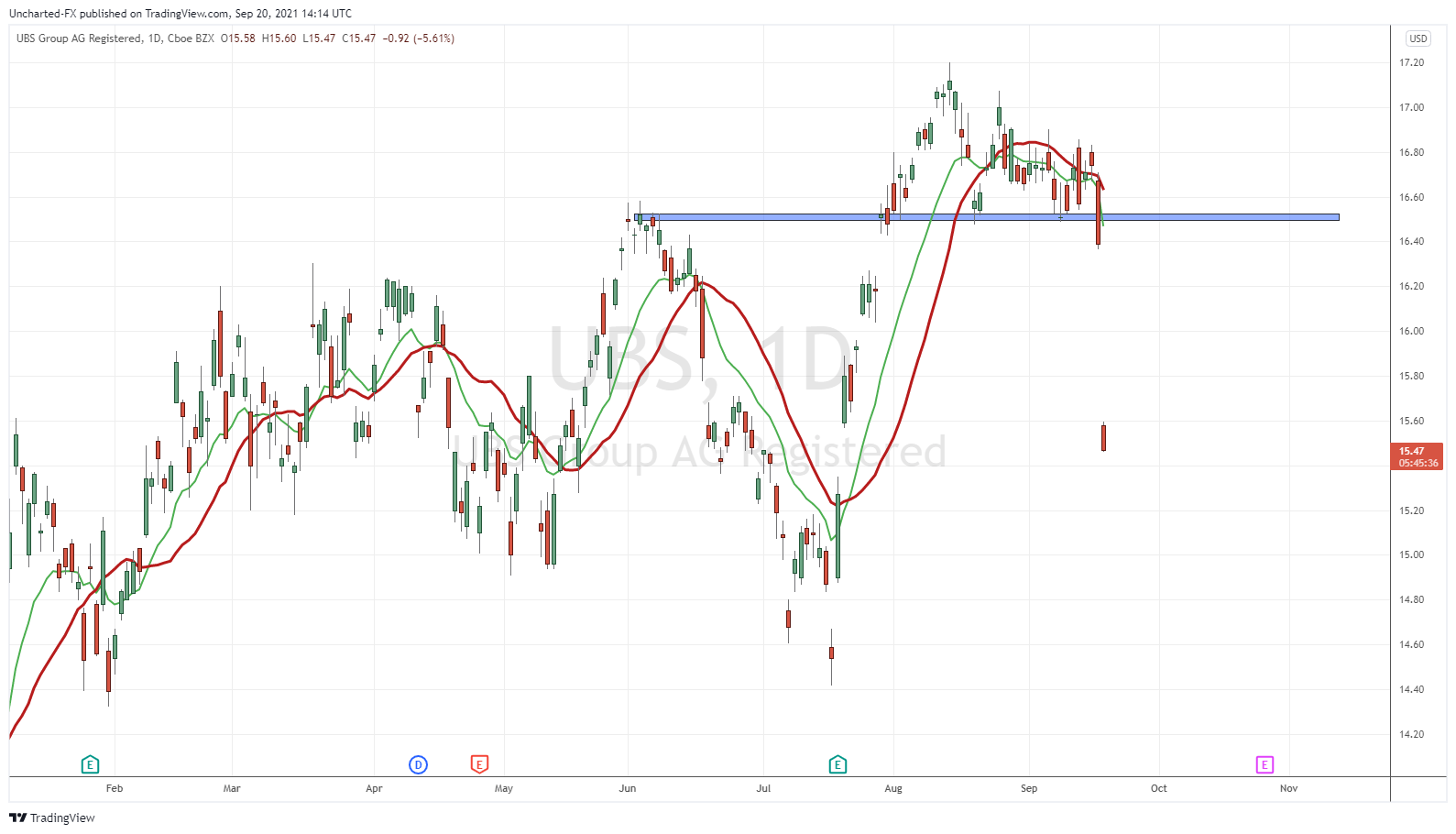

China is what everyone is talking about. China and the Evergrande situation. Last week, we heard Evergrande stopped paying interest on bonds, and prevented trading of their bonds. In our Discord channel I highlighted bond holders such as HSBC, Blackrock, RBC and UBS. I took a UBS put myself. A nice way to wake up:

Boom.

What this is telling me is that there are some real concerns in China. Sure, some sort of restructuring of the debt or bailout will likely happen. But it is all about how the market takes it. Reports last night were about Evergrande offering discounted properties sales to investors. Yikes.

China is going to have its 2008 credit crunch moment. Could this be it? Is Evergrande China’s Lehman?

As I write this up, I came across news that ANOTHER major property developer has fallen 87% in China:

Shanghai-based Sinic Holdings Group which focuses on the development of residential and commercial properties in China, was halted trading after it shares cratered in a freak 87% plunge on Monday afternoon.

Fund manager Kyle Bass has been critical about China and its regime in recent years. In fact, he has been betting on a China and Hong Kong crisis. Been listening to him for the last few years on China, and I must say…things are playing out as he predicted. Remember, this was one of the fund managers who also called and played the 2008 US crisis.

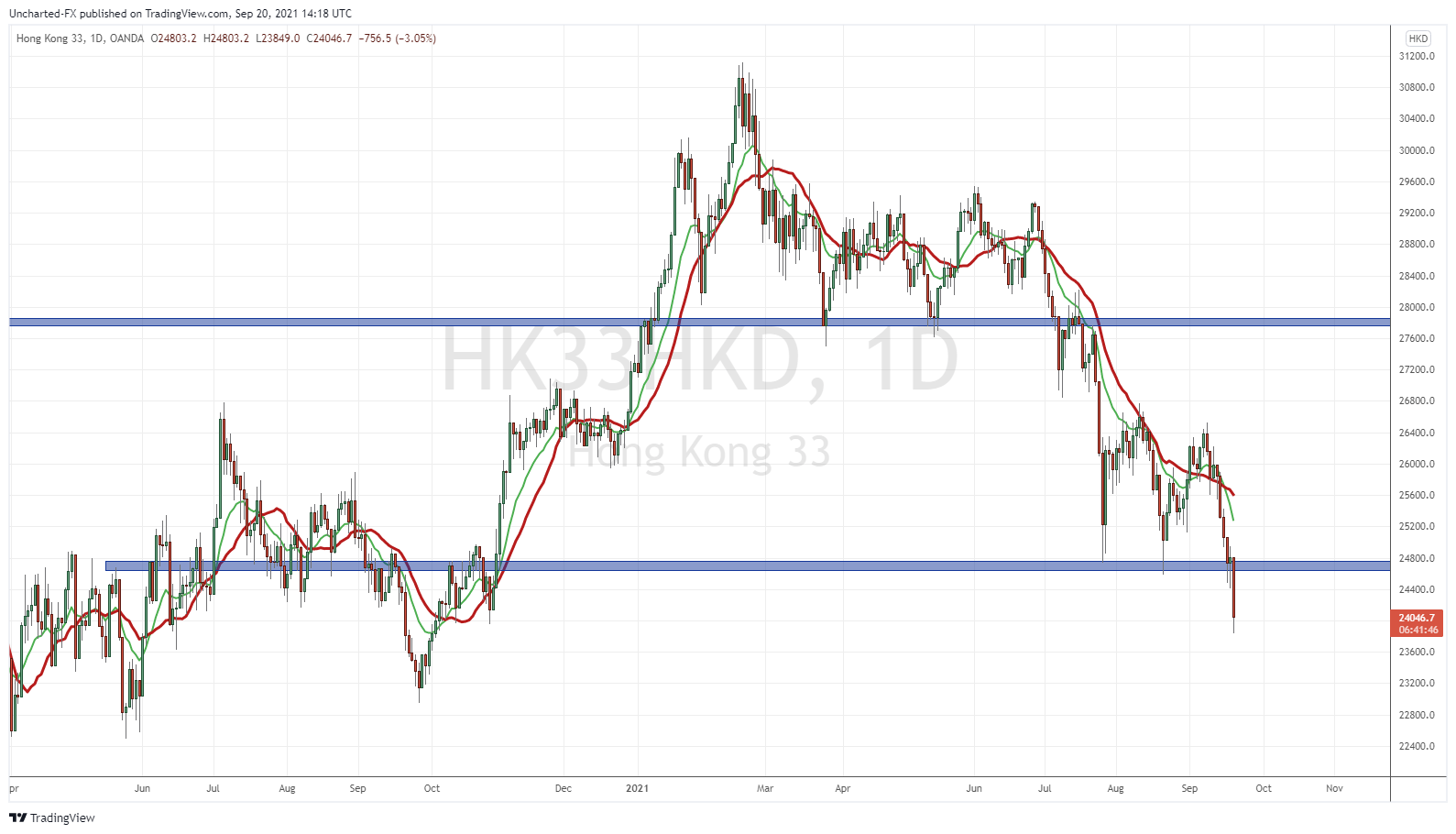

Above is the Hang Seng, where Evergrande and other Chinese tech companies are traded. Looked like we would bounce at the 24800 support level. Nope. We continued to plunge. A daily close like this is a breakdown. Some more pain ahead unless the Hang Seng can climb back across 24800.

China is the big story, BUT we also have a big macro week…which may add some pressure on stocks. Five major interest rate decisions this week. China on Wednesday, which now takes on a whole new importance with the current situation in the country. We also have the Bank of Japan and the Fed…more on the Fed in a second. On Thursday, we are blessed by the Bank of England and the Swiss National Bank.

These rate decisions get more interesting given what the European Central Bank did a few weeks back. They slowed down their bond purchases BUT made it clear that this wasn’t a taper. The ECB is supposedly going to announce a tapering plan in December, but one must consider that the way the ECB worded the bond purchases, leaves the door open to more asset purchases if markets drop.

All eyes and ears will be on the Federal Reserve on Wednesday. Economic data if I recall has been mixed. Inflation is still high but decreasing, while employment numbers flip flop. Markets expect the Fed to announce a taper timeline just like the ECB. However, contrarians believe tapering cannot stop as it would induce a taper tantrum. A further market sell off. If markets are truly propped by cheap money, I suspect the Fed is going to be changing their diction.

So Powell has the power to move these markets and I expect two scenario’s: 1) Powell upsets markets and we continue to head lower, 2) Powell provides a pop for the markets, but markets could continue the downtrend if the Evergrande situation deteriorates.

This is what I will be looking at this week:

Just typical trend line break action. We tend to eventually pullback and retest the trendline before continuing the move lower. So let’s watch this. Especially if we close back above the trendline on the retest. That would be extremely bullish.

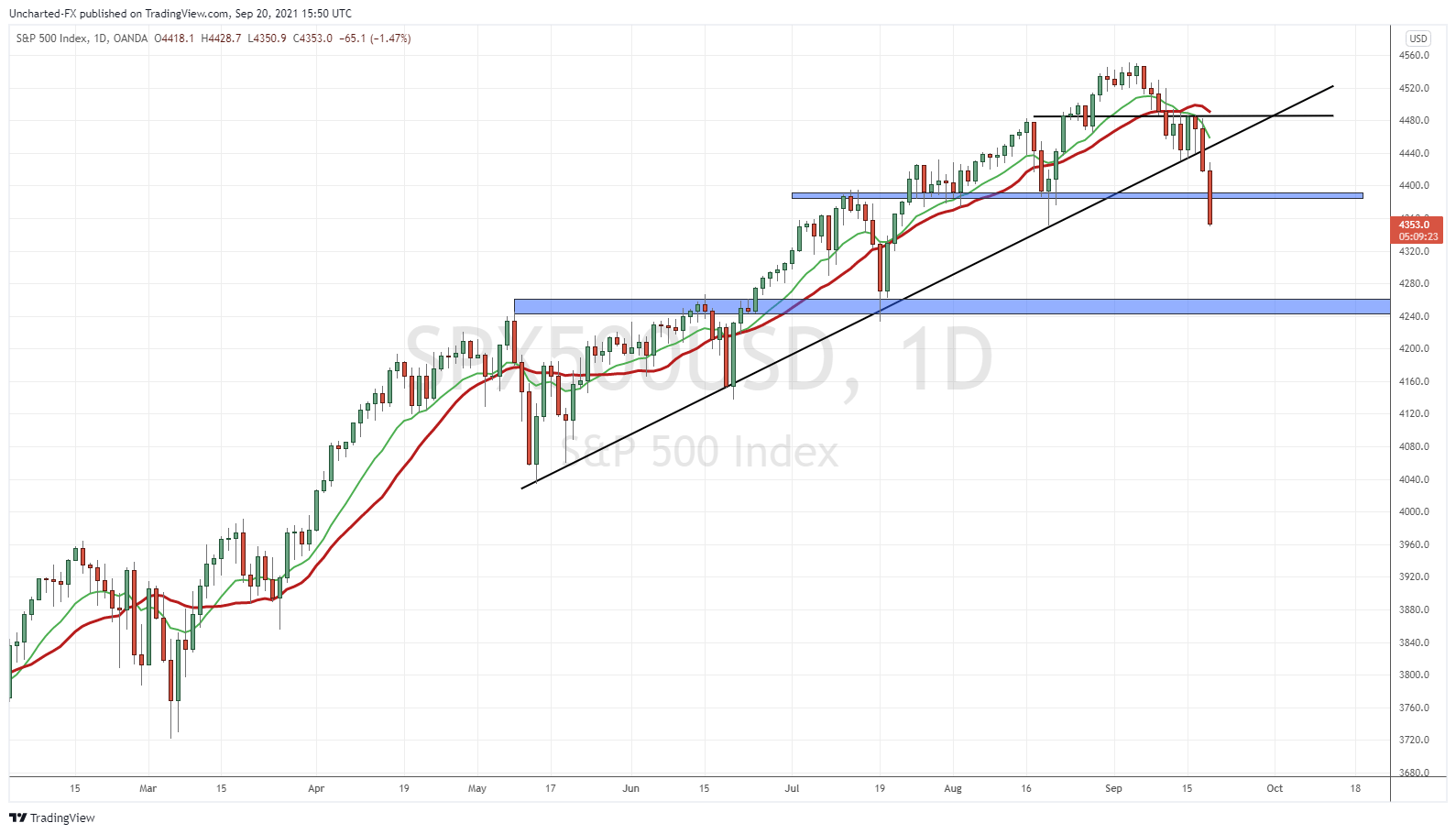

What I am thinking is we hit a support level first before bouncing up.

Today’s close will be important. Can we pump up before the end of the day to close above 4385? If not, this support zone is broken, and we are looking around 4250 for another support retest. Maybe even with price popping tomorrow to retest 4385 as resistance and then selling off on the Fed.

Technicals are bearish. We have broken below many key levels, now it is all about when to enter. I don’t want to short right now. I have made cash playing the US Dollar and the Japanese Yen on the currency side of things. I want to see some sort of bounce and then see sellers step back in. If we can get green candles at these support zones I mentioned, that would be a big. If we can close above the trendline, that would be even more bullish, and nullifies this downtrend.

Big week with China and interest rate decisions. Don’t be too hasty. In weeks like this, cash is the better position until your criteria for a trade is met. Just be prepared for some volatility. As always, eyes on the US Dollar and Bonds.